How much tax do you pay on unemployment benefits?

- Taxable social security benefits (Instructions for Form 1040 or 1040-SR, Social Security Benefits Worksheet)

- IRA deduction (Instructions for Form 1040 or 1040-SR, IRA Deduction Worksheet)

- Student loan interest deduction (Instructions for Form 1040 or 1040-SR, Student Loan Interest Deduction Worksheet)

Is the 300 unemployment taxable?

Yes, the extra $300 unemployment benefit will be considered taxable income in April 2021 when you file your taxes. Do I have to pay Taxes on Stimulus Payments The $1,200 stimulus payments that people received from the federal government under the COVID-19 pandemic stimulus bill are not taxable.

How much unemployment compensation is tax free?

Yet researchers estimate that only 40% of unemployment payments in 2020 had taxes withheld. That’s due, in part, to the fact that while state unemployment agencies are supposed to offer the option to withhold 10% of benefits for income taxes, some states failed to do so.

Are federal taxes owed on unemployment?

The Pennsylvania labor department has compiled a list of companies that are violating state labor and public safety laws. More than 500 Lehigh Valley employers landed on the list due to issues over payment of unemployment compensation taxes, according to a ...

Is the $600 unemployment taxed in Ohio?

Click here to read more about COVID-19 relief. The additional $600 per week from the CARES Act is taxable. The $600 emergency federal unemployment benefits you may have received each week on top of your regular unemployment benefits is part of your taxable income for federal taxes and possibly for state taxes.

Is unemployment taxable in Ohio in 2021?

On March 31, 2021, Governor DeWine signed Sub. S.B. 18 into law which allowed individuals filing Ohio income tax returns for the tax year 2020 to claim the same unemployment compensation exclusion allowed on their federal income tax return.

Is unemployment compensation taxable in Ohio 2020?

Ohio income taxes: Unemployment benefits from 2020 won't be taxed for most filers.

What is the tax rate on unemployment benefits in Ohio?

Effective Jan. 1, 2022, total unemployment tax rates for experienced employers are to range from 0.8% to 7.5% for positive-rated employers and from 7.7% to 10.2% for negative-rated employers, the department said on its website. The rates include a mutualized tax rate of 0.5%.

Do you have to pay taxes on pandemic unemployment in Ohio?

If you DID apply and/or receive unemployment benefits from ODJFS: 1. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns. Unemployment benefits are taxable pursuant to federal and Ohio law.

Is the pandemic unemployment assistance taxable income?

Overview. PUP is available to employees and the self-employed who lost their job on or after 13 March 2020 due to the COVID-19 pandemic. The PUP is paid by the Department of Social Protection (DSP). Payments from the DSP are taxable sources of income unless they are specifically exempt from tax.

Are unemployment benefits taxed?

