Do the Beneficiaries of Death Benefits Pay Taxes?

- Death Benefits. A death benefit is a sum of money paid to one or more beneficiaries when the owner of the death benefit dies.

- Insurance Policies. In just about all cases, the death benefits paid by insurance policies are free from income tax. ...

- Qualified Retirement Accounts. ...

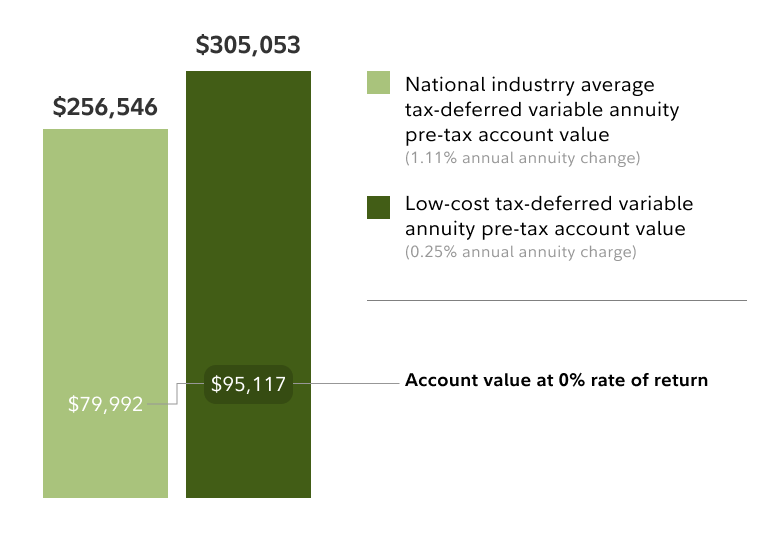

- Variable Annuities. ...

Do you pay taxes on death benefits on an annuity?

When the insured or annuitant dies, a death benefit is paid to the recipient of a life insurance policy, annuity, or pension. Death payments from life insurance plans are not taxed, and named recipients often get the death benefit as a lump-sum payment.

How to cash in a death benefit on an annuity?

Annuity death benefits that can be included in an annuity fall into a number of main categories:

- Guaranteed periods

- Joint life annuity

- Nominee annuity

- Value protection

Are the proceeds from an annuity death benefit taxable?

Whether a variable annuity death benefit is taxable depends on its classification as a qualified or nonqualified annuity. Qualified annuities, which are held by 401 (k) s or individual retirement accounts, are taxed the same as other qualified plans. Nonqualified annuities have death benefits that don't receive a step up in cost basis if they're left to a non-spouse beneficiary, so the beneficiary will pay ordinary income taxes on any deferred earnings.

Do fixed annuities have a death benefit?

Please leave this field empty. All annuities can designate a beneficiary. Once an annuity starts paying a lifetime income, the option selected will determine if there is any death benefit payable. The basic option is a lifetime income and while this benefit will pay until the annuitant dies, there isn’t any benefit for a beneficiary.

Who pay taxes on annuity death benefit?

In this situation, the beneficiary will owe taxes on the entire difference between what the owner paid for the annuity and the death benefit. This is the option with the highest tax consequences for the beneficiary. The beneficiary can also withdraw the money over a period of five years.

Do the beneficiaries of an annuity have to pay taxes?

You'd have to pay any taxes due on the benefits at the time you receive them. The five-year rule lets you spread out payments from an inherited annuity over five years, paying taxes on distributions as you go.

How do I avoid taxes on an annuity death benefit?

To avoid taxes on inheritance, you can use a deferred annuity or a life insurance policy. Annuities offer enhanced death benefits that allow beneficiaries to offset taxes or spread the tax burden over time.

How much tax do you pay on an inherited annuity?

Under the terms of the SECURE Act, those who inherit an IRA annuity have to withdraw all of the money in it within 10 years following the death of the original owner. Failing to withdraw the required amount could trigger a 50% tax penalty on any remaining amounts.

What happens to annuities when someone dies?

Payments will continue to you for as long as you live. But you or your beneficiary are guaranteed to get a least the amount you paid in. If you die before that amount is paid out, your beneficiary will get payments up to the amount that you initially paid for the annuity.

What should you do when you inherit an annuity?

