Is employer paid long term care insurance taxable?

Now, rather than seeking personal policies, every employee in Washington State will automatically pay for their own long-term care insurance policy unless they choose to opt out of the program. Employees have a one-time exemption opportunity from the tax ...

Is long term care insurance a good investment?

Long-term care insurance can help you pay for the costs associated with your care as you get older and need help with everyday activities — such as bathing, dressing and eating — or care ...

How to fund Long Term Care?

- You can tell us about news and ask us about our journalism by emailing [email protected] or by calling 425-339-3428.

- If you have an opinion you wish to share for publication, send a letter to the editor to [email protected] or by regular mail to The Daily Herald, Letters, P.O. ...

- More contact information is here.

Are long term care insurance premiums tax deductible?

The Internal Revenue Service just announced the increased limits for tax deductibility of long-term care insurance premiums. According to IRS Revenue Procedure 2019-44, a couple age 70 or older who both have the right kind of long-term care insurance policy can deduct as much as $10,860 in 2020.

In which case are long-term care benefits taxable?

If payments exceed the greater of $360 per day (adjusted annually for inflation) or the actual amount of qualified long-term care expenses incurred, the excess payment amounts are taxable as income when benefits are paid.

Are long-term care insurance benefits taxable income?

In general, the income from a long-term care insurance policy is non-taxable, and the premiums paid to buy the insurance are tax deductible.

Do I need to report 1099 LTC?

Do I have to report benefits from a Long-Term Care Insurance policy to the IRS? Generally, no. Tax-qualified Long-Term Care Insurance benefits come to you tax-free. Insurance companies that pay long-term care insurance benefits are required by the Internal Revenue Service (IRS) to provide claimants with a 1099 LTC.

Is long-term care a tax deduction?

Long-term-care costs. You can deduct unreimbursed costs for long-term care as a medical expense if certain requirements are met. This includes eligible expenses for in-home, assisted living and nursing-home services. First, the long-term care must be medically necessary.

How do I report a 1099 LTC on my tax return?

If unchecked, the payments should be reported as Other Income in Schedule 1 (Form 1040) notated "LTC". Box 5 "Chronically ill" or "Terminally ill" may be checked, along with the date certified.

Are long-term care premiums tax deductible in 2020?

The Internal Revenue Service just announced the increased limits for tax deductibility of long-term care insurance premiums. According to IRS Revenue Procedure 2019-44, a couple age 70 or older who both have the right kind of long-term care insurance policy can deduct as much as $10,860 in 2020.

How do I enter a 1099-LTC in Turbotax?

How do I enter a 1099-LTCFrom the top, select tab Federal Taxes.Wages and Income /Scroll down to Less Common Income section.Choose Miscellaneous Income, 1099-A, 1099-C / Start.Scroll down to Long-term care account distributions (Form 1099-LTC) , continue to follow the prompts.

Where do you enter a 1099-LTC?

If you received the 1099-LTC box 1 on a per-diem or periodic basis, use the Gross LTC payments received on per-diem or periodic basis (code 107) field. Enter all applicable amounts, including the Portion of gross from qualified LTC insurance contracts (code 108).

Where do long-term care premiums go on 1040?

Qualified long-term care premiums, up to the amounts shown below, can be included as medical expenses on Form 1040, Schedule A, Itemized Deductions or in calculating the self-employed health insurance deduction: Age 40 or under: $450.

Are long-term care benefits taxable 2022?

2022 Tax Year Remember, benefits paid under a qualified Long-Term Care Insurance policy are generally excluded from taxable income.

Are long-term care premiums tax deductible in 2021?

According to IRS Revenue Procedure 2020-45, a couple age 70 or older who both have the right kind of long-term care insurance policy can deduct as much as $11,280 in 2021 an increase of $420 from the $10,860 limit for 2020.

What states have a long-term care tax?

For decades many states and the federal government have implemented tax incentives to encourage the purchase of Long-Term Care Insurance....In addition to California the other states are starting the process include:Alaska.Colorado.Hawaii.Illinois.Michigan.Missouri.Minnesota.North Carolina.More items...

What is tax qualified long term care insurance?

