Major Benefits of a Defined Benefit Pension Plan

- Significant benefits (read money) can be provided and earned over a short period of time, even with early retirement.

- Employers can contribute (and deduct) more than other pensions such as defined contributions.

- The plan offers a predictable and guaranteed benefit, and the benefits are not dependent on asset performance.

What companies offer defined benefit pension plans?

Who has the best pension plan?

- The Typical 401 (k) Match. When an employer decides to offer a 401 (k) plan for its workers, there are different types of plans on the market to choose from. ...

- Generous Employer 401 (k) Matches. …

- Amgen.

- Boeing. …

- BOK Financial. …

- Farmers Insurance. …

- Ultimate Software.

How much can I contribute in a defined benefit plan?

- Client's age - In general, the older the client then the larger the annual contribution that can be made into the plan.

- Client's income - The calculation is based on the average of the client's highest 3 years of income. ...

- Planned retirement age - In general, at least 5 years from the year the plan is adopted.

What companies have defined benefit plans?

What job has the best pension?

- Protective service. …

- Insurance. …

- Pharmaceuticals. …

- Nurse. …

- Transportation. …

- Military. …

- Unions. A union card might be your ticket to more comprehensive retirement benefits. …

- Check out these jobs with pensions: Teacher.

How do you calculate defined benefit?

How do you calculate the present value of a defined benefit pension? The formula is simple: Net present value = CF/[(1 + r) ^ n] — where CF, or “cash flow,” is the final number from the last section’s calculation. This formula accounts for the number of years you have left until you retire and the pension begins to pay out.

What is a defined benefit work retirement plan?

A defined-benefit plan is an employer-sponsored retirement plan where employee benefits are computed using a formula that considers several factors, such as length of employment and salary history.

What is the difference between a 401k and a defined benefit plan?

A 401(k) and a pension are both employer-sponsored retirement plans. The most significant difference between the two is that a 401(k) is a defined-contribution plan, and a pension is a defined-benefit plan.

What does a defined benefit plan do?

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans.

Is a defined benefit plan a 401k?

Yes, a 401(k) is usually a qualified retirement account. Defined-benefit and defined-contribution plans are two of the most popular categories of qualified plans.

What is one disadvantage to having a defined benefit plan?

The main disadvantage of a defined benefit plan is that the employer will often require a minimum amount of service. Although private employer pension plans are backed by the Pension Benefit Guaranty Corp up to a certain amount, government pension plans don't have the same, albeit sometimes shaky guarantees.

Why is defined benefit plan better?

Easier to plan for retirement – defined benefit plans provide predictable income, making retirement planning much more straightforward. The predictability of these plans takes the guesswork out of how much income you will have at retirement.

How does a DB pension work?

A defined benefit (DB) pension scheme is one where the amount you're paid is based on how many years you've been a member of the employer's scheme and the salary you've earned when you leave or retire. They pay out a secure income for life which increases each year in line with inflation.

Who pays for defined benefit retirement?

Defined-contribution plans are funded primarily by the employee, as the participant defers a portion of their gross salary. Employers can match the contributions up to a certain amount if they choose. A shift to defined-contribution plans has placed the burden of saving and investing for retirement on employees.

Can you withdraw money from a defined benefit plan?

In-service withdrawals. Many defined contribution plans permit in-service withdrawals. Such withdrawals generally can be provided without restriction from rollover accounts, upon attainment of age 59-1/2 and in the event of a financial hardship.

What happens to my defined benefit plan if I leave the company?

If the plan you are leaving is a defined benefit plan, you would be notified of the amount that your reduced pension benefit would be.

Do I need to save if I have a defined benefit pension?

In short, yes. You do need to save for retirement even if you have a pension. While having a pension definitely reduces the amount you need to save, it is still important to do so to full prepare you for retirement! A pension will typically provide you with 40-60% of your working salary in retirement.

Do you pay tax on defined benefit pension?

For Retirement Access pensions: All pension payments are tax-free. For Defined Benefit pensions: – No tax is payable on annual pension payments up to the defined benefit income cap4, which is $106,250 for 2021–22.

Defined Benefit Plans: A Definition

In a defined benefit plan, a company takes charge of its workers’ retirement income. Using a formula based on each worker’s salary, age and time wi...

Defined Benefit Plan vs. Defined Contribution Plan

Defined benefit plans used to be common, particularly in heavily unionized industries, like the auto industry. Today, though, they have largely bee...

Frozen Defined Benefit Plans

Many of the remaining defined benefit plans have been “frozen.” This means the company wants to phase out its retirement plan, but will wait to do...

