What are the advantages of company form of business?

The advantages of company form of business are determined by the type of company you form, but you could enjoy up to six basic advantages, such as limited liability. When you are forming a business, you will first have to consider what type of structure it should have. Consider the following:

What are the benefits of being a corporation?

These benefits are, in many cases, unavailable to sole proprietorships and general partnerships. Limited Liability – Corporations provide limited liability protection to their owners (who are called shareholders).

Is incorporation beneficial to your business?

Although there are several reasons why incorporating can be advantageous to your business, there are a few disadvantages to be aware of as well.

What kind of business can a corporation do?

According to Shannon Almes, attorney at Feldman & Feldman, corporations can generally conduct any lawful business as well as the actions necessary to conduct the business, like entering into contracts, owning assets, borrowing money, hiring employees, suing and being sued.

What are the benefits of the corporate form?

The corporate form of organization offers several advantages, including limited liability for shareholders, greater access to financial resources, specialized management, and continuity.

What are the advantages of the corporate form of business organization quizlet?

The corporate form has the advantage of unlimited liability. The corporate form is preferred over the sole proprietorship because a corporation is easier to form and faces less regulation. The corporate form has the disadvantage of double taxation relative to a sole proprietorship.

Which of the following is correct One of the advantages of the corporate form of organization is that it avoids double taxation?

TF: One advantage of the corporate form of organization is that it avoids double taxation. False: Corporations have double taxation. Proprietorships and partnerships do not have double taxation.

Which of these are an advantage of the corporate form of business over a sole proprietorship?

Advantages of the corporate form of business include: (1) the owners have limited liability, (2) ownership stock can be easily transferred, (3) corporations usually lasts forever, (4) raising money is easier than for other forms of business and, (5) expansion into a new business is simpler because of the ability of the ...

What are the advantages of a company form of business?

The advantages of company form of business are determined by the type of company you form, but you could enjoy up to six basic advantages, such as limited liability.

How many types of advantages are there in a corporation?

If you opt to form a corporation or an LLC, there are six types of advantages of a company form of business, based on the type of company you create:

Which type of business can avoid corporate income taxes while enjoying the limited liability of corporations?

S corporation: This type of business can avoid some corporate income taxes while enjoying the limited liability of corporations. Nonprofit corporation: A nonprofit does not have to pay any income taxes for funds it receives for charitable purposes.

How can companies expand?

Companies can expand by offering new shares and use their reserves to expand further. The ability to transfer shares: Shareholders can sell their shares for any reason, especially if the company is not as profitable as they'd hoped. Even though shares are changing hands, the business will continue to run.

What is a C corporation?

C corporation: This type of business is a separate tax and legal entity from the people who created it. The shareholders provide money and/or property to the business; in turn, they receive a share of the company's capital.

What type of partnership divides profits and losses?

General partnership: In this type of setup, participants may equally divide the profits and losses and shoulder the liability, unless a written agreement specifies how these things are to be shared.