A tax-qualified Long-Term Care Insurance contract qualifies for favorable federal income tax treatment. If the policy only pays benefits that reimburse you for qualified long-term care expenses you will not owe federal income tax on these benefits. 2. If Box 3 is marked "Reimbursed Amount" and you have a Non-Tax Qualified Contract, ...

How to get 1099 LTC?

If you are preparing your own taxes make sure you order or download the Instructions for Form 1099-LTC from the Internal Revenue Service. You can request free tax forms and guides by calling the IRS at 1-800-TAX-Form or 1-800-829-3676. Otherwise, your tax preparer should have access to this form.

What is the box in a health insurance claim?

Box 1. Gross benefits paid by the insurance company. Box 2. Does not apply to long-term care insurance. Box 3. This indicates benefits paid (as reflected in Box 1) as either on a Per Diem (Indemnity) basis or as a Reimbursement for actual long-term care expenses incurred. Box 4: This is an optional field that indicates if benefits were paid ...

When will insurance companies issue 1099?

The insurance companies typically will issue these special 1099 forms in January for the previous tax year. All payments which were made directly to you, as well as those that were paid to a third party on your behalf, will be reflected on the Form 1099-LTC.

What is box 5 in LTC?

Box 5: The Chronically Ill box will always be checked for LTC. The Terminally Ill box is not applicable to long-term care

Is per diem taxable?

If this per diem (indemnity) limitation is exceeded, part of the benefits received may be taxable. The amount of the limitation increases every year. If you have that type of policy be sure to consult with your tax advisor.

Is long term care insurance tax deductible?

Usually, the benefits from a Long-Term Care Insurance policy are tax-free and, in some cases, premiums can be tax-deductible. All tax-qualified Long-Term Care Insurance benefits will come to you tax-free in most cases. The insurance companies that pay these benefits are required by the Internal Revenue Service ...

What is the floor for medical expenses?

The federal tax code has a 7.5 percent floor governing medical expenses deductions taken on Schedule A (Form 1040), meaning that the premium expense is deductible to the extent that it exceeds 7.5 percent of the individual’s Adjusted Gross Income. There are other considerations with regard to the policyholder’s age.

Can a subchapter C corporation take a 100 percent deduction?

A. A Subchapter C Corporation is entitled to take a 100 percent deduction as a business expense on the total premium paid. Different rules apply to a Limited Liability Company and a partnership, however. In such cases, seek legal or tax assistance from an expert, as the complexities are many.

Is a medical conference tax deductible?

Medical conference costs are deductible if the conference is primarily for and necessary to the medical care of you, your spouse or dependent. Expenses for prescribed drugs and medicines are tax deductible. Q.

Is long term care insurance taxable?

In general, the income from a long-term care insurance policy is non-taxable, and the premiums paid to buy the insurance are tax deductible. Similar tax advantages exist at the state level, but each state treats the subject differently. The fact that there are tax benefits to purchasing long-term care coverage testifies to ...

Can you file taxes if you are chronically ill?

A. The short answer is yes—to qualify for the tax treatment an individual must have been certified as “chronically ill” by a licensed health care practitioner within the previous twelve months. A chronically ill person is defined as someone unable to perform at least two activities of daily living, such as eating, bathing, dressing and continence, without substantial assistance from another individual for at least 90 days. Chronic illness also is described as severe cognitive impairment requiring substantial supervision.

Can nursing home expenses be deducted?

The costs of care in a nursing home or similar institution, as well as the wages and other amounts paid for nursing services at home, can be included as medical expenses deductions. In such cases the services provided must be connected with the individual’s chronic illness.

Can you deduct long term care insurance premiums?

A. Broadly speaking, the answer is yes, although these incentives differ. For example, Colorado residents may be granted a credit equaling 25 percent of the premiums paid (or $150) per long-term care policy, whereas California residents may deduct the total cost of long-term care insurance premiums paid in a given tax year. The National Association of Insurance Commissioners advises soliciting information on the tax implications of long-term care insurance from state insurance departments.

How does long-term care insurance affect my taxes?

