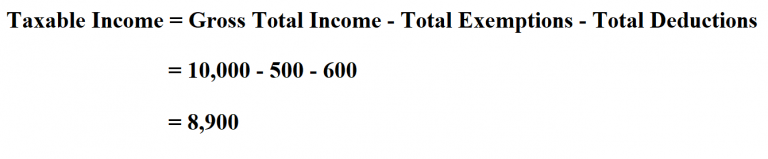

| Nature | Nature | Taxable/ Not taxable |

| 1 | Reimbursements of medical and dental car ... | |

| 1 | a) Employee, employee's spouse and child ... | Not taxable if the benefits are availabl ... |

| 1 | b) Dependants other than those listed in ... | Taxable |

| 2 | Medical benefits that are available to e ... | Not taxable, if:There is a basic form of ... |

Should health benefits be taxed?

Your Health Insurance Benefits Are Unlikely to be a Tax Burden Traditional health insurance benefits are not taxable under any federal or state tax laws. If you pay for your own health insurance, you will be eligible to write off the premiums and out of pocket expenses, most of the time.

Is there tax benefit on medical expenses?

The calculation depends on the taxable income you earn and in many taxpayers' cases there actually is no additional medical credit – this is because their qualifying (out of pocket) medical expenses are not high enough and therefore the required threshold is not met in order for an additional medical tax credit to kick in.

Can medical expenses be a taxable deduction?

Yes, you can claim medical expenses on taxes. For tax year 2020, the IRS permits you to deduct the portion of your medical expenses that exceeds 7.5% of your adjusted gross income, or AGI. But not everyone will be able to claim medical expenses on their taxes. It only works if you itemize deductions instead of taking the standard deduction.

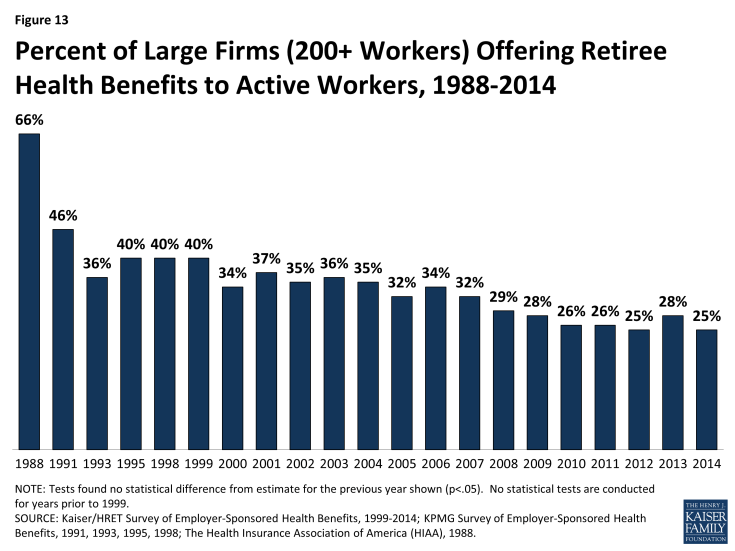

What medical costs are tax deductible for retirees?

Can I claim tax exemption on these expenses (incurred out of my own pocket) after retirement ... senior citizens may avail a deduction of up to Rs 50,000 for payment of premium towards medical insurance policy. This limit includes expenses incurred ...

Are medical benefits taxable in Canada?

If you pay or provide an amount to pay for an employee's medical expenses in a tax year, these amounts are considered to be a taxable benefit for the employee. Generally, there is no GST/HST and PST to include in the value of this benefit.

Does medical insurance count as taxable?

Employer-paid premiums for health insurance are exempt from federal income and payroll taxes. Additionally, the portion of premiums employees pay is typically excluded from taxable income.

Is health insurance reimbursement taxable income?

So...is health insurance reimbursement considered income? No. Unlike a healthcare stipend, with a health insurance reimbursement, employers don't have to pay payroll taxes and employees don't have to recognize income tax. In addition, reimbursements made by the company count as a tax deduction.

Are benefits counted as income?

Do I include benefits? Most, but not all, taxable state benefits should be included as social security income. However, income-based Jobseekers Allowance although taxable is not counted as income for tax credit purposes.

What benefits are taxable in payroll?

Taxable fringe benefits include bonuses, company-provided vehicles, and group term life insurance (if coverage exceeds $50,000). The IRS views most fringe benefits as taxable compensation; employees would report them exactly as they would their standard taxable wages, displayed in Form W-2 or Form 1099-MISC.

