Is defined contribution plan a taxable benefit to the employer?

Defined Benefit Plan Contributions Are Tax-deductible. As mentioned, when pre-funding the Defined Benefit Plan, employer contributions up to the maximum annual limit are tax-deductible. Moreover, employees are not taxed on the employer contributions that are made on their behalf. In fact, employees are not taxed until the distribution of their benefits.

What are defined benefit retirement plans?

Key Takeaways

- A defined-benefit plan is an employer-based program that pays benefits based on factors such as length of employment and salary history.

- Pensions are defined-benefit plans.

- In contrast to defined-contribution plans, the employer, not the employee, is responsible for all of the planning and investment risk of a defined-benefit plan.

What taxes are considered tax exempt?

- Organizations exempt from income tax under Internal Revenue Code Section (IRC) 501 (including charities, private foundations and other types of exempt organizations, such as business leagues, labor unions, and veterans’ ...

- Political organizations described in IRC 527

- Federal, state and local governments

- Indian tribal governments

- Tax-exempt bonds

What is a traditional defined benefit plan?

Traditional Defined Benefit Plan

- The Benefit. In as short as five years a business owner can contribute a significant amount of money that is deductible annually as a business expense and grows tax deferred.

- Numerical Example. Example for owners aged 50 and 55.

- More Detail. Defined benefit plans are qualified employer-sponsored retirement plans. ...

- Set Up This Plan. ...

Is defined benefit pension taxed?

The taxable part of your pension or annuity payments is generally subject to federal income tax withholding. You may be able to choose not to have income tax withheld from your pension or annuity payments (unless they're eligible rollover distributions) or may want to specify how much tax is withheld.

What is one disadvantage to having a defined benefit plan?

The main disadvantage of a defined benefit plan is that the employer will often require a minimum amount of service. Although private employer pension plans are backed by the Pension Benefit Guaranty Corp up to a certain amount, government pension plans don't have the same, albeit sometimes shaky guarantees.

How are distributions from defined benefit plans treated for tax purposes?

Distributions from defined benefit plans are taxed as long-term capital gains to beneficiaries. Taxpayers withdrawing funds from an IRA before they turn 70½ are generally subject to a 10 percent penalty on the amount of the withdrawal.

What is the difference between a 401k and a defined benefit plan?

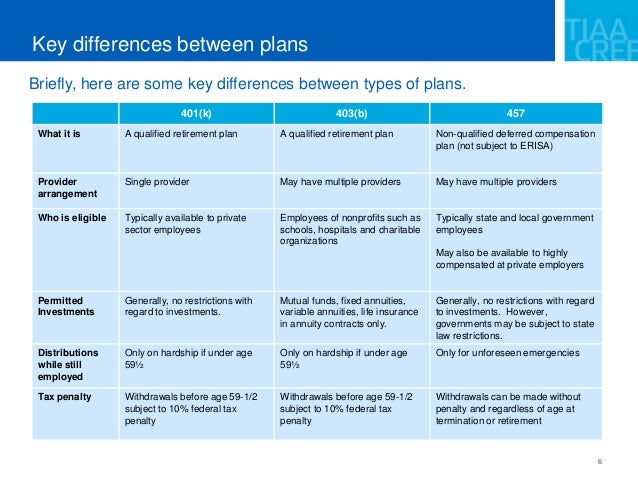

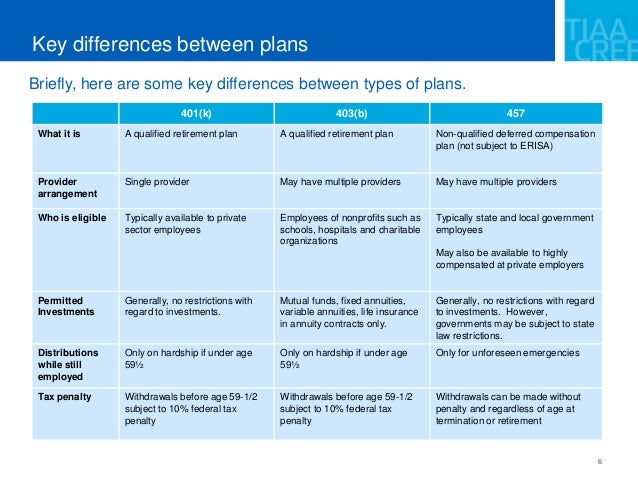

A 401(k) and a pension are both employer-sponsored retirement plans. The most significant difference between the two is that a 401(k) is a defined-contribution plan, and a pension is a defined-benefit plan.

