Other government benefits may or may not be taxable:

- Unemployment benefits are fully taxable as regular income.

- Disaster relief payments under the Disaster Relief and Emergency Assistance Act can’t be included in income if they’re...

- Medicare – The costs for medical care under Medicare are tax free, and the premiums are tax deductible (if you itemize...

Do I have to pay taxes on my government benefits?

While millions of Americans receive government benefits every month, many people are surprised to learn that most types of federal government benefits are subject to income tax. It is generally safe to assume that your benefits will be taxable for the purpose of the federal income tax - because you are receiving something of monetary value.

Are Social Security benefits taxable by the federal government?

Social Security Benefits and Federal Income Tax. Social Security taxes have been taxable since 1983. However, social security benefits are only taxable when certain conditions are met.

What benefits are subject to income tax?

The benefits are subject to income tax withholding and employment taxes. Fringe benefits include cars and flights on aircraft that the employer provides, free or discounted commercial flights, vacations, discounts on property or services, memberships in country clubs or other social clubs, and tickets to entertainment or sporting events.

Are welfare benefits taxable in the US?

The federal government has a key exception to the non-taxable welfare benefits rule. According to the IRS, welfare benefits acquired through fraudulent activity are taxable. Additionally, individuals must report income from welfare benefits received as "compensation for services," such as through a job or "workfare" program, on their tax returns.

Are government benefits taxed?

Learn more about the U.S.' progressive tax system here. Important: Many states have not followed the federal government's lead on this. In many states, such as New York, all unemployment benefits are still subject to state taxes. In other states, like California, unemployment benefits are exempt from state tax.

What benefits are exempt from taxes?

These fringe benefits can include such things as health insurance, medical expense reimbursements, dental insurance, education assistance, and day care assistance. When we say tax free, we mean it: Tax qualified benefits are totally free of federal and state income tax, and Social Security and Medicare taxes.

What type of benefits are taxable?

Bonuses, company-provided vehicles, and group term life insurance (with coverage that exceeds $50,000) are considered taxable fringe benefits. Nontaxable fringe benefits can include adoption assistance, on-premises meals and athletic facilities, disability insurance, health insurance, and educational assistance.

Do benefits count as income for tax?

Do I include benefits? Most, but not all, taxable state benefits should be included as social security income. However, income-based Jobseekers Allowance although taxable is not counted as income for tax credit purposes.

How are benefits taxed?

Benefits received in-kind, or considered de minimis, are usually not subject to taxation. Employers often provide other employee benefits such as health plans, unemployment insurance, and worker's compensation. Taxable fringe benefits are included on an employee's W-2.

What kind of income is not taxable?

Nontaxable income won't be taxed, whether or not you enter it on your tax return. The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer.

Are benefits considered income?

Fringe benefits are generally included in an employee's gross income (there are some exceptions). The benefits are subject to income tax withholding and employment taxes.

Are social benefits taxable?

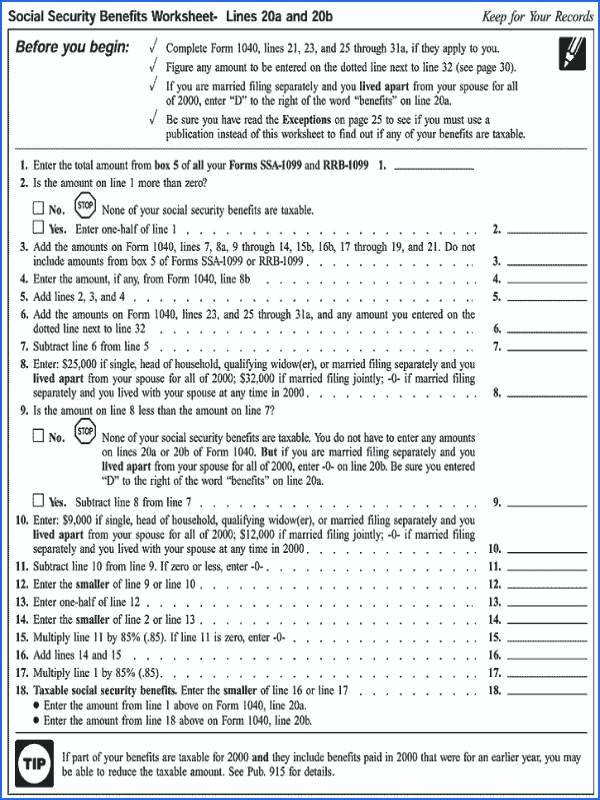

Some people who get Social Security must pay federal income taxes on their benefits. However, no one pays taxes on more than 85% percent of their Social Security benefits. You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000.