How are benefits taxed?

Benefits received in-kind, or considered de minimis, are usually not subject to taxation. Employers often provide other employee benefits such as health plans, unemployment insurance, and worker's compensation. Taxable fringe benefits are included on an employee's W-2.

Is health insurance reported on w2?

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee's Form W-2, Wage and Tax Statement, in Box 12, using Code DD.

What allowances are not taxable?

2. What are Non-Taxable allowances? The Allowances paid to Govt servants abroad, Sumptuary allowances, Allowance paid by UNO and Compensatory allowance paid to judges are non-taxable allowances.

Are Social Security benefits taxable?

Some people who get Social Security must pay federal income taxes on their benefits. However, no one pays taxes on more than 85% percent of their Social Security benefits. You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000.

What income does Social Security count?

We only count your earnings up to the month before you reach your full retirement age, not your earnings for the entire year. If your earnings will be over the limit for the year and you will receive retirement benefits for part of the year, we have a special rule that applies to earnings for one year.

How much medical expenses can be deducted from your income?

Medical expenses can be deducted to the extent they exceed 7.5 percent of your adjusted gross income for the 2018 tax year, and this threshold rises to 10 percent for 2019.

Is medical reimbursement taxable?

Personal Medical Expense Reimbursement. If your benefits do nothing but pay for doctor bills, prescriptions and hospital stays, then don't worry – those payments are not taxable. Even though your health insurance is essentially paying for these critical services, this will in no way be considered part of your annual income.

Is health insurance considered income?

Are Health Insurance Benefits Considered Income by the IRS? Health insurance is not taxable income, even if your employer pays for it. Under the Affordable Care Act, the amount your employer spends on your premiums appears on your W-2s, but it should in no way be classified as income.

Is insurance tax free?

The primary factor decided who the tax burden falls on at this point is who is currently paying your premiums. When you pay for the insurance policy, your benefits are tax-free. When your employer pays, the benefits are taxable.

Is 60 percent of your health insurance premiums taxable?

If it's a split – your employer pays 60 percent of the premiums, for example – then 60 percent of the benefits are taxable. Your employer should factor that into your withholding.

Can you claim a high tech exam as a deduction?

If your insurance pays for a $2,000 high-tech exam, for example, you can't claim that as a deduction. However, if you paid a $40 co-payment, you can write that off if you have enough other deductions to make itemizing a better deal than taking the standard deduction.

Is adult child coverage taxable?

In that case, your coverage is a fringe benefit and part of your taxable income. One effect of the Affordable Care Act is that if you cover an adult child younger than 27, the coverage isn't subject to tax.

Are Fringe Benefits Taxable?

There are a number of different types of fringe benefits that employers can offer their employees. In most cases, fringe benefits are taxable, but there are some exceptions. Like wages, most fringe benefits are subject to federal income taxes: FICA (Social Security and Medicare) and FUTA taxes.

Non-Employee Fringe Benefits

Fringe benefits, whether they’re taxable or not, are not exclusively for your employees. You also have the option to offer these benefits to independent contractors. An independent contractor refers to a worker that is hired to do only a specific job and doesn’t work directly under you.

What is a Cafeteria Plan?

A cafeteria plan, also referred to as a section 125 plan, allows employees to choose the fringe benefits that they want. These benefits are issues as pre-tax deductions, which means that they help decrease the employee’s taxable income, thus, reducing tax liability overall.

Is Group Medical Insurance a Taxable Fringe Benefit?

The majority of employers offer some form of medical insurance coverage to their employees. While some of them pay a percentage of monthly premiums, others issue full coverage and make health insurance free for their workers.

What is tax deferred health benefit?

What is a tax-deferred health benefit? With a tax-deferred health benefit, taxes are not levied until the benefit is used. These benefits are typically account-based, where contributions are made tax free, but taxes only apply to funds when they are withdrawn. HSAs can be used as a retirement savings vehicle.

What is a health stipend?

With a taxable health benefit, an employer simply gives money to employees without any formal arrangement. This is commonly called a “health stipend” and is paid as additional wages, with both payroll taxes and income taxes withheld. While this can seem easy for employers, nondiscrimination rules still apply.

How much does an employer pay for HRA?

Typically, the employer pays half (7.65%) and the employee pays half (7.65%), though self-employed people pay both (totaling 15.3%). All reimbursements paid through an HRA are free of payroll taxes for both the employer and the employee.

