Although the taxability of pension benefits depends largely on the specifics of the plan and the payment structure, most beneficiaries must pay taxes on money received. Recipients should typically report this inherited pension income the same way the plan participant did.

What states have no pension tax?

Thirteen states exempt pension income for qualified retirees as of tax year 2021:

- Alabama

- Alaska

- Florida

- Illinois

- Mississippi

- Nevada

- New Hampshire

- Pennsylvania

- South Dakota

- Tennessee

How much in taxes should I withhold from my pension?

Pensions and Annuity Withholding

- Withholding on Periodic Payments. Generally, periodic payments are pension or annuity payments made for more than 1 year that are not eligible rollover distributions.

- Nonperiodic Payments. ...

- Mandatory Withholding on Payments Delivered Outside the United States. ...

- Eligible Rollover Distributions. ...

- Depositing and Reporting Withheld Taxes. ...

How do you calculate taxable pension?

Pension Credit Universal Credit Working Tax Credit The calculator can only indicate possible eligibility for the following benefits, and cannot estimate the amount received: Age-related Tax Allowance Attendance Allowance Boiler Grants Bus pass Carer's ...

What tax do you pay on your pension?

- your social insurance number (SIN)

- your date of birth

- your postal code or ZIP code

- an amount you entered on your income tax and benefit return (the line we ask for will vary; it could be from the current or the previous tax year)

- your business number (BN)

Do beneficiaries pay taxes on pensions?

With a pension, people pay income taxes when they withdraw the money in retirement or their heirs pay income taxes when they inherit it. The income tax rates that apply are those that apply at the time of the withdrawal or inheritance.

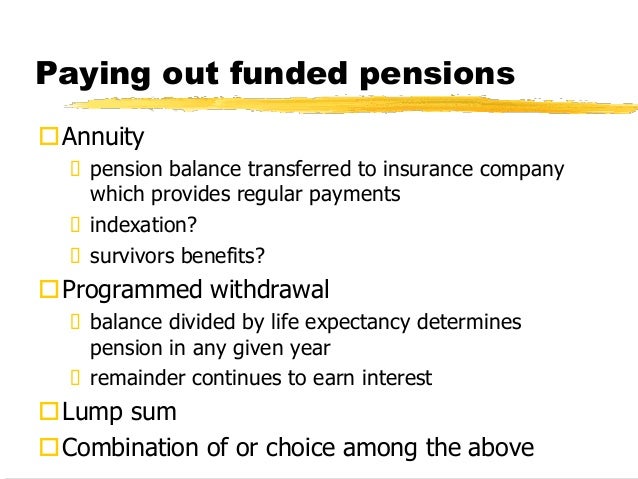

How are pensions paid to beneficiaries?

The pension payout How your beneficiary is paid depends on your plan. For example, some plans may pay out a single lump sum, while others will issue payments over a set period of time (such as five or 10 years), or an annuity with monthly lifetime payments.

Do I have to pay tax on my deceased husband's pension?

Although the taxability of pension benefits depends largely on the specifics of the plan and the payment structure, most beneficiaries must pay taxes on money received. Recipients should typically report this inherited pension income the same way the plan participant did.

When a person dies what happens to their pension?

The deceased person may have been entitled to pension benefits from a private company, government agency, or union. Some pensions end at death, but many pensions provide for payments to a surviving spouse or dependent children. Survivors may be entitled to part of the payments the person would have received.

Who gets private pension after death?

If the deceased hadn't yet retired: Most schemes will pay out a lump sum that is typically two or four times their salary. If the person who died was under age 75, this lump sum is tax-free. This type of pension usually also pays a taxable 'survivor's pension' to the deceased's spouse, civil partner or dependent child.

Who gets retirement benefits after death?

A widow or widower age 60 or older (age 50 or older if they have a disability). A surviving divorced spouse, under certain circumstances. A widow or widower at any age who is caring for the deceased's child who is under age 16 or has a disability and receiving child's benefits.

How are pension survivor benefits taxed?

They are not taxable when the member receives them as a refund or pension or when the member's beneficiary(ies) receives them as a death benefit. tax-deferred member contributions and the interest are taxable. The income tax treatment is the same as that described in subparagraph 1(c) above.

Can I leave my pension to my daughter?

The new pension rules have made it possible to leave your fund to any beneficiary, including a child, without paying a 55% 'death tax'. Many people want to leave their assets to their family when they pass, and a pension is now a tax-efficient way to do this.

Can you leave your pension to anyone?

The new pension rules have made it possible to leave your fund to any beneficiary, including a child, without paying a 55% 'death tax'. Many people want to leave their assets to their family when they pass, and a pension is now a tax-efficient way to do this.

How long does it take for pension to pay out after death?

12 monthsThe payment can only be made 12 months after the death. This is a legal waiting period that is applied to give untraced dependants a chance to come forward. If there are no dependants and no nominees, the trustees will pay the benefit to the member's estate after the 12-month waiting period.

