Which states do not have Social Security taxes?

- Colorado

- Connecticut

- Kansas

- Minnesota

- Missouri

- Montana

- Nebraska

- North Dakota

- Rhode Island

- Vermont

What states charge tax on social security?

- Colorado: Social Security income received in Colorado will be taxed at the state’s flat rate of 4.55%. ...

- Connecticut: Connecticut’s Social Security income tax rate ranges from 3% to 6.99%. ...

- Kansas: In Kansas, Social Security benefits are taxed at the same rate as all other forms of income, with the tax rate ranging from 3.1% to 5.7%. ...

What states have no SS tax?

I'd like to retire in a no (or low ... unfortunately isn't that tax-friendly. But before I make any suggestions, let's talk more about taxes. Please look beyond whether a state has an income tax. Far more don't tax Social Security payments, for example.

Do you pay state taxes on social security?

The 37 remaining states impose no tax on Social Security income, regardless of the amount received or the recipient's gross income. Some of the states that exempt Social Security income from taxation also allow retirees to exclude other retirement income on their tax returns.

Which states do not tax Social Security payments?

States That Don't Tax Social SecurityAlaska.Florida.Nevada.New Hampshire.South Dakota.Tennessee.Texas.Washington.More items...•

Is Social Security included in state income tax?

Alaska, Nevada, Washington, and Wyoming don't have state income taxes at all, and Arizona, California, Hawaii, Idaho, and Oregon have special provisions exempting Social Security benefits from state taxation.

Are Social Security benefits subject to federal and state income tax?

Some people who get Social Security must pay federal income taxes on their benefits. However, no one pays taxes on more than 85% percent of their Social Security benefits. You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000.

What states charge income tax on Social Security?

The 12 states that tax Social Security are Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont and West Virginia.

Do most states tax Social Security benefits?

Most states, however, exempt Social Security from state taxes. The list of 37 states, plus the District of Columbia, that don't tax Social Security includes the nine states with no state income tax, as well as some other states that rank as the most tax-friendly states for retirees, such as Delaware and South Carolina.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Does Social Security benefits count as income?

Social Security benefits do not count as gross income. However, the IRS does count them in your combined income for the purpose of determining if you must pay taxes on your benefits.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

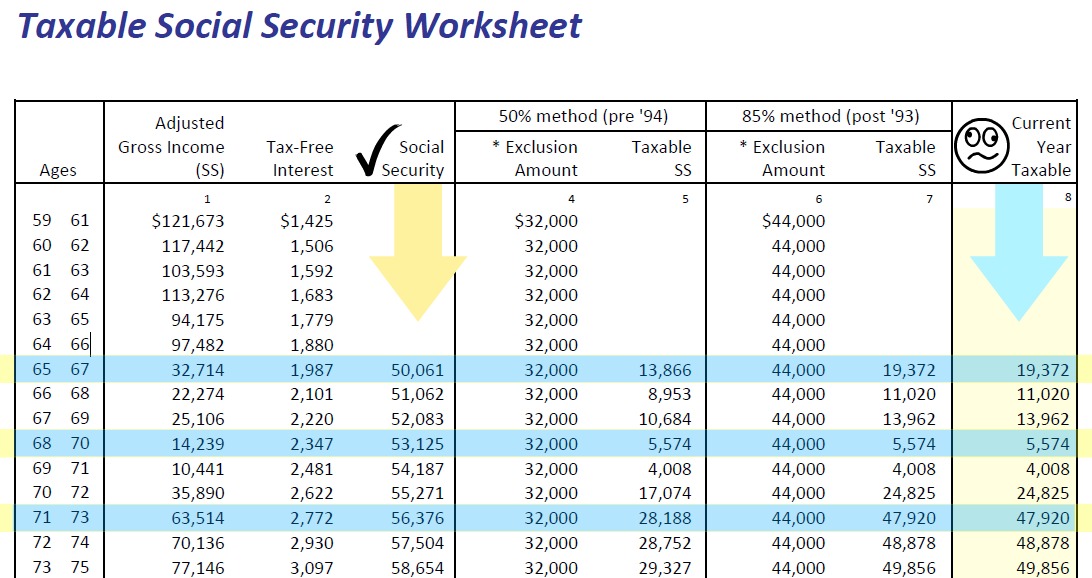

How do I figure the taxable amount of my Social Security benefits?