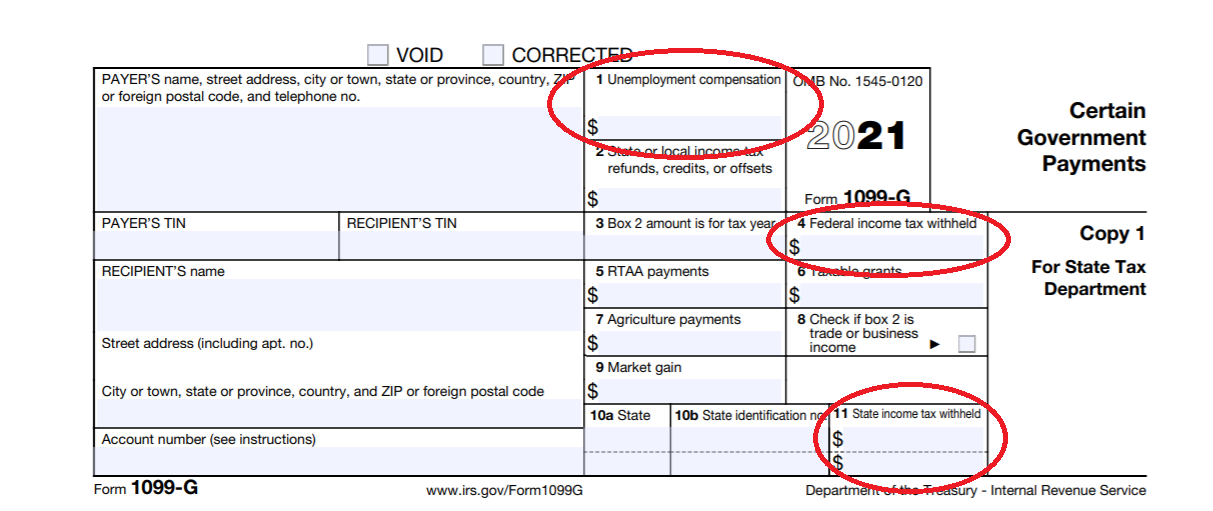

In general, all unemployment compensation is taxable in the tax year it is received. You should receive a Form 1099-G showing in box 1 the total unemployment compensation paid to you. See How to File for options, including IRS Free File and free tax return preparation programs.

Is unemployment considered earned income?

Earned income also includes net earnings from self-employment. Earned income does not include amounts such as pensions and annuities, welfare benefits, unemployment compensation, worker's compensation benefits, or social security benefits.

Do you owe money on a 1099-G?

Unemployment benefits are taxable income and your 1099-G form shows you how much you were paid in benefits and how much you paid in federal and state taxes. If you didn't withhold any taxes and you're looking at zeros in the withheld boxes, you could owe the government money.

Is unemployment taxable for local taxes?

Yes. Certain income, such as Social Security benefits, Unemployment Compensation, military pay, interest and dividends are not taxable.

How do I get my 1099 G from unemployment Ohio?

1099-G Tax Forms You can view and print your 1099-G from your correspondence inbox. In addition, this form will be sent by U.S. mail to the most current address on your claim.

Does Ohio have state income tax?

The state of Ohio requires you to pay taxes if you're a resident or nonresident that receives income from an Ohio source. The 2021 state income tax rates range from 2.765% to 3.99%, and the sales tax rate is 5.75%.

How much money did Ohio lose from unemployment?

Ohio will lose between $81 million and $141 million in income tax revenue because of the change.

Do you have to file amended taxes in Ohio?

If you're one of at least 2.65 million Ohioans who have already filed their income taxes, you do not need to file an amended return for federal taxes – the IRS will refund any overpayments.

Do you have to list unemployment benefits on your taxes?

For example, if you received $12,000 in unemployment, you would list ($10,200) here, because that is the maximum amount you can exclude from income taxes. You do not need to list unemployment benefits on state tax forms because they will be accounted for in your federal adjusted gross income.

Do you have to pay taxes on unemployment in Ohio?

COLUMBUS – Ohioans who received unemployment benefits in 2020 won't have to pay income taxes on the first $10,200 they received. The change, in a bill signed by Gov. Mike DeWine Wednesday, brought Ohio in line with federal tax law.

When are Ohio 1040 forms due?

The taxpayer timely filed the Ohio IT 1040 (and SD 100 if applicable). For most taxpayers, the due date for both forms is May 17, 2021; The taxpayer accrued interest, penalty and/or interest penalty as a result of nonpayment or underpayment of the 2020 tax liability related to the taxpayer’s unemployment income; AND.

How to check status of tax refund?

If you have already filed your return by paper but would like to expedite your refund, please re-submit your return electronically using the Department's free I-File service, or any commercial software product. You may check the status of your refund online or by calling 1-800-282-1784.

When does the statute of limitations expire for the 2020 tax refund?

Pursuant to uncodified section 22 of Am. Sub. H.B. 197, the statute of limitations for a refund claim set to expire between March 9, 2020 and the end of the Governor's COVID-19 emergency declaration (or July 30, 2020, whichever is earlier) is tolled during that time.

Is Ohio in compliance with the Cares Act?

