What states tax SS Benefits?

- Colorado: Social Security income received in Colorado will be taxed at the state’s flat rate of 4.55%. ...

- Connecticut: Connecticut’s Social Security income tax rate ranges from 3% to 6.99%. ...

- Kansas: In Kansas, Social Security benefits are taxed at the same rate as all other forms of income, with the tax rate ranging from 3.1% to 5.7%. ...

How do you calculate taxable SS?

- Refund the employee. You will need to pay the employee back for the excess deduction amount. ...

- File a Corrected 941. If the mistake was included in Form 941 (quarterly payroll) report, you will need to file a correction form (941-X) to receive a refund.

- Change the employee's payroll record. ...

Do I have to pay taxes on my SSDI benefits?

The general rule is that if your total income, including Social Security disability benefits, exceeds $25,000 a year for an individual or $32,000 a year for a married couple, you have to pay federal taxes on that income.

Is there a maximum SS retirement benefit?

This cap is the maximum family Social Security benefit, and it’s typically 150% to 180% percent of the benefit that the primary beneficiary is entitled to at full retirement age. Social security ...

How much of your Social Security income is taxable?

Income Taxes And Your Social Security Benefit (En español) between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How can I avoid paying taxes on Social Security?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

Do seniors pay taxes on Social Security income?

Many seniors are surprised to learn Social security (SS) benefits are subject to taxes. For retirees who are still working, a part of their benefit is subject to taxation. The IRS adds these earnings to half of your social security benefits; if the amount exceeds the set income limit, then the benefits are taxed.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

How much can a retired person earn without paying taxes in 2021?

If you're 65 and older and filing singly, you can earn up to $11,950 in work-related wages before filing. For married couples filing jointly, the earned income limit is $23,300 if both are over 65 or older and $22,050 if only one of you has reached the age of 65.

Are Social Security benefits taxed after age 66?

Are Social Security benefits taxable regardless of age? Yes. The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level — specifically, what the Internal Revenue Service calls your “provisional income.”

Is Social Security taxed after age 70?

Yes, Social Security is taxed federally after the age of 70. If you get a Social Security check, it will always be part of your taxable income, regardless of your age.

How much will I get from Social Security if I make $30000?

1:252:31How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars whichMoreYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars which comes out to just under 500 bucks.

Quick Rule: Is My Social Security Income Taxable?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security...

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never...

How to File Social Security Income on Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this par...

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay...

State Taxes on Social Security Benefits

Everything we’ve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes. As y...

Tips For Saving on Taxes in Retirement

1. What you pay in taxes during your retirement will depend on how retirement friendly your state is. So if you want to decrease tax bite, consider...

What percentage of Social Security recipients owe income tax?

The Social Security Administration estimates that about 56 percent of Social Security recipients owe income taxes on their benefits. For purposes of determining how the Internal Revenue Service treats your Social Security payments, “income” means your adjusted gross income plus nontaxable interest income plus half of your Social Security benefits.

How many states tax Social Security?

All of the above concerns federal taxes; 13 states also tax Social Security to varying degrees. If you live in Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, North Dakota, Vermont, Utah or West Virginia, contact your state tax agency for details on how benefits are taxed.

Is Social Security income taxable?

Supplemental Security Income (SSI) is never taxable. If you do have to pay taxes on your benefits, you have a choice as to how: You can file quarterly estimated tax returns with the IRS or ask Social Security to withhold federal taxes from your benefit payment. Updated June 30, 2021.

Do Social Security payments count toward income?

If your child receives Social Security dependent or survivor benefits, those payments do not count toward your taxable income. That money is taxable if the child has sufficient income (from Social Security and other sources) to have to file a return in his or her own name.

How much to withhold from Social Security?

The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit . After you fill out the form, mail it to your closest Social Security Administration (SSA) office or drop it off in person.

