How do you calculate disability income?

- The SSA starts with $735.

- The only income you receive each month is $400 from a part-time babysitting job.

- The SSA ignores the first $65 of that each month, as well as half of the rest. ($400 – $65) x 0.50 = $167.50.

- So the SSA deducts the remaining $167.50 of your babysitting dollars from $735.

- You receive a grand total of $567.50 for SSI.

Are disability pensions and benefits taxable income?

Unfortunately, the general rule is that a disability pension is subject to tax, although there are some exceptions and limitations. People who receive a disability pension through their employer must report that pension as income on Form 1040 if they retire early with a disability.

Is disability pension considered earned income?

This may allow you to claim the Earned Income Credit, contribute to an IRA account or qualify for other benefits and deductions. After you reach the minimum retirement age, your taxable disability pension is treated as a pension and doesn't count as earned income.

How much in Social Security disability benefits can you get?

- 90% of the first $1,024 of average indexed monthly earnings

- 32% of the average indexed monthly earnings over $1,024 through $6,172, and

- 15% of the average indexed monthly earnings over $6,172.

How many people are disabled before age 67?

Federal Tax Rules for Short Term Disability Income. Going on disability is a lot more common than you might think. The Social Security Administration says over 1 in 4 people in their 20s will become disabled before reaching age 67.

Is disability insurance considered earned income?

If you get benefits from a disability insurance policy, the IRS classifies your payments based on who paid the insurance premiums. If you paid the whole cost of the premiums out of your pocket, as with a private policy, your benefits aren't considered earned income. In fact, you don't report those benefits as income at all;

Is disability income earned or unearned?

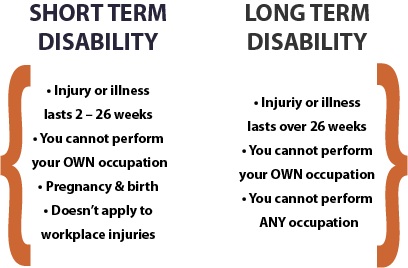

Whether your disability payments count as earned or unearned income for tax purposes depends on when and from where you receive them. Generally, short-term disability payments – as well as long-term disability payments received before retirement age – are earned income, while long-term disability payments received after retirement age are unearned ...

Is long term disability considered earned income?

If you suffer a disability that leaves you unable to work entirely, long-term disability benefits provided by an employer will be considered earned income until you reach retirement age. This is true even if you have to "retire on disability.". Once you hit retirement age, though, the IRS looks at such payments like a pension, ...

Do you report disability benefits as income?

In fact, you don't report those benefits as income at all; insurance payments are generally untaxed. Some employers offer their workers a supplemental disability insurance policy, in which you and the employer split the cost of your premiums. In this situation, the part of your benefits that your employer paid is earned income -- which means it's ...

Do disability payments qualify for tax breaks?

When disability payments are considered earned income and treated like wages, they may help you qualify for such tax breaks.

Do employers pay you for short term disability?

Some employers offer short-term disability benefits that pay you some or all of your wages while you're temporarily unable to work. The Internal Revenue Service considers those payments earned income -- the same as money earned on the job.

Is Social Security Disability counted as income?

The Social Security administration has outlined what does and doesn’t count as earned income for tax purposes. While the answer is NO, disability benefits are not considered earned income , it’s important to know the difference between earned and unearned income and know where your benefits fit in during tax season.

Does disability count as income for unemployment?

SSI is different than Social Security in several ways, but unemployment income also counts as unearned income for SSI. This means that SSI benefits may be offset by the amount of the unemployment benefits . This is particularly likely because of the increased PUC benefits authorized by the CARES Act.

Is Social Security considered income?

Generally, if your Social Security benefits is your only source of income , then it is usually not considered taxable income and thus it’s not taxed. If you receive Social Security benefits, you will be sent a Form 1099- SSA , which will show the total dollar amount of your Social Security income for the given tax year.

Can you get a tax refund on SSDI?

The IRS emphasized that Social Security benefits and Social Security Disability Income ( SSDI ) do not count as earned income. The law is clear that tax refunds , including refunds from tax credits such as the EITC, are not counted as income for purposes of determining eligibility for such benefits.

How much money can you have in the bank with SSDI?

Because SSDI is this type of benefit, a person’s assets have nothing to do with their potential eligibility to draw and collect SSDI. In other words, whether you have $50 or $50,000 in the bank makes no difference to the SSA.

How much can I earn on disability in 2020?

