To find out if their benefits are taxable, taxpayers should:

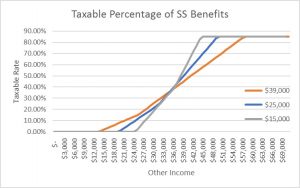

- If they are single and that total comes to more than $25,000, then part of their Social Security benefits may be taxable.

- If they are married filing jointly, they should take half of their Social Security, plus half of their spouse's Social...

Should I file taxes married or separate?

- These partners reported individual income and expenses on individual tax returns.

- They had to agree on either itemizing expenses or using the standard deduction.

- By filing separately, their similar incomes, miscellaneous deductions or medical expenses likely helped them save taxes.

Do I have to file married on my taxes?

Your filing status is determined on December 31 of each year, so even if you were not married for most of the tax year, you do not have the option of filing as single if you are married on that date. Generally, married filing jointly provides the most beneficial tax outcome for most couples because some deductions and credits are reduced or not ...

How do I file taxes when married?

Filing status. Married people can choose to file their federal income taxes jointly or separately each year. While filing jointly is usually more beneficial, it’s best to figure the tax both ways to find out which works best. Remember, if a couple is married as of December 31, the law says they’re married for the whole year for tax purposes

How to file separate income taxes when married?

This means:

- Both of you are responsible for the taxes, interest and penalties due on the return.

- You’d both be responsible for any underpayment of tax that might be due later.

- If one spouse doesn’t pay the tax due, the other might have to.

Is Social Security taxed on joint income?

You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000. If you file a joint return, you must pay taxes if you and your spouse have “combined income” of more than $32,000.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Does married filing jointly affect Social Security benefits?

Regardless of how much your spouse earns, it will not affect how much is held back from your benefit. Your spouse's income only affects you if your spouse has taken Social Security early and you are collecting spousal benefits on their work record.

How much of my Social Security income is taxable?

Income Taxes And Your Social Security Benefit (En español) between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

How can I avoid paying taxes on Social Security?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

Does Social Security benefits count as income?

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) one-half of your benefits, plus (2) all of your other income, including tax-exempt interest, is greater than the base amount for your filing status.

How much can a married couple make before Social Security is taxed?

$32,000If your total income is more than $25,000 for an individual or $32,000 for a married couple filing jointly, you must pay federal income taxes on your Social Security benefits. Below those thresholds, your benefits are not taxed.

What is the best Social Security strategy for married couples?

3 Social Security Strategies for Married Couples Retiring EarlyHave the higher earner claim Social Security early. ... Have the lower earner claim Social Security early. ... Delay Social Security jointly and live on savings or other income sources.

Does Social Security penalize married couples?

Not when it comes to each spouse's own benefit. Both can receive retirement payments based on their respective earnings records and the age when they claimed benefits. One payment does not offset or affect the other.

How much of my Social Security is taxable in 2021?

Between $25,000 and $34,000: You may have to pay income tax on up to 50% of your benefits. More than $34,000: Up to 85% of your benefits may be taxable.

Is Social Security taxed after age 70?

Yes, Social Security is taxed federally after the age of 70. If you get a Social Security check, it will always be part of your taxable income, regardless of your age.

How much can a retired person earn without paying taxes in 2021?

If you're 65 and older and filing singly, you can earn up to $11,950 in work-related wages before filing. For married couples filing jointly, the earned income limit is $23,300 if both are over 65 or older and $22,050 if only one of you has reached the age of 65.