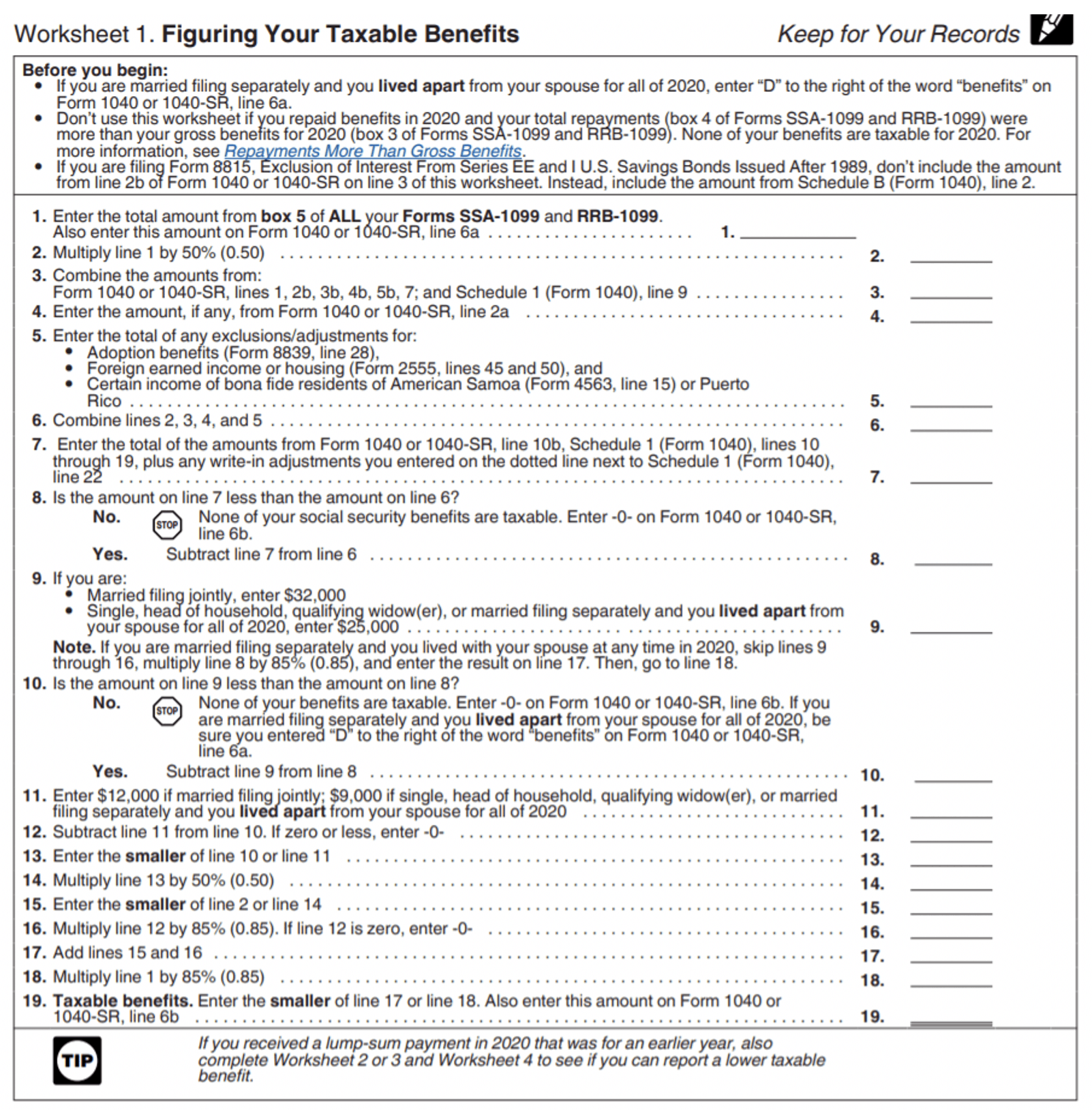

Generally, if Social Security benefits were your only income, your benefitsare not taxable and you probably do not need to file a federal income tax return.If you received Social Security benefits plus other income, the answer to howmuch, if any, is taxable can be found in the worksheet in the Form 1040instruction book.

Can taxes be withheld from Social Security?

You can elect to have federal income tax withheld from your Social Security benefits if you think you'll end up owing taxes on some portion of them. Federal income tax can be withheld at a rate of 7%, 10%, 12%, or 22% as of the tax year 2021. 3 You're limited to these exact percentages—you can't opt for another percentage or a flat dollar amount.

What jobs are exempt from Social Security?

- The employee was performing regular and substantial services for remuneration for the state or political subdivision employer before April 1, 1986,

- The employee was a bona fide employee of that employer on March 31, 1986,

- The employment relationship was not entered into for purpose of avoiding the Medicare tax, and

Does the IRS consider Social Security income?

While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable. Social Security benefits do not count as gross income. However, the IRS does count them in your combined income for the purpose of determining if you must pay taxes on your benefits.