Pursuant to Am. Sub. H.B. 197 of the 133rd Ohio General Assembly, Ohio is in conformity with federal income tax law as it existed on March 27, 2020. This includes the CARES Act (H.R. 748) and its applicability to Ohio’s income taxes.

Is Ohio claiming unemployment benefits for 2020?

Ohio has conformed to this unemployment benefits de duction for tax year 2020. However, while some taxpayers will file their 2020 federal and Ohio income tax returns and claim the unemployment benefits deduction, the Department of Taxation is aware that many taxpayers filed and reported their unemployment benefits prior to the enactment ...

Is a grant from a business excluded from gross receipts?

The receipt of such a grant by a business is not excluded from gross receipts for the CAT. Examples of such grants include, but are not limited to, county-issued grants, Small Business Relief Grants, and grants from the Bar and Restaurant Assistance Fund.

Does Ohio have an unemployment deduction?

Ohio does not have its own deduction for unemployment benefits. Thus, if the taxpayer does not qualify for the federal deduction, then all unemployment benefits included in federal AGI are taxable to Ohio. Taxpayers who claim the unemployment benefits deduction on their federal return and report that federal AGI on line 1 ...

What is unemployment tax?

Unemployment benefits provide short-term income to workers who lose their jobs through no fault of their own and who are actively seeking work.

How to determine how much unemployment tax is due?

To determine how much tax is due each quarter, multiply the rate by the total taxable wages you paid during the quarter. Employers’ state unemployment tax rates are based largely on their “experience rating,” which is a measure of how much they have paid in taxes and been charged in benefits.

How long do you have to keep Ohio employment records?

These records must be kept for at least five years.

How much is Florida unemployment tax?

State Taxes on Unemployment Benefits: There are no taxes on unemployment benefits in Florida. State Income Tax Range: There is no state income tax. Sales Tax: 6% state levy. Localities can add as much as 2.5%, and the average combined rate is 7.08%, according to the Tax Foundation.

How much is unemployment taxed in Massachusetts?

State Taxes on Unemployment Benefits: Massachusetts generally taxes unemployment benefits. However, for the 2020 and 2021 tax years, up to $10,200 of unemployment compensation that's included in a taxpayer's federal adjusted gross income is exempt for Massachusetts tax purposes if the taxpayer’s household income is not more than 200% of the federal poverty level. Up to $10,200 can be claimed by each eligible spouse on a joint return for unemployment compensation received by that spouse. Note that, since the Massachusetts income threshold is different from the federal income threshold (AGI of less than $150,000), some taxpayers may be eligible for a deduction on their federal tax return but not on their Massachusetts tax return.

What is the tax rate for 2022?

Beginning in 2022, a two-bracket tax rate structure will be adopted. The rates will be 2.55% (on up to $54,544 of taxable income for joint filers and up to $27,272 for single filers) and 2.98% (on over $54,54 of taxable income for joint filers and on over $27,272 of taxable income for single filers).

What is the Colorado income tax rate?

Income Tax Range: Colorado has a flat income tax rate of 4.55% (the approval of Proposition 116, which appeared on the November 2020 ballot, reduced the rate from 4.6 3% to 4.55% ). The state also limits how much its revenue can grow from year-to-year by lowering the tax rate if revenue growth is too high.

Is unemployment taxed in Maine?

State Taxes on Unemployment Benefits: Unemployment benefits are usually fully taxable in Maine. However, to the extent its included in federal adjusted gross income (AGI), up to $10,200 of unemployment compensation received in 2020 is not taxed by Maine for people with a federal AGI less than $150,000 (for joint filers, up to $10,200 per spouse is exempt from state tax). If you filed your 2020 Maine personal income tax return before the exemption was available, you should file an amended state tax return to claim the exemption.

Is Iowa unemployment taxed?

