Are real estate agents eligible for unemployment?

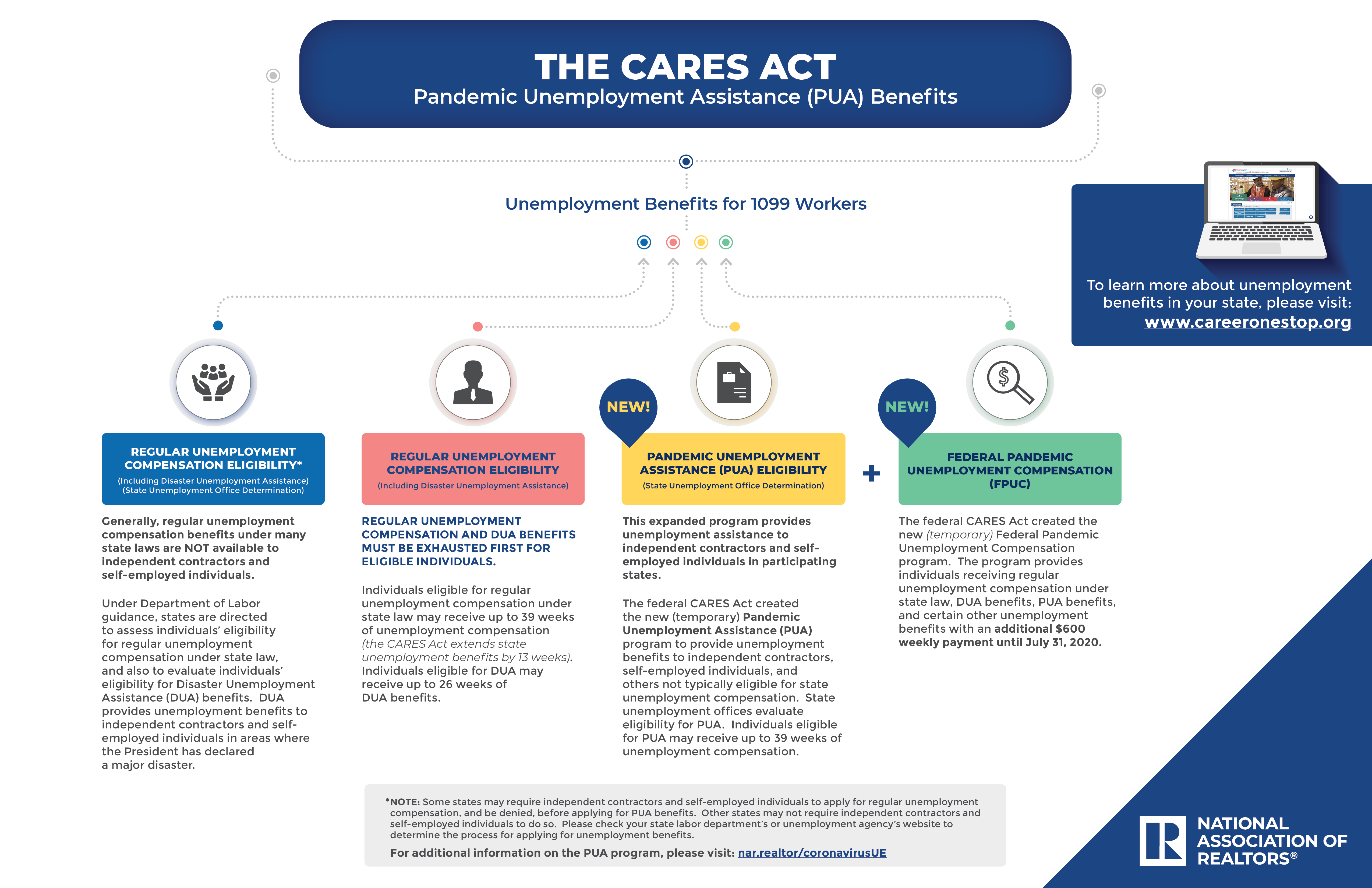

Unfortunately, as 1099 independent contractors, real estate agents are not eligible for unemployment benefits. Salaried W2 agents, which make up about 5% of real estate professionals, are eligible for their state’s unemployment benefits.

