New York Taxability of Social Security Benefits

- Federal Income Tax. Not all recipients of Social Security will pay tax on their benefits. You must count Social Security...

- State Income Tax. New York is one of 36 states that do not impose any income tax on Social Security benefits. At the...

- New York Taxes. To complete your New York tax return, you must use your federal...

What states have no Social Security tax?

- Colorado

- Connecticut

- Kansas

- Minnesota

- Missouri

- Montana

- Nebraska

- New Mexico

- North Dakota

- Rhode Island

Does New York state tax Social Security and Pensions?

When it comes to income taxes, New York State is very tax-friendly for retirees. All Social Security retirement benefits are exempt from taxation. Income from retirement accounts or a private pension is deductible up to $20,000. There are several other types of taxes in New York that are not so favorable to retirees.

Does New York state tax Social Security?

While there are still federal taxes on Social Security for some, New York doesn't tax Social Security income at the state level, and will only tax some of the income from a retirement account. Frisch explains how these tax savings work for New York retirees.

Is social security subject to state income tax?

Currently, Social Security benefits subject to federal taxation are also subject to New Mexico income tax. New Mexico is one of only 12 states that taxes social security benefits. Nebraska recently joined the ranks of states removing the tax.

How much is Social Security taxed in NY?

Social Security: It's tax-free in New York While the IRS may tax you on up to 85% of on Social Security benefits, all Social Security income is tax-free on your New York State income tax return —regardless of income or the size of your Social Security benefit.

How do I calculate how much of my Social Security is taxable?

According to the IRS, the quick way to see if you will pay taxes on your Social Security income is to take one half of your Social Security benefits and add that amount to all your other income, including tax-exempt interest.

At what age is Social Security not taxable?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How much of my Social Security is taxable 2020?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Does Social Security benefits count as income?

Social Security benefits do not count as gross income. However, the IRS does count them in your combined income for the purpose of determining if you must pay taxes on your benefits.

Is Social Security considered gross income?

In addition, a portion of your Social Security benefits are included in gross income, regardless of your filing status, in any year the sum of half your Social Security benefit plus all of your adjusted gross income, plus all of your tax-exempt interest and dividends, exceeds $25,000, or $32,000 if you are married ...

How much of my Social Security is taxable in 2021?

Between $25,000 and $34,000: You may have to pay income tax on up to 50% of your benefits. More than $34,000: Up to 85% of your benefits may be taxable.

Do you pay taxes on Social Security after age 70?

Bottom Line. Yes, Social Security is taxed federally after the age of 70. If you get a Social Security check, it will always be part of your taxable income, regardless of your age.

Do you pay taxes on Social Security after 66?

Are Social Security benefits taxable regardless of age? Yes. The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level — specifically, what the Internal Revenue Service calls your “provisional income.”

Quick Rule: Is My Social Security Income Taxable?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security...

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never...

How to File Social Security Income on Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this par...

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay...

State Taxes on Social Security Benefits

Everything we’ve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes. As y...

Tips For Saving on Taxes in Retirement

1. What you pay in taxes during your retirement will depend on how retirement friendly your state is. So if you want to decrease tax bite, consider...

How much can you leave in New York State without paying taxes?

In short, since April 1 of 2017 each New York State resident can leave an estate of up to $5.25 million without owing any estate tax to New York. Starting in 2019, the $5.25 million exemption amount will be indexed to the federal exemption and will rise along with it.

How much is the added credit for low income?

Added Credit for Low Income Homeowners: If at least one member of a household is 65 or older, and the household’s gross income is $18,000 or less , there is a $375 tax credit payable to those who pay property taxes by virtue of being a homeowner, or who pay rent for their primary residence.

What is the double exemption for married couples?

Married couples get a double exemption, with each eligible for the $20,000 exclusion for a total of $40,000. This benefit applies to all taxpayers of any income level. Taxes on Public Pensions: Workers with New York State or local government pensions, federal government pensions, or certain public authorities get an added break: No state income tax ...

Is Social Security taxed in New York?