If you've inherited a qualified annuity, you are permitted to roll it over into an inherited IRA. The reason for doing this is that IRAs typically have lower fees And, they usually have better investment options when compared to annuities.

Is a lump sum death benefit taxable?

While some forms of death benefits, such as life insurance payments, are not subject to income tax, the IMRF lump sum death benefit is taxable. Payments from insurance are not subject to income tax because the member paid the premiums on the policy using previously taxed money.

How is taxable amount of survivor annuity calculated?

Under the Simplified Method, you figure the tax-free part of each full monthly payment by dividing your cost by a number of months based on your age. This number will differ depending on whether your annuity starting date is before November 19, 1996, or after November 18, 1996.

Do beneficiaries pay taxes on life insurance policies?

Generally speaking, when the beneficiary of a life insurance policy receives the death benefit, this money is not counted as taxable income, and the beneficiary does not have to pay taxes on it.

Do you have to report annuity on taxes?

You do not owe income taxes on your annuity until you withdraw money or begin receiving payments. Upon a withdrawal, the money will be taxed as income if you purchased the annuity with pre-tax funds. If you purchased the annuity with post-tax funds, you would only pay tax on the earnings.

What happens to my annuity when I die?

It depends on the terms of your annuity contract. Payments may stop when you die, but if the contract includes a death-benefit provision, you can a...

How are annuities taxed at death?

A person who inherits an annuity has to pay income tax based on the difference between the premium paid into the annuity and the amount still in it...

What is the best thing to do with an inherited annuity?

While you can’t avoid paying at least some taxes on an inherited annuity, you can minimize the amount of tax you owe. A financial professional who...

How long does a death benefit tax liability last?

Some carriers allow your beneficiaries to spread that death benefit tax liability over a 5 year time period, and so do not. All carriers have their own internal policy rules concerning the distribution of death benefit proceeds, so it's important that you do your homework.

Do you see death benefits on life insurance?

It's the best ROI (Return on Investment) you will never see. You won't see it because you will be dead! However, your family will love you for it. So what about death benefits on annuities?

Is an annuity tax free?

But that's were most of the similarities end, especially when it comes to the taxation of death benefits. Annuity death benefits are NOT tax-free to the listed beneficiaries on the policy. That's right, annuities are issued by life insurance companies but the death benefits on ...

What happens to an annuity after the owner dies?

After an annuitant dies, insurance companies distribute any remaining payments to beneficiaries in a lump sum or stream of payments. It’s important to include a beneficiary in the annuity contract terms so that the accumulated assets are not surrendered to a financial institution if the owner dies.

Who is the beneficiary of an annuity?

A beneficiary is the person who receives the death benefits, usually the remaining contract value or the amount of premiums minus any withdrawals, upon the annuitant’s death.

What is a beneficiary list?

Beneficiaries can be people or organizations. A list of beneficiaries ensures that the designated people and organizations receive the specified amount or percentage. Minors designated as beneficiaries can’t access their inherited annuity until they reach the age of majority (18).

What is inheritance tax?

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitant’s death. How taxes are paid on an inherited annuity will depend on the payout structure selected and the status of the beneficiary.

What happens when a spouse becomes an annuitant?

The spouse then becomes the new annuitant. When a spouse becomes the annuitant, the spouse takes over the stream of payments. This is known as a spousal continuation.

Do annuities end after death?

Because annuities offer many benefits, lottery winners, retirees and structured settlement recipients use them to create predictable cash flow for the present, future and even after their death. Depending on the terms of the contract, annuity payments will end after the death of the annuity owner.

Who is the annuitant in an annuity?

The annuitant is the person on whose life expectancy the contract is based. It is common for the annuity owner to name him or herself as the annuitant.

How are annuities taxed?

How annuities are taxed also depends on how they were purchased. This means when figuring your annuity taxation at death, you’ll also need to think about how you put the funds in when you set it up. If you funded your annuity using money you’ve never paid taxes on, it’s considered a qualified annuity, and the IRS will want its share when you take your distribution. A qualified annuity is funded using money from an account like a 401 (k) or IRA.

How to keep an annuity going after death?

One option to keep your annuity going long after your death is to set up a joint life annuity. This is usually an option set up by spouses who want to make sure the survivor is taken care of if something should happen.