Can an employer reimburse an employee for premiums paid through spouse's employer?

However, the employer determines what expenses they will reimburse an employee for. They might choose not reimburse an employee for premiums paid through a spouse’s employer or for all of the expenses listed in the IRS publication 502.

Do you pay taxes on health insurance premiums?

With a tax free health benefit, participants pay no taxes on premiums and, often medical expenses paid through the benefit.

Is HSA tax free?

Group health insurance premiums, HSA contributions, and HRA reimbursements are all tax free. While withdrawals from an HSA for medical use are also tax-free, withdrawals for non-medical use are tax-deferred (income tax must be paid for the taxable year when they are withdrawn). Health stipends are fully taxable—while it’s easy for employers to do, it’s also highly inefficient.

What expenses can you deduct from your AGI?

Expenses that qualify for this deduction include premiums paid for a health insurance policy, as well as any out-of-pocket expenses for things like doctor visits, surgeries, dental care, vision care, and mental healthcare. However, you can deduct only the expenses that exceed 7.5% of your AGI.

What is health insurance premium?

Health insurance premiums, the amount paid upfront in order to keep an insurance policy active, have been steadily increasing as the cost of healthcare has increased in the United States. Premiums can be thought of as the "maintenance fee" for a healthcare policy, not including other payments ...

How much is HDHP insurance?

For the tax years 2020 and 2021, the IRS considers an HDHP an individual insurance policy with a deductible of at least $1,400 or a family policy with a deductible of at least $2,800. 6 .

Why are health insurance premiums increasing?

Health insurance premiums, the amount paid upfront in order to keep an insurance policy active, have been steadily increasing as the cost of healthcare has increased in the United States.

How much is the standard deduction for 2020?

For the tax year 2020, the standard deduction is $12,400 for those filing an individual return and $24,800 for married couples filing jointly.

Is HDHP a tax deductible plan?

You might consider electing a high-deductible health plan (HDHP) as a type of insurance coverage. HDHPs typically offer lower premiums than other plans. They also offer the unique feature of enabling plan subscribers to open up a Health Savings Account (HSA), a tax-advantaged savings account.

Is health insurance tax deductible in 2021?

For some Americans, health insurance is one of their largest monthly expenses, leading them to wonder what medical expenses are tax-deductible to reduce their bill . As the price of healthcare rises, some consumers are seeking out ways to reduce their costs through tax breaks on their monthly health insurance premiums .

Scope of Administrative Concession

Reimbursements for medical and dental care treatment including traditional Chinese medicine treatment are not taxable.

General Practitioner (GP) vs. Specialist Medical Bills

There is no difference in the tax treatment for GP bills from specialist medical bills. If both benefits are available to all employees,the reimbursement for both types of bills are not taxable.

Reimbursements Based on Employee's Grade

Applying different thresholds for staff of different grades does not affect the tax treatment. The different amounts of reimbursements on the same benefit (e.g. hospitalisation) are not taxable.

Medical or Dental Benefits under Flexible Benefits Scheme

Offering medical and dental benefits under the flexible benefits scheme (also known as cafeteria benefits) does not change the tax treatment of the benefits. For details, please refer to Flexible Benefits Scheme.

Ceiling or Cap on Reimbursements

There is no threshold or cap on the amount/value of reimbursement for medical or dental care.

How much can you exclude from your income?

However, the amount you can exclude is limited to your employer's cost and can’t be more than $1,600 ($400 for awards that aren’t qualified plan awards) for all such awards you receive during the year. Your employer can tell you whether your award is a qualified plan award. Your employer must make the award as part of a meaningful presentation, under conditions and circumstances that don’t create a significant likelihood of it being disguised pay.

When is nonqualified compensation included in gross income?

In most cases, any compensation deferred under a nonqualified deferred compensation plan of a nonqualified entity is included in gross income when there is no substantial risk of forfeiture of the rights to such compensation. For this purpose, a nonqualified entity is one of the following.

What is included in gross income?

In most cases, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

What is income received by an agent for you?

Income received by an agent for you is income you constructively received in the year the agent received it. If you agree by contract that a third party is to receive income for you, you must include the amount in your income when the third party receives it.

Is emergency financial aid included in gross income?

The amounts of these are not included in the gross income of the eligible self-employed individual. Emergency financial aid grants. Certain emergency financial aid grants under the CARES Act are excluded from the income of college and university students, effective for grants made after 3/26/2020.