Which retirement plans offer tax benefits?

Which Retirement Plans Offer Tax Benefits

- Which Retirement Plans Offer Tax Benefits. When it comes to saving for retirement, there are many potential options and paths to choose, as there’s no one size fits all approach.

- 401 (k) Accounts. Let’s start with the 401 (k), which can only be made available to you through your employer. ...

- Traditional IRA. ...

- Roth IRA. ...

- SEP IRAs. ...

- 403 (b) Accounts. ...

- Closing. ...

Which states won't tax my retirement income?

States That Won't Tax Your Retirement Income Alaska. This is the only state that doesn't collect state sales tax or levy an individual income tax, so even people who aren't retired can benefit. Florida. ... Illinois. ... Mississippi. ... Nevada. ... New Hampshire. ... Pennsylvania. ... South Dakota. ... Tennessee. ... Texas. ... More items...

What pensions are not taxable?

Under current law, veterans who are 65 or older can exempt $30,000 of their military pensions from taxation, no questions asked. But veterans younger than 65 may claim a tax exemption of only $17,500 — and that only if they’re making at least that much at another job. Editorial: SC Senate finally said ‘enough’ to Commerce giveaways.

How will your retirement benefits be taxed?

- Large IRA account balances

- Large taxable (non-retirement) account balances

- Large investments in municipal bonds (non-taxable interest)

- Pensions

- Annuities

- Employment

- Inflation (more on that shortly)

Do you have to pay taxes on your retirement benefits?

Taxes on Pension Income You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money.

How much taxes do you pay on retirement benefits?

While California exempts Social Security retirement benefits from taxation, all other forms of retirement income are subject to the state's income tax rates, which range from 1% to 13.3%. Additionally, California has some of the highest sales taxes in the U.S.

Do retirement benefits count as income?

Pension payments, annuities, and the interest or dividends from your savings and investments are not earnings for Social Security purposes. You may need to pay income tax, but you do not pay Social Security taxes.

What types of retirement income are not taxable?

10 Types of Retirement Income That Are Not TaxableStimulus payments. Berna Namoglu / Shutterstock.com. ... Social Security benefits. ... Health savings account distributions. ... Reverse mortgage payments. ... Roth IRA distributions. ... Life insurance proceeds. ... Municipal bond interest. ... Profit from selling your home.More items...

How can I avoid paying taxes on retirement income?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How much can a retired person earn without paying taxes in 2020?

For retirees 65 and older, here's when you can stop filing taxes: Single retirees who earn less than $14,250. Married retirees filing jointly, who earn less than $26,450 if one spouse is 65 or older or who earn less than $27,800 if both spouses are age 65 or older.

How much can a retired person earn without paying taxes in 2021?

In 2021, the income limit is $18,960. During the year in which a worker reaches full retirement age, Social Security benefit reduction falls to $1 in benefits for every $3 in earnings. For 2021, the limit is $50,520 before the month the worker reaches full retirement age.

Do 401k distributions count as earned income for Social Security?

Are 401k Withdrawals Considered Income for Social Security? No. Social Security only considers “earned income," such as a salary or wages from a job or self-employment.

What income can't be taxed?

Other forms of income that can’t be taxed are municipal bonds interest, life insurance policy loans and reverse mortgages. Bottom Line. Once you reach retirement, it’s mostly time to relax. But it’s important that you don’t forget you’ll still be held responsible for paying certain taxes.

How to fill 401(k) with investments?

If your employer offers a 401(k), take advantage of it. Put a solid amount of your paycheck into the account every pay period. If you fill your 401(k) with investments, make sure it’s the most optimized mix of investments, which you can do with the help of a financial advisor if not on your own.

Do you have to report an annuity on taxes?

The company who distributes your annuity should inform you of your taxable amount. Another bit of income that you’ll have to pay taxes on is any gains you earn from investments. Just as you do now, when you sell investments, you have to report that capital loss or gain on your tax forms.

Do you have to pay taxes on 401(k)?