The Solo Defined Benefit Plan

There is a way certain savers can start a DIY defined benefit plan. It’s built off of contributions you make yourself, without any help from your e...

What is defined benefit plan?

A defined benefit plan is a retirementplan in which employers provide guaranteed retirement benefits to employees based on a set formula. These plans, often referred to as pension plans, have become less and less common over the last few decades. This decline is especially pronounced in the private sector, where more and more employers have shifted ...

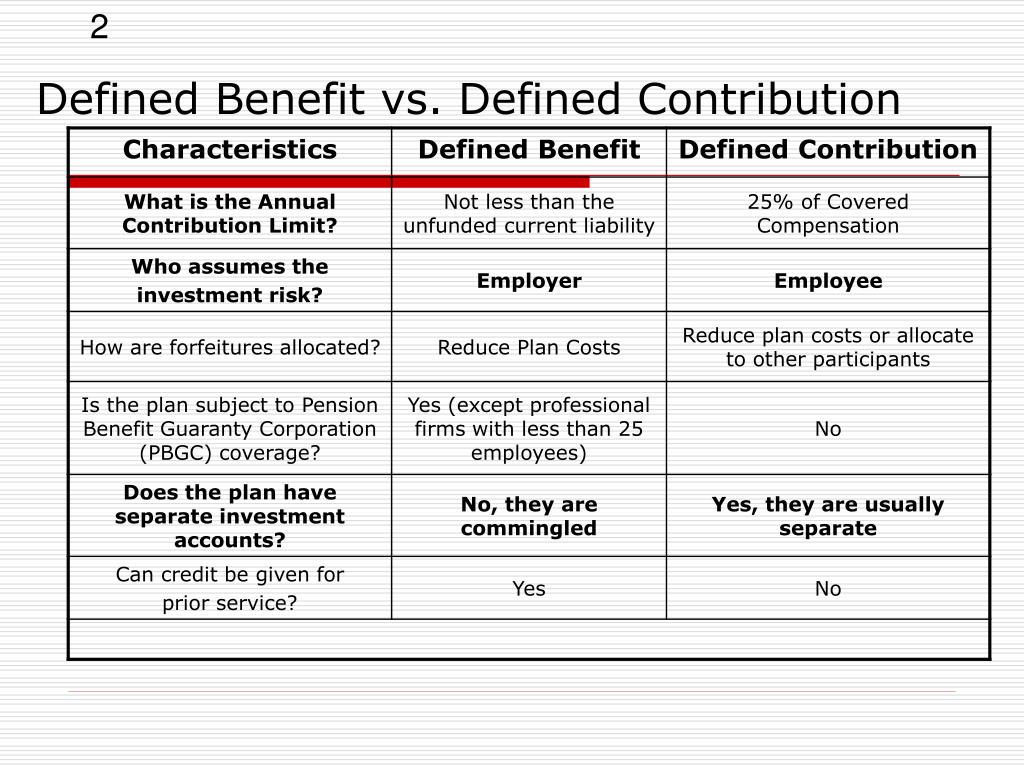

What is the difference between defined benefit and defined contribution?

Some companies offer both defined benefit and defined contribution plans. The key difference between each of these employer-sponsored retirement plans is in their names. With a defined contribution plan, it’s only the employee’s contributions (and the employer’s matching contributions) that’s defined. The benefits they receive in retirement depend ...

Why do you have to keep funding a defined benefit plan?

Because the benefits of a defined benefit plan are very specific, you have to keep funding the plan to make sure it will pay those benefits in your retirement. Plus, you’ll need to have an actuary perform an actuarial analysis each year.

Do defined benefit plans grow with inflation?

Many defined benefit plans also grow with to inflation. As a result, inflation over long periods of time won’t affect your money as much as a defined contribution plan participants. Defined benefit plans also feature low fees, meaning more of your money will stay in your pocket.

Is the defined benefit plan frozen?

This has led to the shift in responsibility from employers to employees. Many of the today’s remaining defined benefit plans have been “ frozen.”. This means the company is phasing out its retirement plan, though it’s waiting to do so until the enrollees surpass the age requirement.

Is 401(k) a high employer match?

Between their defined benefit plans and Social Security benefits, workers could expect to sail into a dignified retirement. These days, companies still with the much cheaper 401(k). Therefore, having a generous 401(k) with a high employer match is the new gold standard for employees.

Can you deduct contributions to a defined benefit plan?

The problem with making your own defined benefit plan is that you have to meet the annual minimum contribution floor.

What is defined benefit plan?

