How much does a spouse get in Social Security?

A spouse can choose to retire as early as age 62, but doing so may result in a benefit as little ...

Can my spouse collect Social Security before I retire?

No. You have to be receiving your Social Security retirement or disability benefit for your husband or wife to collect spousal benefits. When can a spouse claim spousal benefits? You can claim spousal benefits as early as age 62, but you won’t receive as much as if you wait until your own full retirement age.

Does taking early social security hurt your spouse?

Taking early Social Security has an impact on the survivor benefits your spouse would be eligible to receive after your death, but a lot depends on your spouse's own work history and how much in benefits that work history would produce.

Can a husband and wife both collect Social Security?

Whether a husband and wife can both collect Social Security depends on a few factors. The circumstances at play include what type of benefits one or both partners receive, their ages, and their total income. There are also situations where each partner is eligible to collect their own benefits, but it may make more sense for one partner to receive spousal benefits from the other.

What are the rules for spousal benefits of Social Security?

To qualify for spouse's benefits, you must be one of these: At least 62 years of age. Any age and caring for a child entitled to receive benefits on your spouse's record and who is younger than age 16 or disabled.

When can a spouse claim spousal Social Security benefits?

You must have been married at least 10 years. You must have been divorced from the spouse for at least two consecutive years. You are unmarried. Your ex-spouse must be entitled to Social Security retirement or disability benefits.

When a husband and wife retire Do they both get Social Security?

Each spouse can claim their own retirement benefit based solely on their individual earnings history. You can both collect your full amounts at the same time. However, your spouse's earnings could affect the overall amount you get from Social Security, if you receive spousal benefits.

Can my wife claim my Social Security benefits?

If you're getting Social Security retirement benefits, some members of your family may also qualify to receive benefits on your record. If they qualify, your ex-spouse, spouse, or child may receive a monthly payment of up to one-half of your retirement benefit amount.

What is the best Social Security strategy for married couples?

3 Social Security Strategies for Married Couples Retiring EarlyHave the higher earner claim Social Security early. ... Have the lower earner claim Social Security early. ... Delay Social Security jointly and live on savings or other income sources.

Does a wife get 50 of husband's Social Security?

You can receive up to 50% of your spouse's Social Security benefit. You can apply for benefits if you have been married for at least one year. If you have been divorced for at least two years, you can apply if the marriage lasted 10 or more years.

Do married couples get 2 Social Security checks?

Not when it comes to each spouse's own benefit. Both can receive retirement payments based on their respective earnings records and the age when they claimed benefits. One payment does not offset or affect the other.

Can I collect my husband's Social Security if he is still alive?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

Can I collect on my husband Social Security at age 62?

Even if you are at full retirement age when you file for spousal benefits, your total monthly payment will be less than half of your spouse's primary insurance amount, reflecting the fact that your initial Social Security claim came early.

What age can a spouse file for Social Security?

When a worker files for retirement benefits, the worker's spouse may be eligible for a benefit based on the worker's earnings. Another requirement is that the spouse must be at least age 62 or have a qualifying child in her/his care. By a qualifying child, we mean a child who is under age 16 or who receives Social Security disability benefits.

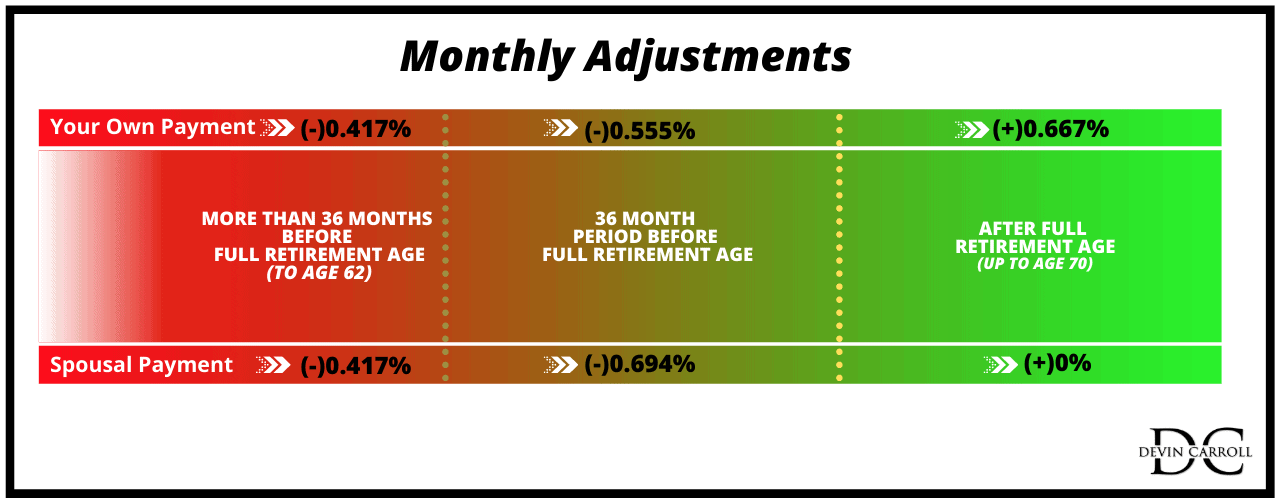

How much is spousal benefit reduced?

A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of one percent per month.

What is the reduction factor for spousal benefits?

For a spouse who is not entitled to benefits on his or her own earnings record, this reduction factor is applied to the base spousal benefit, which is 50 percent of the worker's primary insurance amount. For example, if the worker's primary insurance amount is $1,600 and the worker's spouse chooses to begin receiving benefits 36 months ...

Can a spouse reduce their spousal benefit?

However, if a spouse is caring for a qualifying child, the spousal benefit is not reduced. If a spouse is eligible for a retirement benefit based on his or her own earnings, and if that benefit is higher than the spousal benefit, then we pay the retirement benefit. Otherwise we pay the spousal benefit. Compute the effect of early retirement ...

How much is spousal benefit?

Depending on your age upon claiming, spousal benefits can range from 32.5 percent to 50 percent of your husband’s or wife’s primary insurance amount (the retirement benefit to which he or she is entitled at full retirement age, or FRA).

How long do you have to be married to collect spousal benefits?

You qualify for spousal benefits if: Your spouse is already collecting retirement benefits. You have been married for at least a year. You are at least 62 (unless you are caring for a child who is under 16 or disabled, in which case the age rule does not apply).

What percentage of survivor benefits are based on a child?

If the survivor benefit is based on your caring for a child, you receive 75 percent of the deceased’s benefit, ...

How much of a survivor's Social Security benefit do you get if you have a child?

If the survivor benefit is based on your caring for a child, you receive 75 percent of the deceased’s benefit, regardless of your own age when you file. Keep in mind. Your spousal benefit is not affected by the age at which your husband or wife claimed Social Security benefits.

What is survivor benefit?

In most cases, survivor benefits are based on the benefit amount the late spouse was receiving, or was eligible to receive, when he or she died. How much of that amount you are entitled to depends on your age when you file.

How long do you have to be married to receive survivor benefits?

The chief criteria to qualify for survivor benefits are: You were married to the deceased for at least nine months (unless the death is accidental or occurs in the line of military duty, in which case there is no minimum time period). You are at least age 60, unless you are disabled (then it’s 50) or caring for a child of ...

Does Social Security increase if late spouse files for FRA?

With survivor benefits, if your late spouse boosted his or her Social Security payment by waiting past FRA to file, your survivor benefit would also increase. Your spousal or survivor benefits may be reduced if you are under full retirement age and continue to work. Social Security is phasing in the FRA increase differently for different types ...

How much of my spouse's retirement is my full benefit?

Your full spouse’s benefit could be up to 50 percent of your spouse’s full retirement age amount if you are full retirement age when you take it. If you qualify for your own retirement benefit and a spouse’s benefit, we always pay your own benefit first. You cannot receive spouse’s benefits unless your spouse is receiving his or her retirement ...

What is the maximum survivor benefit?

The retirement insurance benefit limit is the maximum survivor benefit you may receive. Generally, the limit is the higher of: The reduced monthly retirement benefit to which the deceased spouse would have been entitled if they had lived, or.

What happens if you take your reduced retirement first?

If you took your reduced retirement first while waiting for your spouse to reach retirement age, when you add spouse’s benefits later, your own retirement portion remains reduced which causes the total retirement and spouses benefit together to total less than 50 percent of the worker’s amount. You can find out more on our website.

What does it mean to have a partner?

Having a partner means sharing many things including a home and other property. Understanding how your future retirement might affect your spouse is important. When you’re planning for your fun and vibrant golden years, here are a few things to remember:

Can my spouse's survivor benefit be reduced?

On the other hand, if your spouse’s retirement benefit is higher than your retirement benefit, and he or she chooses to take reduced benefits and dies first, your survivor benefit will be reduced, but may be higher than what your spouse received.

How many people receive Social Security benefits as a spouse?

A recent Social Security report found that 2.3 million individuals received at least part of their benefit as a spouse of an entitled worker. Some of these spouses had benefits of their own, but were eligible to receive higher benefit because the spousal benefit amount was greater than their own benefit. Others never worked outside the home ...

How much of my spouse's Social Security is my full retirement?

Remember, in that case, it’s between 32.5% and 50% of the higher-earning spouse’s full retirement age benefit, depending on your filing age. However, it can seem a little more complicated if you have Social Security benefits from your work history.

How much is spousal benefit?

Depending on how old you are when you file, the spousal benefit amount will range between 32.5% and 50% of the higher-earning spouse’s full retirement benefit. Check out the chart below to get an idea of how the benefit works and what your payment might be if you can take advantage ...

What is the 1 year requirement for Social Security?

The 1-year requirement is also waived if you were entitled (or potentially entitled!) to Social Security benefits on someone else’s work record in the month before you were married. An example of these benefits would be spousal benefits, survivor benefits or parent’s benefits.

What is Julie's reduction to her own benefit?

This means that Julie’s reduction to her own benefit would be based on her age when she filed for her benefit. However, her reduction to the spousal benefit would be based on her age when Joe filed for his benefit. So, if Julie filed when she was 62, her own benefit would be reduced.

How long do you have to be married to get spousal benefits?

The Two Exceptions to Know Around the 1 Year Marriage Requirement. Normally, you must be married for at least 12 continuous months to meet the spousal benefit duration-of-marriage requirement. However, there are two exceptions to this rule.

Can a spouse receive Social Security?

They have no benefit of their own, but thanks to the Social Security spousal benefit available under their spouse’s work record, they can still receive payments. This particular benefit doesn’t just provide retirement income, either. As an eligible spouse, you could also receive premium-free Medicare benefits.

When does my spouse get my spousal benefits?

If your spouse is caring for your child who is younger than 16, your spouse may receive the full amount of spousal benefit at any age, and until the child turns 16. If your spouse receives a spouse’s benefit based on your work record, your retirement benefits are not reduced, you receive the full amount of your benefit.

What happens if your spouse receives more than your spousal benefit?

If the spousal benefit is higher, he or she receives an additional amount to equal the spouse benefit amount. If your spouse does not qualify for an individual benefit, he or she may receive the spouse benefit amount of 50 percent of your benefits, if they are at full retirement age.

What is the spousal benefit for a person who has not reached retirement age?

If you decide to opt for the spousal benefit but have not yet reached full retirement age yourself, that benefit will be less than 50 percent. This may still be a good option if you have not been working much through the years.

When does a widow receive Social Security?

A widow or widower who has reached full retirement age, and whose spouse did not receive Social Security benefits until 70 years old, receives the full benefit amount of the deceased spouse.

Does Social Security pay your spouse first?

Social Security pays your benefits first, but if the benefits you would receive through your spouse are higher than yours, you can receive a combination of these benefits to reach the amount you would receive as a spouse.

What is the maximum Social Security benefit for a spouse?

The allowed Social Security retirement benefit for a spouse starts at 32.5% at age 62 and gradually increases to 50% of the amount that their spouse is eligible to receive at full retirement age, which is 66 or 67 depending on their birth year.

What is the maximum amount of benefits a spouse can receive?

Note that the maximum benefit for a spouse is 50% of their spouse’s benefit. That means that your spouse would have had to earn a substantial amount more over his or her working life to make that benefit higher ...

How old do you have to be to get spousal benefits?

The spouse must be at least 62 years old or have a qualifying child – a child who is under age 16 or who receives Social Security disability benefits – in his or her care.

How long do you have to wait to apply for Social Security?

You can first apply for Social Security if you are no more than three months away from age 62. But your benefits increase significantly if you wait until you reach full retirement age, which can be 66 or 67, depending on your year of birth. To apply for spousal benefits, go to the Social Security Administration (SSA) website.

How much Social Security can a widow receive?

Widows and widowers may be able to receive up to 100% of the deceased spouse's Social Security benefit. Social Security uses a formula for families with more than one eligible dependent to calculate maximum benefits.

Can same sex couples get Social Security?

Both opposite-sex and same-sex married couples are eligible for Social Security spousal and dependent benefits. So are some individuals in legal relationships such as civil unions and domestic partnerships. And those who were married for at least 10 years and have been divorced for at least two years also can apply.

Is Social Security complicated for married people?

Social security is complicated for individual filers, and being married can make it even more complicated. That’s because Social Security includes benefits for the spouse as well as the individual. When an individual files for retirement benefits, that person’s spouse may be eligible for a benefit based on the worker's earnings according to ...