However, you don’t have to pay full taxes on everything. There are some sources, like IRAs and 401(k)s, that will mostly be taxed. But even then, there are limitations and exceptions. You may also have some accounts that can only be taxed partially, ensuring the accounts aren’t depleted.

Is a Roth IRA safe?

While your Roth IRA may be safe, your 401(k) and pension aren’t entirely tax-free. Keep an eye out for 1099 forms that may come in. . Tips for Saving for Retirement. First things first: it is never too early to start saving for retirement.

Is cashing in life insurance taxable?

Cashing in some of your cash value life insurance policy can also trigger a tax bill. If what you get from cashing in exceeds what you paid in premiums, that’s considered a gain. It’s the gain that becomes taxable. Tax-Free Retirement Income. Luckily, the IRS can’t leave you entirely high and dry in retirement.

Do you have to pay taxes on retirement?

True, you don’t have to pay taxes on every bit of money you have in retirement. But you will need to pay taxes on some of that income. Is Retirement Income Taxable? Unfortunately, while you may want to just relax in retirement, you can’t fully escape taxes.

How is Social Security income determined?

Your income is determined by adding half your Social Security benefits to all your other taxable income from other sources. Some tax-free income, such as municipal bond interest, is also added to determine your total income.

How many states tax Social Security?

As for state taxes, only 13 states tax Social Security benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. If you live in one of them, you'll also need to learn your state's rules for when and how your benefits will be taxed.

Why are state taxes so complicated?

Things get even more complicated when it comes to state taxes, because there are big differences from one state to another. Here's what you need to know about how the federal government and the state you live in may tax different benefits.

What do you need to know when you're retired?

Passionate advocate of smart money moves to achieve financial success. When you're retired, you need all the income you can get. This income may derive from many sources, including retirement investment accounts, pensions, and Social Security.

Does pension income have to be taxed in Alaska?

As far as state taxes go, if you live in Alaska, Florida, Illinois, Mississippi, Nevada, New Hampshire, Pennsylvania, South Dakota, Tennessee, Texas, Washington, or Wyoming, your pension income won't be taxed. If you live in any other state, you'll need to find out your local rules.

Is pension income taxable?

Pension income. If you're lucky enough to get a pension from your employer, the entire amount you receive is probably taxable income federally. This is the rule if you didn't contribute any of your own money to your employer's pension plan.

Do you pay taxes on 401(k) withdrawals?

That means you'll pay taxes based on whatever your tax rate is . If you have Roth accounts, on the other hand, you aren't subject to any federal taxes on withdrawals as long as you've complied with requirements related to your age and how long you've had your accounts open.

How much of your Social Security benefits can you be taxed?

If the total is between $25,000 and $34,000 and you're single, or if you're jointly filing and the total is between $32,000 and $44,000, then you can be taxed on up to 50 percent of your social security benefits.

How to work out if you need to pay taxes on Social Security?

To work out whether you'll need to pay tax on these benefits, calculate your total income (excluding social security) and add any tax-free interest you receive. Finally, add half your social security benefit to the total. Article continues below advertisement.

What happens if you withdraw from 401(k) early?

If you withdraw early, you'll have to pay tax and face a 10 percent early withdrawal penalty. You can only make penalty-free withdrawals before retirement age if you leave your job associated with the 401 (k) at age 55 or older. Source: istock. Article continues below advertisement.

What is the minimum age to withdraw from retirement?

However, after the age of 72 , a minimum distribution becomes mandatory, and you can face substantial fees of 50 percent if you fail to withdraw.

Is Roth IRA withdrawal taxable?

You may have also saved money into a Roth IRA. Withdrawals from this type of account are not taxable because contributions were made with after-tax income. As long as the account is at least five years old, and the account owner is more than 59.5 years old, then you won't face tax on withdrawals.

Do you have to pay taxes on 401(k) contributions?

Since your contributions to this type of account were taken before tax, you'll have to pay tax when you retire. Income from a traditional IRA is taxed as regular income.

Is Social Security taxable?

