What percent of health insurance is paid by employers?

Most employers tend to pay around 65 – 70% of coverage towards employees plans, while small businesses often find other ways to help employees afford insurance. Hopefully, this guide opened your eyes to the realities of employer health insurance.

Does having employer health insurance make you better paid?

Using the health insurance plan is much more expensive for the low income worker than the high income worker. Assuming that every worker is paid the value of the average employer health premium hides key differences in the value of the benefit.

Does being on salary only benefit the employer?

The main difference between salary and hourly wage is that salaries are a fixed upon payment agreed to by both the employer and employee. Wages, on the other hand, may vary depending on hours worked and performance. Benefits of salaried pay Consistency: Your employees are guaranteed a certain amount every week or month excluding bonuses.

Are employee taxes paid by Employer deductible?

First, you need to pay tax by considering the benefit ... With this, now the taxes will need to be withheld by the employers on such ESOP benefits after a period of four years. However, the tax deduction may also trigger early; i.e., in the year when ...

What employer benefits are taxable?

Key Takeaways. Fringe benefits (e.g., life insurance, tuition assistance, and employee discounts) are perks and additions to normal compensation that companies give their employees. If a fringe benefit is transferred as cash, such as a bonus or reimbursement for expenses, they are likely to be subject to income tax.

Are health benefits included in taxable income?

The general rule is as follows: Employees are not taxed on the value of their health coverage. The value of employer-provided health coverage for the employee and their opposite-sex spouse or tax dependents is not taxable income to the employee under federal and state tax law.

Does employer paid health insurance go on w2?

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee's Form W-2, Wage and Tax Statement, in Box 12, using Code DD.

What benefits are not taxable in payroll?

Tax-free employee fringe benefits include:Health benefits. ... Long-term care insurance. ... Group term life insurance. ... Disability insurance. ... Educational assistance. ... Dependent care assistance. ... Transportation benefits. ... Working condition fringe benefits.More items...

Is health insurance included in gross salary?

Gross salary is the term used to describe all the money an employee has made working for the company in a year. It is the salary which is without any deductions like income tax, PF, medical insurance etc. Gross salary is however, inclusive of bonuses, overtime pay, holiday pay, and other differentials.

Are health insurance premiums deducted from payroll pre tax or post tax?

Medical insurance premiums are deducted from your pre-tax pay. This means that you are paying for your medical insurance before any of the federal, state, and other taxes are deducted.

How do I know if my health insurance premiums are pre tax?

If the value of your FICA-eligible income is higher than the value of your withholding income, your premiums are “pre-tax.” If your FICA-eligible income is identical to your withholding income, your premiums are “post-tax.” In the second instance, you'll be able to claim them as a deduction.

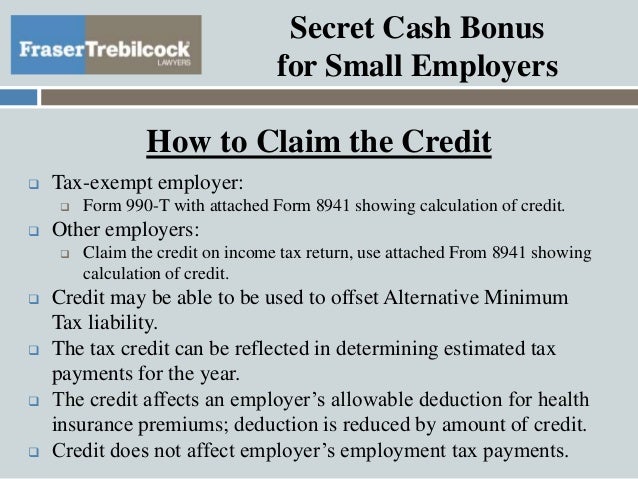

Is employee health insurance tax deductible?

As an employee, you can deduct any health insurance premiums that you pay out of pocket, which hasn't been reimbursed through a stipend or an HRA. COBRA and Medicare premiums can also be tax-deductible. You can reimburse Medicare Part B, Part C, and Part D on your tax return.

Can I deduct my health insurance premiums from my income tax?

Health insurance premiums are deductible on federal taxes, in some cases, as these monthly payments are classified as medical expenses. Generally, if you pay for medical insurance on your own, you can deduct the amount from your taxes.

What employee benefits are pre tax?

Pre-tax deductions: Medical and dental benefits, 401(k) retirement plans (for federal and most state income taxes) and group-term life insurance. Mandatory deductions: Federal and state income tax, FICA taxes, and wage garnishments. Post-tax deductions: Garnishments, Roth IRA retirement plans and charitable donations.

What are taxable and non taxable benefits?

