How do you calculate taxable SS?

- Refund the employee. You will need to pay the employee back for the excess deduction amount. ...

- File a Corrected 941. If the mistake was included in Form 941 (quarterly payroll) report, you will need to file a correction form (941-X) to receive a refund.

- Change the employee's payroll record. ...

How much are survivor SSA benefits?

The amount of Social Security benefits that you are eligible for varies depending on whether or not you are currently working, or how much your spouse was earning at the time of their death. How do I prove that I qualify for survivor benefits? The Social ...

Do you have to claim Surviver benefits on your taxes?

Your son’s Social Security survivors benefits will not affect your taxes in any way since you do not have to report his Social Security income on your tax return. In fact, because your son has no other income, he will not have to file a tax return for this monthly $1,050 benefit as it is not taxable to him.

How your spouse earns Social Security Survivors Benefits?

How your spouse earns Social Security Survivors Benefits Social Security work credits are based on your total yearly wages or self-employment income. You get one credit quarterly for every $1,470 dollars you earn in 2021, and you can earn up to four credits .

Is deceased spousal Social Security taxable?

Up to 85% of a widow's Social Security survivors benefits could be taxed.

Are survivor benefits considered household income?

Social Security income includes retirement, survivor benefits, and disability payments. For the most part, only taxable sources of income count in determining household MAGI-based income.

What is the difference between survivor benefits and widow benefits?

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

Where do I claim survivor benefits on my taxes?

Social Security reports payment of survivors benefits on Form 1099-SSA. These benefits may be taxable; to calculate the tax rate, the beneficiary must add one-half of the benefits to other earned and unearned income, including tax-exempt interest.

How long do you get survivor benefits?