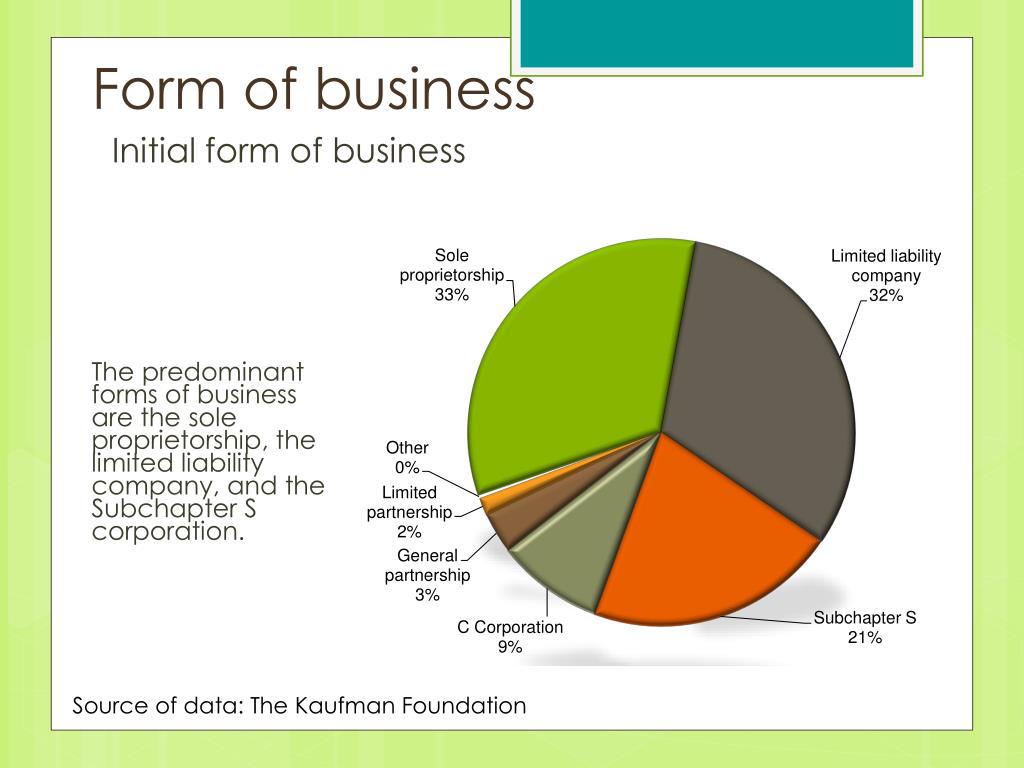

What is a sole proprietorship?

Sole proprietorship: In a sole proprietorship, the owner and the business are legally one and the same. This is one of the easiest ways to start a business and the most common type of business.

What are the advantages of a corporation?

Advantages of a corporation include personal liability protection, business security and continuity, and easier access to capital.

What is a corporation in business?

Key takeaway: A corporation is recognized as a separate entity by the state and protects its owners from personal liability for the business's debts or legal trouble.

What is a C corp?

As one of the most common types of corporations, a C corporation (C-corp) can have an unlimited number of shareholders and is taxed on its income as a separate entity. C-corp shareholders are also taxed on the dividends they receive from the company, and they receive personal liability protection from business debts and litigation. Ownership for this type of corporation is divided based on stocks, which can be easily bought or sold. A C-corp can raise capital by selling shares of stock, making this a common business entity type for large companies.

Why do corporations have personal liability protection?

For example, if a corporation is sued, the shareholders are not personally responsible for corporate debts or legal obligations – even if the corporation doesn't have enough money in assets for repayment. Personal liability protection is one of the main reasons businesses choose to incorporate.

What is double taxation?

Most corporations (like C-corps) face double taxation, which means that the business income is taxed at the entity level as well as the shareholder level (based on their percentage of profits earned). The only way around this is to operate as an S corporation. S-corps eliminate this problem by only taxing each shareholder on their ...

How are corporations governed?

Corporations are generally governed by a board of directors elected by the shareholders. "Each shareholder typically gets one vote per share in electing the directors," said Almes. "The board of directors oversees the management of the daily operations of the corporation, and often do so by hiring a management team.".

How to maintain a corporation?

You have to follow many formalities and heavy regulations to maintain your corporation status . For example, you need to follow your bylaws, maintain a board of directors, hold annual meetings, keep board minutes and create annual reports. There are also restrictions on certain corporation types (for example, S-corps can only have up to 100 shareholders, who must all be U.S. citizens).

Why is corporate entity important?

The corporate entity shields them from any further liability, so their personal assets are protected. This is a particular advantage when a business routinely takes on large risks for which it could be held liable. Source of capital.

What are the disadvantages of a corporation?

The disadvantages of a corporation are as follows: 1 Double taxation. Depending on the type of corporation, it may pay taxes on its income, after which shareholders pay taxes on any dividends received, so income can be taxed twice. 2 Excessive tax filings. Depending on the kind of corporation, the various types of income and other taxes that must be paid can require a substantial amount of paperwork. The exception to this scenario is the S corporation, as noted earlier. 3 Independent management. If there are many investors having no clear majority interest, the management team of a corporation can operate the business without any real oversight from the owners.

How can a publicly held corporation raise capital?

Source of capital. A publicly-held corporation in particular can raise substantial amounts by selling shares or issuing bonds. This is a particular advantage when its shares trade on a stock exchange, where it is easier to buy and sell shares.

Can a shareholder sell shares in a corporation?

It is not especially difficult for a shareholder to sell shares in a corporation, though this is more difficult when the entity is privately-held. Perpetual life. There is no limit to the life of a corporation, since ownership of it can pass through many generations of investors. Pass through.

Does a S corporation pay income tax?

Pass through. If the corporation is structured as an S corporation, profits and losses are passed through to the shareholders, so that the corporation does not pay income taxes.

Can a corporation pay double taxes?

Double taxation. Depending on the type of corporation, it may pay taxes on its income, after which shareholders pay taxes on any dividends received, so income can be taxed twice.

Who is personally responsible for all business debts and company actions under this business structure?

