What are commuting expenses and can I deduct them?

To qualify as a deductible expense, there are three hurdles you have to jump for driving expenses:

- Is the business driving commuting? Is it a regular back-and-forth to work situation? ...

- Is there a specific business purpose? Can you write a short description of the business activity? ...

- Can the specific expense be deducted fully, or does the IRS impose limits? Most business expenses are completely deductible, but some are limited. ...

Do my moving expenses qualify as tax deductions?

You may be able to deduct your costs if you move to start a new job or to work at the same job in a new location. The IRS offers the following tips about moving expenses and your tax return. In order to deduct moving expenses, your move must meet three requirements: The move must closely relate to the start of work. Generally, you can consider moving expenses within one year of the date you start work at a new job location.

How to claim moving expenses as a tax deductible?

Under the TCJA, you can only claim certain moving expenses, including:

- Travel expenses for yourself and family members traveling with you

- Moving services

- Moving supplies

- Fees incurred for turning off utilities at your previous home

- Shipping your vehicle to your new home

- Temporary lodging while you are en route to your new home

- Up to 30 days of storage for your belongings until they are delivered to your new home

- Parking fees

When can I deduct commuting expenses?

You can deduct daily transport expenses when you travel between your home and a temporary work location. A temporary work location is one that’s expected to (and does) last for one year or less. Usually this must be outside the metropolitan area where you live and normally work.

Can I deduct commuter expenses on my taxes?

Unfortunately, commuting costs are not tax deductible. Commuting expenses incurred between your home and your main place of work, no matter how far are not an allowable deduction. Costs of driving a car from home to work and back again are personal commuting expenses.

Are commuter benefits reported on w2?

How do I know that my commuter benefit (pre-tax transit) was properly recorded? It is not a deduction, it is an exclusion from income. The result is the same. If you entered the W-2 correctly, it should be excluded as your employer should have already excluded it from taxable wages on your W-2.

Can commuter benefits be refunded IRS?

Per IRS regulations, your employer can't refund your unused commuter benefits funds back to you. However, you can submit claims for eligible expenses incurred during employment for up to 90 days.

How does the commuter tax benefit work?

Commuter benefits are pre-tax. Once enrolled, you have the monthly cost of your commute deducted from your pay before paying taxes. Meanwhile, your employer saves up to 7.65 percent on payroll tax. Spend the benefit on the way you commute; Drivers, for example, can pay for parking costs.

Is commuter benefits use it or lose it?

If commuters change jobs or are laid off, they lose any unused funds, which go to their employers. Some companies have used the forfeited money to help cover the transit benefits' administrative costs or redistributed the money to other employees in the plan, Ms.

What is the IRS limit for commuter benefits?

$280 per monthRecently, the IRS released the pre-tax benefits amount for 2022. Employees who use commuter benefits can now spend up to $280 per month, tax-free. That's up from $270 per month in 2021.

What do I do with my commuter card balance?

Use it at transit agency ticket vending machines, ticket windows, and transit agency ordering websites. You can use your pre-tax dollars to fund your card (up to $265 for transit and up to $265 for parking, or both).

Do commuter funds expire?

Commuter benefits funds do not expire unless you leave your company. These funds will continue to rollover month to month, year to year, as long as you're still at the same company. However, when you leave the company, any unused funds in your account will be returned to the company.

How much does pre-tax transit save?

By offering employees a pre-tax commuter benefit program, the cost of commuting deducted for employees reduces the amount of payroll being taxed. This means a savings of up to 7.65% on average, on payroll taxes.

Are commuter benefits taxable in California?

The value of the benefit paid to employees is considered a tax-free transportation fringe benefit and not wage or salary compensation, therefore, payroll taxes do not apply.

Are transit benefits taxable?

Parking or transit benefits that exceed the monthly limits are taxable as compensation to the employees (e.g., where the fair market value of parking is $300 per month in 2018, only $260 per month is excluded from employee compensation).

What is the IRS limit for commuter benefits 2022?

