Which states don't tax Social Security benefits?

37 States That Don’t Tax Social Security Benefits

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

What states charge tax on social security?

- Colorado: Social Security income received in Colorado will be taxed at the state’s flat rate of 4.55%. ...

- Connecticut: Connecticut’s Social Security income tax rate ranges from 3% to 6.99%. ...

- Kansas: In Kansas, Social Security benefits are taxed at the same rate as all other forms of income, with the tax rate ranging from 3.1% to 5.7%. ...

How do you calculate taxable social security benefits?

- $25,000 if you’re filing single, head of household, or married filing separately (living apart all year)

- $32,000 if you’re married filing jointly

- $0 if you’re married filing separately and lived together with your spouse at any point in the year

Does Colorado tax Social Security payments?

Colorado, one of the states that taxes at least some Social Security benefits, actually ranks as one of the 10 most tax-friendly state for retirees. That's why it's best to weigh all state taxes when researching the best places to retire. And our list of the 12 states that tax Social Security benefits will help you do just that.

How much of Social Security income is taxable in Colorado?

4.55 percentColorado. Benefit income is taxable at the state's flat rate of 4.55 percent. Coloradans, however, can deduct up to $20,000 in retirement income, including Social Security payments, if they are between the ages of 55 and 64 and up to $24,000 if they are 65 or older.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How much of Social Security benefits are taxable?

If you file as an individual, your Social Security is not taxable only if your total income for the year is below $25,000. Half of it is taxable if your income is in the $25,000–$34,000 range. If your income is higher than that, then up to 85% of your benefits may be taxable.

Is Colorado a tax friendly state for retirees?

Tax Breaks for Retirees Colorado is considered to be tax-friendly for retirees, allowing a deduction of $24,000 per year on all retirement income for taxpayers 65 years old and older.

How can I avoid paying taxes on Social Security?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

Do seniors pay taxes on Social Security income?

Many seniors are surprised to learn Social security (SS) benefits are subject to taxes. For retirees who are still working, a part of their benefit is subject to taxation. The IRS adds these earnings to half of your social security benefits; if the amount exceeds the set income limit, then the benefits are taxed.

How much of my Social Security is taxable in 2021?

Between $25,000 and $34,000: You may have to pay income tax on up to 50% of your benefits. More than $34,000: Up to 85% of your benefits may be taxable.

Which states do not tax Social Security?

States That Don't Tax Social SecurityAlaska.Florida.Nevada.New Hampshire.South Dakota.Tennessee.Texas.Washington.More items...•

Does Social Security income count as income?

For tax filers, Social Security income will always be includ- ed as part of total household income. For tax dependents, Social Security income will be includ- ed only if the dependent is required to file a federal in- come tax return.

What are the pros and cons of retiring in Colorado?

17 Pros and Cons of Retiring in Colorado#1 Pro – Enjoy the Scenery. ... #2 Pro – Colorado's Climate Can't be Beat. ... #3 Pro – Play Outside. ... #4 Pro – Pay Lower Taxes in Retirement. ... #5 Pro – Access High-Quality Medical Care. ... #6 Pro – Take in a Concert. ... #7 Pro – Get Season Tickets. ... #8 Pro – Take Day Trip Whenever You Want.More items...•

What taxes do retirees pay in Colorado?

Colorado is tax-friendly toward retirees. Social Security income is partially taxed. Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 5.90%.

What income is taxable in Colorado?

Colorado charges the same income tax rate for its residents regardless of how much you make. The standard deduction in Colorado is $12,550 for single taxpayers and $25,100 for married filers. The state does not have personal exemptions.

Quick Rule: Is My Social Security Income Taxable?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security...

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never...

How to File Social Security Income on Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this par...

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay...

State Taxes on Social Security Benefits

Everything we’ve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes. As y...

Tips For Saving on Taxes in Retirement

1. What you pay in taxes during your retirement will depend on how retirement friendly your state is. So if you want to decrease tax bite, consider...

How much can you deduct in Colorado retirement?

It also means relatively low taxes. Retirees can deduct between $20,000 and $24,000 in retirement income from state taxes in Colorado, depending on their age.

What is the Colorado sales tax rate?

The average total rate is 7.65%. That could hurt a retiree’s budget, but exemptions for groceries and prescription medicine should help lessen the blow.

What is senior property tax exemption?

The senior property tax exemption is a form of property tax relief available to seniors who own and occupy their home in Colorado. The exemption is equal to 50% of the first $200,000 in home value. So, for example, if a home is worth $100,000, $50,000 of that will be exempt from property tax.

What is the property tax rate in Colorado?

The average effective property tax rate in Colorado is 0.49%, one of the lowest in the U.S. Because the median home value in Colorado is $394,600, that means the typical Colorado homeowner pays $1,951 in property taxes each year.