How can a realtor get unemployment in Florida?

Finally! Here's How Realtors Can Get Unemployment Assistance | Florida Realtors Finally! Here's How Realtors Can Get Unemployment Assistance The first step is to be DENIED benefits from the state of Florida.

Who is eligible for individual unemployment benefits?

Individuals who are self-employed, or who would not otherwise qualify for regular unemployment. The U.S. Secretary of Labor is authorized to establish additional eligibility criteria that could potentially include other factors to prove eligibility, which is also possible by individual state programs.

Can a title company make an employee eligible for unemployment?

However, the employee likely will be deemed eligible for unemployment insurance compensation through their position with the title company, so it may be more expedient to file for traditional unemployment. What factors are considered when determining unemployment benefit eligibility as a result of COVID-19?

Do REALTORS qualify for unemployment benefits in California?

The CARES Act includes a Pandemic Unemployment Assistance (PUA) program expanding unemployment benefits eligibility to business owners, self-employed workers, and independent contractors, including most REALTORS®.

Who qualifies for pandemic unemployment in California?

You must also have been unemployed, partially unemployed, or unable or unavailable to work due to at least one of the following reasons to be eligible for PUA: My place of employment was closed as a direct result of the COVID-19 public health emergency.

Can real estate agents collect unemployment in NY?

With the Congress' passage of the CARES Act, also known as the Coronavirus (COVID-19) federal stimulus package, most individuals who have been laid off or who have seen a loss of wages are eligible for unemployment benefits through the New York State Department of Labor (DOL) – this includes independent contractors, ...

Who can apply for pandemic unemployment in NY?

Quit a job as a direct result of COVID-19; Place of employment closed as a direct result of COVID-19; Had insufficient work history and affected by COVID-19; Otherwise not qualified for regular or extended UI benefits and affected by COVID-19.

Is California still paying Covid unemployment?

Federal Unemployment Benefits Have Ended Federal unemployment benefit programs under the CARES Act ended on September 4, 2021. You will no longer be paid benefits on the following claim types for weeks of unemployment after September 4: Pandemic Unemployment Assistance (PUA)

Can self-employed get unemployment benefits in California?

If you are self-employed, you may have benefits available from EDD unemployment insurance programs that you or your employer may have paid into over the past 5 to 18 months. You may have contributions from a prior job, or you could have been misclassified as an independent contractor instead of an employee.

Can self-employed get unemployment?

Self-employed people can become unemployed if their business has to close down. It may also be the case, though you continue to be self-employed the amount of work you are getting has reduced so much that it no longer provides you with a sufficient income.

Can self-employed Get unemployment in NY 2022?

Therefore, in 2022 there is no longer much support for self-employed workers through the CARES Act.

What can disqualify you from unemployment benefits in NY?

For What Reasons Can You Be Denied Unemployment?Failing to Meet the Earnings Requirements. To qualify for benefits in New York (as in most states), you must have earned a minimum amount in wages during a 12-month stretch called the "base period."Getting Fired for Misconduct. ... Quitting Your Last Job.

How do I file for unemployment in NY if self employed?

Call our Telephone Claim Center, toll-free during business hours to file a claim.1-888-209-8124.Telephone filing hours are as follows: Monday through Friday, 8 am to 5 pm.

Is Nys still giving pandemic unemployment?

Regular Unemployment Insurance The Pandemic Emergency Unemployment Compensation Program (PEUC) provided 53 weeks of additional benefits. It went into effect April 5, 2020 and expired the benefit week ending September 5, 2021.

Is EDD giving extra 300 a week?

We automatically added the federal unemployment compensation to each week of benefits that you were eligible to receive. Any unemployment benefits through the end of the program are still eligible for the extra $300, even if you are paid later.

Is Pua extended in California?

This includes the following extensions: Pandemic Unemployment Assistance (PUA) – The PUA program, designed for freelancers, gig workers and independent contractors or those that generally don't qualify for regular state unemployment, has been extended by another 29 weeks.

