Are they taxing unemployment?

Unemployment benefits are usually taxable, although a new law excludes some payments for 2020 – and complicates tax filing this year. How Are Unemployment Benefits Taxed? People who haven't filed their income-tax returns should consider waiting to file their return until the IRS provides more guidance on taking the exclusion. (Getty Images)

Is unemployment considered taxable income?

Unemployment income is always considered taxable income. Apply for unemployment benefits online through your state unemployment website if you have lost your job. Due to the COVID-19 Pandemic, these benefits were enhanced and made easier to enroll in - see details below.

Is unemployment considered income wages?

- Unemployment benefits are subject to federal income tax, and state income tax where applicable.

- A tax waiver on $10,200 of benefits under the American Rescue Plan Act only applied only to 2020 payments.

- If you can't afford to pay the all the tax due, you can apply for an installment plan.

Are federal taxes owed on unemployment?

The Pennsylvania labor department has compiled a list of companies that are violating state labor and public safety laws. More than 500 Lehigh Valley employers landed on the list due to issues over payment of unemployment compensation taxes, according to a ...

/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png)

Does Edd count as earned income?

Unemployment benefits are taxable. Unemployment compensation is not considered “earned” income for the Earned Income Tax Credit (EITC), childcare credit, and the Additional Child Tax Credit calculations and can reduce the amount of credits you may have traditionally received.

Is unemployment considered earned income for Roth IRA?

Unemployment insurance doesn't count as earned income for IRA eligibility.

Does the cares act count as income?

A. Yes. The receipt of a government grant by a business generally is not excluded from the business's gross income under the Code and therefore is taxable.

What are examples of unearned income?

This type of income is known as unearned income. Two examples of unearned income you might be familiar with are money you get as a gift for your birthday and a financial prize you win. Other examples of unearned income include unemployment benefits and interest on a savings account.

What qualifies as earned income?

Earned income is any income received from a job or self-employment. Earned income may include wages, salary, tips, bonuses, and commissions. Income derived from investments and government benefit programs would not be considered earned income. Earned income is often taxed differently from unearned income.

What counts as earned income for Social Security?

Wages include salaries, commissions, bonuses, severance pay, and any other special payments received because of your employment. (2) Wages paid in cash to uniformed service members.

Is the pandemic unemployment assistance taxable income?

Overview. PUP is available to employees and the self-employed who lost their job on or after 13 March 2020 due to the COVID-19 pandemic. The PUP is paid by the Department of Social Protection (DSP). Payments from the DSP are taxable sources of income unless they are specifically exempt from tax.

Is Pua counted as income for Section 8?

The Office of Public and Indian Housing (PIH), which administers the Section 8 Housing Assistance Payments (HAP) program, published guidance that public housing agencies (PHAs) should consider PUA and PEUC benefits as annual income in calculating income to determine eligibility for applicable programs.

Do you pay taxes on the 600 stimulus check?

The good news is that you don't have to pay income tax on the stimulus checks, also known as economic impact payments. The federal government issued two rounds of payments in 2020 — the first starting in early April and the second in late December.

What is not considered earned income?

Earned income does not include amounts such as pensions and annuities, welfare benefits, unemployment compensation, worker's compensation benefits, or social security benefits.

Are benefits unearned income?

Regular income other than earnings (including some benefits) will usually be treated as unearned income when working out your Universal Credit payments.

What does the IRS consider unearned income?

Unearned income includes investment-type income such as taxable interest, ordinary dividends, and capital gain distributions. It also includes unemployment compensation, taxable social security benefits, pensions, annuities, cancellation of debt, and distributions of unearned income from a trust.