What can a financial advisor do in Colorado?

A financial advisor in Colorado can help you plan for retirement and other financial goals. Financial advisors can also help with investing and financial plans, including taxes, homeownership, insurance and estate planning, to make sure you are preparing for the future.

Does Colorado tax capital gains?

Colorado does tax most types of capital gains at the state income tax rate of 4.63%, so it’s important to keep that in mind when selling any assets that aren’t part of a retirement account. The Centennial State does not have an estate tax or an inheritance tax.

Can you claim retirement income in Colorado?

Yes, but only above a certain level. Colorado offers a retirement income deduction of $20,000 annually for persons age 55 to 64 and $24,000 annually for persons age 65 and up. For married couples, each person can claim the deduction.

How much can I deduct from my Colorado Social Security?

Currently, taxpayers can deduct up to $24,000 of social security income from their Colorado taxable income. Under the change, that deduction will be unlimited, effectively eliminating state taxes on social security for people over 65.

When will Colorado's tax code be rewritten?

June 23, 2021. Hart Van Denburg/CPR News. The Colorado state Capitol in 2020. Colorado lawmakers finished a significant rewrite of the state’s tax code on Wednesday when Gov. Jared Polis signed two new laws. “We’re delivering tax relief for the people of Colorado,” Polis said, calling it one of the most exciting days of his term as governor.

When will the 529 deduction be changed?

Tax reformers argued that without the cap, the 529 accounts were providing too much benefit for wealthy families. The change takes effect in tax year 2022.

How much money did the state of New York draw in from the 2017 tax break?

That’s expected to draw in nearly $80 million in annual revenue.

When will the state tax deduction be eliminated?

That deduction will largely be eliminated starting in tax year 2022, forcing more people to pay state taxes when they sell assets like land, stock and businesses, in addition to federal taxes. People who own certain agricultural property will still be able to take a deduction.

Can you deduct 529 contributions?

People who put money in a 529 college savings account are allowed to take a deduction for those contributions — in essence, sending money straight into the savings account without paying taxes on it. The legislation caps that deduction at $30,000 per household per year.

Is Colorado going to change its tax rate?

It adds up to one of the biggest tax changes in more than a decade for Colorado, but none of the laws required voter approval because they don’t change the actual tax rates. The laws, sponsored mostly by Democrats, will affect several different groups of people and businesses.

Colorado

State Taxes on Social Security: For beneficiaries younger than 65, up to $20,000 of Social Security benefits can be excluded, along with other retirement income. Those 65 and older can exclude benefits and other retirement income up to $24,000.

Connecticut

State Taxes on Social Security: Social Security income is fully exempt for single taxpayers with federal adjusted gross income of less than $75,000 and for married taxpayers filing jointly with federal AGI of less than $100,000.

Kansas

State Taxes on Social Security: Social Security benefits are exempt from Kansas income tax for residents with a federal adjusted gross income of $75,000 or less. For taxpayers with a federal AGI above $75,000, Social Security benefits are taxed by Kansas to the same extent they are taxed at the federal level.

Minnesota

State Taxes on Social Security: Social Security benefits are taxable in Minnesota, but for 2021 a married couple filing a joint return can deduct up to $5,290 of their federally taxable Social Security benefits from their state income.

Missouri

State Taxes on Social Security: Social Security benefits are not taxed for married couples with a federal adjusted gross income less than $100,000 and single taxpayers with an AGI of less than $85,000. Taxpayers who exceed those income limits may qualify for a partial exemption on their benefits.

Montana

State Taxes on Social Security: Social Security benefits are taxable. The method used to calculate the taxable amount for Montana income tax purposes is similar to the method used for federal returns. However, there are important differences. As a result, the Montana taxable amount may be different than the federal taxable amount.

Nebraska

State Taxes on Social Security: For 2021, Social Security benefits are not taxed for joint filers with a federal adjusted gross income of $59,960 or less and other taxpayers with a federal AGI of $44,460 or less.

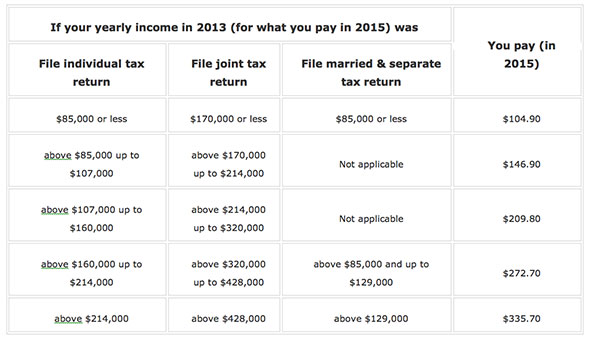

How much of your Social Security income is taxable?

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income. If you file as an individual with a total income that’s less than $25,000, you won’t have to pay taxes on your social security benefits in 2020, ...