Bonuses, company-provided vehicles, and group term life insurance (with coverage that exceeds $50,000) are considered taxable fringe benefits. Nontaxable fringe benefits can include adoption assistance, on-premises meals and athletic facilities, disability insurance, health insurance, and educational assistance.

Do benefits count as income?

Do I include benefits? Most, but not all, taxable state benefits should be included as social security income. However, income-based Jobseekers Allowance although taxable is not counted as income for tax credit purposes.

Are benefits counted as income?

Do I include benefits? Most, but not all, taxable state benefits should be included as social security income. However, income-based Jobseekers Allowance although taxable is not counted as income for tax credit purposes.

Are health benefits taxable in Canada?

In Canada, health and dental benefits can be paid out tax-free to employees. This requires that a special arrangement be set up between the employer and the employee. The employer cannot simply pay an employee, call it a health or dental benefit, and expect it to be a tax-free.

Does health insurance affect tax return?

If your employer offers health insurance as a benefit and you pay a portion of the plan's premium, your part of the bill is paid with pre-tax dollars . This means the amount isn't subject to withholdings for federal or state income tax, or Social Security and Medicare taxes .

Are health insurance premiums tax-deductible in 2020?

If you buy health insurance through the federal insurance marketplace or your state marketplace, any premiums you pay out of pocket are tax-deductible. If you are self-employed, you can deduct the amount you paid for health insurance and qualified long-term care insurance premiums directly from your income.

What percentage of AGI can you deduct for medical expenses?

For example, if your AGI was $60,000, and you have medical expenses totaling $6,500, you can only deduct $500. ($6,500 minus $6,000, which is ten percent of the AGI.) Seniors age 65 and older can deduct expenses above 7.5 percent of AGI. As you can see by this example, most people will not be able to use this deduction.

Why are individual health insurance premiums higher?

Individual premiums tend to be higher for the same coverage because the risk is only on that individual or family group.

How much can I deduct for dental insurance?

Under the current Affordable Care Act (ACA) rules, you can deduct medical and dental expenses that exceed 10 percent of your Adjusted Gross Income (AGI). The AGI is calculated using the Form 1040, Schedule A and includes all of your income in a given year, minus alimony, student loans, and some other items.

Can you deduct employer healthcare premiums?

Employer paid healthcare premiums are never tax deductible. If you pay some portion of your premiums, you may be able to deduct it. Tax rules have become more complicated since the advent of the Affordable Care Act (ACA) so it’s important to understand the current law. su_box]

Can you deduct insurance premiums?

The basic rule of thumb is that if you paid for it, you can deduct it. If the insurer paid it, you can’t deduct it.

Is it worth taking the time to calculate your medical expenses?

However, if you have had major medical expenses such as an extended hospital stay, major surgery, in-vitro fertilization, a new baby, home health care, rehabilitation or some other situation, it is worth taking the time to calculate. Your chances of being able to use it are also greater if your income is lower.

Do companies pay all their employees' premiums?

In past decades, many companies paid all their employees’ premiums. Unfortunately, those days are long gone. Most companies no longer pay one hundred percent of an employee’s premiums, though the amount of burden on the employee varies greatly.

How many full time employees are required to have health insurance?

Health insurance is one of the most common benefits found with many full-time positions. Because of the Affordable Care Act, employers with more than 50 full-time employees must offer health care.

What is a health insurance premium?

Not all of these plans are offered by every employer and each comes with its own tax rules. A premium is the price that you pay for coverage.

What is the deductible amount for 2016?

The deductible amount for 2016 is the total of all medical costs that are above 10 percent of annual income. This includes any money that they must pay for their health insurance premium. There are other forms of medical coverage associated with wages.

What is an HSA?

A Health Savings Account, or HSA, is a tax-deductible way to save money for large health bills. To qualify, you must have a high-deductible health plan and annual medical bills below a certain cap. These numbers are adjusted by the IRS each tax year.

Is premium deductible on taxes?

A premium is the price that you pay for coverage. As stated above, the portion of this premium that is provided by the employer is not included in taxable income in most cases. However, the portion of the deductible that is covered by the employee can be a tax deduction. The details of this are discussed in the next section.

Is long term care insurance taxable?

Both insurance premiums and long-term care insurance, when offered by an employer, are non-taxable benefitst s. There are a few exceptions to this rule. Here is a look at how health insurance is viewed in the tax code, the exceptions that make it a taxable item, and when it is a tax deduction instead. Enter your zip code above to compare private ...

When do employers send out 1095-B?

It is scheduled to come by mid-March of each year. This form is proof that a person or a family had health coverage.