Calculating Taxable Social Security Benefits – Not as Easy as 0%, 50%, 85%Less than $25,000 single/$32,000 joint: 0% taxable.$25,000 to $34,000 single/$32,000 to $44,000 joint: up to 50% taxable.Greater than $34,000 single/$44,000 joint: up to 85% taxable.

What are the 12 state taxable Social Security benefits?

Twelve states also tax some or all of their residents' Social Security benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont and West Virginia.

Which states have no state tax for retirees?

Nine of those states that don't tax retirement plan income simply because distributions from retirement plans are considered income, and these nine states have no state income taxes at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

Is Social Security taxed after age 70?

Bottom Line. Yes, Social Security is taxed federally after the age of 70. If you get a Social Security check, it will always be part of your taxable income, regardless of your age.

Quick Rule: Is My Social Security Income Taxable?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security...

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never...

How to File Social Security Income on Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this par...

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay...

State Taxes on Social Security Benefits

Everything we’ve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes. As y...

Tips For Saving on Taxes in Retirement

1. What you pay in taxes during your retirement will depend on how retirement friendly your state is. So if you want to decrease tax bite, consider...

How much of your Social Security income is taxable?

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income. If you file as an individual with a total income that’s less than $25,000, you won’t have to pay taxes on your social security benefits in 2020, ...

How many states have Social Security taxes?

There are 13 states that collect taxes on at least some Social Security income. Four of those states (Minnesota, North Dakota, Vermont or West Virginia) follow the same taxation rules as the federal government.

How much to withhold from Social Security?

The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit . After you fill out the form, mail it to your closest Social Security Administration (SSA) office or drop it off in person.

How to save on taxes in retirement?

You can also save on your taxes in retirement simply by having a plan. Help yourself get ready for retirement by working with a financial advisorto create a financial plan. It may seem daunting to wade through the options, but a matching tool like SmartAsset’scan help you find a person to work with to meet your needs. Just answer some questions about your financial situation and the tool will match you with up to three advisors in your area.

How to find out if you will pay taxes on Social Security?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security benefits and add that amount to all your other income , including tax-exempt interest. This number is known as your combined income (combined income = adjusted gross income + nontaxable interest + half of your Social Security benefits).

How much tax do you pay on your income if you live in one of the states?

So if you live in one of those four states then you will pay the state’s regular income tax rates on all of your taxable benefits (that is, up to 85% of your benefits). The other nine states also follow the federal rules but offer deductionsor exemptions based on your age or income.

How to file Social Security income on federal taxes?

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099.

How much of a person's income is taxable?

Fifty percent of a taxpayer's benefits may be taxable if they are: Filing single, single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Married filing separately and lived apart from their spouse for all of 2019 with $25,000 to $34,000 income.

When is the IRS filing 2020 taxes?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS. Social Security Income.

How much income do you need to be married to be eligible for a widow?

Filing single, head of household or qualifying widow or widower with more than $34,000 income. Married filing jointly with more than $44,000 income. Married filing separately and lived apart from their spouse for all of 2019 with more than $34,000 income.

Is Social Security taxable if you are single?

If they are single and that total comes to more than $25,000, then part of their Social Security benefits may be taxable.

Do you pay taxes on Social Security?

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income payments, which aren't taxable. The portion of benefits that are taxable depends on ...

Only 12 states actually levy a tax on Social Security benefits

Ward Williams is an Associate Editor with over four years of professional editing, proofreading, and writing experience. Ward is also an expert on government and policy as well as company profiles. He received his B.A. in English from North Carolina State University and his M.S. in publishing from New York University.

