Are health insurance benefits considered income by the IRS?

You must report as income any amount you receive for your disability through an accident or health insurance plan paid for by your employer: If both you and your employer have paid the premiums for the plan, only the amount you receive for your disability that's due to your employer's payments is reported as income.

Do health insurance premiums reduce taxable income?

Yes, though there are significant differences between the treatment of health insurance premiums for tax purposes for persons with individual and group health insurance policies. If you are self-employed and purchase individual health insurance then this expense can be deducted directly on your Form 1040 as an adjustment to income.

How does health insurance affect your taxes?

- Lower costs for Marketplace coverage

- New qualifications to help pay for health coverage

- Special enrollment periods

- Changes reporting the excess advance payments for the Premium Tax Credit (APTC) on your 2020 tax return only

- 2021 and 2022 Health Plans and Prices.

Are healthcare subsidies taxable income?

Traditional health insurance benefits are not taxable under any federal or state tax laws. If you pay for your own health insurance, you will be eligible to write off the premiums and out of pocket expenses, most of the time. If your employer pays for your health insurance premiums, it is paid with pre-taxed dollars.

Do health benefits count as income?

Health insurance is not taxable income, even if your employer pays for it. Under the Affordable Care Act, the amount your employer spends on your premiums appears on your W-2s, but it should in no way be classified as income.

Is a health insurance allowance taxable?

Health insurance reimbursement through a health reimbursement arrangement is not taxable. HRA contributions aren't considered income, so employees don't pay income tax on it and employers don't pay payroll tax.

Are health benefits taxable in Canada?

In Canada, health and dental benefits can be paid out tax-free to employees. This requires that a special arrangement be set up between the employer and the employee. The employer cannot simply pay an employee, call it a health or dental benefit, and expect it to be a tax-free.

Is health insurance included in gross income?

If your pay stub lists “federal taxable wages,” use that. If not, use “gross income” and subtract the amounts your employer takes out of your pay for child care, health insurance, and retirement plans. Include “net self-employment income” you expect — what you'll make from your business minus business expenses.

What benefits are taxable in payroll?

Taxable fringe benefits include bonuses, company-provided vehicles, and group term life insurance (if coverage exceeds $50,000). The IRS views most fringe benefits as taxable compensation; employees would report them exactly as they would their standard taxable wages, displayed in Form W-2 or Form 1099-MISC.

What allowances are not taxable?

2. What are Non-Taxable allowances? The Allowances paid to Govt servants abroad, Sumptuary allowances, Allowance paid by UNO and Compensatory allowance paid to judges are non-taxable allowances.

Is health benefits taxable income in Ontario?

If you make contributions to a private health services plan (such as medical or dental plans) for employees, there is no taxable benefit for the employees.

What group benefits are taxable in Canada?

For employees, in general, employer-paid premiums for group life insurance (for both employees and dependents), accident insurance and critical illness insurance are considered taxable benefits. This can be applied at both a provincial and federal level.

How are benefits taxed Canada?

When a benefit is taxable, it is also pensionable, insurable, and subject to income tax. This means you may have to deduct Canadian Pension Plan contributions, Employment Insurance premiums, and income tax from the employee's pay.

Are benefits taken out before taxes?

Health benefit plans like an HSA or FSA are considered pre-tax deductions. Company-sponsored health insurance may also allow pre-tax deductions for employees who pay for such health plans.

Are health insurance premiums deducted from payroll pre-tax or post tax?

Medical insurance premiums are deducted from your pre-tax pay. This means that you are paying for your medical insurance before any of the federal, state, and other taxes are deducted.

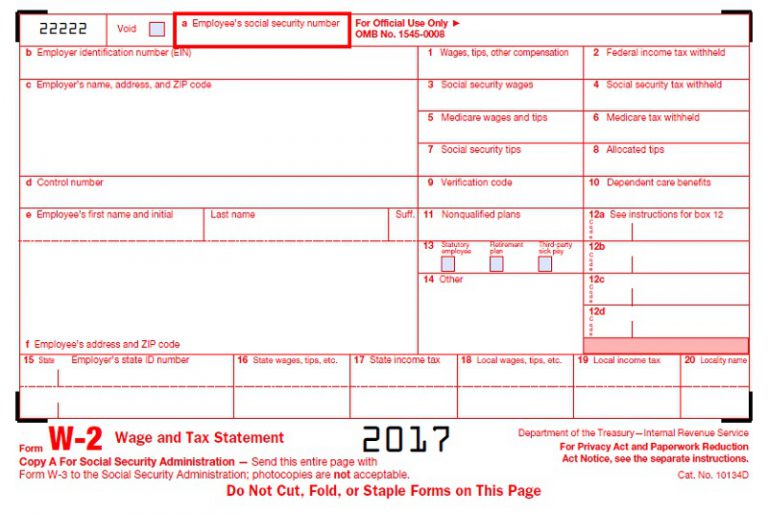

Does employer-paid health insurance go on w2?