Unlimited liability: You are personally responsible for all business debts and company actions under this business structure.

What are the advantages of a partnership?

Some advantages of partnerships include: Easy to establish: Compared to other business structures, partnerships require minimal paperwork and legal documents to establish. Partners can combine expertise: With more than one like-minded individual, there are more opportunities to increase their collaborative skillset.

Why are cooperatives more relaxed?

Lack of accountability: Cooperatives are more relaxed in terms of structure, so members who don't fully participate or contribute to the business leave others at a disadvantage and risk turning other members away. Many cooperatives exist in the retail, service, production and housing industries.

Why do investors prefer corporations when lending money?

Difficulty in raising funds: Investors typically favor corporations when lending money because they know that those businesses have strong financial records and other forms of security.

How to decide what business structure is best for my business?

Once you have decided on the most important details related to your business, you can decide which business structure works best for your plan. The legal form your business takes determines your risk in the business, including your eligibility for financial returns. Knowing which business structure best serves your needs depends on many factors, including the number of people involved and their desired roles, as well as your future goals. Review the five most common types of structures thoroughly to decide which plan works best for you and your business before moving ahead with the registration process.

How to start a business with a passion?

Successful business owners build a business around what they love doing the most. People who have a passion for making specialty items or a desire to change the world by offering a unique service may choose to form a start-up that allows for flexibility and creativity.

Which is the easiest business structure to set up?

This popular form of business structure is the easiest to set up. Sole proprietorships have one owner who makes all of the business decisions, and there is no distinction between the business and the owner.

Why are corporations so difficult to form?

This is because corporations must comply with stricter rules as compared to other types of businesses. Similarly, there are several different stages that the initial owners of a corporation must go through to form a corporation.

What is the final type of business?

The final type of business is known as corporations . Corporations are legal business entities that can have anywhere between 1 to unlimited owners. The ownership of corporations comes in the form of shares. Shares are legal documents that give the ownership of a corporation to the shareholder.

Why are corporations subject to stricter compliance standards?

As discussed above, due to various reasons, corporations are subject to stricter compliance standards as compared to other businesses. These compliances ensure the safety of shareholders’ investments in corporations and can also be beneficial for the corporation.

Why do corporations have unlimited growth potential?

This is mainly because corporations are not dependent on a single owner or a few owners for capital requirements. As discussed before, a corporation can have an unlimited number of shareholders.

Why are corporations limited liability?

However, that isn’t the only benefit of being a separate entity. Corporations can enter into contracts and guarantees, lend and borrow money, invest funds, buy, own or sell property , and get into legal disputes as a separate entity.

Why is management of a corporation problematic?

One of the problems of corporations is that their management is separate from their shareholders. While this can provide advantages for both the corporation and the shareholders, as discussed above, it can also be problematic. The management of a corporation acts as agents of the shareholders in the corporation.

What is a share in a corporation?

Shares are legal documents that give the ownership of a corporation to the shareholder. The percentage of ownership depends on the number of shares that the shareholder possesses. The earnings that corporations pay to their shareholders are also dependent on the number of their shareholding.

What Is CSR, and Why Is It Important?

Corporate social responsibility is the concept of incorporating philanthropy, ethics, and activism into business practices to benefit both society and the company itself. Adopting a CSR strategy also helps corporations build closer relationships with their employees and customers.

10 Advantages and Benefits of CSR

The full benefits of CSR are innumerable, but let’s look at ten of the most widely recognized:

Hit Your Social Impact Goals with TeamBondingCSR

Now that you know the benefits of CSR for your organization, you’re probably wondering how exactly to incorporate its concepts into your business practices.

What are the advantages and disadvantages of sole proprietorship?

Their major advantages are the following: (1) They are easy and inexpensive to form, (2) they allow a high level of secrecy, (3) all profits belong to the owner, (4) the owner has complete control over the business, (5) government regulation is minimal, (6) taxes are paid only once, and (7) the businesses can be closed easily. The disadvantages include: (1) the owner may have to use personal assets to borrow money, (2) sources of external funds are difficult to find, (3) the owner must have many diverse skills, (4) its survival of the business is tied to the life of the owner and his or her ability to work, (5) qualified employees are hard to find, and (6) wealthy sole Proprietors pay a higher tax than they would under the corporate form of business.

Why are partnerships important?

Partnership saw for the following advantages: (1) they are easy to organize, (2) they have higher credit ratings because the partners possibly have more combined wealth, (3) partners can specialize, (4) Partners can make decisions faster than larger businesses, and (5) government regulations are few .