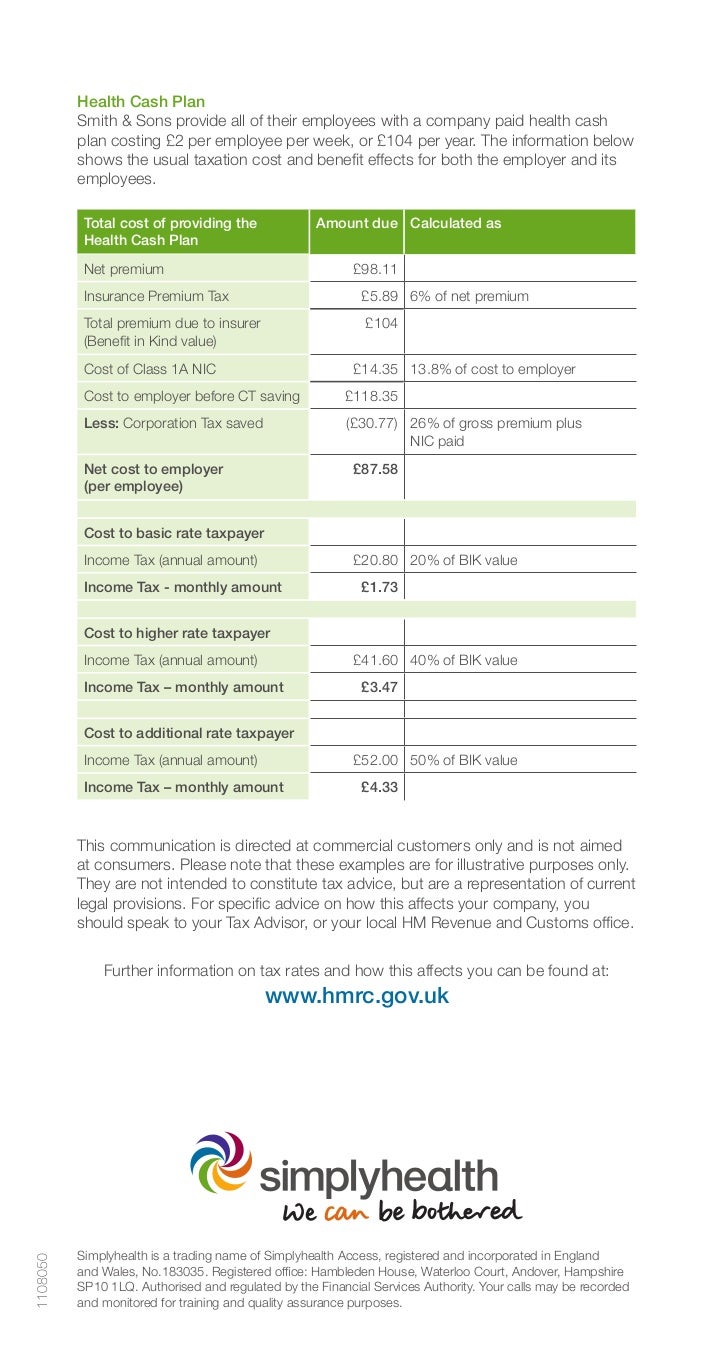

Cost of Coverage Reporting

You may think that the insurance premiums your company pays on your behalf could be taxable because your employer reports them on your Form W-2, which you use to file your income tax return.

Employer-Paid Insurance Premiums

If your health insurance is provided directly through your employer and they paid for 100 percent of the premium cost, the Internal Revenue Service regards this as an employee benefit, not a wage or taxable income. Your pay stub may or may not show the amount of your health insurance premium that your employer pays.

Reimbursed Premiums

Some employers may request that you buy health insurance on your own. They will then reimburse the premiums that you pay. The Affordable Care Act (ACA) refers to premium reimbursement as a Health Reimbursement Arrangement (HRA).

High-Cost Employer-Sponsored Health Coverage

Some people refer to high-cost insurance plans as “Cadillac” health insurance plans. In 2018, high-cost insurance plans will trigger a 40 percent excise tax on employers and insurers. Technically, employees with high-cost health insurance plans will only pay the tax on the share of their health insurance that they pay.

Your Share of Health Insurance Premiums

If you pay a portion of your health insurance premiums as part of a group plan offered by your employer, these premiums are not taxable. Employers should deduct the amounts that you pay for your share of health insurance premiums from your wages before they withhold payroll taxes.

Stipends or Lump-Sum Payments

Some employers offer employees stipends or lump-sum payments to buy their health insurance directly or put the funds into a Health Savings Account (HSA). These payments are taxable because they are paid directly to the employee, not an insurance company.

Health Savings Accounts

Health Savings Accounts or HSAs, are available to qualifying individuals, and employers or employees may make contributions. Internal Revenue Service rules regarding HSAs are complex. Employer contributions to the accounts are not taxable unless you use the account to pay non-eligible costs (non-medical uses) at a later date.