A person who earns more than a certain monthly amount is considered to be “engaging in SGA.” Federal regulations use the national average wage index to set the income limit for determining the SGA each year. In 2020 , the amount is $1,260 for disabled applicants and $2,110 for blind applicants.

Can you get unemployment while on Social Security disability?

It is legally permissible to draw Social Security Disability Insurance ( SSDI ) and unemployment benefits, and neither affects the amount of the other.

What are the benefits of disability?

Payments that are considered disability benefits include: Disability compensation and pension payments for disabilities paid either to veterans or their families. Grants for homes designed for wheelchair living. Grants for motor vehicles for veterans who lost their sight or the use of their limbs.

What is gross income in IRS?

The IRS defines Gross Income in Section 61 as: Compensation for services, including fees, commissions, and similar items.

What is a VA claim insider?

VA Claims Insider is here for disabled veterans who are exploring eligibility for increased VA disability benefits. We serve veterans in a “done with you” mastermind concept, in a community of fellow disabled veterans from around the world. Elite members work with fellow disabled veteran coaches to help you take control of your VA claim.

What is considered income for Snap?

For SNAP purposes, “income” includes both earned income such as wages, and unearned income such as Supplemental Security Income (SSI) and veteran disability and death benefits. Because veteran disability benefits are not explicitly excluded, they are counted when determining a household’s eligibility for SNAP.

Does VA disability count as income?

Calculating income for child support and alimony. VA disability payments count as income for purposes of calculating child support and maintenance. The fact that they’re tax-free payments means they’re “invisible” to the IRS, but they’re not invisible to other agencies or for other purposes.

Does VA loan count disability income?

VA lenders can count disability income when calculating income toward a mortgage. Borrowers with a service-connected disability are exempt from paying the VA Funding Fee, a mandatory cost the VA applies to every purchase and refinance loan to help cover losses and ensure the program’s continued success.

Do VA benefits count as income?

There are some circumstances under which VA benefits do count as income . This is not an exhaustive list, and you should always check your state’s laws and regulations, but some common examples include:

How long does EITC refund count as income?

It can’t be counted as income for at least 12 months after you get it. To find out if this rule applies to your benefits, check with your benefit coordinator.

How to find my minimum retirement age?

To find your minimum retirement age, check your retirement plan. The minimum retirement age is the earliest age you could get disability retirement benefits if you didn’t have the disability. After you reach the minimum retirement age, your disability retirement payments do not quality as earned income.

What is sheltered employment?

Sheltered employment is when a child with a physical or mental disability works for minimal pay under a special program.

Why can't people engage in gainful activities?

They can’t engage in any substantial gainful activity because of a physical or mental condition and

When will the American Rescue Plan Act be signed into law?

We’re reviewing the tax provisions of the American Rescue Plan Act of 2021, signed into law on March 11, 2021. Find out if your disability benefits and the refund you get for the EITC qualify as earned income for the Earned Income Tax Credit (EITC).

Do disability payments qualify as earned income?

Disability Insurance Payments. If you get disability insurance payments, your payments do not qualify as earned income when you claim the EITC if you paid the premiums for the insurance policy. If you got the policy through your employer, your Form W-2 may show the amount you paid in box 12 with code J. For more information about disability ...

How to prove a child's disability?

To prove your child's disability, get a letter from their doctor, healthcare provider or any social service program or agency that can verify their disability.

How is Social Security Disability funded?

Social Security Disability Insurance, or SSDI, is funded by the payroll taxes withheld from workers’ paychecks or paid as a part of self-employment taxes. The benefits you may be eligible to receive are based on your earnings or the earnings of your spouse or parents.

How much tax do you have to pay on SSDI?

For SSDI, you can ask the SSA to withhold taxes when you first apply, or by completing Form W-4V and selecting a withholding rate of 7%, 10%, 12% or 22%. If you receive disability benefits from an insurance company, you can ask the company to withhold federal income tax by filling out Form W-4S.

What is SSI disability?

Supplemental Security Income, or SSI, is for eligible disabled adults and children and adults 65 and older who have limited income and resources. The benefits you receive are based on the federal benefit rate, may be reduced by other forms of income you receive, and will be added to any state supplement you may receive. Some states coordinate their own disability programs with the Social Security Administration, so if your state participates, you could receive federal and state SSI in one monthly check.

How long does a long term disability last?

Long-term disability insurance, which, after a waiting period, may pay disability benefits for a few years or until your disability ends.

How much was the average disability payment in 2017?

And the percentage of awards has declined every year. Among those who did receive benefits in 2017, the average monthly amount paid was about $1,197.

Is disability income taxable?