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee's Form W-2, Wage and Tax Statement, in Box 12, using Code DD.

Who Pays for Your Policy?

If your insurance does more than just reimburse you – for example, if you receive financial benefits when you are temporarily disabled or sick, for instance – these benefits might indeed be taxable. The primary factor decided who the tax burden falls on at this point is who is currently paying your premiums.

Is medical reimbursement taxable?

Personal Medical Expense Reimbursement. If your benefits do nothing but pay for doctor bills, prescriptions and hospital stays, then don't worry – those payments are not taxable. Even though your health insurance is essentially paying for these critical services, this will in no way be considered part of your annual income.

Is health insurance considered income?

Are Health Insurance Benefits Considered Income by the IRS? Health insurance is not taxable income, even if your employer pays for it. Under the Affordable Care Act, the amount your employer spends on your premiums appears on your W-2s, but it should in no way be classified as income.

Is insurance tax free?

The primary factor decided who the tax burden falls on at this point is who is currently paying your premiums. When you pay for the insurance policy, your benefits are tax-free. When your employer pays, the benefits are taxable.

Is 60 percent of your health insurance premiums taxable?

If it's a split – your employer pays 60 percent of the premiums, for example – then 60 percent of the benefits are taxable. Your employer should factor that into your withholding.

Is long term care insurance taxable?

If your disability or other health problems require long-term care, money you get from a long-term care insurance policy is usually tax-free. If there's a cash surrender value on the policy, your benefits are taxable.

Is adult child coverage taxable?

In that case, your coverage is a fringe benefit and part of your taxable income. One effect of the Affordable Care Act is that if you cover an adult child younger than 27, the coverage isn't subject to tax.

What is the federal unemployment tax?

The Federal Unemployment Tax Act (FUTA), with state unemplo yment systems , provides for payments of the unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only the employer pays FUTA tax; it is not withheld from the employee’s wages.

What is the most important benefit provided by an employer?

A health plan can be one of the most important benefits provided by an employer. The Department of Labor's Health Benefits Under the Consolidated Omnibus Budget Reconciliation Act (COBRA) provides information on the rights and protections that are afforded to workers under COBRA.

What is unemployment benefit?

Unemployment insurance payments (benefits) are intended to provide temporary financial assistance to unemployed workers who meet the requirements of state law. Each state administers a separate unemployment insurance program within guidelines established by federal law.

Is fringe income taxed?

Fringe benefits are generally included in an employee’s gross income (there are some exceptions). The benefits are subject to income tax withholding and employment taxes. Fringe benefits include cars and flights on aircraft that the employer provides, free or discounted commercial flights, vacations, discounts on property or services, memberships in country clubs or other social clubs, and tickets to entertainment or sporting events.

Is an employer's health insurance taxable?

If an employer pays the cost of an accident or health insurance plan for his/her employees, including an employee’s spouse and dependents, the employer’s payments are not wages and are not subject to Social Security, Medicare, and FUTA taxes, or federal income tax withholding.

Is benefit funding based on employer contributions?

In the majority of states, benefit funding is based solely on a tax imposed on employers. (Three states require minimal employee contributions.)

Does the employer pay FUTA tax?

Only the employer pays FUTA tax; it is not withheld from the employee’s wages. The Department of Labor provides information and links on what unemployment insurance is, how it is funded, and how employees are eligible for it. In general, the Federal-State Unemployment Insurance Program provides unemployment benefits to eligible workers who are ...

What is a tax-free health benefit?

With a tax free health benefit, participants pay no taxes on premiums and, often medical expenses paid through the benefit.

What is the taxability of HRAs?

Group premium payments, HSA contributions are free of payroll taxes and income taxes. HRAs usually are free of both, depending on how employees use their allowance.

What is payroll tax?

Also known as FICA (Federal Insurance Contributions Act) taxes, payroll taxes include deductions for Social Security and Medicare. Typically, the employer pays half (7.65%) and the employee pays half (7.65%), though self-employed people pay both (totaling 15.3%). All reimbursements paid through an HRA are free of payroll taxes for both the employer and the employee.

What is a health stipend?

With a taxable health benefit, an employer simply gives money to employees without any formal arrangement. This is commonly called a “health stipend” and is paid as additional wages, with both payroll taxes and income taxes withheld. While this can seem easy for employers, nondiscrimination rules still apply.

Is HSA tax free?