$280The IRS also announced an increase in the 2022 monthly limits for qualified transportation fringe benefits under Code § 132(f). For transportation in a commuter highway vehicle and mass transit passes, the limit will be $280 (up from $270 this year).

How do Commuter Benefits Work?

The commuter benefits tax break can only be offered as part of an employer benefits plan. The benefits can be managed in one of three ways:

What are the benefits of being a commuter?

Commuter Benefits – Tax Savings, Expenses, Advantages, and More. For most people, the transportation costs associated with getting to and from work aren’t in the same ballpark as healthcare costs. Yet, fuel costs, vehicle maintenance, parking fees, transit fares, and other associated expenditures can still add up to a sizeable expense for many.

What is qualified transportation fringe benefit?

The formal designation for federal commuter benefits is the “Qualified Transportation Fringe Benefit.” It consists of a voluntary benefit program, regulated by IRS Code Section 132 (f), that allows employers to provide pre-tax transportation benefits to their employees. It is one of eight types of tax-free employee benefits that would otherwise be subject to federal tax.

How does a transit card work?

The card connects directly to a specific account funded by employee contributions and deducts the money whenever a purchase is made for commuter expenses. This can help account holders keep better track of their transit purchases, and they don’t have to worry about filing claims for reimbursement.

Why do employers save on pre-tax contributions?

Employees save on pre-tax contributions to their commuter plan because it reduces their total taxable income.

Do commuters pay taxes?

Employees pay for their commuter expenses with pre-tax income deducted from their paychecks. They pay no taxes on the deductions, and the employer benefits from lower payroll taxes.

How do commuter benefits work?

If pre-tax commuter benefits are sounding like something that you or your employees could benefit from, you’ll probably want to know more about how they work. Like most fringe benefits that you can implement for your employees, pre-tax commuter benefits are subject to rules and regulations. Let’s review some of those.

How much is a commuter's benefit in 2019?

Reimbursing commuters for their travel expenses. The IRS maintains that pre-tax commuter benefits in 2019 must be limited to $265 a month for transit and $265 a month for parking costs. Any funds added to a commuter account over and above the $265 a month transit and $265 a month parking limits must come out of post-tax income.

How are transit funds applied?

Funds are applied by purchasing transit cards for commuters using public transit, investing in a vanpool that picks employees up and takes them home daily (including ride-hailing services ), or a direct reimbursement for bicycle-riding expenses.

Why do employees save money on transit?

Employees save because this money set aside is not taxed. Essentially, instead of paying (post-tax) out of pocket for transit, this benefit allows commuters to save extra money by putting untaxed income toward transit. These benefits can be used to promote the use of alternative forms of transportation — incentivizing vanpools, biking, trains, ...

How many people use public transportation?

According to Pew Research, 11% of Americans use public transit regularly. However, in some regions, the percentage is much higher. In the Northeast, where urban areas are older and denser and include more public transit, 25% of commuters regularly use buses, trains, and subways. Nationally, 21% of urbanites use transit.

Is pre-tax transit good for employees?

You can clearly see that pre-tax transit benefits are a win-win for employees and employers — and a win-win-win if you count the environment too! If you’re an employee who’s looking to save money on your daily commute, or an employer who is looking to provide competitive benefits to your employees in a way that’s also beneficial to your own bottom line, pre-tax commuter benefits can be a great option. Commuters will benefit from the reduced costs associated with their commutes, and employers will benefit from reduced payroll taxes, increased employee morale, and a more eco-friendly reputation. If your company does not have a commuter benefit program in place, you should consider starting one! You could talk to employees to find out how most people are getting to work, and see if your HR department can work on opening up a program. There are also services online that will manage your commuter benefit program, as well as multiple vanpool companies employers can contract with. Be sure to shop around to see what your options are. If your employees are mostly riding transit already, and your company is located in the heart of a city, a vanpool might not be ideal. Be sure to get plenty of info from employees on what benefits system would suit them best. If you need a little extra help figuring out anything tax related, feel free to reach out to our team of dedicated tax professionals .

Can you deduct transit benefits on your taxes?

While you can’t deduct pre-tax transit benefits from your taxes, they can still save you a lot of money, especially in the long run. If you’re thinking about enrolling in your company’s commuter benefits program, or you’re considering setting up a fund for your company, you’ll definitely want to think about the following benefits.

What are commuter benefits?

Commuter benefits are fringe benefits that cover an employee’s transportation-related expenses with pre-tax dollars. Transportation benefits are exempt from income tax withholding, Social Security and Medicare ( FICA) taxes, and federal unemployment tax. Employees can use the funds on qualifying expenses, such as public transportation and parking fees.

Why are commuter benefits pre-tax?

Because commuter benefits are pre-tax deductions, they can reduce the amount your employees pay in payroll and income taxes. When employees contribute to their commuter benefits plan, they owe less in federal income, Medicare, and Social Security taxes. Offering commuter benefits provides tax savings for employers, too.

Why is it important to offer commuter benefits?

Offering commuter benefits decreases employee transportation costs and encourages your workforce to use public transportation, which is especially helpful in congested cities. Employers and employees can contribute to an employee’s commuter benefits plan.

How much do you have to contribute to Social Security and Medicare?

Social Security and Medicare taxes are employer and employee taxes, meaning you and the employee need to contribute a matching 7.65% of the employee’s wages. When an employee owes less in Social Security and Medicare taxes, you owe less too. Let’s say an employee earns gross wages of $2,000 per month.

What is public transportation?

Public transportation includes buses, trains, subways, ferries, or highway vehicles that have at least six passenger seats. Parking expenses: Commuter benefit funds can also go towards parking expenses. Employees can use pre-tax dollars to pay for parking at or near work. Employees can also use funds to pay for parking on or near mass transit ...

Can you use commuter benefits for biking?

Prior to the Tax Cut and Jobs Act of 2017, employees could also use pre-tax dollars to cover up to $20 per month for biking-related expenses. Employees can no longer use commuter benefits for biking-related expenses.

Can you use pre-tax dollars to pay for parking?

Employees can use pre-tax dollars to pay for parking at or near work. Employees can also use funds to pay for parking on or near mass transit premises. Not all transportation-related expenses are included under commuter benefits. For example, an employee can’t use transit benefit funds to pay for things like gas or car insurance.

What Is Commuting?

Commuting is considered getting back and forth from work. Commuting is a daily thing, different from business travel, which may be overnight .

Can a business owner move to a temporary worksite?

The reason for this exception is that it is not reasonable for a business owner to move permanently to a worksite for a job that is only temporary.

Can you deduct commuting expenses?

You cannot deduct commuting expenses no matter how far your home is from your place of work. Consider it like this: Everyone needs to get to work, employees and business owners alike, so this expense is not part of your specific business.

Is commuting expense deductible?

Commuting Expenses Are Not Deductible. Just to clarify, commuting expenses are not deductible. The time you spend traveling back and forth between your home and your business is considered commuting, and the expenses associated with commuting (standard mileage or actual expenses) are not deductible as a business expense .

Is a bike considered a commuting expense?

Ride-sharing services like Uber may also be commuting expenses if you take them to and from work. The costs of taking public transportation, riding a bicycle to work, or parking at your business location are also considered commuting expenses. 1 .

Does the IRS have a chart for commuting expenses?

The IRS has a helpful chart that explains commuting expenses, for businesses that are not operating out of the home.

Is home office deductible?

Home Office as Principal Place of Business. Expenses for travel between your home and other work locations are deductible if your residence is your principal place of business. First, you must establish that your home is your principal place of business.

What is de minimus transportation benefit?

First, the de minimus transportation benefit. “De minimus” is Latin for “ about minimal things” and when the IRS uses the term, ...

What is de minimus benefit?

First, the de minimus transportation benefit. “De minimus” is Latin for “ about minimal things” and when the IRS uses the term, they are stating there are some matters that are deemed too small to worry about for tax purposes.

What is a pre-tax commuter benefit?

A pre-tax commuter benefit is when employees can have the monthly cost of their commute deducted from pay before taxes, which means more take-home pay and for employers, saving on reduced payroll taxes.

Why you should offer commuter benefits to your employees?

Employees save on commuting costs while employers save on payroll taxes.

How does a pre-tax program save employers?

How Employers Save Offering a Pre-tax Program ? By offering employees a pre-tax commuter benefit program, the cost of commuting deducted for employees reduces the amount of payroll being taxed. This means a savings of up to 7.65% on average, on payroll taxes. The more employees that enroll, the greater the savings.

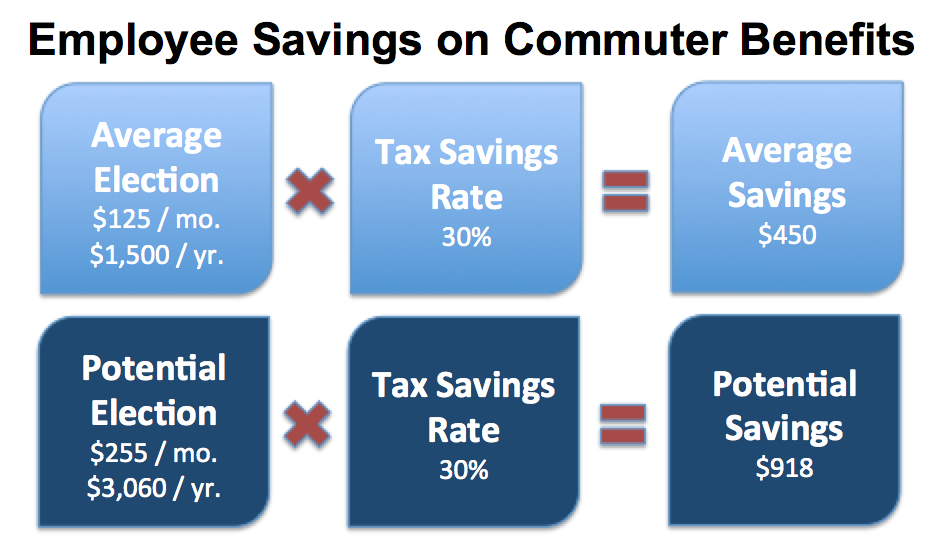

How Employees Save in a Pre-tax Program?

By using pre-tax dollars, employees are saving 40% on their commuting costs.

Is commuting expense tax deductible?

Answer. Unfortunately, commuting costs are not tax deductible. Commuting expenses incurred between your home and your main place of work, no matter how far are not an allowable deduction. Costs of driving a car from home to work and back again are personal commuting expenses.

Can you deduct transportation expenses if you work from home?

If your home is your main place of business, you can deduct transportation expenses you incur. The expenses must be for going from your home to another work location in the same trade or business.

When will the cents per mile rule be implemented?

Due solely to the COVID-19 pandemic, if certain requirements are satisfied, employers and employees that are using the lease value rule may instead use the cents-per-mile rule for 2020 to determine the value of an employee's personal use of an employer-provided vehicle beginning as of March 13, 2020.

How much is a de minimis fringe benefit?

Group-term life insurance coverage paid by the employer for the spouse or dependents of an employee may be excludable from income as a de minimis fringe benefit if the face amount isn't more than $2,000. If the face amount is greater than $2,000, the dependent coverage may be excludable from income as a de minimis fringe benefit if the excess (if any) of the cost of insurance over the amount the employee paid for it on an after-tax basis is so small that accounting for it is unreasonable or administratively impracticable.

Can a deceased employee be exempt from gross income?

For certain government accident and health plans, payments to a deceased employee's beneficiary may qualify for the exclusion from gross income if the other requirements for exclusion are met. See section 105 (j) for details.

Can you withhold noncash fringe benefits?

But the benefits must be treated as paid no less frequently than annually. You don't have to choose the same period for all employees. You can withhold more frequently for some employees than for others.