If you’re already covered by long-term care (LTC) insurance, you may be eligible to deduct some or even all of your LTC premiums. Or, if you’re receiving payments from a LTC insurance plan, you could exclude from your taxable income any payments made to you.

How do I deduct premiums for LTC insurance?

You may deduct LTC insurance premiums as a medical expense. As with all deductible medical expenses, you’ll need to meet the percentage of AGI floor requirement first. See Deducting Medical Expenses.

How much can you pay for per diem in 2020?

However, if payments are made regardless of expenses paid, then there’s a limit. If you’re receiving payments on a periodic or per diem basis, the limit is $380 for each day for the 2020 tax year.

Can you exclude long term care from your taxable income?

To exclude payments from your taxable income, your plan must meet a few requirements: You, your spouse, or dependent receiving care must be considered chronically ill by a licensed health care practitioner. Your plan must only provide coverage for long-term care and must be renewable.

Does a long term care plan have to be renewable?

Your plan must only provide coverage for long-term care and must be renewable. Your plan must not provide cash or have a surrender value or money that is pledged, assigned, or borrowed. Check with your HR department or LTC provider to make sure your plan meets these requirements.

Do payments from a LTC plan count as taxable income?

Payments from a LTC insurance plan are considered taxable income, but you may be able to exclude that income from your return.

When is nonqualified compensation included in gross income?

In most cases, any compensation deferred under a nonqualified deferred compensation plan of a nonqualified entity is included in gross income when there is no substantial risk of forfeiture of the rights to such compensation. For this purpose, a nonqualified entity is one of the following.

Is alimony included in gross income?

Alimony received will no longer be included in your income if you entered into a divorce or separation agreement on or before December 31, 2018, and the agreement is changed after December 31, 2018, to expressly provide that alimony received isn't included in your income. Alimony received will also not be included in income if a divorce or separation agreement is entered into after December 31, 2018. For more information, see Pub. 504.

Do you have to include childcare in your income?

If you provide childcare, either in the child's home or in your home or other place of business, the pay you receive must be included in your income. If you're not an employee, you're probably self-employed and must include payments for your services on Schedule C (Form 1040), Profit or Loss From Business. You generally aren’t an employee unless you're subject to the will and control of the person who employs you as to what you're to do, and how you're to do it.

Is a bonus on a W-2 taxable?

If the prize or award you receive is goods or services, you must include the FMV of the goods or services in your income. However, if your employer merely promises to pay you a bonus or award at some future time, it isn’t taxable until you receive it or it’s made available to you.

What is considered long term care?

First, the long-term care must be medically necessary. It may include preventive, therapeutic, treating, rehabilitative, personal care or other services. (See IRS Publication 502 for a full list of qualifying services.)

How much medical expenses can you claim on your taxes?

Plus, itemized deductions for medical expenses are only allowed to the extent they exceed 7.5% of your adjusted gross income.

Why are medical expenses higher as you age?

Why? For one thing, income tends to drop in retirement, so the deductions can have a greater overall impact on tax liability. As you age, you’re also more likely to have medical expenses exceeding 7.5% of AGI—IRS data shows two-thirds of all medical-expense deductions are claimed by seniors. Those deductions could push your total itemized deductions past the standard deduction amount. The chances of satisfying the medical necessity requirements for the care costs deduction also increase with age, and the cap for the premiums deduction levels off after age 70.

How long can a chronically ill person be without help?

A person is “chronically ill” if he or she can’t perform at least two activities of daily living—such as eating, bathing or dressing—without help for at least 90 days.