Is worker's compensation taxable?

Worker's compensation benefits are not taxable to employees if they are paid as part of a state's worker's compensation program. Other payments to employees who are receiving worker's compensation benefits (such as a pension) are taxable to the employee. 13 . Commuter and transportation benefits from businesses to their employees are typically ...

Is tip income taxable on W-2?

Employee gross income is taxable to the employee, including overtime pay for non-exempt employees and certain lower-income exempt employees. All tip income is included with all other income in the relevant boxes on Form W-2.

Is mileage taxable to employees?

The employee's personal mileage is taxable as a benefit. 3 . Stock options may be taxable to employees when the option is received, or when the option is exercised, or when the stock is disposed of. 4 . Employee bonuses and awards for outstanding work are generally taxable to the employee.

Is moving expenses taxable?

Moving expenses are considered an employee benefit and these payments are taxable to the employee, from 2018 through 2025. 7 Even if your business has an a ccountable plan for distributing and keeping track of these moving costs, they are still taxable to the employee.

Is advance commission taxable?

Employee commissions are included in taxable income. If an employee received advance commissions for services to be performed in the future, those commissions are, in most cases, taxable when received by the employee. 1 2 .

Is $5,250 taxable?

Educational assistance benefits under $5, 250 paid to employees in a calendar year are not taxable to the employee if there are provided as part of a qualified educational assistance program. For more information on educational assistance programs, see IRS Publication 971 . 18 .

Is a gift card under $25 taxable?

6 . You may have heard that if you give a gift card under $25 to an employee it's not taxable. That's not true.

Who is subject to reporting requirements for employer sponsored health insurance?

Employers that provide "applicable employer-sponsored coverage" under a group health plan are subject to the reporting requirement. This includes businesses, tax-exempt organizations, and federal, state and local government entities (except with respect to plans maintained primarily for members of the military and their families).

What is IRPAC in tax?

IRPAC’s members are representatives of industries responsible for providing information returns, such as Form W-2, to the IRS. IRPAC works with IRS to improve the information reporting process.

Is W-2 taxable?

Reporting the cost of health care coverage on the Form W-2 does not mean that the coverage is taxable. The value of the employer’s exclud able contribution ...

Is employer excludable contribution taxable?

The value of the employer’s excludable contribution to health coverage continues to be excludable from an employee's income, and it is not taxable. This reporting is for informational purposes only and will provide employees useful and comparable consumer information on the cost of their health care coverage. ...

How much medical expenses can be deducted from your income?

Medical expenses can be deducted to the extent they exceed 7.5 percent of your adjusted gross income for the 2018 tax year, and this threshold rises to 10 percent for 2019.

Is medical reimbursement taxable?

Personal Medical Expense Reimbursement. If your benefits do nothing but pay for doctor bills, prescriptions and hospital stays, then don't worry – those payments are not taxable. Even though your health insurance is essentially paying for these critical services, this will in no way be considered part of your annual income.

Is health insurance considered income?

Are Health Insurance Benefits Considered Income by the IRS? Health insurance is not taxable income, even if your employer pays for it. Under the Affordable Care Act, the amount your employer spends on your premiums appears on your W-2s, but it should in no way be classified as income.

Is insurance tax free?

The primary factor decided who the tax burden falls on at this point is who is currently paying your premiums. When you pay for the insurance policy, your benefits are tax-free. When your employer pays, the benefits are taxable.

Is 60 percent of your health insurance premiums taxable?

If it's a split – your employer pays 60 percent of the premiums, for example – then 60 percent of the benefits are taxable. Your employer should factor that into your withholding.

Can you claim a high tech exam as a deduction?

If your insurance pays for a $2,000 high-tech exam, for example, you can't claim that as a deduction. However, if you paid a $40 co-payment, you can write that off if you have enough other deductions to make itemizing a better deal than taking the standard deduction.

Is adult child coverage taxable?

In that case, your coverage is a fringe benefit and part of your taxable income. One effect of the Affordable Care Act is that if you cover an adult child younger than 27, the coverage isn't subject to tax.

Nontaxable benefits

Some benefits are not taxable to the employee, although some are subject to certain dollar limits. These benefits include:

Taxable benefits

Offering even taxable benefits to employees can be beneficial, provided that the benefit is valuable enough to the employee. That is because employees pay less in tax on a benefit than they would pay for the service if they purchased it out of pocket. Taxable benefits must be included as income on the employee’s W-2 or 1099.

Employer considerations

Employers should keep in mind that tax standing is not an issue for some benefits they may offer. For example, offering a remote, flexible or hybrid work arrangement does not have tax consequences. Benefits such as these are valuable to employees and can help attract new talent.