While you're working, your spousal benefit amount will be reduced only until you reach your full retirement, which is age 66 for those born between 1943 and 1954. If you are under full retirement age when you start getting your spousal benefits, $1 in benefits will be deducted for each $2 you earn above the annual limit.

How to maximize social security with spousal benefits?

According to the Social Security Administration, you may qualify for spousal benefits if:

- Your spouse is already collecting retirement benefits.

- You have been married for at least a year.

- You are at least 62 years old (unless you are caring for a child who is under 16 or disabled).

What can reduce my Social Security benefits?

To take a simple example:

- Say you claimed benefits 12 months prior to FRA. ...

- If you worked during that time, earned a lot of money, and ended up not actually receiving any benefits in 6 of those 12 months, you wouldn't get the 5/9 ...

- Instead of your PIA being reduced by 6.7%, it would only be reduced by around 3.35%

How much can a married couple get from Social Security?

You may need to produce these documents when you apply

- Your Social Security card.

- An original birth certificate or other proof of your birth.

- A copy of your W-2 form or self-employment tax return for the previous year.

- Your marriage certificate.

- If you weren't born in the United States, proof of U.S. citizenship or lawful alien status.

Is there cap on Social Security benefits for married couples?

Social Security Factors for Married Couples

- Eligibility for Spousal and Survivor Benefits. A married person may claim benefits on their own earnings record, but in many cases, they may also claim a benefit on their spouse’s ...

- Taxes on Social Security. Another factor overlooked by singles and married couples alike is the impact of taxes. ...

- Don’t Forget the Earnings Test. ...

- Calculate, Then Claim. ...

Can I collect spousal benefits if I am still working?

You can collect benefits on a spouse's work record regardless of whether you also worked. If you are eligible for both your own retirement benefit and a spousal benefit, Social Security will pay you the higher of the two amounts.

Will Working decrease my spousal survivor benefit?

No, the effect that working has on benefits is only on the benefits of the person who is actually working. It will have no effect on the benefits received by other family members. Learn more about survivors benefits for spouses and survivors benefits for divorced spouses, including the eligibility requirements.

What are the rules for spousal benefits of Social Security?

A spouse can choose to retire as early as age 62, but doing so may result in a benefit as little as 32.5 percent of the worker's primary insurance amount. A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months.

How spousal benefit is calculated?

A person's primary insurance amount is the amount of their monthly retirement benefit, if they file for that benefit exactly at their full retirement age. A Social Security spousal benefit is calculated as 50% of the other spouse's PIA.

How long does a widow receive survivor benefits?

for lifeWidows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

Is there an income limit to receive Social Security survivor benefits?

There's no earnings limit beginning with the month you reach full retirement age. Also, your earnings will reduce only your benefits, not the benefits of other family members. What if I remarry? Usually, you can't get widow's or widower's benefits if you remarry before age 60 (or age 50 if you're disabled).

When should lower earning spouse claim Social Security?

To claim a spousal benefit, the low earner must wait until the later of (1) reaching age 62 or (2) the month in which the high earner claims his own-record benefit. If the low earner claims the spousal benefit at or after FRA L, her benefit amount equals the PIA S.

Can I draw my own Social Security and then switch to spousal benefit?

In this case, you can claim your own Social Security beginning at 62 and make the switch to spousal benefits when your husband or wife files. Social Security will not pay the sum of your retirement and spousal benefits; you'll get a payment equal to the higher of the two benefits.

What is the best Social Security strategy for married couples?

3 Social Security Strategies for Married Couples Retiring EarlyHave the higher earner claim Social Security early. ... Have the lower earner claim Social Security early. ... Delay Social Security jointly and live on savings or other income sources.

Can my wife collect spousal Social Security benefits before I retire?

Can my spouse collect Social Security on my record before I retire? No. You have to be receiving your Social Security retirement or disability benefit for your husband or wife to collect spousal benefits.

What is the maximum amount you can earn while collecting Social Security in 2021?

Once you have turned your full retirement age, there is no limit on how much you can earn while collecting Social Security payments.

Can I draw on my husband's Social Security if he is still alive?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

How much of my spouse's retirement is my full benefit?