What happens to pension plan when owner dies?

If a pension plan owner dies prior to retirement, designated beneficiaries may receive a lump sum payment. The amount typically reflects a multiple of the deceased’s yearly salary.

Who can explain the terms of a pension?

If you are the spouse or dependent child of somebody who's passed away, your loved one’s employer or the plan administrator can explain the terms of the pension and help you determine if you qualify for death benefits.

What is pension payout?

A pension from a union, private company or government agency may provide monetary benefits to surviving spouses or dependent children upon the death of the plan participant. Known as pension death benefits or inherited pension benefits, these payouts typically take the form of ongoing payments representing a percentage of the amount ...

How do DBOs avoid estate taxes?

DBOs may be set up to avoid estate taxes by specifying beneficiaries by type rather than by given name and by limiting the employee’s rights and control over the plan. Payments are still taxed as ordinary income.

What happens if my retirement plan is approved?

You should also be notified about whether the payout can be rolled over into another retirement plan.

Do pensions have to be taxed?

Although the taxability of pension benefits depends largely on the specifics of the plan and the payment structure, most beneficiaries must pay taxes on money received. Recipients should typically report this inherited pension income the same way the plan participant did. However, if a disbursement was previously subject to an estate tax, you may be entitled to a yearly deduction and should consult a qualified tax professional to find out the best way to proceed.

Is pension death taxable?

Some death benefits purchased through a pension plan function similarly to life insurance, which means they’re only taxable if the payout amount exceeds the purchase price. If the payout does exceed the original purchase price, only the amount over what was paid is taxable.

Why is defined benefit called defined benefit?

It is called "defined benefit" because employees and employers know the formula for calculating retirement benefits ahead of time, and they use it to set the benefit paid out. The employer typically funds the plan by contributing a regular amount, usually a percentage of the employee's pay, into a tax-deferred account.

What is pension plan?

Pension plans are a type of retirement plan that requires an employer to make contributions to a pool of funds set aside for a worker's future benefit. The pool of funds is invested on the employee's behalf, and the earnings on the investments generate income to the worker upon retirement. Pension plan options typically offer a lump-sum ...

What are the different types of pension plans?

Types of Pensions. There are two main types of pension plans: defined-benefit and defined-contribution . A defined-benefit plan is what people normally think of as a "pension.". It is an employer-sponsored retirement plan in which employee benefits are computed using a formula that considers several factors, such as length ...

What is a period certain annuity?

Period Certain Annuity. A period certain annuity option allows the customer to choose how long to receive payments. This method allows beneficiaries to later receive the benefit if the period has not expired at the date of the member's death.

What is defined contribution plan?

A defined-contribution plan is a retirement plan that's typically tax-deferred, like a 401 (k) or a 403 (b) , in which employees contribute a fixed amount or a percentage of their paychecks to an account that is intended to fund their retirements. The sponsor company will, at times match a portion of employee contributions as an added benefit.

Can a spouse be a beneficiary of a joint life plan?

If the plan member is married with a joint-life payout option, the default beneficiary is automatically the member's spouse unless the spouse waives that option. The spouse would need to certify in writing via a spousal consent or spousal waiver form that they are choosing not to receive survivor benefits. 4 5 It may need to be notarized. If done properly, this allows the member to designate another beneficiary, such as a child. If the plan member is not married, they may designate another beneficiary.

Can you continue to receive pension benefits if your parents retire?

Assuming your parent elected a period certain pension option for payment at retirement and named you as beneficiaries, you and your siblings would be entitled to the continuing payments until the period expires.

When are pensions taxable?

The taxable portion of your pension or annuity will vary depending on the year you began receiving payments. If your distributions began on or before November 18, 1996, then you have to use what is called the General Rule, which is based on life-expectancy charts produced by the IRS. The calculations can be difficult, which is why the IRS offers to calculate the correct tax amount for you for a small fee. (Who says government isn’t helpful?)

How much is the penalty for early retirement?

If you take a withdrawal under age fifty-nine-and-a-half, you will ante up an additional 10% early withdrawal penalty on the amount of the withdrawal. There are some exceptions for workers leaving/losing a job at age 55 or later, or due to illness and disability, but most people would pay the early distribution penalty. Working an extra year or three, even if you don’t otherwise need to, may pay large dividends.

Is a pension fully taxed?

The answer is “it depends”— on when and how you contributed to your pension. Depending on how contributions were made and by whom (e.g., by your employer or by you), your pension may be fully taxed, partially taxed, or not taxed at all. Also, the type of pension or retirement account matters: employer-funded pensions are treated somewhat ...

Is IRA taxable in the year you retire?

If you get your tax break up front, you pay for it on the backend: once you retire, traditional IRA benefits are generally taxable in the year you receive them. And also similar to pensions, there is an early-withdrawal (basically early retirement) penalty.