State Taxes on Unemployment Benefits: Unemployment benefits are generally fully taxable in Iowa. However, the state adopts the federal $10,200 exemption for unemployment compensation received in 2020. The Iowa Department of Revenue will make automatic adjustments for people who already filed a 2020 Iowa income tax return. As a result, taxpayers won't need to file an amended Iowa tax return if their only adjustment pertains to unemployment compensation. People filing an original 2020 Iowa tax return should report the unemployment compensation exclusion amount on Form IA 1040, Line 14, using a code of M.

Does Connecticut tax unemployment?

State Taxes on Unemployment Benefits: Connecticut taxes unemployment compensation to the same extent as it is taxed under federal law. As a result, any unemployment compensation received in 2020 (up to $10,200) exempt from federal income tax is not subject Connecticut income tax.

When are Ohio 1040 forms due?

The taxpayer timely filed the Ohio IT 1040 (and SD 100 if applicable). For most taxpayers, the due date for both forms is May 17, 2021; The taxpayer accrued interest, penalty and/or interest penalty as a result of nonpayment or underpayment of the 2020 tax liability related to the taxpayer's unemployment income; AND.

Do all school districts have income tax?

Not all school districts have an income tax. If you are subject to a school district income tax, you must file an SD 100, even if you are due a refund, if all of the following are true: You lived in a school district with an income tax for any portion of the tax year;

Can you deduct Ohio state income tax on a 1040?

If Ohio law does not have a corresponding state tax deduction for a federal itemized deduction, the amounts are not deductible on your Ohio IT 1040. Ohio’s deductions in calculating Ohio adjusted gross income are listed on Ohio Schedule A. Example: Traci loses $50,000 due to a Ponzi scheme.

Does Ohio have an unemployment deduction?

Ohio does not have its own deduction for unemployment benefits. Thus, if the taxpayer does not qualify for the federal deduction, then all unemployment benefits included in federal AGI are taxable to Ohio. Taxpayers who claim the unemployment benefits deduction on their federal return and report that federal AGI on line 1 ...

Do you have to file a 1040 in Ohio?

If you are subject to Ohio’s income tax, you must file an Ohio IT 1040, even if you are due a refund, unless: Your Ohio adjusted gross income (Ohio IT 1040, line 3) is less than or equal to $0; Your Ohio income tax base (Ohio IT 1040, line 5) is less than or equal to $0; OR.

Is Ohio claiming unemployment benefits for 2020?

Ohio has conformed to this unemployment benefits de duction for tax year 2020. However, while some taxpayers will file their 2020 federal and Ohio income tax returns and claim the unemployment benefits deduction, the Department of Taxation is aware that many taxpayers filed and reported their unemployment benefits prior to the enactment ...

Do you have to file Ohio tax return electronically?

If you file your return electronically, you are not required to send any income statements to the Department of Taxation upon filing.

How to report a stolen 1040?

Contact the Internal Revenue Service (IRS), if a fraudulent federal income tax return (1040) was filed. File a police report with your local police department. Contact the following organizations to notify them that your identity was stolen: Federal Trade Commission: www.ftc.gov or call 1-877-438-4338.

Is unemployment taxable in Ohio?

Unemployment benefits are taxable pursuant to federal and Ohio law. a. Visit the IRS website here, for specific information about the IRS adjustment for tax year 2020. b. Ohio law is in conformity with federal law, therefore the provisions applicable under federal law (e.g. the $10,200 exclusion) are also applicable under Ohio law. 1.

Can you include unemployment on your taxes?

Generally, you should not include unemployment benefits you did not apply for as income on your federal and state income tax returns. For guidance regarding the filing of your federal income tax return in this situation, please visit the IRS at: IRS identity theft and unemployment benefits instructions. IRS offers guidance to taxpayers on identity ...

Do you need a 1099-G to file Ohio taxes?

You do not need to have a determination from ODJFS on your ID theft claim or a corrected 1099-G to file your federal and state income tax returns. However, you should continue to pursue a corrected 1099-G from ODJFS after your returns are filed to avoid a future tax bill from the IRS or ODT. If you have additional questions with filing your Ohio ...