A defined benefit plan, more commonly known as a pension plan, offers guaranteed retirement benefits for employees. Defined benefit plans are largely funded by employers, with retirement payouts based on a set formula that considers an employee’s salary, age and tenure with the company. In an age of defined contribution plans like 401 (k)s, ...

How much can an employee contribute to a defined benefit plan?

In 2020, the annual benefit for an employee can’t exceed the lesser of 100% of the employee’s average compensation for their highest three consecutive calendar years or $230,000.

What is the form of retirement payment?

When it comes time to collect your retirement, you usually receive payment in the form of a lump sum or an annuity that provides regular payments for the rest of your life. Deciding between the two can be a difficult decision, especially since there are different ways an annuity could be structured:

What is a vested pension plan?

After racking up the required tenure, an employee is considered “vested.”. Pension plans may have different vesting requirements. For instance, after one year with a company, an employee might be 20% vested, granting them retirement payments equal to 20% of a full pension.

What happens to your annuity when you die?

When you die, your surviving spouse will get monthly payments for the rest of their life that are equal to 50% of your original annuity. • 100% joint and survivor. When you die, your surviving spouse will get monthly payments for the rest of their life that are equal to 100% of your original annuity.

What does it mean to add more stipulations to an annuity?

Adding more stipulations to your annuity usually means you’ll get lower monthly payments. But if you’re in good health and expect to live a long life, you’ll usually get the most benefit from choosing annuity payments. If you’re in poor health and expect a short retirement, a lump sum may be the best way to go.

Is a defined benefit plan funded by employer contributions?

You’re probably more familiar with qualified employer-sponsored retirement plans like a 401 (k). Unlike 401 (k)s, defined benefit plans are usually funded entirely by employer contributions, although in rare cases employees may be required to make some contributions. The retirement benefits provided by a defined benefit plan are typically based on ...

What is defined benefit plan?

Key Takeaways. A defined-benefit plan is an employer-based program that pays benefits based on factors such as length of employment and salary history. Pensions are defined-benefit plans. In contrast to defined-contribution plans, the employer, not the employee, is responsible for all of the planning and investment risk of a defined-benefit plan.

How does an employer fund a fixed benefit plan?

The employer typically funds the plan by contributing a regular amount, usually a percentage of the employee's pay, into a tax-deferred account.

What is a single life annuity?

Payment options commonly include a single- life annuity, which provides a fixed monthly benefit until death; a qualified joint and survivor annuity , which offers a fixed monthly benefit until death and allows the surviving spouse to continue receiving benefits thereafter; 2 or a lump-sum payment, which pays the entire value of the plan in a single payment.

Why is it important to choose the right payment option?

Selecting the right payment option is important because it can affect the benefit amount the employee receives. It is best to discuss benefit options with a financial advisor. Working an additional year increases the employee's benefits, as it increases the years of service used in the benefit formula.

Who is entitled to the benefits if an employee passes away?

The surviving spouse is often entitled to the benefits if the employee passes away. Since the employer is responsible for making investment decisions and managing the plan's investments, the employer assumes all the investment and planning risks.

Can I withdraw from a 401(k)?

Typically an employee cannot just withdraw funds as with a 401 (k) plan. Rather they become eligible to take their benefit as a lifetime annuity or in some cases as a lump-sum at an age defined by the plan's rules.

Does working past retirement age increase benefits?

This extra year may also increase the final salary the employer uses to calculate the benefit. In addition, there may be a stipulation that says working past the plan's normal retirement age automatically increases an employee's benefits.

What is defined benefit plan?

What are defined benefit plans? Defined benefit plans are qualified employer-sponsored retirement plans. Like other qualified plans, they offer tax incentives both to employers and to participating employees. For example, your employer can generally deduct contributions made to the plan.

How to calculate retirement benefits?

Many plans calculate an employee's retirement benefit by averaging the employee's earnings during the last few years of employment (or, alternatively, averaging an employee's earnings for his or her entire career), taking a specified percentage of the average, and then multiplying it by the employee's number of years of service.

Why is it important to choose the right payment option?

Choosing the right payment option is important, because the option you choose can affect the amount of benefit you ultimately receive. You'll want to consider all of your options carefully, and compare the benefit payment amounts under each option. Because so much may hinge on this decision, you may want to discuss your options with a financial ...

What happens if you leave your job before you get a full retirement?

If you leave your job before you fully vest in an employer's defined benefit plan, you won't get full retirement benefits from the plan.

What is hybrid retirement plan?

Some employers offer hybrid plans. Hybrid plans include defined benefit plans that have many of the characteristics of defined contribution plans. One of the most popular forms of a hybrid plan is the cash balance plan.