Why are companies moving away from defined benefit plans?

Frequently cited reasons for the decline in employer sponsorship of defined benefit plans include longer employee lifespans, which increases benefit costs; decreased corporate tolerance of fluctuating contribution requirements, which can jump up and down due to investment results; and escalating Pension Benefit ...

What percentage of retirees have a defined benefit pension?

Not very. The percentage of workers in the private sector whose only retirement account is a defined benefit pension plan is now 4%, down from 60% in the early 1980s. About 14% of companies offer a combination of both types.

Is defined contribution taxable?

A DCPP is a registered pension plan designed to help you save for retirement. Your contributions are tax- deductible, subject to government limits (visit www.cra-arc.gc.ca for this year's limits).

Are employee benefit plans taxable?

But any short- or long-term disability benefits you receive in the future from your employer will be taxable. Conversely, if all employees pay their own short or long-term disability premiums, any benefits they receive are tax-free. The same applies to premiums you pay for an individual policy you own.

Should I keep my defined benefit pension?

Transferring a DB pension may give you more options for your retirement, but it's not right for everyone. The FCA and TPR believe that it will be in most people's best interests to keep their defined benefit pension. If you transfer out of a defined benefit pension, you cannot reverse it.

What are the advantages of defined benefit plan?

A defined benefit plan delivers retirement income with no effort on your part, other than showing up for work. And that payment lasts throughout retirement, which makes budgeting for retirement a whole lot easier.

Why is defined benefit plan better?

Easier to plan for retirement – defined benefit plans provide predictable income, making retirement planning much more straightforward. The predictability of these plans takes the guesswork out of how much income you will have at retirement.

How does a defined benefit plan work?

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans.

What is defined benefit plan?

A Defined Benefit Plan is a type of retirement plan. However, unlike a Defined Contribution Plan, a Defined Benefit Plan provides covered employees with a retirement benefit based on a predefined formula. Defined Benefits typically are paid for by the employer, and Defined Benefit rules require employers to prefund pension benefits in ...

Why are investment gains taxed?

As you may be aware, the tax-deferral of investment gains may result in significantly higher retirement assets. This is because returns are compounded on returns. On the other hand, in a taxable account, asset gains are taxed each year. As a result, a portion of each year’s return may be needed to pay income tax.

Is a defined benefit plan tax deductible?

Defined Benefit Plan Contributions Are Tax-deductible. As mentioned, when prefunding the Defined Benefit Plan, employer contributions up to the maximum annual limit are tax-deductible. Moreover, employees are not taxed on the employer contributions that are made on their behalf. In fact, employees are not taxed until the distribution ...

Is employer contribution taxable?

First, all permissible employer contributions are tax-deductible to the employer. Additionally, contributions made on behalf of employees to pay their future benefits are not taxable to the employee at that time. Second, investment gains on employer contributions are not taxable to the employer.

Can a defined benefit plan be rolled over to an IRA?

This single sum distribution can be rolled over to an IRA, further deferring income tax on the retirement benefit until amounts are withdrawn from the IRA. If, on the other hand, the funds are not rolled ...

Does a W-2 increase payroll taxes?

In some cases, to support the targeted deduction, the owner may need to increase his or her W-2 income. This is especially true when the owner’s W-2 wage has been low relative to shareholder distributions. Of course, higher W-2 income means higher payroll taxes. At least temporarily.

Is a lump sum distribution taxed?

On the other hand, if the employee elects to receive a lump sum distribution, the entire payment is taxed unless it is rolled over.

Law and Policy Group Senate measure would exempt DB plans from minimum corporate tax

Defined benefit (DB) pension plans and other post-retirement benefit plans would be exempt from Democrats’ proposed minimum corporate tax, under draft legislation recently released by Senate Finance Committee Chairman Ron Wyden, D-OR.

Related resources

Legislative text of draft portion of the BBBA (Senate Finance Committee, Dec. 11, 2021)

How much does a defined benefit plan pay?

One type of defined-benefit plan might pay a monthly income equal to 25% of the average monthly compensation that an employee earned during their tenure with the company. 3 Under this plan, an employee who made an average of $60,000 annually would receive $15,000 in annual benefits, or $1,250 every month, beginning at the age of retirement (defined by the plan) and ending when that individual died.

What is defined benefit pension?

A defined-benefit pension plan requires an employer to make annual contributions to an employee’s retirement account. Plan administrators hire an actuary to calculate the future benefits that the plan must pay an employee and the amount that the employer must contribute to provide those benefits. The future benefits generally correspond ...