Is pension money taxable?

If your employer made all the payment s to your pension fund, you must report that amount on your tax return and pay the tax due when you file the return for the year . (2) Pension benefits are also fully taxable ...

Is a 401(k) a pension?

401 (k)s: Though slightly different from employer-funded pensions, 401 (k) accounts receive similar treatment to those pensions. Any employer matching funds and pre-tax funds withheld from your paycheck are fully taxable, while any contributions you make using after tax dollars are not taxable.

Is a Roth IRA tax free?

Roth IRAs: essentially the reverse of traditional IRAs—you pay your taxes upfront (there is no tax break or advantage on contributions to the Roth IRA), but then your benefits are tax-free when you withdraw them.

Can a 401(k) be rolled into an IRA?

For example, many 401 (k) plans require a lump-sum distribution upon the death of the account holder. The surviving spouse can roll the 401 (k) into an IRA, but if the beneficiary is not a spouse, s/he might be forced to take a lump-sum payment and the tax bill that goes along with it.

Is inheritance taxable?

An inheritance, except for a deferred plan such as a 401k or IRA, is not taxable and is not reported on your tax return.

Is a Roth 401(k) distribution taxable?

Distributions from an inherited Roth are not taxable unless the Roth was established within the past 5 years. 2. Inherited 401 (k) plans are (or eventually will be) taxable but the amount of tax depends on the 401 (k) plan rules. For example, many 401 (k) plans require a lump-sum distribution upon the death of the account holder.

Is an inherited IRA distribution taxable?

In general, inherited retirement plans are not taxable until you take a distribution. 1. Distributions from an inherited traditional IRA are taxable, just as they are for non-inherited traditional IRAs. Distributions from an inherited Roth are not taxable unless the Roth was established within the past 5 years. 2.

How to choose not to have income tax withheld from pension?

If you're a U.S. citizen or resident alien, you must provide the payer with a home address in the United States (or its possessions) to be able to choose to have no tax withheld. Payers generally figure the withholding from periodic payments of a pension or annuity the same way as for salaries and wages. If you don't submit the Form W-4P withholding certificate, the payer must withhold tax as if you were married and claiming three withholding allowances. Even if you submit a Form W-4P PDF and elect a lower amount, if you don't provide the payer with your correct SSN, tax will be withheld as if you were single and claiming no withholding allowances.

When do you receive distributions after retirement?

Distributions made after your separation from service and in or after the year you reached age 55.

What happens if you don't file a W-4P?

If you don't submit the Form W-4P withholding certificate, the payer must withhold tax as if you were married and claiming three withholding allowances.

Do you have to pay estimated taxes?

If you pay your taxes through withholding and the withheld tax isn't enough, you may also need to make estimated tax payments to ensure you don't underpay taxes during the tax year. For more information on increasing withholding tax, making estimated tax payments, and the consequences of not withholding the proper amount of tax, refer to Publication 505, Tax Withholding and Estimated Tax.

Is a pension payment taxable?

Partially Taxable Payments. If you contributed after-tax dollars to your pension or annuity, your pension payments are partially taxable. You won't pay tax on the part of the payment that represents a return of the after-tax amount you paid. This amount is your investment in the contract and includes the amounts your employer contributed ...

Is 410 taxable?

Topic No. 410 Pensions and Annuities. If you receive retirement benefits in the form of pension or annuity payments from a qualified employer retirement plan, all or some portion of the amounts you receive may be taxable.

Is an annuity taxable if you have no investment?

The pension or annuity payments that you receive are fully taxable if you have no investment in the contract (sometimes referred to as "cost" or "basis") due to any of the following situations:

What section of the succession law reform act allows a beneficiary to receive pension benefits?

In Ontario, the ability to designate a beneficiary by Will to receive benefits from a pension plan on a member’s death is found in sections 50 and 51 of the Succession Law Reform Act.

Do you include beneficiary designations in a will?

In Will drafting, it is common to include beneficiary designations for life insurance, TFSAs and RRSPS/RRIFs, but sometimes pension plans are overlooked. If the client has a spouse (married or common law), the spouse will automatically receive the client’s pension survivor benefits pursuant to Ontario law. However, members of a plan generally have ...

What happens to a participant in a retirement plan when he dies?

When a participant in a retirement plan dies, benefits the participant would have been entitled to are usually paid to the participant’s designated beneficiary in a form provided by the terms of the plan (lump-sum distribution or an annuity).

What to do when a spouse dies in a retirement plan?

When a plan participant dies, the surviving spouse should contact the deceased spouse’s employer or the plan’s administrator to make a claim for any available benefits. The plan will likely request a copy of the death certificate. Depending upon the type of plan, and whether the participant died before or after retirement payments had started, the plan will notify the surviving spouse as to: