How do you calculate federal retirement?

- The employee’s length of service under FERS;

- the employee’s high-three average salary; and

- the FERS annuity calculation formula.

What states don t tax retirement pensions?

The following states are exempt from income taxes on Thrift Savings Plan (TSP) Income:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

- Illinois

How will your retirement benefits be taxed?

- Large IRA account balances

- Large taxable (non-retirement) account balances

- Large investments in municipal bonds (non-taxable interest)

- Pensions

- Annuities

- Employment

- Inflation (more on that shortly)

Is pension considered income and taxable at the federal level?

Yes, pensions are generally subject to federal tax. However, depending on the nature of the pension contribution, a pension may be fully taxable or only partially taxable. A pension is fully taxable if you made no investment in the plan. You didn't make an investment in a pension if you didn’t contribute anything toward the pension plan.

Are federal pensions taxable income?

The taxable part of your pension or annuity payments is generally subject to federal income tax withholding. You may be able to choose not to have income tax withheld from your pension or annuity payments (unless they're eligible rollover distributions) or may want to specify how much tax is withheld.

What states do not tax federal pensions?

But again, there are many states (14 to be exact) that do not tax pension income at all. Here they are: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming New Hampshire, Alabama, Illinois, Hawaii, Mississippi, and Pennsylvania.

How is FERS pension taxed?

During your career you do pay a portion of your paycheck into the FERS retirement system (the system that funds your pension). And that money that you paid in you actually does come out tax free because you already pay taxes on it.

Are retirement pensions taxable?

Pensions. Most pensions are funded with pretax income, and that means the full amount of your pension income would be taxable when you receive the funds. Payments from private and government pensions are usually taxable at your ordinary income rate, assuming you made no after-tax contributions to the plan.

How much federal tax is taken out of a pension check?

Have 11% in federal taxes withheld from their pension and IRA distributions.

Which retirement benefits are exempt from income tax?

If the payment is received from a provident fund which comes under the purview of Provident Fund Act, 1925, the entire amount is exempted from tax liability. Also, in case of Public Provident Fund which was started in 1968, the lump sum amount received at the time of retirement is considered to be tax free.

Will my FERS pension affect my Social Security?

Great question. So the short answer is no, your FERS pension is not going to reduce your Social Security. As a FERS employee you certainly can get your full Social Security while getting your FERS pension.

Is FERS pension considered earned income?

Your Federal Employees Retirement System (FERS) basic benefit is not considered earnings. Your earnings for any year will consist of the sum of wages for service performed in the year, plus all net earnings from self-employment for the year, minus any net loss from self-employment for the year.

When will I get my annual 1099-R tax statement?

OPM mails out 1099-R tax forms to all annuitants by January 31. You may not receive your mailed 1099-R tax form until mid-February, depending on wh...

How do I get a corrected 1099-R tax statement?

You should contact us. After we make an update, we will mail you the corrected or amended tax form to the mailing address we have on file. OPM does...

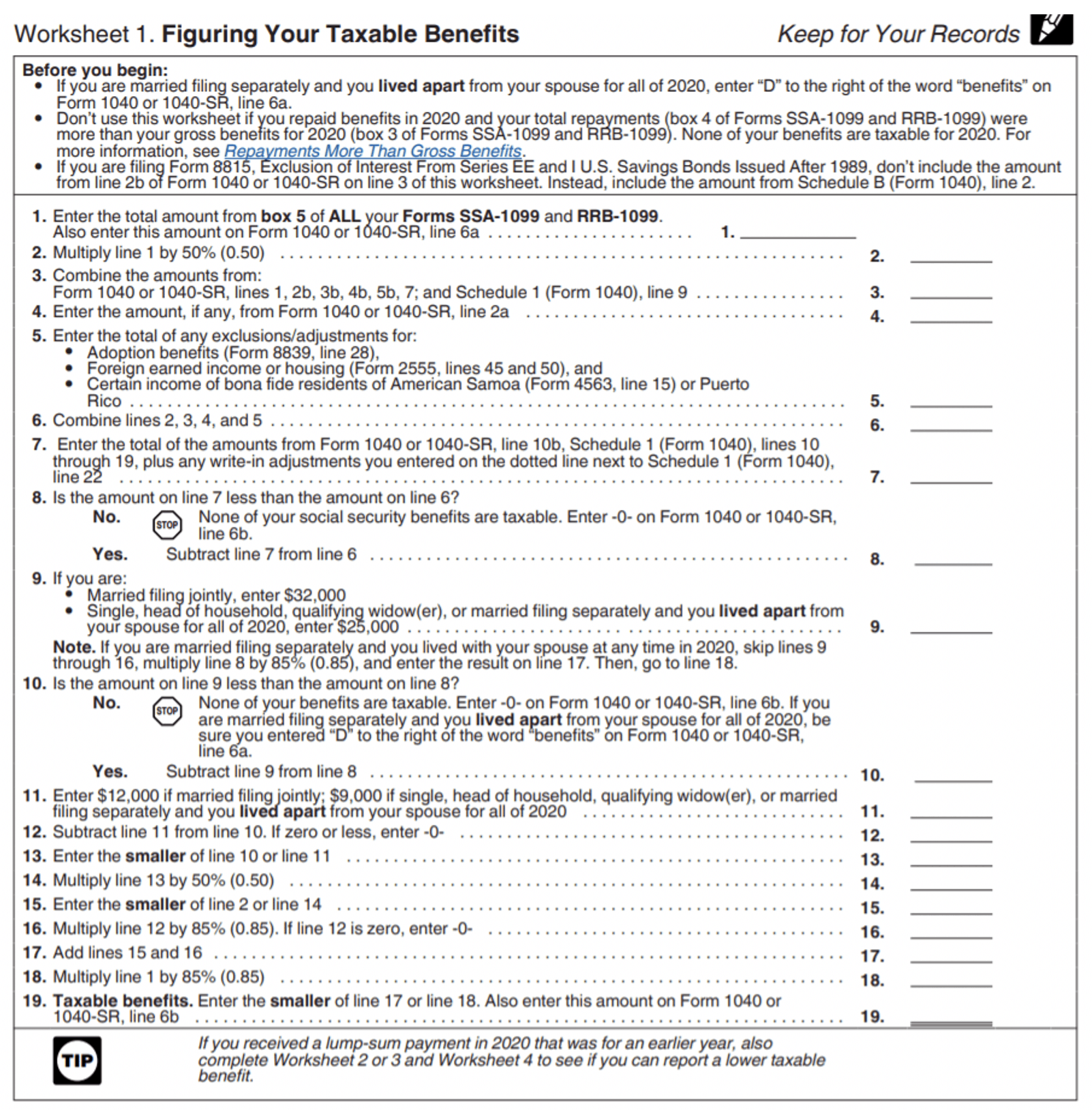

How much of my retirement benefit is taxable?

Your retirement contributions are shown on the 1099-R tax form we send you each January for tax filing purposes. Use the IRS tax withholding estim...

How is the tax-free portion of my annuity determined?

If your non-disability annuity started on or after July 2, 1986, then a portion of each annuity payment is taxable and a portion is considered a ta...

Can I rollover my refund of retirement contributions?

You can rollover lump-sum payments representing your retirement contributions, including voluntary contributions, and applicable interest. An eligi...

How can I receive a direct rollover?

You can open an individual retirement account to receive a direct rollover. You must contact the individual retirement account sponsor to find out...

Is my refund of retirement contributions taxable?

Your retirement contributions are not taxable, but interest included in the payment is taxable. You should contact the IRS for more information.

The taxable amount on my 1099-R tax statement is listed as unknown. What does that mean?

If Box 2.a is marked Unknown, this means that OPM didn't calculate the tax-free portion of your annuity. The most common reasons for not calculatin...

How do I get a refund of my federal or state tax withholdings?

OPM can refund federal and/or state income tax withholding only for the current year. Contact us to request a refund. If you want a partial reimbur...