Understanding Taxes on Social Security Benefits

Since 1983, Social Security payments have been subject to taxation by the federal government. 5 How much of a person’s benefits are taxed will vary, depending on their combined income (defined as the total of their adjusted gross income (AGI), nontaxable interest, and half of their Social Security benefits) and filing status.

Social Security Benefit Taxation by State

Out of all 50 states in the U.S., 38 states and the District of Columbia do not levy a tax on Social Security benefits. 2 Of this number, nine states—Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming—do not collect state income tax, including on Social Security income. 8

Are States That Tax Social Security Benefits Worse for Retirees?

Including Social Security benefits in taxable income doesn’t make a state a more expensive place to retire.

Which state is the most tax-friendly for retirees?

Although there’s no official measure of tax friendliness, Delaware is a strong contender for the best state for retirees when it comes to taxes. The First State levies neither state or local sales tax, nor estate or inheritance tax. 40 41 Delaware’s median property tax rate is also one of the lowest in the U.S.

At what age is Social Security no longer taxable?

Whether or not a person’s Social Security benefits are taxable is determined not by their age but by their income—the amount that’s subject to taxation is referred to as “combined income” by the Social Security Administration. 1

The Bottom Line

Although low taxes shouldn’t be the sole motivating factor when deciding on a long-term residence, you still should be aware of which taxes the local government levies so as not to be caught unprepared when your next tax bill rolls in. State taxes on Social Security income can take a significant bite out of your retirement income.

What states tax Social Security?

States have different ways of taxing Social Security, too. For example, New Mexico treats Social Security benefits the same way as the feds. But other states tax Social Security benefits only if income exceeds a specified threshold amount. For example, Missouri taxes Social Security benefits only if your income tops $85,000, or $100,000 for married couples. Then there's Utah, which includes Social Security benefits in taxable income, but starting in 2021 allows a tax credit for a portion of the benefits subject to tax. Other states have different methods of taxing your Social Security check.

How much is Social Security taxable?

Are Social Security benefits taxable? You can bet your bottom dollar they are – at least by the federal government, which taxes up to 85% of your benefits, depending on your income. But what about state taxes on Social Security? Unfortunately, a dozen states can tack on additional taxes of their own.

What is the income tax rate in Kansas?

Income Tax Range: Low: 3.1% (on $2,501 to $15,000 of taxable income for single filers and $5,001 to $30,000 for joint filers). High: 5.7% (on more than $30,000 of taxable income for single filers and more than $60,000 for joint filers). Kansas also has an "intangibles tax" levied on unearned income by some localities.

What is the tax rate for a taxable income of $60,000?

Income Tax Range: Low: 3% (on up to $10,000 of taxable income). High: 6.5% (on taxable income of $60,000 or more).

How much is Minnesota estate tax?

Inheritance and Estate Taxes: Minnesota’s estate tax exemption is $3 million, but the state looks back to include any taxable gifts made within three years prior to death as part of your estate. Tax rates range from 13% to 16%.

What is the Social Security deduction for 2021?

For 2021, taxpayers can chose to deduct 5% of Social Security benefits included in federal AGI instead of following the rules above. The optional deduction percentage increases to 20% for 2022, 30% for 2023, 40% for 2024, and 50% for 2025 and thereafter. (Note: The state legislature intends to enact future legislation that would increase the percentage to 60% for 2026, 70% for 2027, 80% for 2028, 90% for 2029, and 100% for 2030 and beyond.)

What is the sales tax rate in New Mexico?

Sales Tax: 5.125% state levy. Localities can add as much as 4.313%, and the average combined rate is 7.84%, according to the Tax Foundation. New Mexico's tax is a gross receipts tax that covers most services.

What is the federal tax rate for Social Security?

Federal income tax can be withheld at a rate of 7%, 10%, 12%, or 22% as of the tax year 2020. 3 You're limited to these exact percentages—you can't opt for another percentage or a flat dollar amount.

How much do married couples pay on Social Security?

Married couples who lived apart from each other throughout the entire year can use the same base amount as single filers, $25,000. 1 .

What is the income threshold for married couples filing separately?