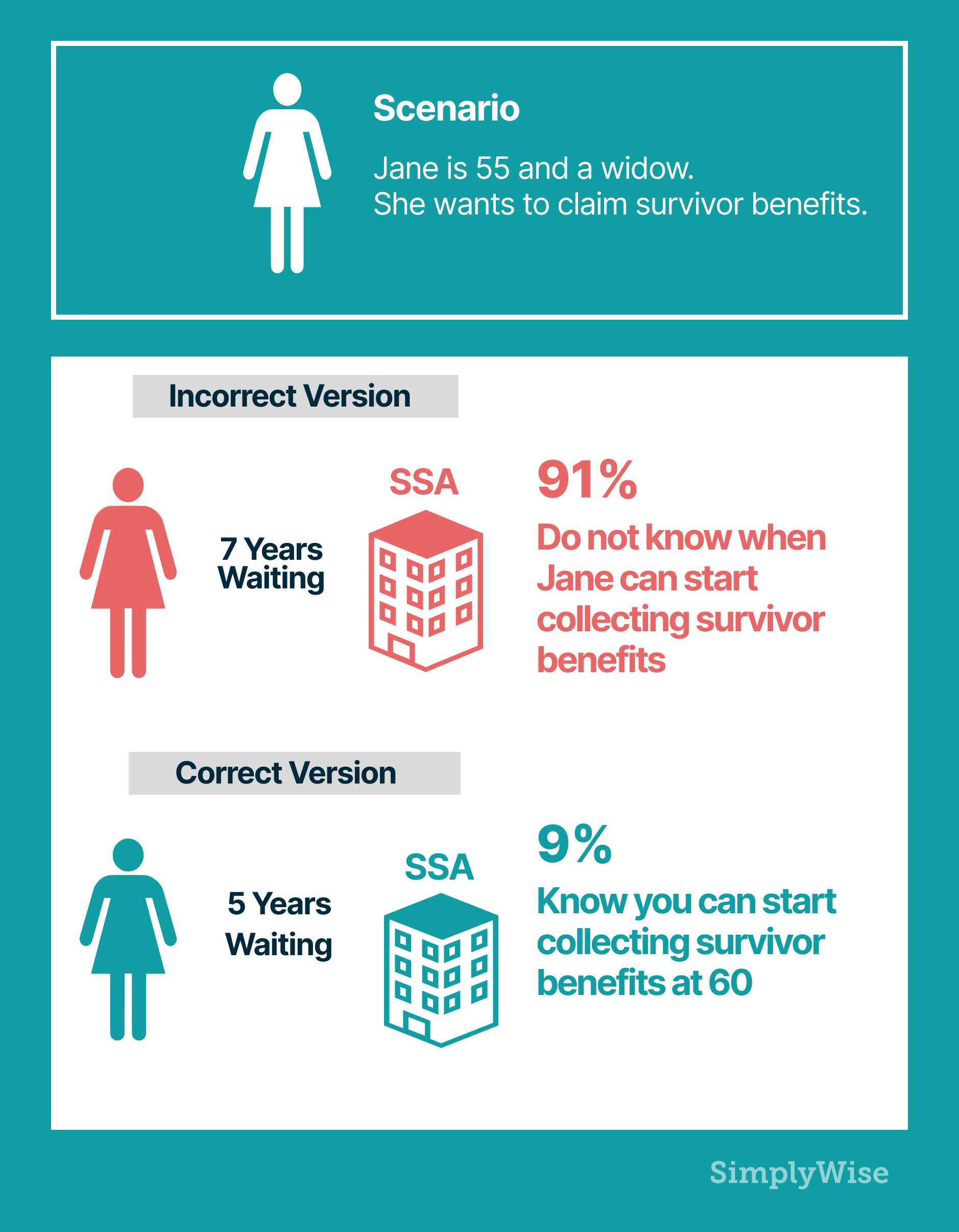

lifeGenerally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

What happens when both spouse's collect Social Security and one dies?

Many people ask “can I collect my deceased spouse's social security and my own at the same time?” In fact, you cannot simply add together both a survivor benefit and your own retirement benefit. Instead, Social Security will pay the higher of the two amounts.

Can I receive Social Security benefits and survivor benefits at the same time?

Social Security allows you to claim both a retirement and a survivor benefit at the same time, but the two won't be added together to produce a bigger payment; you will receive the higher of the two amounts. You would be, in effect, simply claiming the bigger benefit.

At what age is Social Security not taxable?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How to determine taxability of benefits?

The taxability of benefits must be determined using the income of the person entitled to receive the benefits. If you and your child both receive benefits, you should calculate the taxability of your benefits separately from the taxability of your child's benefits. The amount of income tax that your child must pay on that part ...

How to find out if a child is taxable?

To find out whether any of the child's benefits may be taxable, compare the base amount for the child’s filing status with the total of: All of the child's other income, including tax-exempt interest. If the child is single, the base amount for the child's filing status is $25,000.

Is a child's Social Security payment taxable?

If the total of (1) one half of the child's social security benefits and (2) all the child's other income is greater than the base amount that applies to the child's filing status, part of the child's social security benefits may be taxable.

How old do you have to be to get SS survivor benefits?

Answer. Social security survivor benefits are paid to children who have a disabled or deceased parent. To qualify, the child needs to be 18 years old or younger – or 19 years old if enrolled full-time in a qualifying school. Children can get up to 75% of the deceased parent’s social security benefits.

What is the base amount of Social Security?

Other taxable and tax-exempt income. The base amount is $25,000 for a single filer, $32,000 for married filing jointly or zero for married filing separately.

Do children owe taxes?

Most children don’t earn enough to owe tax during a tax year. If benefits are taxable, as explained below, you’ll report any social security survivor benefits for your child on your child’s return.

How much do you have to pay taxes on spousal benefits?

If your combined taxable income is less than $32,000, you won't have to pay taxes on your spousal benefits. If your income is between $32,000 and $44,000, you would have to pay taxes on up to 50% of your benefits. If your household income is greater than $44,000, up to 85% of your benefits may be taxed. 1 .

How many states tax Social Security in 2021?

State Taxes on Social Security Benefits. As of 2021, these 13 states tax Social Security benefits to some degree: Bear in mind that whether a particular state taxes Social Security benefits can change over time.

Can I collect Social Security if I have an ex spouse?

Individual Income Threshold. It's possible to collect spousal benefits based on the Social Security work record of an ex-spouse, as long as you haven't remarried and satisfy certain other requirements. 3 In this case, you would check the box for "Single" filing status on your Form 1040 income tax return, and your benefits would be taxed as follows, ...

Can I pay my spouse Social Security?

Key Takeaways. Social Security income can be paid to spouses of eligible applicants with a reduced benefit amount. Spousal Social Security benefits may be subject to federal income tax, depending on your household income. Some states also tax Social Security benefits. If you are married and file taxes jointly, you have to include your spouse's ...

Do you have to include spouse's income in taxes?

Some states also tax Social Security benefits. If you are married and file taxes jointly, you have to include your spouse's income in your calculations, even if they aren't receiving Social Security benefits themselves.

Do you have to include spouse's income when filing jointly?

If you are married and filing jointly, you have to include your spouse’s total income in your calculations —even if your spouse has deferred collecting their own Social Security benefits in order to accrue delayed retirement credits. In this instance, here is how your benefits would be taxed:

Do I pay taxes on my Social Security spousal benefits?