And in some cases, social security can also be taxed. It's essential to plan for any tax that you may have to pay on your retirement benefits. Let's break down which retirement benefits are taxable. Article continues below advertisement.

What do you keep when you retire?

When you retire, you leave behind many things—the daily grind, commuting, maybe your old home—but one thing you keep is a tax bill. In fact, income taxes can be your single largest expense in retirement.

Can you make gifts to your heirs without paying taxes?

But the good news is that prior to your death, you can make gifts to whomever you wish—and you can do so up to a certain amount without paying taxes.

Do you pay taxes on Roth IRA?

You can find instructions for calculating what you owe in IRS Publication 590, Individual Retirement Arrangements. If you have a Roth IRA, you'll pay no tax at all on your earnings as they accumulate or when you withdraw following the rules.

Do you pay taxes on 401(k) contributions?

When you receive income from your traditional 401 (k), 403 (b) or 457 salary reduction plans, you'll owe income tax on those amounts. This income , which is produced by the combination of your contributions, any employer contributions and earnings on the contributions, is taxed at your regular ordinary rate.

Do you pay taxes on pensions?

Taxes on Pension Income. You have to pay income tax on your pension and on withdrawals from any tax-deferred investments—such as traditional IRAs, 401 (k)s, 403 (b)s and similar retirement plans, and tax-deferred annuities—in the year you take the money. The taxes that are due reduce the amount you have left to spend.

Do you have to pay taxes on Social Security?

Whether you have to pay such taxes will depend on how much overall retirement income you and your spouse receive, and whether you file joint or separate tax returns.

Does giving money away reduce estate taxes?

On the upside, giving the money away reduces your taxable estate—that is, what will be subject to estate taxes when you die—while also helping your beneficiaries. But on the downside, once the gift is given, if you need access to that money later in your retirement, it's gone.

How to calculate tax rate for retirement?

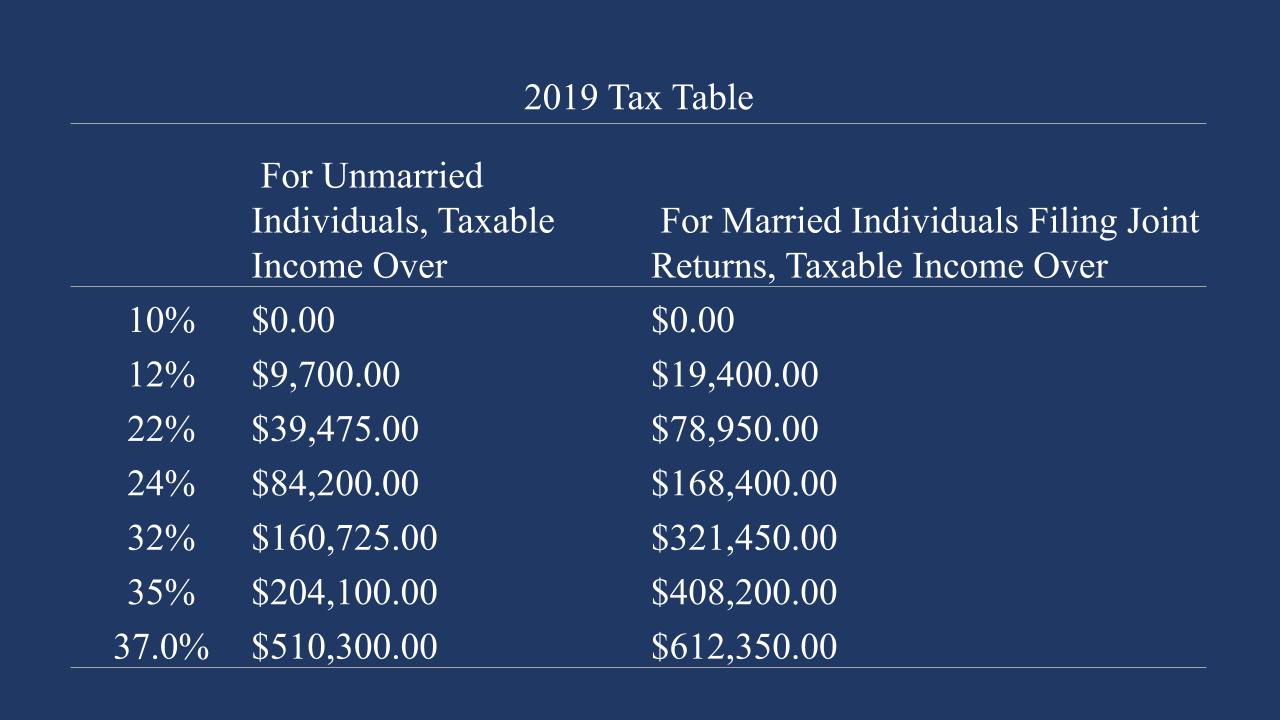

Calculating Your Tax Rate. Your tax rate in retirement will depend on the total amount of your taxable income and your deductions. List each type of income and how much will be taxable to estimate your tax rate. Add that up, and then reduce that number by your expected deductions for the year.

How much of Social Security is taxable?

A formula determines the amount of your Social Security that's taxable. You might have to include up to 85% of your benefits as taxable income on your return. 2. The taxable amount—anywhere from zero to 85%—depends on how much other income you have in addition to Social Security.

How much is capital gains taxed?

With capital gains, your total income is $45,000. At $45,000, you'll be taxed on up to 85% of your Social Security benefits—that doesn't mean 85% exactly, because it's a formula, so it may be less. 2 Based on all of this information, you'll pay taxes on $15,350 of your Social Security benefits.

How much is your standard deduction for 2020?

Your standard deduction for 2020—the tax return you filed in 2021—would be $24,800 as a married couple filing jointly.

Is a withdrawal from a 401(k) taxed?

Withdrawals from tax-deferred retirement accounts are taxed at ordinary income rates. These are long-term assets, but withdrawals aren't taxed at long-term capital gains rates. IRA withdrawals, as well as withdrawals from 401 (k) plans, 403 (b) plans, and 457 plans, are reported on your tax return as taxable income. 4

Is pension income taxable?

Pension Income. Most pension income is taxable. 1 It will be taxed if you withdraw pre-tax money you contributed to it. Most pension accounts are funded with pre-tax income, so the entire amount of your annual pension income will be included on your tax return as taxable income each year that you take it.

Is a withdrawal from an investment account taxable?

You'll initially be withdrawing earnings or investment gains if your account is worth more than what you contributed to it, so it will all be taxable. You'll begin withdrawing your original contributions after you've withdrawn all of your earnings, and these are not included in your taxable income. 6.

What is pension tax?

Tax on Pension Income. Pensions are private retirement accounts created and funded by your employer. The money held in a pension account is composed of two things: the amounts contributed by you or your employer, and the interest earned on those funds.

What is a pre-tax retirement account?

Contributions to Retirement Accounts: Pre-Tax or Post-Tax. Many retirement accounts are funded by contributions you make from each paycheck, and those contributions sit in an interest-bearing account and earn interest over the decades as you work. Contributions can be made pre-tax or post-tax. Pre-tax means that the money comes out ...

How long do you have to pay taxes on an annuity?

An annuity is a retirement vehicle you can buy either by yourself or through your employer. To be an annuity, the contract must require you to make periodic payments for more than one year. There are several types of annuities with complicated sets of rules, but generally, if you buy an annuity and receive retirement income from it, you're only taxed on what it earns. If you contribute $300,000 to the annuity and end up earning interest in the amount of $5,000, when you receive distributions, you'll only have to pay taxes on the $5,000 in interest. However, if you funded the annuity with pre-tax funds, you'll need to pay taxes on everything.

How much tax do you pay on a $1,000 a month?

So if you make $1,000 per month and your employer takes out $300 in taxes, you'll then contribute 5 percent of $700, or $35. When you receive distributions, you'll only be taxed to the extent of the interest earned, because you already paid tax on the principal.