The income thresholds for married couples filing together are $32,000 for the base amount and $44,000 for an additional amount. 2 . For married couples who file separate tax returns, it all depends on whether they spent any part of the year living together.

How to figure out your tax liability?

To figure out your tax liability, you must first calculate your "combined income," then compare it to the base amounts in the chart below. Your combined income is your total income from all other sources, including tax-exempt interest, plus half your Social Security benefits. 1

Can you make adjustments to your income to avoid crossing the threshold?

You can potentially make some adjustments to your income to avoid crossing that threshold. For example, you might want to give up that one-day-a-week job if it looks like your investment income and half your benefits are going to nudge you up against that provisional income threshold.

Is Social Security taxable?

Your tax liability depends on other details about your situation. Social Security benefits might be either non-taxable or partially taxable. Keep reading to learn the factors that determine whether or not you'll owe taxes on your Social Security benefits.

How many states tax Social Security?

All of the above concerns federal taxes; 13 states also tax Social Security to varying degrees. If you live in Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, North Dakota, Vermont, Utah or West Virginia, contact your state tax agency for details on how benefits are taxed.

What percentage of Social Security recipients owe income tax?

The Social Security Administration estimates that about 56 percent of Social Security recipients owe income taxes on their benefits. For purposes of determining how the Internal Revenue Service treats your Social Security payments, “income” means your adjusted gross income plus nontaxable interest income plus half of your Social Security benefits.

Is unemployment taxable in Colorado?

Some follow the federal rules for determining if benefits are taxable, others have their own sets of deductions and exemptions based on age or income, and Colorado, Nebraska and West Virginia are phasing out taxation of benefits entirely for most or all residents. Contact your state tax agency for details on how benefits are taxed.

Is Social Security income taxable?

Supplemental Security Income (SSI) is never taxable. If you do have to pay taxes on your benefits, you have a choice as to how: You can file quarterly estimated tax returns with the IRS or ask Social Security to withhold federal taxes from your benefit payment. Updated June 30, 2021.

Which states impose full income tax on Social Security?

You can click on the state to be directed to its tax authority. Montana. Montana imposes full income taxes on Social Security benefits. Utah. Although Utah imposes taxes, there are some tax credits available to residents depending on their age, filing status, and household income. New Mexico.

What states tax Social Security?

States That Fully Tax Social Security Benefits 1 Montana. Montana imposes full income taxes on Social Security benefits. 2 Utah. Although Utah imposes taxes, there are some tax credits available to residents depending on their age, filing status, and household income. 3 New Mexico. New Mexico doesn't exempt Social Security benefits, but does provide a small exemption for people who have low income or are over 65.

How much is a married person exempt from a state tax?

Married taxpayers who file jointly are exempt from paying state taxes on their Social Security benefits if their federal AGI is below $60,000. Colorado. People under 65 who receive Social Security benefits can exclude up to $20,000 of benefits from their state taxable income. Recipients 65 and older can exclude up to $24,000 ...

Is SSDI income taxed?

In the following states, SSDI income is taxed according to the taxpayer's federally adjusted gross income ( AGI ). However, some states exempt recipients whose income falls under certain thresholds. For more information, you can click on the state to be directed to its tax authority.

Do you have to pay taxes on Social Security disability?

Following are the various categories states fall into regarding the taxation of Social Security disability benefits: states that fully tax benefits, states that have no income tax, including tax on disability benefits, states that exempt disability benefits from income tax, states that tax disability benefits only when the recipient's AGI is under a certain amount, and states that tax disability benefits in the same way that the IRS does. Read on to determine into which category your state falls.

Is Social Security taxable?

Social Security payment s from Social Security Disability Insurance (SSDI) may be taxable in your state. The majority of states, however, exempt disability benefits from state taxation. (Also, read about when you have to pay federal taxes on your disability benefits .)

Does New Mexico have a Social Security exemption?

New Mexico. New Mexico doesn't exempt Social Security benefits, but does provide a small exemption for people who have low income or are over 65. You may be eligible for other disability-related income deductions or credits in these states. For more information, contact your tax professional.