What does taxable benefit mean?

A taxable benefit is a payment from an employer to an employee that is considered a positive benefit and can be in the form of cash or another type of payment.

Why do I pay tax on medical insurance?

If your employer pays for your health insurance, then you'll usually pay a level of tax that relates to the cost of your insurance premiums. This is because the policy is treated as a 'benefit in kind' – a benefit that's received from employment but not included in your salary or wages.

How much of your Social Security check can you take out of your taxes?

You could see taxes taken out of your Social Security check if you made more than: $32,000 if you are filing married filing jointly.

Is Social Security taxed?

Part of your Social Security benefits could be taxed, but it depends on your tax filing status and income. Social Security tax is based on how much income you had during the year from all sources, as well as your filing status.

Is unemployment taxable income?

Unemployment benefits are fully taxable as regular income. Disaster relief payments under the Disaster Relief and Emergency Assistance Act can’t be included in income if they’re to help meet necessary expenses for medical, dental, transportation, personal property or funeral expenses.

Is Medicare deductible?

Medicare – The costs for medical care under Medicare are tax free, and the premiums are tax deductible (if you itemize deductions). Jury duty pay is taxable. Food stamps are not taxable. It’s not too good to be true. See what others are saying about filing taxes online with 1040.com. Trustpilot Custom Widget.

What is TANF in the federal government?

These benefits come in the form of Temporary Assistance for Needy Families (TANF) payments, food stamps and heating assistance.

What is the IRS?

The Internal Revenue Service is the federal government's tax agency. The IRS manages the levels and flow of all United States income taxes. As of December 2010, all forms of welfare benefits, including non-federal benefits from a state or local agency, are exempt from federal taxation, says the IRS.

Is welfare income taxable?

According to the IRS, welfare benefits acquired through fraudulent activity are taxable. Additionally, individuals must report income from welfare benefits received as "compensation for services," such as through a job or "workfare" program, on their tax returns.

Do state and local governments have to file separate taxes?

Many state and local governments and agencies administer income taxes, which are in addition to federal income taxes. These governments sometimes require individuals to file separate tax returns. Although income tax procedures vary among state and local governments and agencies, the vast majority of these exempt welfare ...

Is Medicare taxable income?

Income from basic Medicare programs, including hospital insurance benefits for the elderly and supplemental medical insurance for the aged, is not taxable by the IRS. Additionally, old-age and disability Social Security benefits are also exempt from federal taxation.

What is the federal unemployment tax?

The Federal Unemployment Tax Act (FUTA), with state unemplo yment systems , provides for payments of the unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only the employer pays FUTA tax; it is not withheld from the employee’s wages.

What is the most important benefit provided by an employer?

A health plan can be one of the most important benefits provided by an employer. The Department of Labor's Health Benefits Under the Consolidated Omnibus Budget Reconciliation Act (COBRA) provides information on the rights and protections that are afforded to workers under COBRA.

What is unemployment benefit?

Unemployment insurance payments (benefits) are intended to provide temporary financial assistance to unemployed workers who meet the requirements of state law. Each state administers a separate unemployment insurance program within guidelines established by federal law.

Is fringe income taxed?

Fringe benefits are generally included in an employee’s gross income (there are some exceptions). The benefits are subject to income tax withholding and employment taxes. Fringe benefits include cars and flights on aircraft that the employer provides, free or discounted commercial flights, vacations, discounts on property or services, memberships in country clubs or other social clubs, and tickets to entertainment or sporting events.

Is an employer's health insurance taxable?

If an employer pays the cost of an accident or health insurance plan for his/her employees, including an employee’s spouse and dependents, the employer’s payments are not wages and are not subject to Social Security, Medicare, and FUTA taxes, or federal income tax withholding.

Does the employer pay FUTA tax?

Only the employer pays FUTA tax; it is not withheld from the employee’s wages. The Department of Labor provides information and links on what unemployment insurance is, how it is funded, and how employees are eligible for it. In general, the Federal-State Unemployment Insurance Program provides unemployment benefits to eligible workers who are ...

How much can you exclude from your income?

However, the amount you can exclude is limited to your employer's cost and can’t be more than $1,600 ($400 for awards that aren’t qualified plan awards) for all such awards you receive during the year. Your employer can tell you whether your award is a qualified plan award. Your employer must make the award as part of a meaningful presentation, under conditions and circumstances that don’t create a significant likelihood of it being disguised pay.

When is nonqualified compensation included in gross income?

In most cases, any compensation deferred under a nonqualified deferred compensation plan of a nonqualified entity is included in gross income when there is no substantial risk of forfeiture of the rights to such compensation. For this purpose, a nonqualified entity is one of the following.

How many employee achievement awards did Ben Green receive?

Ben Green received three employee achievement awards during the year: a nonqualified plan award of a watch valued at $250, and two qualified plan awards of a stereo valued at $1,000 and a set of golf clubs valued at $500. Assuming that the requirements for qualified plan awards are otherwise satisfied, each award by itself would be excluded from income. However, because the $1,750 total value of the awards is more than $1,600, Ben must include $150 ($1,750 − $1,600) in his income.

What is included in gross income?

In most cases, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

What is income received by an agent for you?

Income received by an agent for you is income you constructively received in the year the agent received it. If you agree by contract that a third party is to receive income for you, you must include the amount in your income when the third party receives it.

Is emergency financial aid included in gross income?

The amounts of these are not included in the gross income of the eligible self-employed individual. Emergency financial aid grants. Certain emergency financial aid grants under the CARES Act are excluded from the income of college and university students, effective for grants made after 3/26/2020.

How much of your Social Security income is taxable?

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income. If you file as an individual with a total income that’s less than $25,000, you won’t have to pay taxes on your social security benefits in 2020, ...

How much tax do you pay on your income if you live in one of the states?

So if you live in one of those four states then you will pay the state’s regular income tax rates on all of your taxable benefits (that is, up to 85% of your benefits). The other nine states also follow the federal rules but offer deductionsor exemptions based on your age or income.

How much to withhold from Social Security?

The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit . After you fill out the form, mail it to your closest Social Security Administration (SSA) office or drop it off in person.

How to find out if you will pay taxes on Social Security?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security benefits and add that amount to all your other income , including tax-exempt interest. This number is known as your combined income (combined income = adjusted gross income + nontaxable interest + half of your Social Security benefits).

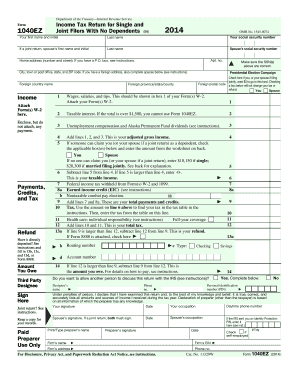

How to file Social Security income on federal taxes?

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099.

How many states have Social Security taxes?

There are 13 states that collect taxes on at least some Social Security income. Four of those states (Minnesota, North Dakota, Vermont or West Virginia) follow the same taxation rules as the federal government.

Do you pay taxes on Roth IRA?

With a Roth IRA, you save after-tax dollars. Because you pay taxes on the money before contributing it to your Roth IRA, you will not pay any taxes when you withdraw your contributions.

Who pays Social Security taxes?

Federal Employees Pay Social Security Taxes. All federal employees hired in 1984 or later pay Social Security taxes. This includes the president, the vice president, and members of Congress. It also includes federal judges and most political appointees. They all pay the same amount of Social Security taxes as people working in the private sector.

How to find out about federal benefits?

To learn about your federal benefits or get help with them, contact your agency's personnel or human resources office. And visit the Office of Personnel Management (OPM) website. You can also Contact OPM.

What is TSP retirement?

The Thrift Savings Plan (TSP) is a retirement plan for federal government employees and members of the military. Find the basics about participating - Eligibility, contributions, loans, withdrawals, setting up and managing your account. Learn about investment funds - Overview of fund types, fund options, and performance.

Does OPM have access to beneficiary information?

OPM and the Office of Federal Employees' Group Life Insurance (OFEGLI) do not have access to your records and cannot answer questions about coverage or beneficiaries.