Is group life insurance cheaper than individual?

The cost of insuring a group of people, rather than an individual person, is cheaper because the rate is based on the overall risk of the group. The insurer typically assumes that not all people who are insured will remain with the company until they retire, which in turn means a shorter life insurance term.

Should you buy group term life insurance?

Yes, if you belong to an alumni association, trade group, professional society, or other organization, then it may offer group term life insurance for its members. And unlike employer-based insurance, it will be portable if you change jobs.

Is a life insurance taxable before it reaches the beneficiary?

Typically, beneficiaries on a life insurance policy will not be required to pay income tax when they receive a death benefit, but there are certain exceptions to this rule.

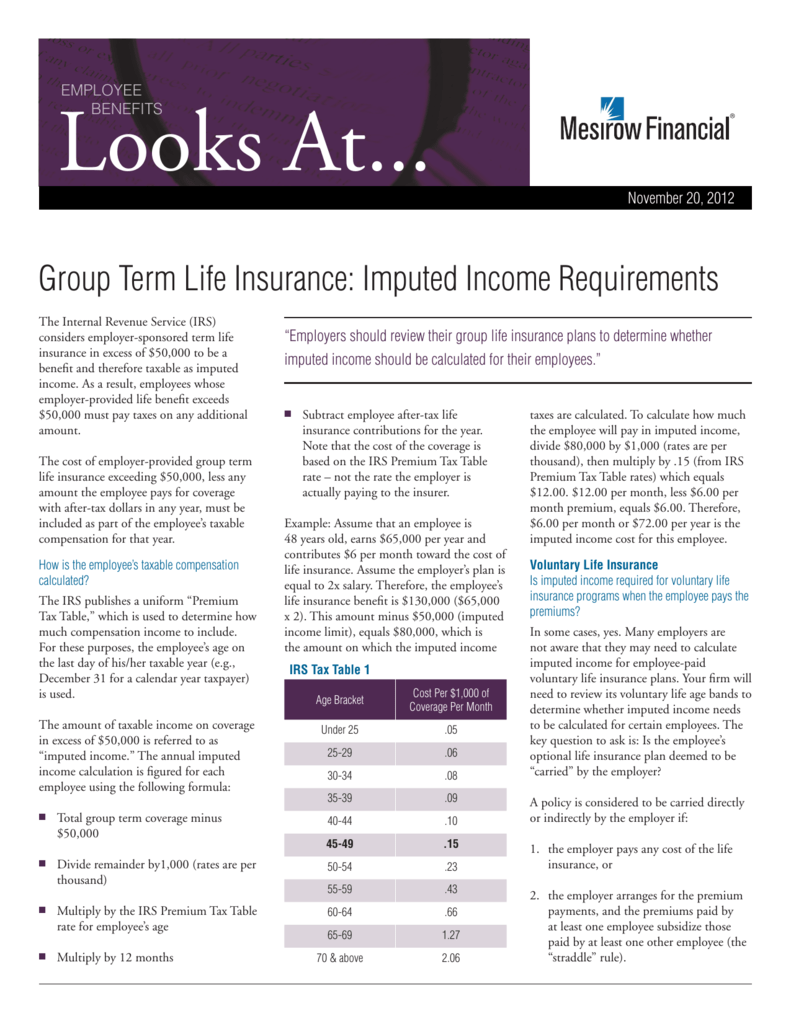

How to calculate group term life insurance?

Group-term life insurance is a term life insurance protection for a fixed time. Amounts provided to an employee that are more than $50,000 must be reported by the employer as part of the employee's wages. These amounts are included as wages in boxes 1 (Wages, tips, other compensation), 3 (Social Security wages), and 5 (Medicare wages and tips ...

Are proceeds from group life insurance taxable?

Answer: Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received.

At what point does group term life insurance become taxable?

Your employer may pay the premiums for this coverage, rather than passing them on to you. Group term life insurance becomes a taxable benefit when the coverage amount exceeds $50,000. Group term life insurance does not have a cash value component, nor is it permanent.

Is group term life insurance reported on w2?

Group Term Life Insurance. If your former employer provided more than $50,000 of group-term life insurance coverage during the year, the amount included in your income is reported as wages in box 1 of Form W-2.

How are premiums for group life insurance taxed?

Life insurance premiums, under most circumstances, are not taxed (i.e., no sales tax is added or charged). These premiums are also not tax-deductible. If an employer pays life insurance premiums on an employee's behalf, any payments for coverage of more than $50,000 are taxed as income.

Is group term life insurance tax deductible to employer?

The good news, from a federal income tax standpoint, is that group term life premiums paid by an employer are tax deductible by the business, even if your plan is discriminatory.

Is GTL considered gross wages?

Group Term Life Insurance (GTL) The taxable portion is computed using your gross wages, the age you are on December 31 of the taxable calendar year, and a cost table per $1000 of coverage provided by the IRS. On your paycheck under Deductions, you will see “GTL” with a benefit amount.