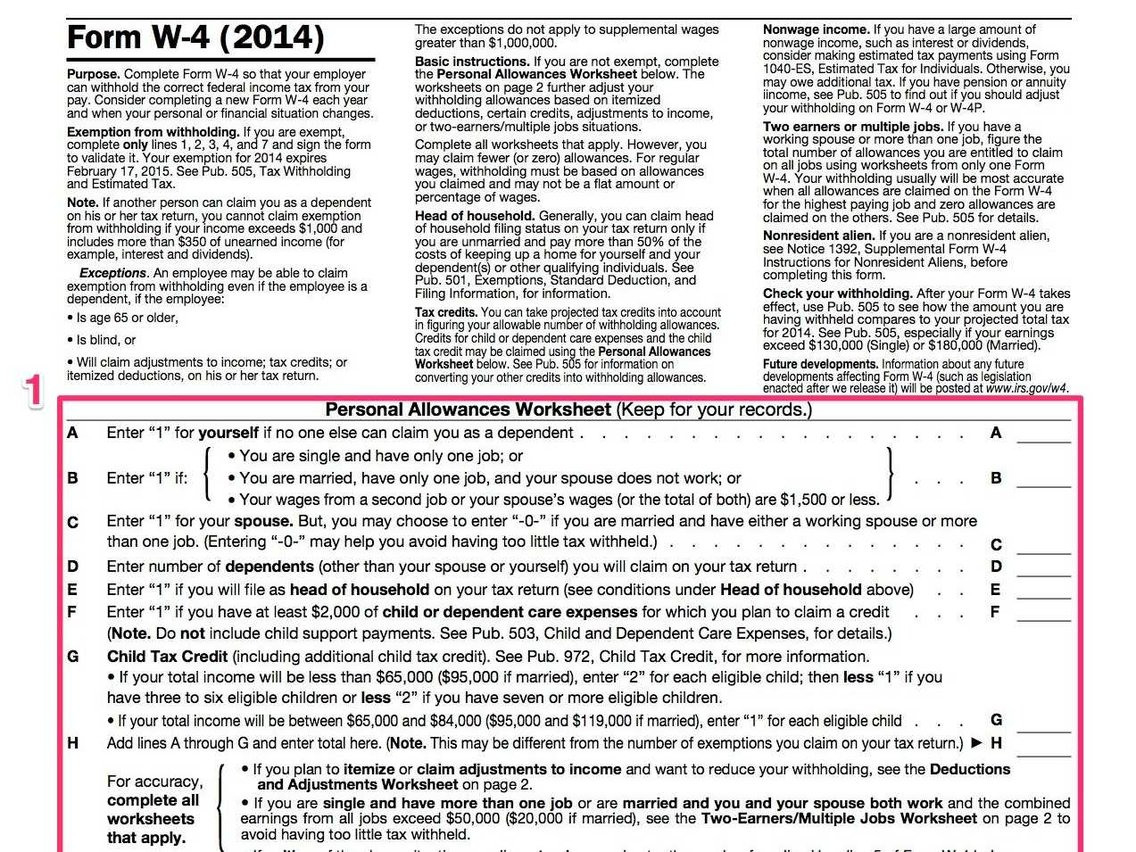

How many lines are there on a W-4V?

To withhold taxes from your Social Security benefits, you will need to fill out Form W-4V(Voluntary Withholding Request). The form only has only seven lines.

How to find out if you will pay taxes on Social Security?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security benefits and add that amount to all your other income , including tax-exempt interest. This number is known as your combined income (combined income = adjusted gross income + nontaxable interest + half of your Social Security benefits).

How much tax do you pay on your income if you live in one of the states?

So if you live in one of those four states then you will pay the state’s regular income tax rates on all of your taxable benefits (that is, up to 85% of your benefits). The other nine states also follow the federal rules but offer deductionsor exemptions based on your age or income.

How to file Social Security income on federal taxes?

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099.

What to do with a Roth IRA?

If you’re concerned about your income tax burden in retirement, consider saving in a Roth IRA. With a Roth IRA, you save after-tax dollars. Because you pay taxes on the money before contributing it to your Roth IRA, you will not pay any taxes when you withdraw your contributions. You also do not have to withdraw the funds on any specific schedule after you retire. This differs from traditional IRAs and 401 (k) plans, which require you to begin withdrawing money once you reach 72 years old (or 70.5 if you were born before July 1, 1949).

How many states have Social Security taxes?

There are 13 states that collect taxes on at least some Social Security income. Four of those states (Minnesota, North Dakota, Vermont or West Virginia) follow the same taxation rules as the federal government.

How much of your Social Security benefits are taxable?

more than $34,000, up to 85 percent of your benefits may be taxable. between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. more than $44,000, up to 85 percent of your benefits may be taxable. are married and file a separate tax return, you probably will pay taxes on your benefits.