But in some cases, the IRS might view your disability benefits as taxable income. You may hope you never have to receive disability income.

Where does disability income come from?

Disability income can come from multiple sources, both government and private sector. Let’s look at two sources: the Social Security Administration and disability insurance.

How much can I make on SSDI in 2021?

In 2021, any month in which an SSDI recipient earns more than $940 is considered a trial work month. (Notice that this amount is lower than the SGA amount.) After an SSDI recipient has worked for nine months making more than $940, the SSA will start evaluating the person's work to see if it is over the SGA limit.

How long can you work on SSDI?

The trial work period provides nine months (that do not need to be consecutive) out of a 60-month period where SSDI recipients can try out working without having their disability benefits terminated.

What is the SGA amount for 2021?

In 2021, the SGA amount is $1,310 for disabled applicants and $2,190 for blind applicants. (Federal regulations use the national average wage index to set the income limit for determining the SGA each year.)

How much is the average amount of Social Security benefits in 2021?

Those who are approved for benefits receive monthly SSDI payments determined by their respective earnings records (the average amount is $1,277 in 2021).

How much can I earn on SSDI?

While a disabled (nonblind) person applying for or receiving SSDI cannot earn more than $1,310 per month by working, a person collecting SSDI can have any amount of income from investments, interest, or a spouse's income, and any amount of assets.

Does SSDI have a trial period?

To encourage SSDI recipients with disabilities to try to return to work, the SSA provides for a trial work period. During the trial work period (TWP), a person receiving SSDI can have unlimited earnings and still receive full benefits without risking termination of benefits.

Can I get SSDI if I earn more than my monthly income?

If you can do what the Social Security Administration (SSA) calls " substantial gainful activity " (SGA), you won't be eligible for SSDI benefits. A person who earns more than a certain monthly amount is considered to be "engaging in SGA." In 2021, the SGA amount is $1,310 for disabled applicants and $2,190 for blind applicants. (Federal regulations use the national average wage index to set the income limit for determining the SGA each year.)

What is the income limit for blind people in 2021?

For 2021 the monthly income limit is $1,310; it’s $2,190 per month for people who are blind. If you can earn more than these amounts, the SSA deems you capable of engaging in “substantial gainful activity,” which prevents you from qualifying for benefits. 6

What is the income limit for 2021?

For 2021 the income limit is $1,310 per month; it’s $2,190 per month for people who are blind. There’s no limit to the amount of unearned income you can have, which means you can make money from investments such as stocks and bonds.

What is earned income?

Earned income is money you make while actively working, either for an employer or yourself. It includes wages, salaries, tips, bonuses, net earnings from self-employment, contract work, certain royalties, and union strike benefits. 7 This type of income counts against your monthly maximum for SSD eligibility.

What is considered when making a determination for SSA?

In addition to the two earnings tests, the SSA considers the following when making its determination: your medical condition, when it started, how it limits your activities, your medical test results, and the medical treatments you’ve received. 3

How many earnings tests are required to qualify for disability?

To qualify for disability benefits, you must meet two earnings tests: 2

Why does Social Security pay for people who can't work?

According to the Social Security Administration (SSA), “Social Security pays benefits to people who can’t work because they have a medical condition that’s expected to last at least one year or result in death.” 1

What is the duration of work test?

A Duration of Work Test —This test measures the amount of time that you worked over your lifetime. In general, you can subtract the year when you turned 22 from the year when you became disabled to determine the number of work quarters that you need to meet the duration requirement.

How to determine if SSDI is taxable?

To determine if your SSDI is taxable, enter your benefit, income and marital information into the IRS’ online tax tool or fill out Worksheet 1, “Figuring Your Taxable Benefits,” in IRS Publication 915, "Social Security and Equivalent Railroad Retirement Benefits."

How many states tax disability benefits?

Thirteen states — Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia — tax some or all disability benefits. Rules differ by state. Contact your state tax agency to learn more.

Why don't SSDI recipients get taxed?

As a practical matter, many SSDI recipients don't face this issue because their overall income is too low to reach the tax threshold.

What is SSI 2021?

Treasury, not your Social Security taxes, pays for it. SSI payments in 2021 max out for an individual at $794 a month from the federal government , not including supplement s in most states, and $1,191 for a married couple. Those benefits are not subject to income tax.

Do disabled people pay taxes?

According to the Social Security Administration, about a third of disabled beneficiaries pay taxes on their benefits. When they do, it's typically because of other household income, such as a spouse's earnings.

Is SSDI taxable?

However, SSDI is potentially taxable using the same set of rules as Social Security retirement, family and survivor benefits.