What happens if an annuity goes to your spouse?

If your annuity contract designates that it goes to your spouse, there will be no immediate tax consequences. In this scenario, your spouse would simply reassign the annuity to his own name. The annuity would continue to operate as it did when you were alive, only going to your spouse instead of you.

What is a qualified annuity?

A qualified annuity is funded using money from an account like a 401 (k) or IRA. The other type of annuity you’ll likely encounter when signing your contract is a non-qualified annuity. This means you purchased the annuity using money you’ve already paid taxes on, like cash straight out of your bank account.

Can you take an annuity in a lump sum?

They can take the annuity in a lump sum, at which point they would be required to pay taxes on the appreciation as ordinary income. Instead of that lump sum, though, they can choose to take it over a five-year period, which will avoid the hefty tax, plus keep them from moving into a higher tax bracket.

Can you roll an annuity over to your spouse?

You can choose for your annuity to go to a parent, child or even a friend after your death, as long as you build it into your contract. Unlike your spouse, these other parties can’t simply roll the annuity over to them and continue to take it, though, since they weren’t married to you .

Do annuities grow tax free?

One of the biggest benefits of annuities is that the funds grow tax-free until you’re ready to take them out. If you earn any interest or dividends, you must reinvest them in the annuity to keep those tax benefits, but you’ll be able to enjoy tax-free growth throughout the life of your annuity.

What is an annuity death benefit?

Annuity Death Benefit Provision Explained. An annuity is a contract between yourself and an insurance company. You pay the insurer a set amount of money to purchase the contract. In turn, the insurer agrees to pay you according to a set schedule.

When adding an annuity to your financial plan, is the death benefit important?

When adding an annuity to your financial plan, the death benefit is an important consideration. The annuity company you’re working with should be able to walk you through different death benefit scenarios to help you decide which one is the best fit for your needs.

What are annuity riders?

Annuity Riders. Aside from death benefit upgrades, there are other riders that can increase an annuity’s value. For example, you may be able to add a rider to cover long-term carein case you need nursing home care in retirement. Having this rider could reduce the amount of the death benefit.

What happens if you live longer and receive more money from an annuity?

In exchange, the insurance company increases the death benefit payout your beneficiaries are eligible to receive, since there may be less money left in the annuity by the time you pass away.

How to determine death benefit amount?

Death Benefit Amounts. Generally, there are two ways to determine a standard annuity death benefit. First, you can pay out any remaining assets to your beneficiary. Say you purchased a $500,000 annuity and it paid out $300,000 during your lifetime.

Does an annuity increase the death benefit?

Increasing an Annuity Death Benefit. Your insurance company may offer opportunities to increase your annuity death benefit.

Does an annuity increase if you pass away?

For example, if you pass away during a market upswing, the annuity’s death benefit may automatically increase. Annual increases.

What Happens to an Annuity When the Annuitant or Owner Dies?

First, it’s important to note that some annuities are annuitant driven and some are owner driven. The main difference is whose death triggers the death benefit. If the policy is annuitant driven, proceeds are payable to the beneficiary when the annuitant dies.

Income Tax and Annuities

Once the money is inside of an annuity, it grows tax-deferred. That means the owner does not have to pay taxes on the growing account balance. After a set number of years, the policy can be annuitized, which turns the annuity into a steady income stream, payable to the annuitant.

How Much Tax Do You Pay on an Inherited Annuity?

For any type of annuity, the Internal Revenue Service will require taxes to be paid by the beneficiary either on the lump sum received or on the regular fixed payments. The payments received from an annuity are treated as ordinary income, which could be as high as a 37% marginal tax rate depending on your tax bracket.

How Death Benefits are Paid

There are a handful of ways that annuity death benefits are paid. In all cases, the recipient pays ordinary income tax on the money distributed to them:

Tax Rules When an Annuity Has Been "Annuitized"

If you die after payments have begun as part of annuitizing your contract, the policy will terminate unless you have a death benefit provision in the original contract.

Rules for Annuities Prior to Annuitization

If your annuity is in the "accumulation" phase, meaning not yet annuitized, there are specific rules for what happens when you die and have identified beneficiaries to receive the proceeds of our annuity:

Death Benefit Riders

Some types of annuities offer a guaranteed death benefit to the beneficiary, no matter the amount remaining in the contract. This is known as a death benefit rider, and the annuity owner pays an annual fee for this benefit. Death benefit riders protect beneficiaries against declines in contract values because of market conditions.

