What is the earnings test for worker or survivor benefits?

Another point worth noting is that, depending upon how much an individual earns, a worker or survivor benefit may be subject to a reduction. This determination is made based on a calculation known as the Earnings Test, and is discussed below.

Does the earnings test apply to a surviving spouse’s benefits?

Don’t forget the Earnings Test may apply if a surviving spouse is earning income. It is commonly known that a widow or widower entering retirement is entitled to claim Social Security benefits based on his or her own work record (the worker benefit) or on the work record of his or her deceased spouse (the survivor benefit).

How does the earnings test work for Social Security beneficiaries?

Beneficiaries may receive Social Security retirement, dependent, or survivor benefits and work at the same time. Under the earnings test, we will reduce a beneficiary’s monthly benefits by the amount of his or her excess earnings if the beneficiary is under or in the year of FRA.

What is a Social Security survivor benefit?

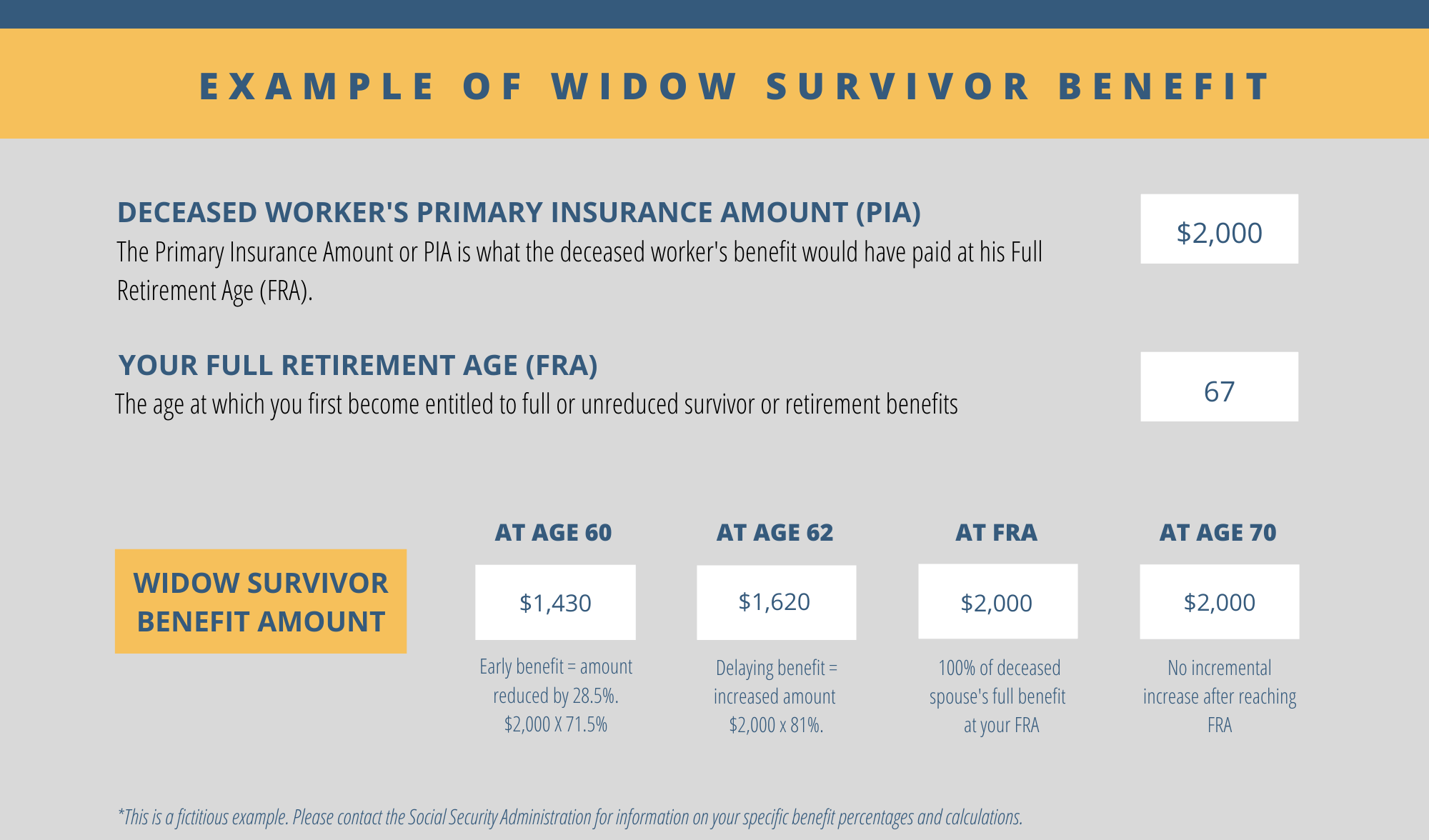

With a survivor benefit, an individual can elect to receive benefits as early as age 60 (an individual does not have to be age 60 for a full month). A survivor benefit is 100% of the deceased spouse’s Primary Insurance Amount, which is based on contributions the deceased paid into the Social Security system during his or her lifetime.

Does earnings test apply to survivor benefits?

Earnings test applies to all types of Social Security benefits, whether you claim on your own work record, as a spouse or as a survivor. Your benefit will increase at your full retirement age to account for benefits withheld due to earlier earnings.

Are survivor benefits affected by earned income?

How much will my survivors benefits be reduced based on my age and work earnings? If you are not going to reach full retirement age within the year, Social Security will reduce your benefit payment by half of the amount you earn over the annual limit.

Are Social Security survivor benefits means tested?

Social Security disability benefits are not means tested, although beneficiaries may lose eligibility if they engage in substantial gainful activity. Benefits are funded by a dedicated payroll tax paid by a worker and the worker's employer and by taxes paid by a self-employed person.

Does earnings test apply to spousal benefits?