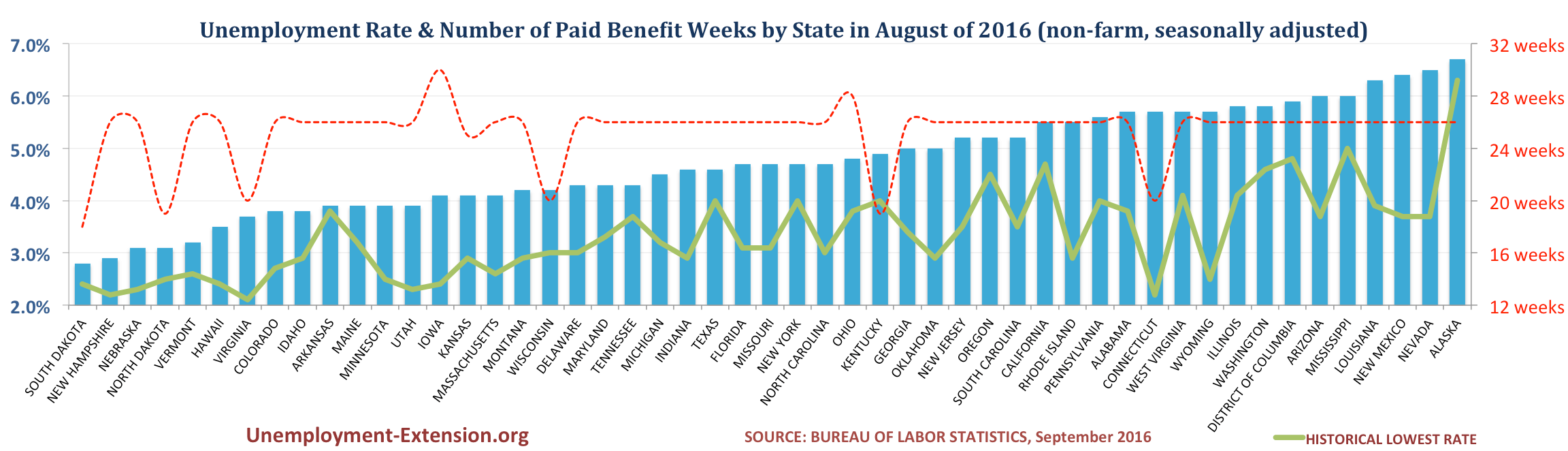

How long does unemployment last?

In most states, unemployment benefits are paid weekly for 26 weeks after the unemployment application and approval process. Some states offer different maximum weeks for unemployment compensation, such as Montana at 28 weeks or Florida at 12 weeks (see table below).

When will the IRS refund unemployment?

The IRS announced o n March 31, 2021 that the money will be automatically refunded by the IRS during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15, 2021.

How to withhold taxes from unemployment in 2022?

Tax Withholding in 2022: If you think you will still receive unemployment benefits in 2022, start and estimate your 2022 Income Tax Return first and factor in the unemployment benefit payments or income . If you see a result of large tax refund, you should start withholding taxes from your unemployment benefit payments or other income you might have (e.g. W-2, 1099 income, etc.). Based on the estimated tax return results, you might want to have 10% withheld for IRS or Federal taxes. To do so, complete the Voluntary Tax Withholding Request Form W-4V and submit to your state tax agency (click your state below and scroll to the bottom for the state agency address). The state agency will then withhold federal income taxes from your unemployment benefit payments. Alternatively, you can also submit Form 1040-ES with quarterly tax estimate payments - FileIT - or pay your IRS taxes online.

How long will unemployment be extended in 2021?

Monitor here to see how your state (s) will handle the unemployment compensation exclusion in response to the ARPA. 2020 Unemployment benefit payments were extended from September 6, 2020 to March 14, 2021, and then again until September 6, 2021, thus states will now provide 53 weeks of benefits, up from 23 weeks in 2020.

How many people filed for unemployment in 2020?

Over 23 million individuals had filed for unemployment during 2020. For the first time, some self-employed workers qualified for unemployment benefits. Get the details on the third stimulus payment.

How long will unemployment benefits be extended?

Enhanced 2020 unemployment benefit payments were extended from September 6, 2020 to March 14, 2021, and then again until September 6, 2021, thus states will now provide 53 weeks of benefits, up from 23 weeks in 2020. However, many states ended this earlier than the September date. The unemployment benefits have increased by $300 per week as a result of the December 2020 second stimulus payment package. It is not too late to claim the first or second stimulus payment on your 2020 Tax Return if you never received them! See how to claim the Recovery Rebate Credit on your 2020 Return by filing a previous year return.

When will the IRS refund unemployment benefits in 2021?

n March 31, 2021 that the money will be automatically refunded by the IRS during the spring and summer of 2021 to taxpayers who filed their tax return reporting unemployment compensation on or before March 15, 2021. The IRS will issue these payments in two phases: first to individual taxpayers affected, then to married filing joint taxpayers and/or those with more complicated returns.

What taxes do you pay on unemployment in New York?

For those receiving unemployment benefits in New York, you must pay federal, state, and local income tax. Your federal and state taxes can be withheld from your checks. Your state liability for income tax is 2.5% .

What does it mean when unemployment claims are low?

If you’ve recently lost your position within a company, don’t feel disheartened. The fact that claims are so low means the economy is doing well and you should find a new job quickly. However, in the meantime, unemployment benefits are there to help you bridge the gap between positions. One question we get asked often is, ...