What taxes is group term life subject to?

Total Amount of Coverage The imputed cost of coverage in excess of $50,000 must be included in income, using the IRS Premium Table, and are subject to social security and Medicare taxes.

How does group term life insurance affect payroll?

However, with group life insurance, your employer either deducts your monthly premiums through your salary and pays them on your behalf or pays the premiums with no deductions to your salary. Either way, with group life insurance, the employee pays very little for a good amount of protection.

How much tax do you pay on imputed income?

The imputed income is reported on Form W-2 as taxable wages . In this example, $2 . 66 per pay would be added to the employee's W-2 wages . Assuming a 20% tax rate, this employee would have an annual impact of $13 .

Is group term life insurance subject to FICA?

Code Section 79 governs employer-sponsored group term life insurance plans and provides us with an income exclusion of the cost of up to $50,000 of employer-provided group term life insurance coverage. 1. The same amount can be excluded from the employee's wages for purposes of FICA (Social Security and Medicare) taxes ...

How do I avoid tax on life insurance proceeds?

Using an Ownership Transfer to Avoid Taxation If you want your life insurance proceeds to avoid federal taxation, you'll need to transfer ownership of your policy to another person or entity.

Are Life Insurance Premiums Taxable?

The life insurance premiums you pay are not taxable. They are also not deductible on your tax return.

Do You Pay Inheritance Tax on Life Insurance?

There is no inheritance tax on life insurance. Life insurance death benefits are paid tax-free to your life insurance beneficiaries.

Is There a Penalty for Cashing Out Life Insurance?

If you surrender a cash value life insurance policy, the only “penalty” is that you may have to pay a surrender fee. The life insurance company wil...

What is taxable amount on a loan?

The taxable amount is based on the amount of the loan that exceeds your policy basis. Remember, policy basis is the portion you’ve paid in as premiums. Amounts “above basis” are based on interest or investment gains on cash value.

What are the upsides of life insurance?

Compare Life Insurance Companies. One of the primary upsides to life insurance is that the payout is made to your beneficiaries tax-free. Since life insurance death benefits can be in the millions of dollars, it’s a significant advantage to buying (and receiving) life insurance. But there are other aspects to life insurance ...

What is a cash value life insurance policy?

There’s a market for existing life insurance policies, especially cash value life insurance policies that insure people who are terminally ill or have short life expectancies. Transactions involving terminally ill policy owners are called “viatical settlements.” These involve an investor, such as a company specializing in buying policies, paying you money for the policy, becoming the policy owner, and then making the life insurance claim when you pass away.

Why do you need cash value life insurance?

One of the reasons to buy cash value life insurance is to have access to the money that builds up within the policy. When you pay premiums, the payments generally go to three places: cash value, the cost to insure you, and policy fees and charges.

Is a viatical settlement taxable?

Viatical settlements are typically used as a way for patients to get money for medical bills, especially when selling a life insurance policy will mean getting more money than simply surrendering it for the cash value. Fortunately, the IRS doesn’t treat any portion of what you receive for a viatical settlement as taxable.

Can you take the surrender value of a life insurance policy?

There can be times when a policy owner no longer wants or needs the life insurance policy. You can take the surrender value of the policy, and the insurer will terminate the coverage. The amount you receive is your cash value minus any surrender charge.

Is surrender fee taxable?

Surrendering a policy ends the life insurance coverage. A portion of the money you receive may be taxable if it includes investment gains.

How much is taxable income for group term life insurance?

Your employee’s taxable income depends on the amount of group-term life insurance coverage you provide in excess of $50,000. Remember not to include the first $50,000 in the employee’s taxable income. If your employees pay any part of the group-term life insurance premium, deduct their contribution amount.

How many employees can you have for group life insurance?

You can offer group-term life insurance to your employees if you meet four requirements: You meet the 10-employee rule (must provide the insurance to at least 10 full-time employees at some time during the year; some exceptions apply) An employee who has group-term life insurance coverage chooses beneficiaries.

How much life insurance is taxable on W-2?

However, you must report your costs toward any group-term life insurance over $50,000 as taxable income (Social Security and Medicare taxes) for each employee. Include the taxable income for the additional amount (over $50,000) on each employee’s Form W-2. Add the taxable income to their taxable income in boxes 1, 3, and 5.

What percentage of employees have employer sponsored life insurance?

Fifty-five percent of private industry employees have access to employer-sponsored life insurance, and 98% of those employees enroll in the benefit. As a popular benefit, you might offer group-term life insurance. If you decide to offer it, you need to be familiar with group-term life insurance tax.

Who chooses beneficiaries for group term life insurance?

You directly or indirectly carry the group-term life insurance policy. An employee who has group-term life insurance coverage chooses beneficiaries. Their beneficiaries receive the benefits of the life insurance plan if the employee dies.