If you receive spousal Social Security benefits, they may be subject to federal income tax, depending on your total household income for the year. As of 2021, most people who receive Social Security benefits pay income tax on some portion of them. 1. To determine whether or not you owe tax, you first have to calculate your total income base ...

What percentage of Social Security recipients owe income tax?

The Social Security Administration estimates that about 56 percent of Social Security recipients owe income taxes on their benefits. For purposes of determining how the Internal Revenue Service treats your Social Security payments, “income” means your adjusted gross income plus nontaxable interest income plus half of your Social Security benefits.

How many states tax Social Security?

All of the above concerns federal taxes; 13 states also tax Social Security to varying degrees. If you live in Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, North Dakota, Vermont, Utah or West Virginia, contact your state tax agency for details on how benefits are taxed.

Do Social Security payments count toward income?

If your child receives Social Security dependent or survivor benefits, those payments do not count toward your taxable income. That money is taxable if the child has sufficient income (from Social Security and other sources) to have to file a return in his or her own name.

Is Social Security income taxable?

Supplemental Security Income (SSI) is never taxable. If you do have to pay taxes on your benefits, you have a choice as to how: You can file quarterly estimated tax returns with the IRS or ask Social Security to withhold federal taxes from your benefit payment. Updated June 30, 2021.

How to find out if child benefits are taxable?

To find out whether any of the child's benefits may be taxable, compare the base amount for the child’s filing status with the total of: One-half of the child's benefits; plus. All of the child's other income, including tax-exempt interest. If the child is single, the base amount for the child's filing status is $25,000.

How much is the federal income tax for married filing separately?

The base amount for your filing status is: $25,000 if you're single, head of household, or qualifying widow (er), $25,000 if you're married filing separately and lived apart from your spouse for the entire year, $32,000 if you're married filing jointly,

What line do you report Social Security benefits on?

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) ...

Do you have to add spouse's income to joint tax return?

If you're married and file a joint return, you and your spouse must combine your incomes and social security benefits when figuring the taxable portion of your benefits. Even if your spouse didn't receive any benefits, you must add your spouse's income to yours when figuring on a joint return if any of your benefits are taxable.

Is a child's Social Security payment taxable?

If the total of (1) one half of the child's social security benefits and (2) all the child's other income is greater than the base amount that applies to the child's filing status, part of the child's social security benefits may be taxable. You can figure the taxable amount of the benefits on a worksheet in the Instructions for Form 1040 ...

Is Social Security taxable for children?

Yes, under certain circumstances, although a child generally won't receive enough additional income to make the child's social security benefits taxable. The taxability of benefits must be determined using the income of the person entitled to receive the benefits. If you and your child both receive benefits, you should calculate the taxability ...

Is Social Security income taxable?

Social security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income (SSI) payments, which aren't taxable. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099, Social Security Benefit Statement, and you report that amount on line 6a of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. The taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and benefits for the taxable year. You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR.

What happens to my wife's military benefits?

Military Benefits. If you're married to a veteran, her retirement pay stops as soon as she dies. If she buys insurance during her time in service -- a Survivor Benefit Plan, in military-speak -- that guarantees you 55 percent of her retirement pay for as long as you live.

How old do you have to be to get Social Security?

Social Security. Most surviving-spouse benefits for Social Security are geared to spouses at least 50 years old. You can qualify at any age, though, if you're caring for your spouse's child or stepchild. The child must be under 16 or disabled and receiving benefits in his own name.

How to find out if my child is taxable?

To find out if your benefits are taxable, add together your adjusted gross income for the year, any nontaxable benefits you earn and half of your Social Security benefits.

Is death pay taxable?

If your spouse's employer pays you after he dies, the type of pay determines if it's taxable. Any remaining salary, wages or commissions are taxable, just as if he'd lived to receive them himself. Death benefits under a workplace life insurance or accident policy are tax free if they're no more than the policy's value. Payments from an annuity or pension plan are taxed as life insurance is: If you get more than what it cost your spouse to pay for the plan, you probably owe tax.

Is a survivor's benefit taxable?

Buying into this plan reduces your spouse's total retirement pay, though. Your Survivor Benefit Plan benefits are taxable, just as your spouse's retirement pay would be if she were still alive.

Is life insurance taxable income?

Life Insurance. If your spouse took out, say, a $200,000 life-insurance policy and the insurer pays you $200,000 when he dies, there's no tax. If the policy earned interest and you get more than the face value, the extra money is taxable income. You report the taxable part of a lump-sum payment the year you receive it.