Do I have to pay taxes on accelerated benefits?

In most cases accelerated benefits are not subject to federal income taxes. Under the federal tax code, a terminally ill person (defined as a person having only 24 months to live) would not have to pay taxes on accelerated benefits. A chronically ill person is usually exempt but may have to qualify for the exemption by being certified each year.

Are accelerated death benefits taxable?

Accelerated death benefits are typically not taxed as income. In order to qualify for an accelerated death benefit, a policy owner needs to provide proof that they are chronically or terminally ill. Taking accelerated death benefits will reduce the amount of money received by beneficiaries.

Is the cost of accelerated benefits included in the premium?

The cost may be included in your insurance premium or added to the policy for a small amount, usually a percentage of the base premium. Some companies only charge you for the option if you use it. What types of policies offer accelerated benefits?

Are accelerated benefits for long term care tax exempt?

Taxation on Accelerated Benefits. Accelerated benefits are usually tax exempt for individuals expected to die within two years. This type of benefit isn’t meant to substitute for long-term care insurance coverage. It should be used to supplement for expenses not covered by a long-term care policy.

Is long-term care and accelerated death benefits taxable?

Accelerated death benefits for individuals certified as chronically ill are generally excludable from income, just as they would be if paid under a qualified LTC insurance contract. Your 1099-LTC may list a large amount of benefits for which you may not necessarily owe taxes (a "tax-qualified policy").

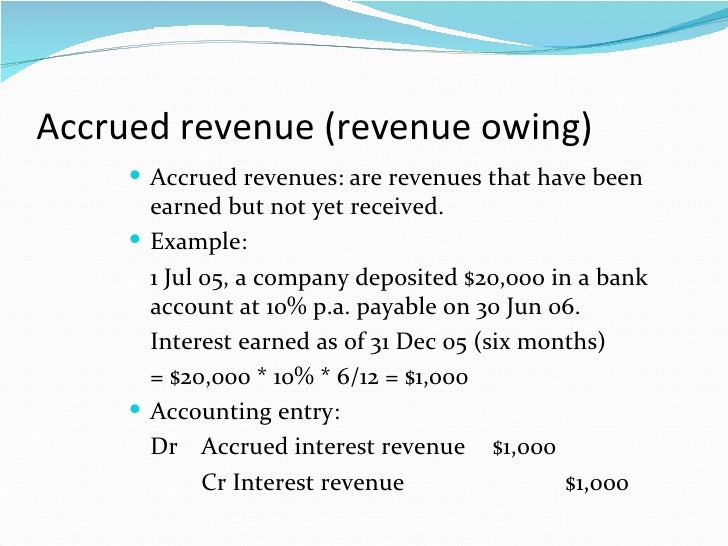

What are accelerated benefits?

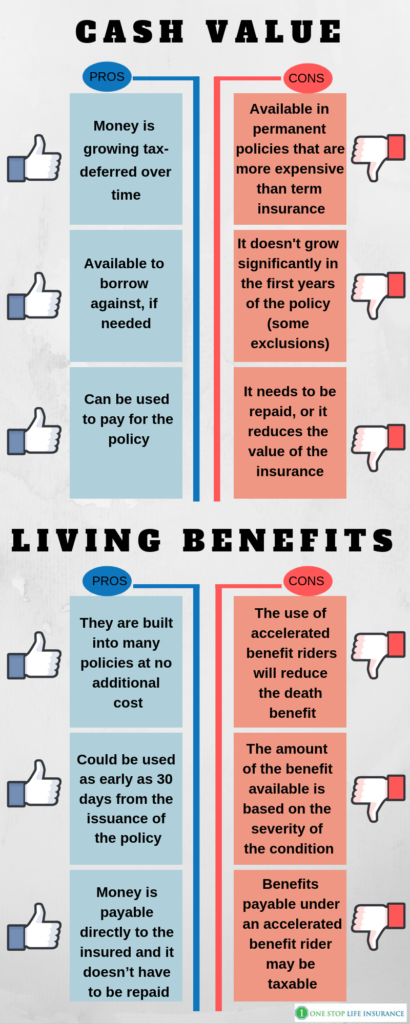

A: Accelerated benefits, also known as "living benefits," are life insurance policy proceeds paid to the policyholder before he or she dies. The benefits may be provided in the policies themselves, but more often they are added by riders or attachments to new or existing policies.

What does Accelerated death benefit mean?

The Accelerated Death Benefit (ADB) is a provision in most life insurance policies that allows a person to receive a portion of their life insurance money early — to use while they are still living. ADB is a standard in the industry and offered by most life insurance carriers.

What is the maximum benefit of the accelerated benefit rider for terminal illness?

For example, Haven Term policyholders can access 75 percent of their death benefit or up to $250,000, whichever comes first. As a result of using this rider, the monthly (or yearly) premium payment would decrease to reflect the new face amount.

Are accelerated death benefits taxable in California?

If you choose to accelerate a portion of your death benefit, doing so will reduce the amount that your beneficiary will receive upon your death. Receipt of accelerated death benefits may be taxable.

Which of the following is true regarding taxation of accelerated benefits paid under a life insurance policy?

Which of the following is true regarding taxation of accelerated benefits under a life insurance policy? They are always taxable to chronically ill insured.

Is terminal illness benefit taxable?

Terminal medical condition benefits A terminal illness lump sum benefit is paid tax-free, regardless of the recipient's age and the underlying tax components. In addition, it is not assessable income, and it is not exempt income.

Does accelerated death benefit rider include disability income?

Separate Coverage Needed Accelerated benefit riders do not completely substitute separate policies that are specifically designed to cover certain risks, such as a disability or health insurance.

How long does it take for death benefits to be paid?

It can take up to a year for a retirement fund death benefit to be paid out, as the trustees must ensure that all financial dependents are provided for.

Does life insurance pay out for terminal illness?

Standard life insurance gives your loved ones a sum of money if you pass away during the term of the policy. Terminal illness protection lets you and your loved ones receive the payout before you die, providing that you can confirm your illness is going to prove fatal within a certain time.

What is accelerated disability?

The Accelerated Disability Benefit is an optional supplementary benefit that provides coverage against Total and Permanent Disability (“TPD”) during the term of the policy, and before the anniversary of the policy on which the life assured attains age 65.

Under which of the following circumstances would an insurer pay accelerated benefit?

Accelerated benefits are paid when insureds endure financial hardship due to severe illness. They may request immediate payment of some portion of the policy's death benefit, usually 50-100%, depending on the insurer.

Who gets accelerated death benefits?

Accelerated death benefits paid to any taxpayer other than the insured if the taxpayer has an insurable interest in the life of the insured because the insured is a director, officer, or employee of the taxpayer or if the insured is financially interested in any trade or business of the taxpayer are received on a tax-free basis.

Does the tax treatment apply to long term care?

Generally, the tax treatment outlined above will not apply to any payment received for any period unless the payment is for costs incurred by the payee (who has not been compensated by insurance or otherwise) for qualified long-term-care services provided to the insured for the period.

Is accelerated death benefit taxed?

Thus, an accelerated death benefit meeting these requirements will generally be received free of income tax. However, amounts paid to a chronically ill individual are subject to the same limitations ...

What is Accelerated Benefits?

Accelerated benefits are limited and are meant to alleviate end-of-life financial hardship. They do not replace comprehensive health or long-term care insurance, which are designed to cover medical and long-term care costs.

What are the conditions for early payment of a health insurance policy?

Certain medical circumstances can trigger eligibility for early payment of all or a portion of your policy's proceeds, including: Terminal illness, with death expected within 24 months. Acute illness, such as acute heart disease or AIDS, which would result in a drastically reduced life span without extensive treatment.

Can you get accelerated benefits from life insurance?

Under U.S. Department of Health and Human Services policy, you cannot be forced to collect accelerated benefits from your life insurance policy before qualifying for Medicaid. But if you choose to receive accelerated benefits, that money could be considered income, which might affect your Medicaid eligibility.

Does group life insurance have accelerated benefits?

Check with your insurance agent or company to see if your policy includes or offers the option. Group policies for term or permanent life insurance may also provide accelerated benefits; check with your benefits administrator.

Do you get accelerated benefits after death?

If your policy's proceeds are entirely depleted, no benefit is paid after your death. How do I pay for the accelerated benefits option? The cost may be included in your insurance premium or added to the policy for a small amount, usually a percentage of the base premium.

Do terminally ill people have to pay taxes?

Under the federal tax code, a terminally ill person (defined as a person having only 24 months to live) would not have to pay taxes on accelerated benefits. A chronically ill person is usually exempt but may have to qualify for the exemption by being certified each year.

Do you have to return accelerated death benefits?

Once your insurer accepts and pays your accelerated death benefits claim, you don't have to return the money if your health improves. However, filing a false claim or concealing information to obtain a benefit under an insurance policy is considered fraud in many states and subject to criminal or civil penalties.

How much does accelerated benefit cover?

For example, if you use the accelerated benefit to cover $100,000 in medical care costs, your beneficiaries will receive $100,000 less in death benefits after you die.

What can you use the accelerated death benefit for?

The benefit can be used to pay for things like treatment costs or stays in a facility. For example, someone diagnosed with a terminal disease could use an accelerated death benefit rider to help pay for in-home nursing or hospice care.

What can an accelerated death benefit rider pay for?

In addition, an accelerated death benefit rider can pay for things such as: Hospital bills. Travel for care. Renovations to help the person stay in the home.

How to access death benefit rider?

To access money via an accelerated death benefit rider, let your life insurance company know that you have been diagnosed with a covered illness. The insurer's claims department will review the medical records and provide an estimated payout based on the life expectancy.

How long can you withdraw from a death benefit?

Other insurance companies may extend that period, such as up to 24 months. The amount of accelerated benefit you can withdraw typically is limited to a percentage of the policy’s overall death benefit payment. A policy may limit the accelerated benefit to 50% of your death benefit, or $500,000, whichever comes first, for example.

Is accelerated death benefit tax free?

An accelerated death benefit rider can provide you with an important way to fund medical care costs. In many cases, the payments are tax-free. The IRS says accelerated death benefits are excluded from taxation if the insured is terminally ill.

Can you lose Medicaid if you get accelerated death benefit?

Accepting accelerated benefits funding might affect your tax status or Medicaid eligibility. You may lose Medicaid coverage if you get accelerated benefits funding.

When did accelerated death benefit start?

This type of benefit was originally started in the late 1980s in an attempt to alleviate the financial pressures of those that were diagnosed with AIDS. The accelerated death benefit provision in a life insurance policy is also known as a "living benefit" rider or "terminal illness benefit.".

How old is Fred from the accelerated death benefit?

Consider a 40-year-old named Fred, a preferred non-tobacco user with a $1 million life insurance policy. Fred contracted terminal brain cancer and decided he wanted to accelerate half the face value of his policy and collect an accelerated death benefit.

What is ADB in insurance?

Many individuals who choose an accelerated death benefit have less than one year to live and use ...

How much was Fred's death benefit?

After cashing the check, Fred's remaining death benefit was $500,000, and he paid new premiums based on a $500,000 face value instead of the original $1 million face value.

Does accelerated death benefit affect Medicaid?

Receiving an accelerated death benefit can affect your eligibility for Medicaid and SSI. The cost of a living benefit can vary according to insurance company and policy. If the coverage is already included, the cost will be included in the policy. If not, then you will have to pay a fee or a percentage of the death benefit.

What happens if I receive a 1099 LTC?

What if I Receive IRS Form 1099-LTC? If you receive IRS Form 1099-LTC, don’t fret, this doesn’t necessarily mean that you will owe taxes to the IRS. The form is primarily used so that your insurance company or payer can notify the IRS that they made long-term care or awarded you accelerated death benefits. Here’s what you need to do ...

Is accelerated death benefit taxable?

Accelerated Death Benefits. Benefits received for accelerated death benefit plans are fully excludable from your taxable income if the insured has been certified by a physician as terminally ill. This means these benefits will not be taxed when your yearly return is filed.

Is 1099 LTC taxable income?

Payments that are from long-term care insurance contracts are generally excludable as taxable income. These payments will either be paid on a per diem basis (fixed payments made on a periodic basis without regard ...

Is per diem taxable for long term care?

If the payments received are per diem benefits, there is a limit on the nontaxable benefits. The taxable amount of the benefit is generally limited to benefits received that are in excess of the actual long-term care costs. For example, if the long-term care benefits paid $5,000 for every month that you were hospitalized ...

How much can you exclude from your income?

However, the amount you can exclude is limited to your employer's cost and can’t be more than $1,600 ($400 for awards that aren’t qualified plan awards) for all such awards you receive during the year. Your employer can tell you whether your award is a qualified plan award. Your employer must make the award as part of a meaningful presentation, under conditions and circumstances that don’t create a significant likelihood of it being disguised pay.

When is nonqualified compensation included in gross income?

In most cases, any compensation deferred under a nonqualified deferred compensation plan of a nonqualified entity is included in gross income when there is no substantial risk of forfeiture of the rights to such compensation. For this purpose, a nonqualified entity is one of the following.

Where to put elective deferrals on W-2?

Your employer generally shouldn't include elective deferrals in your wages in box 1 of Form W-2. Instead, your employer should mark the Retirement plan checkbox in box 13 and show the total amount deferred in box 12.

What is income received by an agent for you?

Income received by an agent for you is income you constructively received in the year the agent received it. If you agree by contract that a third party is to receive income for you, you must include the amount in your income when the third party receives it.

Is emergency financial aid included in gross income?

The amounts of these are not included in the gross income of the eligible self-employed individual. Emergency financial aid grants. Certain emergency financial aid grants under the CARES Act are excluded from the income of college and university students, effective for grants made after 3/26/2020.