Can you retire early and receive a joint annuity?

Your monthly benefit could end up to be far less if you retire early or receive a joint and survivor annuity. Finally, remember that most defined benefit plans don't offer cost-of-living adjustments, so benefits that seem generous now may be worth a lot less in the future when inflation takes its toll.

Is it too early to start planning for retirement?

It's never too early to start planning for retirement. Your pension income, along with Social Security, personal savings, and investment income, can help you realize your dream of living well in retirement. Start by finding out how much you can expect to receive from your defined benefit plan when you retire.

What is defined benefit plan?

A defined benefit plan means that you take control of your employees’ retirement income. Rather than employees contributing to their own plan, you pay into it based on your predetermined formula. The formula usually consists of:

Do small businesses offer 401k?

As a small business owner, you have to worry about your own retirement plan as well as those of your employees (if you want to offer value-added benefits). While many business owners offer the defined contribution plan (401K), there are benefits of offering a traditional pension or defined benefit plan.

What is defined benefit pension?

A defined-benefit pension plan requires an employer to make annual contributions to an employee’s retirement account. Plan administrators hire an actuary to calculate the future benefits that the plan must pay an employee and the amount that the employer must contribute to provide those benefits. The future benefits generally correspond ...

How much does a defined benefit plan pay?

One type of defined-benefit plan might pay a monthly income equal to 25% of the average monthly compensation that an employee earned during their tenure with the company. 3 Under this plan, an employee who made an average of $60,000 annually would receive $15,000 in annual benefits, or $1,250 every month, beginning at the age of retirement (defined by the plan) and ending when that individual died.

How does a straight life annuity work?

In a straight life annuity, for example, an employee receives fixed monthly benefits beginning at retirement and ending when they die. The survivors receive no further payments. In a qualified joint and survivor annuity, an employee receives fixed monthly payments until they die, ...

What is future benefit?

The future benefits generally correspond to how long an employee has worked for the company and the employee’s salary and age. Generally, only the employer contributes to the plan, but some plans may require an employee contribution as well. 1 To receive benefits from the plan, an employee usually must remain with the company for ...

How often do you get a pension payment?

Generally, the account holder receives a payment every month until they die. Companies cannot retroactively decrease benefit amounts for defined-benefit pension plans, but that doesn't mean these plans are protected from failing.

How long do you have to work to get a fixed benefit?

In most cases, an employee receives a fixed benefit every month until death, when the payments either stop or are assigned in a reduced amount to the employee’s spouse, depending on the plan.

When can defined benefit plans make in service distributions?

The IRS also notes that defined-benefit plans generally may not make in-service distributions to participants before age 62, but such plans may loan money to participants. 1 .

Defined Benefit Plan Explained

DBP is a traditional pension vehicle for employees primarily sponsored by employers. The crucial element of this scheme is that the employers take the onus of saving for employees’ retirement on their behalf. Federal insurance usually secures this plan through the Pension Benefit Guaranty Corporation.

Defined Benefit Plan Examples

Judy and Jennifer are both neighbors. They both started their jobs on the same day in two different companies. They worked hard and climbed the corporate ladder with perks, promotions, incentives, and salary hikes. Both Judy and Jennifer worked for their respective companies for 35 years and retired.

Recommended Articles

This has been a Guide to Defined Benefit Plan and its definition. Here we discuss how Defined Benefit Plan works and its types, examples, and a comparison with defined contribution plans. You may learn more about financing from the following articles –

What Is A Defined-Benefit Plan?

Understanding Defined-Benefit Plan

- Also known as pension plansor qualified-benefit plans, this type of plan is called "defined benefit" because employees and employers know the formula for calculating retirement benefits ahead of time, and they use it to define and set the benefit paid out. This fund is different from other retirement funds, like retirement savings accounts, where the payout amounts depend on invest…

Examples of Defined-Benefit Plan Payouts

- A defined-benefit plan guarantees a specific benefit or payout upon retirement. The employer may opt for a fixed benefit or one calculated according to a formula that factors in years of service, age, and average salary. The employer typically funds the plan by contributing a regular amount, usually a percentage of the employee's pay, into a tax-deferredaccount. However, depen…

Annuity vs. Lump-Sum Payments

- Payment options commonly include a single-life annuity, which provides a fixed monthly benefit until death; a qualified joint and survivor annuity, which offers a fixed monthly benefit until death and allows the surviving spouse to continue receiving benefits thereafter; or a lump-sum payment, which pays the entire value of the plan in a single payment.4 Working an additional year increas…