How many states have Social Security taxes?

There are 13 states that collect taxes on at least some Social Security income. Four of those states (Minnesota, North Dakota, Vermont or West Virginia) follow the same taxation rules as the federal government.

How much to withhold from Social Security?

The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit . After you fill out the form, mail it to your closest Social Security Administration (SSA) office or drop it off in person.

How to find out if you will pay taxes on Social Security?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security benefits and add that amount to all your other income , including tax-exempt interest. This number is known as your combined income (combined income = adjusted gross income + nontaxable interest + half of your Social Security benefits).

How much tax do you pay on your income if you live in one of the states?

So if you live in one of those four states then you will pay the state’s regular income tax rates on all of your taxable benefits (that is, up to 85% of your benefits). The other nine states also follow the federal rules but offer deductionsor exemptions based on your age or income.

How to file Social Security income on federal taxes?

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099.

Do you pay taxes on Roth IRA?

With a Roth IRA, you save after-tax dollars. Because you pay taxes on the money before contributing it to your Roth IRA, you will not pay any taxes when you withdraw your contributions.

Only 12 states actually levy a tax on Social Security benefits

Ward Williams is an Associate Editor with over four years of professional editing, proofreading, and writing experience. Ward is also an expert on government and policy as well as company profiles. He received his B.A. in English from North Carolina State University and his M.S. in publishing from New York University.

Understanding Taxes on Social Security Benefits

Since 1983, Social Security payments have been subject to taxation by the federal government. 5 How much of a person’s benefits are taxed will vary, depending on their combined income (defined as the total of their adjusted gross income (AGI), nontaxable interest, and half of their Social Security benefits) and filing status.

Social Security Benefit Taxation by State

Out of all 50 states in the U.S., 38 states and the District of Columbia do not levy a tax on Social Security benefits. 2 Of this number, nine states—Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming—do not collect state income tax, including on Social Security income. 8

Are States That Tax Social Security Benefits Worse for Retirees?

Including Social Security benefits in taxable income doesn’t make a state a more expensive place to retire.

Which state is the most tax-friendly for retirees?

Although there’s no official measure of tax friendliness, Delaware is a strong contender for the best state for retirees when it comes to taxes. The First State levies neither state or local sales tax, nor estate or inheritance tax. 40 41 Delaware’s median property tax rate is also one of the lowest in the U.S.

At what age is Social Security no longer taxable?

Whether or not a person’s Social Security benefits are taxable is determined not by their age but by their income—the amount that’s subject to taxation is referred to as “combined income” by the Social Security Administration. 1

The Bottom Line

Although low taxes shouldn’t be the sole motivating factor when deciding on a long-term residence, you still should be aware of which taxes the local government levies so as not to be caught unprepared when your next tax bill rolls in. State taxes on Social Security income can take a significant bite out of your retirement income.

How many states tax Social Security?

Thirteen states tax Social Security benefits, a matter of significant interest to retirees. Each of these states has its own approach to determining what share of benefits is subject to tax, though these provisions can be grouped together into a few broad categories. Today’s map illustrates these approaches.

How much can I deduct from my Social Security in North Dakota?

North Dakota allows taxpayers to deduct taxable Social Security benefits if their AGI is less than $50,000 (single filer) or $100,000 (filing jointly).

What is the exemption for Social Security in Missouri?

Missouri allows a 100 percent Social Security exemption as long as the taxpayer is 62 or older and has less than $85,000 (single filer) or $100,000 (filing jointly) in annual income. Nebraska allows single filers with $43,000 in AGI or less ($58,000 married filing jointly) to subtract their Social Security income.

What is taxable income?

Taxable income is the amount of income subject to tax, after deductions and exemptions.

Which states have a Social Security exemption?

Kansas provides an exemption for such benefits for any taxpayer whose AGI is $75,000, regardless of filing status. Minnesota provides a graduated system of Social Security subtractions which kick in if someone’s provisional income is below $81,180 (single filer) or $103,930 (filing jointly). Missouri allows a 100 percent Social Security exemption ...

When will West Virginia stop paying Social Security taxes?

West Virginia passed a law in 2019 to begin phasing out taxes on Social Security for those with incomes not exceeding $50,000 (single filers) or $100,000 (married filing jointly). Beginning in tax year 2020, the state exempted 35 percent of benefits for qualifying taxpayers. As of 2021, that amount increased to 65 percent, and in 2022, ...

Does Utah tax Social Security?

Utah taxes Social Security benefits but uses tax credits to eliminate liability for beneficiaries with less than $30,000 (single filers) or $50,000 (joint filers), with credits phasing out at 2.5 cents for each dollar above these thresholds. Until this year, Utah’s credits mirrored the federal tax code, where the taxable portion ...