Does my spouse's income affect the earnings limit for my Social Security benefits? No. Even if you file taxes jointly, Social Security does not count both spouses' incomes against one spouse's earnings limit. It's only interested in how much you make from work while receiving benefits.

Are widows benefits reduced by earned income?

Claiming Benefits While You Are Working If you are under full retirement age when you start getting your widow(er)'s benefits, $1 in benefits will be deducted for each $2 you earn above the annual limit. Source: http://www.socialsecurity.gov/retire2/whileworking.htm.

Can I collect my deceased husband's Social Security and still work?

If you are the divorced former spouse of a deceased Social Security recipient, you might qualify for survivor benefits on his or her work record. If you are below full retirement age and still working, your survivor benefit could be affected by Social Security's earnings limit.

Is survivor benefits considered Supplemental Security income?

Social Security income includes retirement, survivor benefits, and disability payments. For the most part, only taxable sources of income count in determining household MAGI-based income. However, all Social Security income of tax filers is counted, regardless of whether it is taxable or not.

How long does a widow receive survivor benefits?

for lifeWidows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

What is the maximum Social Security survivor benefit?

These are examples of the benefits that survivors may receive: Widow or widower, full retirement age or older — 100% of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99% of the deceased worker's basic amount. Widow or widower with a disability aged 50 through 59 — 71½%.

Who is subject to the Social Security earnings test?

DEFINITION: When you claim Social Security benefits before reaching full retirement age ( FRA ) and continue working and earning above a certain threshold, you are subject to the retirement earnings test ( RET ).

Can I take my Social Security at 62 and then switch to spousal benefit?

Only if your spouse is not yet receiving retirement benefits. In this case, you can claim your own Social Security beginning at 62 and make the switch to spousal benefits when your husband or wife files.

Can I collect spousal benefits and wait until I am 70 to collect my own Social Security?

You can only collect spousal benefits and wait until 70 to claim your retirement benefit if both of the following are true: You were born before Jan. 2, 1954. Your spouse is collecting his or her own Social Security retirement benefit.