How do you calculate income tax on social security?

Will Your Social Security Benefits Be Taxed?

- Build a Long-Term Strategy. Because of these income thresholds, tax planning experts often advise looking for ways to lower your combined income.

- Know the Earnings Limits. Those hoping to work in retirement need to be especially careful if they're planning to claim Social Security benefits early.

- Forewarned Is Forearmed. Lastly, do a bit of homework. ...

At what age is Social Security not taxable?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How much of my Social Security income is taxable?

Income Taxes And Your Social Security Benefit (En español) between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Are Social Security benefits taxed after age 66?

Are Social Security benefits taxable regardless of age? Yes. The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level — specifically, what the Internal Revenue Service calls your “provisional income.”

How do I know if my Social Security is tax exempt?

If you file as an individual, your Social Security is not taxable only if your total income for the year is below $25,000. Half of it is taxable if your income is in the $25,000–$34,000 range. If your income is higher than that, then up to 85% of your benefits may be taxable.

How do I avoid paying taxes on my Social Security benefits?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

What percentage of Social Security is taxable in 2020?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

Are SS benefits taxed after age 70?

Yes, Social Security is taxed federally after the age of 70. If you get a Social Security check, it will always be part of your taxable income, regardless of your age.

How much can a retired person earn without paying taxes in 2021?

In 2021, the income limit is $18,960. During the year in which a worker reaches full retirement age, Social Security benefit reduction falls to $1 in benefits for every $3 in earnings. For 2021, the limit is $50,520 before the month the worker reaches full retirement age.

Quick Rule: Is My Social Security Income Taxable?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security...

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never...

How to File Social Security Income on Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this par...

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay...

State Taxes on Social Security Benefits

Everything we’ve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes. As y...

Tips For Saving on Taxes in Retirement

1. What you pay in taxes during your retirement will depend on how retirement friendly your state is. So if you want to decrease tax bite, consider...

How much of a person's income is taxable?

Fifty percent of a taxpayer's benefits may be taxable if they are: Filing single, single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Married filing separately and lived apart from their spouse for all of 2019 with $25,000 to $34,000 income.

Is Social Security taxable if married filing jointly?

If they are married filing jointly, they should take half of their Social Security, plus half of their spouse's Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable .

Do you pay taxes on Social Security?

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income payments, which aren't taxable. The portion of benefits that are taxable depends on ...

What is the tax rate for Social Security?

Together, the Social Security and Medicare programs make up the Federal Insurance Contributions Act (FICA)tax rate of 15.3%. Currently, the Social Security taxis 12.4% — half of which is paid by the employer, with the other 6.2% paid by the worker through payroll withholding.

Do public employees have Social Security?

These days, most public employees have Social Security coverage — and thus pay into the system out of their paychecks — but there are still a few exceptions. These include public workers who participate in a government pension plan comparable to Social Security. In addition, federal workers, including members of Congress, ...

Is high income taxed in 2020?

High-income employeesare not technically exempt from Social Security taxes, but part of their income is. In 2020, every dollar of taxable income someone makes above $137,700 will effectively be exempt from Social Security taxes.

Do students who work at university pay Social Security?

Currently enrolled students who work at their university can be exempt from Social Security taxes. The exemption, though, only covers income earned from that job; any earnings from a second job off-campus will be subject to all taxes. The student exemption covers medical residents as well.

Do children under 18 have to pay Social Security?

Children under 18 who work for their parents in a family-owned business also do not have to pay Social Security taxes. Likewise, people under 21 who work as housekeepers, babysitters, gardeners or perform similar domestic work are exempt from this tax. 3) Employees of Foreign Governments and Nonresident Aliens.

Does not paying into Social Security increase your take home pay?

The Bottom Line. Although not paying into the Social Security program can increase your take-home pay, it can also lead to less supplemental income in retirement.

Do religious groups pay Social Security taxes?

However, there are certain groups of taxpayers for which Social Security taxes do not apply, including: 1) Religious Organizations. Members of some religious groups can be exempt from paying in to Social Security under certain circumstances.

How much do you have to pay taxes on your Social Security benefits?

You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000. If you file a joint return, you must pay taxes if you and your spouse have “combined income” of more than $32,000.

Do I have to pay taxes if I am married?

If you are married and file a separate return, you probably will have to pay taxes on your benefits. See Retirement Benefits: Income Taxes and Your Social Security Benefits for more information.

How much do married couples pay on Social Security?

Married couples who lived apart from each other throughout the entire year can use the same base amount as single filers, $25,000. 1 .

What is the income threshold for married couples filing separately?

The income thresholds for married couples filing together are $32,000 for the base amount and $44,000 for an additional amount. 2 . For married couples who file separate tax returns, it all depends on whether they spent any part of the year living together.

What is the federal tax rate for 2020?