Do I pay taxes on my Social Security benefits if I am married?

are married and file a separate tax return, you probably will pay taxes on your benefits. Each January, you will receive a Social Security Benefit Statement (Form SSA-1099) showing the amount of benefits you received in the previous year. You can use this Benefit Statement when you complete your federal income tax return to find out ...

Can I get a replacement for my Social Security 1099?

If you currently live in the United States and you misplaced or didn't receive a Form SSA-1099 or SSA-1042S for the previous tax year, you can get an instant replacement form by using your online my Social Security ...

Why are survivor benefits not taxed?

Survivor benefits paid to children are rarely taxed because few children have other income that reaches the taxable ranges. The parents or guardians who receive the benefits on behalf of the children do not have to report the benefits as income. 4

How to minimize Social Security?

2. Withdraw Taxable Income Before Retirement. Another way to minimize your taxable income when drawing Social Security is to maximize, or at least increase, your taxable income in the years before you begin to receive benefits. You could be in your peak earning years between ages 59½ and retirement.

What is included in Social Security income?

That may include wages, self-employed earnings, interest, dividends, required minimum distributions from qualified retirement accounts, and any other taxable income. Then, any tax-exempt interest is added.

How much do you owe on Social Security spousal benefits?

The rules for the spousal benefit are the same as for all other Social Security recipients. If your income is above $25,000, you will owe taxes on up to 50% of the benefit amount. The percentage rises to 85% if your income is above $3 4,000. 2

How to keep Social Security benefits free from taxes?

The simplest way to keep your Social Security benefits free from income tax is to keep your total combined income so low it falls below the thresholds to pay tax. However, few choose to live in poverty just to minimize their taxes. A more realistic goal is to limit how much tax you owe.

How much of Social Security is taxable?

Up to 50% of Social Security income is taxable for individuals with a total gross income including Social Security of at least $25,000, or couples filing jointly with a combined gross income of at least $32,000.

How many states tax Social Security?

There are 13 states which tax Social Security benefits in some cases. If you live in one of those states—Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia—check with the state tax agency. 8 9 As with the federal tax, how these agencies tax Social Security varies by income and other criteria.

How much do you have to pay taxes on your Social Security benefits?

You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000. If you file a joint return, you must pay taxes if you and your spouse have “combined income” of more than $32,000.

Do I have to pay taxes if I am married?

If you are married and file a separate return, you probably will have to pay taxes on your benefits. See Retirement Benefits: Income Taxes and Your Social Security Benefits for more information.

What is the tax torpedo on Social Security?

The odd way Social Security benefits are taxed can cause something called the “tax torpedo,” which is a sharp rise and then drop in marginal tax rates. (A marginal tax rate is basically how much additional tax you pay on an additional dollar of income.)

How much does a tax torpedo affect Social Security?

24%. 24%. The tax torpedo can affect single people with other income that ranges from $10,733 to $48,706, depending on how much Social Security they get, and married couples with other income between $17,538 to $66,941. For example, for a couple receiving $20,000 in Social Security benefits, the tax torpedo inflates marginal tax rates ...

How to tell if you have a tax bill?

One way to tell if you might have a tax bill is to add half your annual benefits to your other income for the year. If the total is over $25,000 for singles or $32,000 for married couples, you could pay tax on at least some of your benefits. The taxes are based on your “combined income,” which includes:

How much of your Social Security benefits are taxable?

Up to 50% of your benefit. Over $44,000. Up to 85% of your benefit. If your benefits are taxable, it doesn’t mean that you will lose 50% to 85% of your checks. Instead, that’s the portion on which you’ll pay taxes at your regular income tax rate. (Federal income tax rates currently range from 10% to 37%.)

How much did Social Security reduce in the 70s?

Delaying benefits until 70 allowed them to reduce combined income by about $14,600, decreasing the taxable portion of Social Security benefits by about $12,400.

How long can you delay Social Security benefits?

How delaying benefits could trim your taxes. Middle-income people can reduce the tax torpedo’s effect by delaying the start of Social Security benefits until age 70 and taking income instead from retirement accounts or other savings, the researchers found.

What is a combined income tax?

The taxes are based on your “combined income,” which includes: Your adjusted gross income. That includes earnings, investment income and retirement plan withdrawals. Any tax-exempt interest, such as interest on municipal bonds. Half of your Social Security benefit. Here’s how it works if you’re single: