Can I file taxes with SSI benefits?

inancial hardships are becoming common occurrence during this pandemic, but as the economy starts to rise and more people return to their jobs, several changes to economic programs and social security benefits, have occurred and people want to know how much they can get from their monthly checks.

What counts as income for SSI?

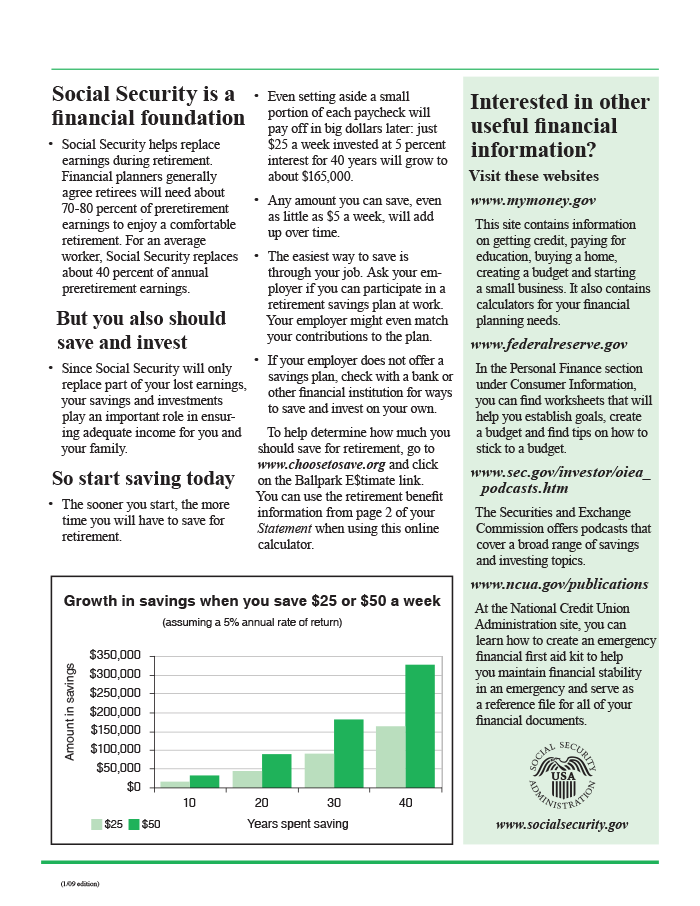

Social security benefits are received by millions in the United States and for many it is their only source of income. Once retirees begin to claim benefits, they will not be able to work at the same levels they had as or they risk jeopardizing their ...

How does income affect SSI benefits?

Key Takeaways

- You can get Social Security and work at the same time, but your monthly benefit may be reduced.

- If you have reached full retirement age, you can receive your entire benefit, no matter how much you earn.

- If you haven't reached full retirement age, Social Security will deduct $1 from your benefits for every $2 or $3 you earn above a certain amount.

When can I collect SSI benefits?

Here’s how

- Getting a divorce is a big decision. But you may not know that you should take Social Security benefits into account.

- Provided you were married for at least 10 years, you may be able to claim spousal benefits on your ex-spouse’s work record.

- If your ex-spouse dies, you may be able to receive survivor benefits.

News about Are Ssi Benefits Taxedbing.com/news

Videos of Are Ssi Benefits Taxedbing.com/videos

How much of my SSI is taxable?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Does SSI get taxes?

If you file as an individual, your Social Security is not taxable only if your total income for the year is below $25,000. Half of it is taxable if your income is in the $25,000–$34,000 range. If your income is higher than that, then up to 85% of your benefits may be taxable.

At what age is Social Security not taxable?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Does SSI count as gross income for taxes?

Disability benefits are excluded from being calculated as gross income. Instead, your benefits must be calculated into your combined income, which the IRS looks at to determine if you need to pay taxes on them.

Do I have to file taxes on SSI disability?

The general rule of thumb to follow is that you will have to pay federal taxes on your Social Security Disability benefits if you file a federal tax return as an individual and your total income is more than $25,000.

What is the difference between Social Security and SSI?

Social Security benefits may be paid to you and certain members of your family if you are “insured” meaning you worked long enough and paid Social Security taxes. Unlike Social Security benefits, SSI benefits are not based on your prior work or a family member's prior work.

How much Social Security will I get if I make $60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much Social Security will I get if I make $30000 a year?

0:362:30How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars whichMoreYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars which comes out to just under 500 bucks.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

How much money can you have in bank on SSI?

$2,000WHAT IS THE RESOURCE LIMIT? The limit for countable resources is $2,000 for an individual and $3,000 for a couple.

How much money can you make and still get SSI 2021?

about $1,650/monthEarned Income Exclusions Social Security excludes the first $65 in earnings and one-half of all earnings over $65 in a month. The earned income exclusions mean that in 2021 a person can earn about $1,650/month and still qualify for SSI (though the monthly payment is reduced when you have countable income).

What is the maximum SSI benefit?

The latest such increase, 5.9 percent, becomes effective January 2022. The monthly maximum Federal amounts for 2022 are $841 for an eligible individual, $1,261 for an eligible individual with an eligible spouse, and $421 for an essential person.

Quick Rule: Is My Social Security Income Taxable?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security...

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never...

How to File Social Security Income on Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this par...

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay...

State Taxes on Social Security Benefits

Everything we’ve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes. As y...

Tips For Saving on Taxes in Retirement

1. What you pay in taxes during your retirement will depend on how retirement friendly your state is. So if you want to decrease tax bite, consider...