Federal income tax can be withheld at a rate of 7%, 10%, 12%, or 22% as of the tax year 2020. 3 You're limited to these exact percentages—you can't opt for another percentage or a flat dollar amount.

Is Social Security taxable?

Your tax liability depends on other details about your situation. Social Security benefits might be either non-taxable or partially taxable. Keep reading to learn the factors that determine whether or not you'll owe taxes on your Social Security benefits.

What is exempt from a levy?

The property exempt from levy in subsection (a) includes wearing apparel and school books; fuel, provisions, furniture, and personal effects, not to exceed $500 in value; books and tools of a trade, business, or profession, not to exceed $250 in value.

What is Section 207 of the Social Security Act?

Section 207 of the Social Security Act provides: "The right of any person to any future payment under this title shall not be transferable or assignable, at law or in equity, and none of the moneys paid or payable or rights existing under this title shall be subject to execution, levy, attachment, garnishment, or other legal process, ...

Is Social Security exempt from garnishment?

20 CFR 404.970. Generally, Social Security benefits are exempt from execution, levy, attachment, garnishment, or other legal process, or from the operation of any bankruptcy or insolvency law.

Is Social Security considered money?

This section defines the terms used in section 459 and specifically provides that monthly Social Security benefits are considered moneys subject to legal process brought by an individual to enforce a legal obligation to provide child support or to make alimony payments.

Only 12 states actually levy a tax on Social Security benefits

Ward Williams is an Associate Editor with over four years of professional editing, proofreading, and writing experience. Ward is also an expert on government and policy as well as company profiles. He received his B.A. in English from North Carolina State University and his M.S. in publishing from New York University.

Understanding Taxes on Social Security Benefits

Since 1983, Social Security payments have been subject to taxation by the federal government. 5 How much of a person’s benefits are taxed will vary, depending on their combined income (defined as the total of their adjusted gross income (AGI), nontaxable interest, and half of their Social Security benefits) and filing status.

Social Security Benefit Taxation by State

Out of all 50 states in the U.S., 38 states and the District of Columbia do not levy a tax on Social Security benefits. 2 Of this number, nine states—Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming—do not collect state income tax, including on Social Security income. 8

Are States That Tax Social Security Benefits Worse for Retirees?

Including Social Security benefits in taxable income doesn’t make a state a more expensive place to retire.

Which state is the most tax-friendly for retirees?

Although there’s no official measure of tax friendliness, Delaware is a strong contender for the best state for retirees when it comes to taxes. The First State levies neither state or local sales tax, nor estate or inheritance tax. 40 41 Delaware’s median property tax rate is also one of the lowest in the U.S.

At what age is Social Security no longer taxable?

Whether or not a person’s Social Security benefits are taxable is determined not by their age but by their income—the amount that’s subject to taxation is referred to as “combined income” by the Social Security Administration. 1

The Bottom Line

Although low taxes shouldn’t be the sole motivating factor when deciding on a long-term residence, you still should be aware of which taxes the local government levies so as not to be caught unprepared when your next tax bill rolls in. State taxes on Social Security income can take a significant bite out of your retirement income.

How many states are imposing Social Security taxes in 2021?

Updated May 26, 2021. Fewer than half of all states impose income taxes on Social Security benefits. In all, 37 states (plus the District of Columbia) don't. Of the 13 states that do impose a tax, six follow the federal rules for determining the taxable portion of Social Security benefits. The remaining seven states have their own calculations ...

How much does Minnesota tax Social Security?

Minnesota partially taxes Social Security benefits. The state allows a subtraction from benefits ranging from $4,090 to $5,240, depending on filing status, but this rule is subject to phase-outs starting at incomes of $79,480 for joint married filers and $62,090 for heads of household and single filers. The subtraction is less for these incomes and eventually phases out entirely as you earn more. 4

What is the income limit for Social Security in Vermont?

Vermont previously followed the federal rules for determining the taxable portion of Social Security benefits, and then it adopted exemptions for taxpayers with incomes below $25,000 for single filers and $32,000 for other statuses.

How many states have phasing out the tax?

Only 13 states do, and one is phasing out the tax. Tonya Moreno is a tax expert who has worked as a tax accountant for numerous large muti-state corporations. She has an accounting degree from the University of Idaho, and holds an active CPA license in Idaho.

How much is the Colorado pension deduction?

Colorado's pension-subtraction system exempts up to $24,000 in pension and annuity income, including some Social Security benefits. The exemption is based on the age of taxpayers, starting at age 55. 1

Does Kansas tax Social Security?

Kansas exempts Social Security benefits from state tax, based on the taxpayer's income. Your Social Security benefits are exempt from Kansas income tax if your federal adjusted gross income (AGI) is $75,000 or less, regardless of your filing status. 3

Does Nebraska allow Social Security deductions?

Nebraska allows a deduction for Social Security income that's included in your federal federal adjusted gross income if your federal AGI is less than or equal to $58,000 for married couples filing jointly, or $44,600 for all other filers 6 6