Taxes on Social Security: The good news here is that all Social Security income is tax-free in New York, regardless of your income or the size of your Social Security benefit. The federal government may tax some of your Social Security benefit if your income is above certain guidelines, but New York will take a pass.

Is New York a tax land?

New York State has long been known as the “land of taxes.”. Higher-than-average real estate, income, and sales taxes have been a reality for many years. However, New York offers some significant tax breaks to older residents, making it less onerous to retire and remain in the state.

Is annuity income included in income calculation?

However, any taxable income from annuities or IRAs is NOT included in the income calculation. Estate Taxes: The state recently changed its estate tax laws to move into conformity with the new, higher limits enacted in federal estate tax law.

Pension and annuity income

Your pension income is not taxable in New York State when it is paid by:

Return filing requirements

Even if you do not owe New York State income taxes, you may be required to file an income tax return. See filing information for:

How much of your Social Security income is taxable?

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income. If you file as an individual with a total income that’s less than $25,000, you won’t have to pay taxes on your social security benefits in 2020, ...

How many states have Social Security taxes?

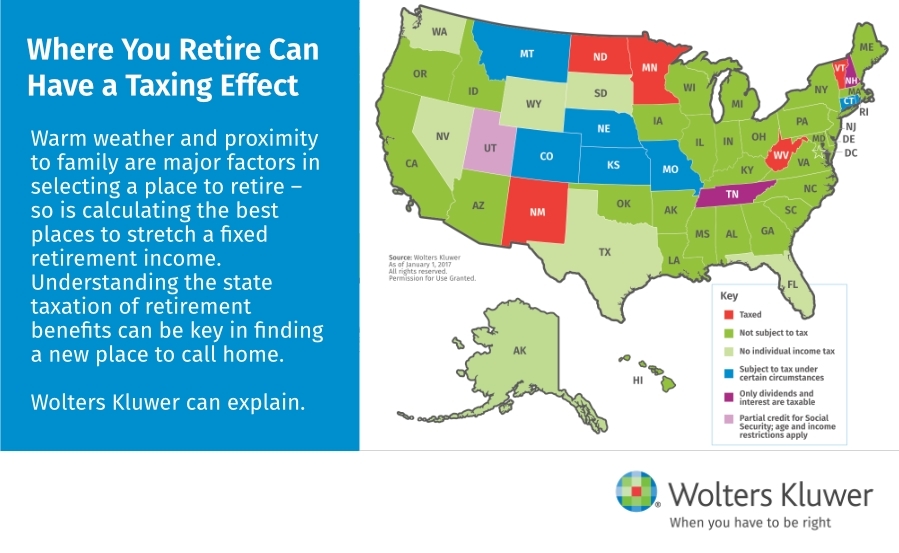

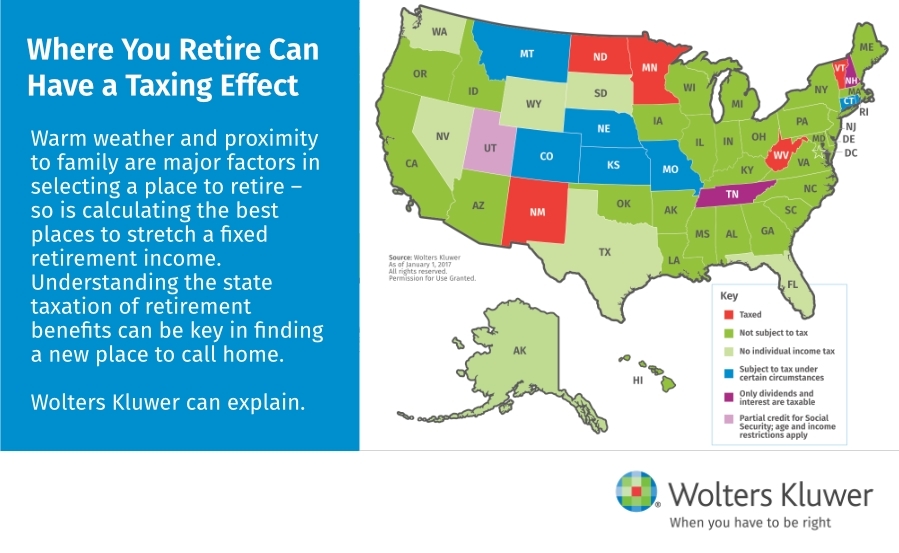

There are 13 states that collect taxes on at least some Social Security income. Four of those states (Minnesota, North Dakota, Vermont or West Virginia) follow the same taxation rules as the federal government.

How much to withhold from Social Security?

The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit . After you fill out the form, mail it to your closest Social Security Administration (SSA) office or drop it off in person.

How to find out if you will pay taxes on Social Security?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security benefits and add that amount to all your other income , including tax-exempt interest. This number is known as your combined income (combined income = adjusted gross income + nontaxable interest + half of your Social Security benefits).

How much tax do you pay on your income if you live in one of the states?

So if you live in one of those four states then you will pay the state’s regular income tax rates on all of your taxable benefits (that is, up to 85% of your benefits). The other nine states also follow the federal rules but offer deductionsor exemptions based on your age or income.

How to file Social Security income on federal taxes?

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099.

Do you pay taxes on Roth IRA?

With a Roth IRA, you save after-tax dollars. Because you pay taxes on the money before contributing it to your Roth IRA, you will not pay any taxes when you withdraw your contributions.

How much of a person's income is taxable?

Fifty percent of a taxpayer's benefits may be taxable if they are: Filing single, single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Married filing separately and lived apart from their spouse for all of 2019 with $25,000 to $34,000 income.

How much income do you need to be married to be eligible for a widow?

Filing single, head of household or qualifying widow or widower with more than $34,000 income. Married filing jointly with more than $44,000 income. Married filing separately and lived apart from their spouse for all of 2019 with more than $34,000 income.

Is Social Security taxable if married filing jointly?

If they are married filing jointly, they should take half of their Social Security, plus half of their spouse's Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable .

Do you pay taxes on Social Security?

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income payments, which aren't taxable. The portion of benefits that are taxable depends on ...

How many states tax Social Security?

Thirteen states tax Social Security benefits, a matter of significant interest to retirees. Each of these states has its own approach to determining what share of benefits is subject to tax, though these provisions can be grouped together into a few broad categories. Today’s map illustrates these approaches.

Which states have a Social Security exemption?

Kansas provides an exemption for such benefits for any taxpayer whose AGI is $75,000, regardless of filing status. Minnesota provides a graduated system of Social Security subtractions which kick in if someone’s provisional income is below $81,180 (single filer) or $103,930 (filing jointly). Missouri allows a 100 percent Social Security exemption ...

What is the exemption for Social Security in Missouri?

Missouri allows a 100 percent Social Security exemption as long as the taxpayer is 62 or older and has less than $85,000 (single filer) or $100,000 (filing jointly) in annual income. Nebraska allows single filers with $43,000 in AGI or less ($58,000 married filing jointly) to subtract their Social Security income.

What is taxable income?

Taxable income is the amount of income subject to tax, after deductions and exemptions.

How much can I deduct from my Social Security in North Dakota?

North Dakota allows taxpayers to deduct taxable Social Security benefits if their AGI is less than $50,000 (single filer) or $100,000 (filing jointly).

When will West Virginia stop paying Social Security taxes?

West Virginia passed a law in 2019 to begin phasing out taxes on Social Security for those with incomes not exceeding $50,000 (single filers) or $100,000 (married filing jointly). Beginning in tax year 2020, the state exempted 35 percent of benefits for qualifying taxpayers. As of 2021, that amount increased to 65 percent, and in 2022, ...

Does Utah tax Social Security?

Utah taxes Social Security benefits but uses tax credits to eliminate liability for beneficiaries with less than $30,000 (single filers) or $50,000 (joint filers), with credits phasing out at 2.5 cents for each dollar above these thresholds. Until this year, Utah’s credits mirrored the federal tax code, where the taxable portion ...

How much is a pension deductible in New York?

Income from retirement accounts or a private pension is deductible up to $20,000. There are several other types of taxes in New York that are not so favorable to retirees. The state’s sales taxes and property taxes both rank among the highest in the country. New York also has its own estate tax.

What is the property tax rate in New York?

The average effective property tax rate in New York State is 1.69%.

What is the STAR property tax exemption in New York?

There are two STAR property tax exemptions in New York: the basic exemption and the enhanced exemption. The basic exemption has no age restriction. It is available to any homeowner with household income of $250,000 or less. It exempts the first $30,000 in home value from school taxes.

What can a financial advisor do in New York?

A financial advisor in New York can help you plan for retirement and other financial goals. Financial advisors can also help with investing and financial planning - including taxes, homeownership, insurance and estate planning - to make sure you are preparing for the future.

Is a 401(k) deductible?

Yes, but they are deductible up to $20,000 . Income from an IRA, 401 (k) or company pension is all taxable. Seniors age 59.5 and older are eligible for the $20,000 deduction. This applies to the total of all retirement income.

Does New York tax Social Security?

New York is moderately tax-friendly for retirees. It does not tax Social Security benefits and provides seniors a sizable deduction of $20,000 on other types of retirement income. Retirees in New York should have relatively low income tax bills.

How to pay estimated taxes electronically?

You can pay estimated taxes electronically by creating an Individual Online Services account or by using Form IT-2105, Estimated Tax Payment Voucher for Individuals. To find out if you need to pay estimated tax, see Estimated taxes.

What can I do to pay less taxes?

What can I do to pay less tax? As a senior, you may qualify for special income tax benefits, including: modifications that reduce your federal adjusted gross income, which reduces your tax bill; tax credits, which may reduce your income tax due, or increase your tax refund; or. property tax benefits, credits, and exemptions.

How long do you keep tax returns?

Be sure to keep all your tax records, such as returns, receipts, and statements, for three years. We may ask you to produce records that prove your deductions or expenses.

Can you get a nursing home assessment credit if you owe taxes?

It can be found on the billing statement from the nursing home. It is not the amount of expenses paid. This credit can be refunded to you, even if you owe no tax.

Does New York have a senior exemption?

Local governments and school districts in New York State can opt to grant a reduction in property taxes paid by qualified seniors, by reducing the home’s assessment by as much as 50%. Seniors who receive STAR may also receive this exemption.

Do seniors have to pay estimated tax?

Estimated tax. Many seniors receive income that doesn’t have income tax withheld, such as pension or annuity income, interest, or some types of unexpected income. In such cases, you may need to pay estimated tax.

Only 12 states actually levy a tax on Social Security benefits

Ward Williams is an Associate Editor with over four years of professional editing, proofreading, and writing experience. Ward is also an expert on government and policy as well as company profiles. He received his B.A. in English from North Carolina State University and his M.S. in publishing from New York University.

Understanding Taxes on Social Security Benefits

Since 1983, Social Security payments have been subject to taxation by the federal government. 5 How much of a person’s benefits are taxed will vary, depending on their combined income (defined as the total of their adjusted gross income (AGI), nontaxable interest, and half of their Social Security benefits) and filing status.

Social Security Benefit Taxation by State

Out of all 50 states in the U.S., 38 states and the District of Columbia do not levy a tax on Social Security benefits. 2 Of this number, nine states—Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming—do not collect state income tax, including on Social Security income. 8

Are States That Tax Social Security Benefits Worse for Retirees?

Including Social Security benefits in taxable income doesn’t make a state a more expensive place to retire.

Which state is the most tax-friendly for retirees?

Although there’s no official measure of tax friendliness, Delaware is a strong contender for the best state for retirees when it comes to taxes. The First State levies neither state or local sales tax, nor estate or inheritance tax. 40 41 Delaware’s median property tax rate is also one of the lowest in the U.S.

At what age is Social Security no longer taxable?

Whether or not a person’s Social Security benefits are taxable is determined not by their age but by their income—the amount that’s subject to taxation is referred to as “combined income” by the Social Security Administration. 1

The Bottom Line

Although low taxes shouldn’t be the sole motivating factor when deciding on a long-term residence, you still should be aware of which taxes the local government levies so as not to be caught unprepared when your next tax bill rolls in. State taxes on Social Security income can take a significant bite out of your retirement income.