Group health insurance premiums, HSA contributions, and HRA reimbursements are all tax free. While withdrawals from an HSA for medical use are also tax-free, withdrawals for non-medical use are tax-deferred (income tax must be paid for the taxable year when they are withdrawn). Health stipends are fully taxable—while it’s easy for employers to do, it’s also highly inefficient.

Do you pay taxes on a tax deferred health insurance plan?

With a tax-deferred health benefit, taxes are not levied until the benefit is used. These benefits are typically account-based, where contributions are made tax free, but taxes only apply to funds when they are withdrawn.

Do you have to claim reimbursements on taxes?

Employers who pay reimbursements through cash, check, or ACH will do so directly, and the employee will not need to claim these payments as income for the taxable year.

When is nonqualified compensation included in gross income?

In most cases, any compensation deferred under a nonqualified deferred compensation plan of a nonqualified entity is included in gross income when there is no substantial risk of forfeiture of the rights to such compensation. For this purpose, a nonqualified entity is one of the following.

What is income received by an agent for you?

Income received by an agent for you is income you constructively received in the year the agent received it. If you agree by contract that a third party is to receive income for you, you must include the amount in your income when the third party receives it.

What is included in income amounts you're awarded in a settlement or judgment for back pay?

These include payments made to you for damages, unpaid life insurance premiums, and unpaid health insurance premiums. They should be reported to you by your employer on Form W-2.

Do you have to include childcare in your income?

If you provide childcare, either in the child's home or in your home or other place of business, the pay you receive must be included in your income. If you're not an employee, you're probably self-employed and must include payments for your services on Schedule C (Form 1040), Profit or Loss From Business. You generally aren’t an employee unless you're subject to the will and control of the person who employs you as to what you're to do, and how you're to do it.

Is alimony included in gross income?

Alimony received will no longer be included in your income if you entered into a divorce or separation agreement on or before December 31, 2018, and the agreement is changed after December 31, 2018, to expressly provide that alimony received isn't included in your income. Alimony received will also not be included in income if a divorce or separation agreement is entered into after December 31, 2018. For more information, see Pub. 504.

Is a bonus on a W-2 taxable?

If the prize or award you receive is goods or services, you must include the FMV of the goods or services in your income. However, if your employer merely promises to pay you a bonus or award at some future time, it isn’t taxable until you receive it or it’s made available to you.

How much did workers contribute to their health insurance in 2016?

Workers contributed an average of $1,129 for their own health insurance premium in 2016 and an average of $5,277 for a family.

What is a health insurance premium?

Not all of these plans are offered by every employer and each comes with its own tax rules. A premium is the price that you pay for coverage.

What is Medicare insurance?

Medicare is the health insurance program that is offered to all adults who are retired and above a certain age.

What is the deductible amount for 2016?

The deductible amount for 2016 is the total of all medical costs that are above 10 percent of annual income. This includes any money that they must pay for their health insurance premium. There are other forms of medical coverage associated with wages.

What is an HSA?

A Health Savings Account, or HSA, is a tax-deductible way to save money for large health bills. To qualify, you must have a high-deductible health plan and annual medical bills below a certain cap. These numbers are adjusted by the IRS each tax year.

How many full time employees are required to have health insurance?

Health insurance is one of the most common benefits found with many full-time positions. Because of the Affordable Care Act, employers with more than 50 full-time employees must offer health care.

Is health insurance taxable income?

While employers may offer some fringe benefits that are considered to be taxable as income, health insurance is not one of these items. Both insurance premiums and long-term care insurance, when offered by an employer, are non-taxable benefitst s. There are a few exceptions to this rule. Here is a look at how health insurance is viewed in the tax code, the exceptions that make it a taxable item, and when it is a tax deduction instead.

What happens if you don't report changes to your tax return?

If you don’t report these changes, you could miss out on savings or wind up having to pay money back when you file your federal tax return for the year .

Who is considered a household?

For most people, a household consists of the tax filer, their spouse if they have one, and their tax dependents, including those who don’t need coverage.

Is Marketplace Savings based on income?

Marketplace savings are based on total household income, not the income of only household members who need insurance. If anyone in your household has coverage through a job-based plan, a plan they bought themselves, a public program like Medicaid, CHIP, or Medicare, or another source, include them and their income on your application.

Does MAGI include SSI?

Tax-exempt interest. MAGI does not include Supplemental Security Income (SSI) See how to make an estimate of your MAGI based on your Adjusted Gross Income. The chart below shows common types of income and whether they count as part of MAGI.

Can you use federal taxable wages on a pay stub?

Notes. Federal Taxable Wages (from your job) Yes. If your pay stub lists “federal taxable wages,” use that. If not, use “gross income” and subtract the amounts your employer takes out of your pay for child care, health insurance, and retirement plans. Tips.