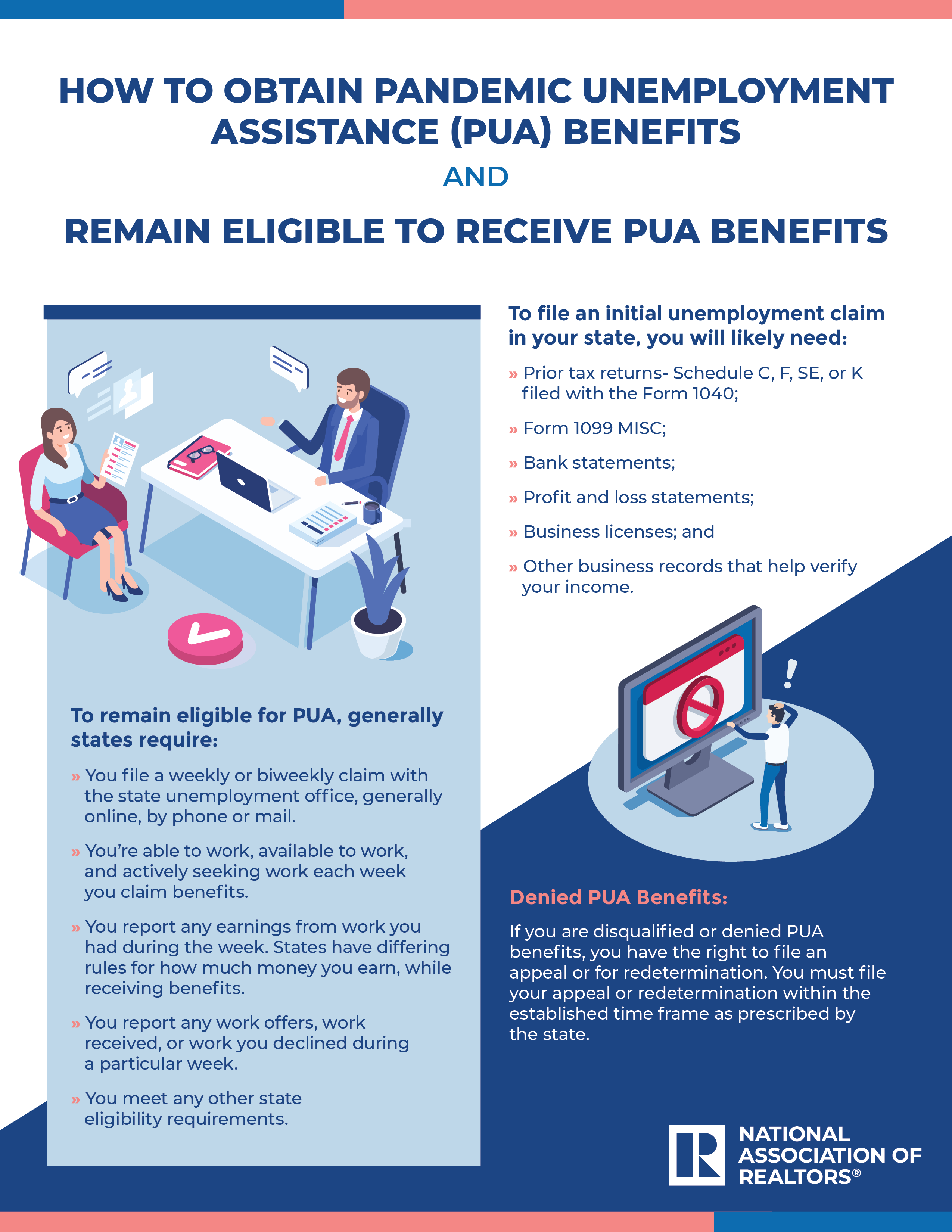

How long does Pua take to be approved?

It can take at least six weeks for us to process your PUA application. If your application is approved, we will send you your $205 (or more) per week in PUA benefits plus the extra $600 per week for all the past weeks you were eligible. You may get several checks at once.

How much is EDD paying now 2021?

The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount, which can range from $40 to $450 per week. Once you submit your application, we will verify your eligibility and wage information to determine your weekly benefit amount.