Inherited IRAs Before the SECURE Act

In the years before the SECURE Act was passed, many households bought annuities with their IRA money to create stretch IRAs. A stretch IRA was a tax planning strategy. It came into play when the original annuity owner dies.

What Happens to an Inherited IRA Now?

According to Scott Ditman with Berdon Accountants & Advisors, now the entire IRA must be distributed within 10 years of the owner’s death. The beneficiary has some choices in terms of how long they stretch out those distributions. Ultimately, though, the account must be “emptied” by year 10.

Exceptions to the New Rules

Some exceptions apply to this new 10-year rule, so check with your tax advisor and estate planning attorney to see if those might apply to you.

What About Required Minimum Distributions?

Before going into more detail, let’s quickly review required minimum distributions. Before the SECURE Act was passed in 2019, you would have to start taking mandatory minimum withdrawals from your 401 (k), traditional IRA, or other tax-advantaged retirement account once you turned 70.5.

RMDs and The Five-Year Rule

Now, let’s go back to our original discussion. Say that an account holder who passed hadn’t reached the age when they would be required to start taking mandatory minimum distributions.

What About Distributions from Roth IRA and Non-Qualified Annuities?

Roth IRAs must still be emptied out by the beneficiary within that 10-year period. However, the withdrawals made by the beneficiary are tax-free, according to Ditman.

Keep This in Mind About the SECURE Act

The SECURE Act seeks to ultimately increase its tax revenue from inherited IRAs as a way to compensate for the loss of revenues that it will absorb from taxes that were reduced or eliminated elsewhere.

What are the tax advantages of annuities?

One of the main tax advantages of annuities is they allow investments to grow tax-free until the funds are withdrawn. This includes dividends, interest and capital gains, all of which may be fully reinvested while they remain in the annuity. This allows your investment to grow without being reduced by tax payments.

How long does an annuity last?

Your life expectancy is 10 years at retirement. You have an annuity purchased for $40,000 with after-tax money. Annual payments of $4,000 – 10 percent of your original investment – is non-taxable. You live longer than 10 years. The money you receive beyond that 10-year-life expectation will be taxed as income.

What is the exclusion ratio on an annuity?

Non-qualified annuities require tax payments on only the earnings. The amount of taxes on non-qualified annuities is determined by something called the exclusion ratio. The exclusion ratio is used to determine what percentage of annuity income payments is taxable and how much is not. The idea is to determine the amount of a withdrawal ...

What is the rest of an annuity?

The rest is the taxable balance, or the earnings. When you receive income payments from your annuity, as opposed to withdrawals, the idea is to evenly divide the principal amount — and its tax exclusions — out over the expected number of payments.

What happens if you withdraw money from an annuity?

In general, if you withdraw money from your annuity before you turn 59 ½, you may owe a 10 percent penalty on the taxable portion of the withdrawal. After that age, taking your withdrawal as a lump sum rather than an income stream will trigger the tax on your earnings.

What is annuity.org?

Annuity.org writers ad here to strict sourcing guidelines and use only credible sources of information, including authoritative financial publications, academic organizations, peer-reviewed journals, highly regarded nonprofit organizations, government reports, court records and interviews with qualified experts . You can read more about our commitment to accuracy, fairness and transparency in our editorial guidelines.

Do you pay taxes on an annuity?

You do not owe income taxes on your annuity until you withdraw money or begin receiving payments. Upon a withdrawal, the money will be taxed as income if you purchased the annuity with pre-tax funds. If you purchased the annuity with post-tax funds, you would only pay tax on the earnings.

What happens to an annuity if the owner dies?

If the owner dies, the primary beneficiary will receive payments or lumpsum distribution. A predetermined list of beneficiaries from an annuity can ensure that the money is given to them based on a percentage or amount. Minors can not touch their inherited annuity until they’ve reached legal adult age.

Why is an annuity important?

An annuity is a good way to save for retirement. It protects you from the risk of living too long, and it can also protect you from market risks. Lottery winners, retirees, and structured settlement owners often use an annuity because it helps them know how much money they will have now and in the future.

What is a lump sum death benefit?

Lump-Sum. Standard death benefits from deferred annuities are payable to a designated beneficiary are a choice of a lump sum or a series of payments. Some deferred annuities offer an enhanced death benefit as a life insurance alternative to increase the inheritance for the beneficiaries.

How long can a non-spousal beneficiary withdraw from an annuity?

Non-spousal beneficiaries can withdraw the proceeds over 5 years. Since the taxes are only owed when withdrawing income, the beneficiary can prevent from falling into a higher tax bracket. Another option is to elect annuity payments paid over the beneficiary’s life expectancy.

How long do you have to take out an annuity?

The beneficiary or beneficiaries of an annuity have five years to take out the proceeds. They can take them out gradually or in a single lump sum anytime, as long as they withdraw all of the death benefit with 5 years of the annuitant’s death.

What happens to an annuity after a guaranteed period?

After the guaranteed period is complete, the income stops.

What happens if an annuity owner names a child as the primary beneficiary?

If an annuity owner names a child the primary or contingent beneficiary, under that owner’s state’s Uniform Transfers to Minors Act, the child’s money will be placed in a custodial account for that child’s benefit to a certain age.

What is death benefit?

Death Benefits. A death benefit is a sum of money paid to one or more beneficiaries when the owner of the death benefit dies. Do not confuse death benefits with the wealth already existing in an account. Rather, death benefits are life insurance payouts on top of the assets accumulated in the decedent’s account.

How long do variable annuities pay out?

Annuities accept contributions up to a certain date and then start paying out assets for a set number of years or until the death of the annuity owner. Most variable annuities come with a death benefit that pays beneficiaries upon the death of the annuitant (who need not be the owner). It is important to separate the payments ...

Why are variable annuities considered variable?

They are "variable" because their returns aren’t guaranteed and depend on the performance of the annuities' investments.

Can a 401(k) be used for life insurance?

Qualified Retirement Accounts. Certain retirement accounts such as 401 (k)s (but not IRAs) can hold life insurance policies with death benefits that pay beneficiaries when the account owner dies. Each year, the account owner must pay income tax on the insurance premiums attributed to pure life insurance protection, ...

Do insurance policies pay taxes on death benefits?

Insurance Policies. In just about all cases, the death benefits paid by insurance policies are free from income tax. However, tax may be due on any interest earned by the death benefit. This situation occurs when the payout of death benefits is delayed.

Can you get death benefits from an annuity?

Death benefits are tied to life insurance policies, retirement plans and annuities. Death benefits can be paid out as lump sums either immediately or at some future date, or they might be paid out in installments over time, as is the case with annuities.

Is an annuity taxed on death benefit?

It is important to separate the payments that stem from the annuity’s investment value and the payments arising from a death benefit. Taxes on annuity payouts are assessed only on the money earned in the annuity and not on the original contributions, which are returned tax-free. Similarly, if the annuity has a death benefit, ...

What Is An Annuity Death Benefit?

- When the holder of an annuity contract passes away, the money and the death benefit available from the annuity come into play. Many annuity products come with the provision for the annuity holder to include a death benefit for a beneficiary, which they choose while setting up the contra…

Tax Scenario For Non-Spouse Beneficiaries

- If the selected beneficiary of an annuity is anyone other than the spouse, the recipient will have to pay tax on the available amount as per the normal tax rate for him or her. In order to spread out this tax liability, the recipient may choose to receive the money in payments over a period of time, rather than as a lump sum. In these cases, the annuity value is added to the estate of the annuit…

Different Annuity Contracts Can Bring Different Situations

- Though death benefits are available with many annuities, your annuity product selection will determine your potential tax implications in the future. To select the most appropriate annuity strategy for you, it is a good idea to seek a recommendation from a knowledgeable, experienced financial or insurance professional. Be sure to work with someone who openly shows they provi…

Ready For Personal Guidance?

- You may be attracted to annuities for their ability to offer guaranteed lifetime income, a guaranteed minimum interest rate, or a guard against financial losses. If you are ready to investigate different annuity strategies and see what might make sense for you, a financial professional at SafeMoney.com can help you. Use our Find a Financial Professional sectionto c…