Does Marketplace count income?

The Marketplace will count their income only if they're required to file a federal tax return. Learn about filing requirements for dependents from the IRS.

Why is my box 14 income higher than my salary?

Have you received your T4 slip for the previous tax year? Are you curious why your income in Box 14 is higher than the salary you earned for the year? That's because your employer must report premiums* they pay for certain group benefits. They report the value of some perks as a taxable benefit, and you must pay tax on those amounts.

Do you have to include company benefits in your income?

You may have valuable company benefits, like a cell phone, tuition reimbursement or service awards. But you may or may not have to include the value of these benefits in income.

Is your work phone a taxable benefit?

Companies sometimes provide employees with smartphones plus a voice and data plan. But the CRA may not consider the payments on your work phone as a taxable benefit. Not as long as:

Is your equipment for working from home a taxable benefit?

Before the COVID-19 pandemic forced most people to work from home, equipment and supplies provided by your employer were not taxable benefits.

Is your tuition reimbursement a taxable benefit?

Tuition paid by your employer isn't a taxable benefit if you need the training to progress in your job. For example, let's say you're employed by a bank and are working towards becoming a Certified Financial Planner. In this case, any tuition reimbursed by the bank for this program would not be taxable.

Are group short- or long-term disability premiums taxable benefits?

Employer-paid short-term disability or long-term disability premiums are not taxable benefits. But any short- or long-term disability benefits you receive in the future from your employer will be taxable. Conversely, if all employees pay their own short or long-term disability premiums, any benefits they receive are tax-free. The same applies to premiums you pay for an individual policy you own. If you pay premiums yourself, using after-tax money, any benefits you receive are tax-free.

Are gifts and awards taxable benefits?

Employers sometimes give non-cash gifts or awards, worth under $500, for things like:

What About the Tax Paperwork?

People might think long-term care benefits are taxable because of how the paperwork goes out. When you receive benefits, the insurance company sends you a 1099-LTC tax form showing what they paid, which may lead you to believe you owe taxes.

Is long term care insurance tax deductible?

Another tax advantage for standa lone long-term care insurance is that your plan's premiums are tax-deductible as well. This is based on your age and the percentage (7.5% or more) of your adjusted gross income spent on combined medical expenses.

Are Long-Term Care Benefits Taxable?

When you receive benefits from a long-term care insurance policy, you typically won't owe taxes. The IRS treats these payouts similarly to reimbursements for medical expenses, which they don't consider taxable income.

Is gym membership taxable income?

The memorandum specifically mentions payments of gym membership fees, which must be included as taxable income.

Can the IRS pursue employees who never paid taxes?

The IRS also could pursue employees who received but never paid taxes on these incentives, creating employee relations issues.

Is a wellness incentive a medical benefit?

Wellness incentive cash payments and “cash equivalents”—ranging from gift cards to subsidized gym memberships—are not excludable from taxation as a medical benefit, the IRS is reminding employers.

Do employers pay HSAs?

Some employers make wellness incentive payments directly to employees' health sav ings accounts (HSAs). Generally, contributions made by an employer to an HSA of an eligible employee are excludable from an employee's income and are not subject to federal income tax, Social Security or Medicare taxes.

Is a wellness award taxable?

There are a few exceptions that make these otherwise taxable awards nontaxable, Fru tchey noted. “The one that best applies to wellness programs is the ‘de minimis award’ rule,” he said. “The IRS states that a de minimis award is one of nominal value and is provided infrequently. Most importantly, these awards can be excluded from an employee’s wage.”

Fringe Benefits

- Fringe benefits are generally included in an employee's gross income (there are some exceptions). The benefits are subject to income tax withholding and employment taxes. Fringe benefits include cars and flights on aircraft that the employer provides, free or discounted commercial flights, vacations, discounts on property or services, memberships in country clubs or other social clubs…

Unemployment Insurance

- The Federal Unemployment Tax Act (FUTA), with state unemployment systems, provides for payments of the unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only the employer pays FUTA tax; it is not withheld from the employee's wages. The Department of Labor provides information and li…

Workers' Compensation

- The Department of Labor's Office of Workers' Compensation Programs (OWCP)administers four major disability compensation programs that provide wage replacement benefits, medical treatment, vocational rehabilitation and other benefits to federal workers or their dependents who are injured at work or who acquire an occupational disease. Individuals injured on the job while e…

Health Plans

- If an employer pays the cost of an accident or health insurance plan for his/her employees (including an employee's spouse and dependents), then the employer's payments are not wages and are not subject to social security, Medicare, and FUTA taxes, or federal income tax withholding. Generally, this exclusion also applies to qualified long-term care...