Your full spouse’s benefit could be up to 50 percent of your spouse’s full retirement age amount if you are full retirement age when you take it. If you qualify for your own retirement benefit and a spouse’s benefit, we always pay your own benefit first. You cannot receive spouse’s benefits unless your spouse is receiving his or her retirement ...

What happens if you take your reduced retirement first?

If you took your reduced retirement first while waiting for your spouse to reach retirement age, when you add spouse’s benefits later, your own retirement portion remains reduced which causes the total retirement and spouses benefit together to total less than 50 percent of the worker’s amount. You can find out more on our website.

What is the maximum survivor benefit?

The retirement insurance benefit limit is the maximum survivor benefit you may receive. Generally, the limit is the higher of: The reduced monthly retirement benefit to which the deceased spouse would have been entitled if they had lived, or.

Can my spouse's survivor benefit be reduced?

On the other hand, if your spouse’s retirement benefit is higher than your retirement benefit, and he or she chooses to take reduced benefits and dies first, your survivor benefit will be reduced, but may be higher than what your spouse received.

How much is spousal benefit?

Depending on how old you are when you file, the spousal benefit amount will range between 32.5% and 50% of the higher-earning spouse’s full retirement benefit. Check out the chart below to get an idea of how the benefit works and what your payment might be if you can take advantage ...

How long do you have to be married to qualify for spousal benefits?

You may also qualify for the spousal benefit If you’re divorced but the marriage lasted for at least 10 years and you’re not currently married.

What Does It Take to Qualify for Social Security Spousal Benefits?

Unlike most rules related to Social Security, the rules for the spousal benefit entitlement are pretty straightforward and easy to understand.

How many people receive Social Security benefits as a spouse?

A recent Social Security report found that 2.3 million individuals received at least part of their benefit as a spouse of an entitled worker. Some of these spouses had benefits of their own, but were eligible to receive higher benefit because the spousal benefit amount was greater than their own benefit. Others never worked outside the home ...

What is the most generous benefit available to retirees?

What’s one of the most generous benefits available to retirees? That’s easy. It’s Social Security spousal benefits ! These benefits are some of the most important, too.

What is Julie's reduction to her own benefit?

This means that Julie’s reduction to her own benefit would be based on her age when she filed for her benefit. However, her reduction to the spousal benefit would be based on her age when Joe filed for his benefit. So, if Julie filed when she was 62, her own benefit would be reduced.

How much of my spouse's Social Security is my full retirement?

Remember, in that case, it’s between 32.5% and 50% of the higher-earning spouse’s full retirement age benefit, depending on your filing age. However, it can seem a little more complicated if you have Social Security benefits from your work history.

What happens if my spouse has already filed for spousal support?

If your spouse has already filed, you will automatically receive the larger of your own or the spousal benefit. If your spouse has not filed yet but you have, when your spouse files, the deemed filing rules come into play.

How old do you have to be to claim spousal benefits?

To claim a spousal benefit based on an ex-spouse's earnings record, your ex-spouse has to be 62 and eligible for benefits, but there is no requirement that they must have already filed for benefits. 1 . To claim a spousal benefit based on your current spouse's earnings record, your current spouse must have filed for their own benefits already ...

Do you file for spousal or own Social Security?

When you file for your Social Security retirement benefits you are deemed to be filing for both your own benefit and a spousal benefit, and you will be given the higher of the two. 3

Can a spouse file for spousal benefits?

There used to be a strategy for married couples called " file and suspend " where one spouse would file but immediately suspend their benefits, which allowed the other spouse to file for spousal benefits. However, this strategy is no longer available. Due to Social Security laws that were passed in November 2015 anyone who suspends benefits after April 30, 2016, will end up suspending all benefits based on their record — which means a spouse cannot collect spousal benefits during a time when their spouse has "suspended" benefits. 3

Is Social Security confusing?

Social Security spousal benefits are confusing, and among the most common thing readers ask about. The most frequent cause for confusion comes from one small difference between benefits for a spouse versus an ex-spouse.

Can I switch from my own Social Security benefit to a spousal benefit?

You can only switch from your own Social Security benefits to spousal benefits if your spouse hasn't yet begun claiming benefits. 5 If you are eligible for Social Security benefits and spousal benefits at the time you initially file, then you will be given the higher of the two options. 3

Who Can Get a Spousal Benefit?

Current spouses and ex-spouses can both get the spousal benefit. You must have been married for over 10 years to get this income. 2

What happens to Social Security when a spouse dies?

When a person dies, their current or former spouse can often start getting their Social Security benefits. Whether this happens depends on several different factors.

How Does Early Retirement Affect Benefits?

Social Security is based on your lifetime earnings. Anyone will lose part of their own benefit if they retire early.

What Happens if One Spouse Dies?

If your spouse passes away, you can collect a survivor’s benefit as early as age 60. You will be able to get the maximum benefit, or the full amount of your spouse's monthly Social Security payment if you’ve reached FRA.

How Much Will Your Divorced Spouse Receive?

If you have not applied for retirement benefits, but can qualify for them, your ex-spouse can receive benefits on your record if you have been divorced for at least two continuous years.

How much life insurance can a married couple get if they delay Social Security?

In many cases, it can provide $50,000 to $250,000 of life insurance. Married couples should plan how to get the most out of both their spousal and survivor benefits.

How much of my spouse's Social Security is based on my work history?

If you take the benefits based on your spouse's work history and earnings, you will get 50% of the amount of your spouse’s Social Security benefit. This amount is calculated their full retirement age, or FRA. FRA depends on when you were born. You can check the Social Security website to find out how old you or your spouse need to be to reach FRA.

When are spousal benefits changed?

The rules applying to spousal benefits for anyone born after Jan. 1, 1954, were changed in 2015 legislation. If you file before your full retirement age for your benefits, you automatically are deemed applying for spousal benefits, as well, if your husband or wife is already getting Social Security.

What is the maximum amount of spousal benefits?

The maximum you can qualify for under spousal benefits generally is 50% of your spouse’s full-retirement-age benefits, although your early filing causes a reduction in that amount.

How much do you get spousal benefits at 62?

Also keep in mind that you would not get both the benefit from your own record and the spousal benefit — you’d get the higher of the two. Using the above scenario: If your monthly benefit at age 62 would be less than $650, you’d get $650. If your benefit were more, you’d get no spousal benefit.

What happens if my spouse dies?

It’s also important to note that if your spouse dies, you would file for survivor benefits, not spousal benefits. (More on that farther below.) And if you were born before that 1954 cutoff date, you may have other strategies available to you as a spouse.

How long do you have to wait to receive 50% of your spouse's retirement?

In other words, the only way to be eligible for the full 50% of the full-retirement-age spousal benefit is to wait until your own full retirement age — and that holds true even if your spouse filed early, Sherman said.

How many people received reduced Social Security benefits in 2018?

About 69% of the 43.7 million retired workers in 2018 received reduced benefits due to tapping them before their full retirement age, according to the Social Security Administration. The earliest you can file for benefits is age 62.

Can you claim 50% of your spousal benefits if you filed early?

However, because you filed early, you still wouldn’t be entitled to the full 50%. “The spousal benefit would still be reduced because you claimed early,” Sherman said. The spousal benefit would still be reduced because you claimed early. Peggy Sherman.

What happens if your spouse's retirement benefits are higher than your own?

If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits equaling the higher spouse benefit. Here is an example: Mary Ann qualifies for a retirement benefit of $250 and a spouse’s benefit of $400.

When will my spouse receive my full retirement?

You will receive your full spouse’s benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse’s record who is younger than age 16 or disabled.

How old do you have to be to get spouse's Social Security?

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age.

What is the maximum Social Security benefit for 2021?

In other words, if your income exceeds the cap on yearly earnings — which in 2021 is $18,960 for people who claim benefits before full retirement age — Social Security will withhold money from your retirement payments. (Full retirement age is 66 and 2 months and is gradually rising to 67 over the next several years.)

When does Social Security stop withholding money?

Once you reach full retirement age , the earnings limit disappears. Social Security will not withhold any money from any type of benefit regardless of how much you earn from work. Updated December 28, 2020.

Can Social Security withhold money from my spousal benefits?

Once you reach full retirement age, the earnings limit disappears. Social Security will not withhold any money from any type of benefit regardless ...

Does Social Security count as income for spouse?

En español | No. Even if you file taxes jointly, Social Security does not count both spouses’ incomes against one spouse’s earnings limit . It’s only interested in how much you make from work while receiving benefits.

Can my spouse take my Social Security early?

Your spouse’s income only affects you if your spouse has taken Social Security early and you are collecting spousal benefits on their work record. In this case, your spouse’s earnings could trigger withholding from both their retirement payment and your spousal benefits.

What happens if your spousal benefit is larger?

If your spousal benefit is larger, you will receive a combination of benefits that total that amount.

How much is delayed retirement worth?

Each year of delayed retirement is worth an additional 8% in benefits for those born between 1943 and 1954. So, for example, a person born in 1952 who retires in 2021 at age 69 will receive an additional 24% over and above what they would have received had they started collecting in 2018 at their full retirement age. However, only one person per couple may collect spousal benefits while earning delayed retirement credits on his or her own account.

What is the full retirement age for Social Security?

Full retirement age, for Social Security purposes, is between 66 and 67, depending on your year of birth. 2 . One exception: If you are caring for your spouse's child who is under age 16 or who receives Social Security disability benefits, you can collect spousal benefits at any age without a reduction. 3 . ...

Can a spouse apply for Social Security based on their own work record?

Spouses who aren't eligible for Social Security on their own work record can apply for benefits based on the other spouse's record.

Can you collect spousal benefits on your own?

However, only one person per couple may collect spousal benefits while earning delayed retirement credits on his or her own account. And, to repeat, this option is no longer available to anyone who wasn't born on or before Jan. 1, 1954.

Spousal Benefits For Spouses Versus Ex-Spouses

Deemed Filing Rules

- When you file for your Social Security retirement benefits you are deemed to be filing for both your own benefit and a spousal benefit, and you will be given the higher of the two.3 If you were born on or before Jan. 1, 1954, and you are full retirement age (FRA) or older, you can specify on your application that it is a restricted applicationand then you can choose to claim either your own be…

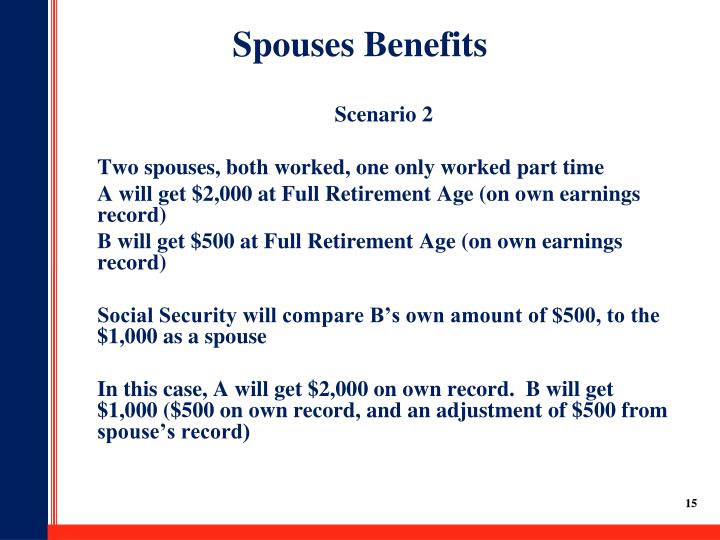

Excess Spousal Or Supplemental Spousal Benefit

- Normally a spousal benefit is 50% of the spouse's FRA benefit amount, reduced if the spouse claiming the spousal benefit is filing for benefits early.7 If one spouse is already receiving their own benefits, and later becomes eligible for a spousal benefit, there is a formula that is used to determine what amount of spousal benefit (if any) they ma...

Further Resources

- The calculations for spousal benefits are confusing and may require help from Social Security or a third-party expert. If you want to read more about how spousal benefits work, go to these resources on the Social Security website: Benefits for Spouses—This page also has a calculator that computes the effect of early retirement. Benefits Estimator—This page takes you to Social …