Does dependent life insurance count as a federal tax?

Unlike group-term life insurance for employees, dependent group-term life insurance coverage is subject to federal income, Social Security, and Medicare taxes, but not FUTA tax. Again, do not count any amounts that employees pay for the coverage.

Is a $2,000 dependent taxable?

If you pay for $2,000 of group-term life insurance coverage for an employee’s dependents, it is exempt from the employee’s taxable income. If the dependent exceeds the $2,000 mark, you must include the entire value in the employee’s taxable income. Unlike group-term life insurance for employees, dependent ...

How much is group life insurance?

Employers can provide employees with up to $50,000 of tax-free group term life insurance coverage. According to Internal Revenue Service (IRS) Code Section 79, the cost of any coverage over $50,000 that is paid for by an employer must be recognized as a taxable benefit and reported on the employee’s W-2 form as income. The taxable amount is calculated using an IRS premium table, based on the employee’s age, and is subject to Social Security and Medicare taxes. 1

What is group term life insurance?

Group term life insurance is a common part of employee benefit packages. Many employers provide, at no cost, a base amount of coverage as well as an opportunity for the employee to purchase additional coverage through payroll deductions. The insurance plan also may offer employees the option to buy coverage for their spouses and children.

What happens to group insurance when you retire?

As mentioned above, because group coverage is linked to employment, if you change jobs, stop working for a period of time, leave to open a business, or retire, then the coverage will stop. This puts you at risk of being uninsured or, if you have health issues, having difficulty with finding new coverage.

Is term life insurance tax free?

Group term life insurance is an employee benefit that’s often provided for free by employers. Employees may also have the option to buy additional coverage through payroll deductions. The first $50,000 of group term life insurance coverage is tax-free to the employee.

Does supplemental insurance require underwriting?

Unlike basic coverage, supplemental coverage may require underwriting. Usually, it is a simplified underwriting process in which the employee answers some questions to determine eligibility rather than going through a physical exam.

Is group term insurance cheap?

Group term coverage is generally inexpensive, especially for younger workers. However, the rates go up as individuals age. Most plans also have rate bands in which the cost of insurance automatically goes up in increments—for example, at ages 30, 35, 40, etc.

Does group life insurance cover spouses?

The insurance plan also may offer employees the option to buy coverage for their spouses and children. Like other types of life insurance, group term life insurance pays out a death benefit to your designated beneficiary if you pass away while the policy is in effect.

Harmonized Sales Tax (HST)

The federal government charges HST on the administration fees for ASO plans.

Provincial Premium Tax (PPT)

Ontario charges 2% Provincial Premium Tax on the cost of group life and health benefits. 1

Provincial Retail Sales Tax (RST)

Ontario charges 8% Retail Sales Tax on group life and health benefits. 2

Provincial Income Tax

The employer portion of health and dental premiums is included in the tax base for Quebec.

How much is the first $50,000 of insurance taxed?

The first $50,000 of coverage isn't taxed, so if you had $200,000 in total coverage, you'd be taxed on the cost of $150,000 in coverage, or $270 for the full year ($1.80 x $150,000). However, you may already have paid at least some of that cost through payroll deductions.

What does GTL mean on paycheck?

One item you may notice is group term life insurance, or GTL for short. If you see GTL or a similar reference to group term life on your paycheck, that means it's included as part of your employee benefits package. Though your employer may pay the premiums for the insurance, you could owe tax on it depending on the amount ...

Is a $2,000 insurance premium taxable?

If the amount of coverage is $2,000 or less, then it's not taxable to the employee. The premiums on coverage for spouses or dependents over that amount, however, could be treated as taxable income for the employee. If coverage exceeds $2,000, then the entire amount of the premium is considered taxable. 2. The amount shown on your paycheck ...

Is group insurance taxable on W-2?

When you receive a W-2 form from your employer at the end of the year, it will report the total cost of any group insurance you received that was in excess of $50,000 and therefore taxable. That amount will appear in box 12c of your W-2 and also be included in your income for boxes 1, 3, and 5. 3.

Is $50,000 in life insurance taxable?

The premiums for any group term life insurance over $50,000 are considered taxable income. $50,000 in life insurance may not be adequate if you have a family or other financial dependents. If you leave your job, you may find yourself without insurance.

Is there a tax on group life insurance?

If your employer offers group term life insurance, you won't be taxed on the first $50,000 of coverage, so there is no downside in taking it. If you need more insurance than that, adding to your employer coverage may mean paying some tax, but it could still be a relatively inexpensive way to get the insurance you need.

Is term life insurance permanent?

Because this is term life insurance, your coverage isn't permanent. Instead, it remains in place as long as you're working for that employer or up to a specified term set by the policy. If you decide to leave your job, you may have the option of converting to an individual term life policy.