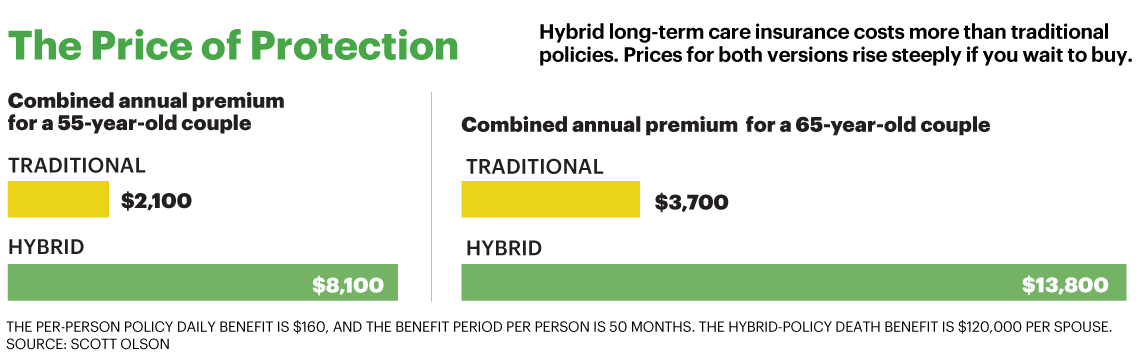

How much does it cost to care for a 65 year old?

According to the U.S. Department of Health and Human Services, about 27% of Americans turning 65 this year will incur at least $100,000 in long-term-care costs, while nearly 18% will require care costing more than $250,000. That’s a hard pill for most seniors to swallow.

How much is the 2021 tax deduction?

The deduction has an age-related cap. For 2021, the cap is $5,640 if you’re older than 70, $4,520 if you’re 61 to 70, and $1,690 if you’re 51 to 60. (For those 41 to 50, it’s $850, and for 40 or younger, it’s $450.)

Can you deduct long term care expenses?

Long-term-care costs. You can deduct unreimbur sed costs for long-term care as a medical expense if certain requirements are met. This includes eligible expenses for in-home, assisted living and nursing-home services. First, the long-term care must be medically necessary.

Where are LTC benefits reported?

This was my question as well but it is not so simple. LTC benefits are reported from form 1099-LTC in the miscellaneous income section. TT then asks what the total reimbursed expenses were and calculates what amount is taxable.

What is a qualified long term care contract?

A qualified long-term care insurance contract is treated as an accident and health insurance contract. Thus, amounts (other than dividends or premium refunds) received under such a contract are treated as amounts received for personal injuries and sickness and are treated as reimbursement for expenses actually incurred for medical care. ...

What is the box 4 on a 1099 LTC?

Box 4 may be checked to indicate the benefits were from a qualified long-term care contract.

Is LTC reimbursement taxable?

Generally, your LTC reimbursement is only taxable if they exceed your medical expenses. Be sure to answer the TurboTax follow-up questions in the 1099-LTC interview. It may be best to answer having read the below info first. If you have additional questions or details regarding this, please feel free to post in the comments for further ...

Is medical excess taxable income?

If the amount reimbursed exceeds the total amount of medical expenses paid, then the excess would be taxable income regardless of whether they are transferred into another long term care insurance policy.

Is long term care insurance considered income?

When is long term care insurance reimbursement considered income? Yes, when entering your medical expenses you would only enter the amount that you paid over and above the reimbursed amount ($15,000 for your example). Or, enter the full amount ($40,000) and also the reimbursement ($25,000).

Is long term care insurance taxable?

Since amounts received for personal injuries and sickness are generally not includable in gross income, benefits received under qualified long-term care insurance are generally not taxable. But there is a limit on the amount of qualified long-term care benefits that may be excluded from income. Generally, if the total periodic payments received ...

What About The Tax Paperwork?

- People might think long-term care benefits are taxable because of how the paperwork goes out. When you receive benefits, the insurance company sends you a 1099-LTC tax form showing what they paid, which may lead you to believe you owe taxes. However, the 1099-LTC form helps with …

Are There Any Exceptions?

- If you receive cash on a per diem basis, there is a limit to how much of it can be tax-free. As of 2021, the maximum is up to $400 per day. This is true even if your daily long-term care expenses are under $400. If your policy pays more than the limit and your expenses are lower than what you receive, the excess counts as taxable income. For example, if you receive $450 a day and your e…

How Can You Prepare For Taxes?

- You should ask your insurer whether your long-term care insurance policy is tax-qualified or nonqualified. These days, most policies are qualified, but if yours is nonqualified, you may want to prepare by saving for potential taxes. Alternatively, you could explore converting your policy into a qualified one. If your policy offers a per diem benefit, you could also ask your insurer whether it'…