How much do you contribute to a Roth IRA if you make $1,000 a month?

However, if you have a post-tax retirement account like a Roth IRA, in the same scenario, your employer will deduct taxes from your check first, based on $1,000 in gross income, and then take out your contribution. So if you make $1,000 per month and your employer takes out $300 in taxes, you'll then contribute 5 percent of $700, or $35.

What does it mean to be pre-taxed?

Pre-tax means that the money comes out of your pay before your taxes come out. This is beneficial because it reduces your taxable income for the year. However, it means that when you start getting that money paid back to you when you retire, you'll have to pay taxes on it then, plus taxes on the interest earned.

How much do you contribute to a 401(k) if you make a monthly contribution?

If you have a tax-deferred retirement account like a 401 (k), your contributions are taken out of your paycheck before taxes. For example, if you make $1,000 per month and contribute 5 percent to a 401 (k), your monthly contribution will be $50. Your employer will then deduct taxes from your check based upon income of $950 instead of $1,000.

What is Section 10 (15) of the Income Tax Act?

Section 10 (15) of the Income Tax Act incorporates a number of investments, the interest from which is totally exempt from taxation. These investments may be considered as one of the options for investing various benefits received on retirement.

Is a PPF exempt from the Provident Fund Act?

Any payment received from a Provident Fund, (i.e. to which the Provident Fund Act, 1925 applies) is exempt. Any payment from any other provident fund notified by the Central Govt. is also exempt. The Public Provident Fund (PPF) established under the PPF Scheme, 1968 has been notified for this purpose.

How much of a person's income is taxable?

Fifty percent of a taxpayer's benefits may be taxable if they are: Filing single, single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Married filing separately and lived apart from their spouse for all of 2019 with $25,000 to $34,000 income.

How much income do you need to be married to be eligible for a widow?

Filing single, head of household or qualifying widow or widower with more than $34,000 income. Married filing jointly with more than $44,000 income. Married filing separately and lived apart from their spouse for all of 2019 with more than $34,000 income.

When is the IRS filing 2020 taxes?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS. Social Security Income.

Is Social Security taxable if married filing jointly?

If they are married filing jointly, they should take half of their Social Security, plus half of their spouse's Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable .

Do you pay taxes on Social Security?

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income payments, which aren't taxable. The portion of benefits that are taxable depends on ...

How much of your Social Security income is taxable?

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income. If you file as an individual with a total income that’s less than $25,000, you won’t have to pay taxes on your social security benefits in 2020, ...

How much tax do you pay on your income if you live in one of the states?

So if you live in one of those four states then you will pay the state’s regular income tax rates on all of your taxable benefits (that is, up to 85% of your benefits). The other nine states also follow the federal rules but offer deductionsor exemptions based on your age or income.

How much to withhold from Social Security?

The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit . After you fill out the form, mail it to your closest Social Security Administration (SSA) office or drop it off in person.

How to find out if you will pay taxes on Social Security?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security benefits and add that amount to all your other income , including tax-exempt interest. This number is known as your combined income (combined income = adjusted gross income + nontaxable interest + half of your Social Security benefits).

How to file Social Security income on federal taxes?

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099.

What to do with a Roth IRA?

If you’re concerned about your income tax burden in retirement, consider saving in a Roth IRA. With a Roth IRA, you save after-tax dollars. Because you pay taxes on the money before contributing it to your Roth IRA, you will not pay any taxes when you withdraw your contributions. You also do not have to withdraw the funds on any specific schedule after you retire. This differs from traditional IRAs and 401 (k) plans, which require you to begin withdrawing money once you reach 72 years old (or 70.5 if you were born before July 1, 1949).

How many states have Social Security taxes?

There are 13 states that collect taxes on at least some Social Security income. Four of those states (Minnesota, North Dakota, Vermont or West Virginia) follow the same taxation rules as the federal government.

/how-does-the-social-security-earnings-limit-work-2388828_FINAL-2a648bdf8bc84b318a1e116131459238.png)