What is future benefit?

The future benefits generally correspond to how long an employee has worked for the company and the employee’s salary and age. Generally, only the employer contributes to the plan, but some plans may require an employee contribution as well. 1 To receive benefits from the plan, an employee usually must remain with the company for ...

How long do you have to work to get a fixed benefit?

In most cases, an employee receives a fixed benefit every month until death, when the payments either stop or are assigned in a reduced amount to the employee’s spouse, depending on the plan.

When can defined benefit plans make in service distributions?

The IRS also notes that defined-benefit plans generally may not make in-service distributions to participants before age 62, but such plans may loan money to participants. 1 .

Do defined benefit pensions require employee contributions?

Defined- benefit pension plans are funded by an employer from a company’s profits and generally do not require employee contributions. The amount of each individual's benefits is usually linked to their salary, age, and length of employment with a company. To be eligible for benefits, an employee must have worked a set amount ...

Do you pay taxes on lump sum retirement?

Some plans offer a lump-sum payment, where an employee receives the entire value of the plan at the time of retirement, and no further payments are made to the employee or survivors. Whatever form the benefits take, employees, pay taxes on them, while the employer gets a tax break for making contributions to the plan.

What does it mean to exclude taxes on retirement income?

The exclusion of taxes on retirement income, specifically dividends and capital gains, means that the double taxation is eliminated for some capital income. In the absence of a corporate income tax, this tax exemption may make less economic sense, but given current corporate taxes in the United States, it has a sound economic logic.

How does the exemption make the tax system more efficient?

In fact, this exemption may make the tax system more efficient both by making the current system function more like a consumption tax and by partially correcting the double taxation of capital within the current tax code. Since individuals can choose when they wish to realize the tax by delaying consumption, this may very well be ...

Why do people save for retirement?

People choose to save more because they probably will be in a lower-income tax bracket during their retirement and also because they will be able to accrue the benefits of invested funds that would have otherwise been taxed away. Despite the complexity that this deduction adds to the tax code and some economic costs, this deferral brings the income-tax function closer to a more economically efficient consumption tax. It also mitigates the problem of the double taxation of capital for the tax-deferred contributions.

What is the purpose of the tax code?

The US federal tax code contains a number of provisions designed to encourage individuals to save for retirement. These provisions allow individuals to avoid or defer taxes if they choose to set aside a portion of their income for future consumption. When all of these provisions are combined, they are the second largest “tax expenditure” category ...

Does tax deferral encourage savings?

Because of this condition, the incentives provided by the tax deferral may not encourage genuine savings. Instead, it may merely encourage deposits and contributions into the account in ways that don’t require reducing one’s present standard of living. Some individuals probably would have saved for retirement even without the tax incentive; thus, ...

Do tax incentives increase savings?

Do Tax Incentive Increase Savings? A primary question on the tax exclusion of retirement savings is whether they encourage individuals to save more than they otherwise would. The primary economic benefits associated with this tax exclu sion can only be achieved if savings increase on net.

Is retirement income taxed in the future?

When an employer chooses to compensate employees with contributions to a retirement or pension plan, rather than with wages, that compensation is not taxed in the current year. Instead, the income will be taxed in the future when employees choose to withdraw it, presumably when they are in a lower tax bracket.

What is defined benefit plan?

A defined benefit plan promises a specific benefit at retirement — $1,000 a month, for example. The amount of this benefit is often based on a set percentage of pay multiplied by the number of years the employee worked for the employer offering the plan.

Why do you need a retirement plan?

By starting a retirement savings plan, you’ll help your employees save for the future, and you’ll help secure your own retirement. Offering a retirement plan may also help you attract and retain better qualified employees.

What is defined benefit plan?

A defined benefit plan is a qualified retirement plan that defines a specific benefit when a person retires; funds can be invested at the trustee's discretion. However, unlike in a typical 401 (k) plan, the trustee bears the risk of the investments as well as the full range of fiduciary obligations under ERISA.

Why are defined benefit plans so expensive?

Defined benefit plans are administratively costly to the plan sponsor, although the plan sponsor may view this investment of expense and effort as worthwhile to offer it as an employee benefit. The administrative expense, which is typically greater than for a 401 (k) plan, is due to the complexity of maintaining defined benefit plans. However, in years of higher cash flow, the plan sponsor may also see a tax benefit that would be greater than under a 401 (k) plan.