What is EITC credit?

The EITC is a federal refundable tax credit that’s dependent on the individual or couple’s income level. It’s aimed at helping those with low to moderate income. You need to meet certain criteria to qualify.

How much is unemployment tax in Utah?

For those working in Utah, there is a flat state personal income tax of 4.95%. Your unemployment benefits are subject to state income taxes. You can opt to have both your federal and state income taxes withheld.

Where to find federal tax withholdings?

Look to Box 1 to find out the total amount of benefits you are liable for. If you choose to have benefits withheld, you’ll see your federal tax withholdings in Box 4. If you also had state taxes withheld, those are located in Box 11.

Do you report unemployment on taxes?

When you file your taxes, you will report your unemployment along with any other income you receive for the year. It’ll be a separate line item from your other forms of income.

Does unemployment count towards earned income?

While unemployment benefits can get taxed, they don’t count towards your earned income. This means they don’t qualify towards your EITC qualifications. You need to receive wages during the year to qualify for this credit.

Unemployment Income Explained in Less Than 5 Minutes

Logan Allec is a licensed Certified Public Accountant (CPA) and a personal finance expert. He has more than a decade of experience consulting and writing about taxes, tax planning, credit cards, budgeting, and more. Logan also has a master's in taxation from the University of Southern California (USC).

Definition and Example of Unemployment Income

Unemployment income is money paid to out-of-work people who meet certain criteria, such as being in between jobs and being out of work through no fault of their own.

How Does Unemployment Income Work?

In the United States, unemployment income is administered by state unemployment offices in partnership with the federal government. It is intended to provide temporary wage replacement to workers who are actively seeking their next job.

How Much Are Unemployment Income Taxes?

In general, unemployment income is considered taxable income on your federal income tax return. It is taxed as ordinary income using the tax rates currently in effect for your filing status.

How To Get Unemployment Income

In order to get unemployment income, there are some important steps to follow.

What is earned income?

Earned income is money you make from work you are paid to perform. If you made more than $51,567 in earned income in tax year 2013, you won't qualify for the EITC. If you made that amount or less, you can check further IRS requirements for your eligibility. To receive the credit, among the most important criteria are that you complete a federal tax return, have some earned income for the tax year, and have a valid Social Security number. If you qualify for the credit, you must specifically claim the EITC on your tax form.

What is EITC in unemployment?

The Earned Income Tax Credit, or EITC, is a tax credit you might be able to get, too, based on your earned income and family size. Unemployment benefits aren't considered earned income, so they will not prevent you from getting the credit.

How to claim EITC without child?

But to claim the EITC, you won't need to fill out a lot of additional paperwork unless you are claiming the EITC with a qualifying child. To claim the EITC without a qualifying child or children, fill out either IRS Form 1040, 1040A or 1040E.

What is the income requirement for 2013?

For the 2013 tax year, your earned income and adjusted gross income must both be less than $14,340 ($19,680 married filing jointly) with no qualifying children; $37,870 ($43,210 married filing jointly) with one qualifying child; $43,038 ($48,378 married filing jointly) with two qualifying children; and $46,227 ($51,567 married filing jointly) with three or more qualifying children. Examples of qualifying children are a daughter, son, stepchild, foster child and a dependent brother or sister. Other requirements include specific age requirements, and that the qualifying child must have lived with you for at least half the year. IRS Publication 596, Earned Income Tax Credit, provides more details.

How much was the EITC in 2012?

The average EITC in 2012 was $2,300, according to the IRS. The amount of the credit you can get back varies based on the information you provide to the IRS on your income and family size. For example, for tax year 2013, taxpayers with no qualifying children are eligible for credits ranging from $2 to $487, while those with three or more qualifying children are eligible for credits ranging from $11 to $6,044.

What are the requirements to get the EITC credit?

To receive the credit, among the most important criteria are that you complete a federal tax return, have some earned income for the tax year, and have a valid Social Security number. If you qualify for the credit, you must specifically claim the EITC on your tax form.

Is unemployment considered earned income?

Unemployment Benefits. While unemployment benefits are not considered earned income for purposes of the EITC, they are considered taxable income on your federal returns. You must include unemployment benefits as part of your gross income on your tax form, on line 19 of Form 1040, line 13 of 1040A, or line 3 of form 1040EZ.

Definition and Examples of Earned Income

The Internal Revenue Service ( IRS) classifies earned income as any taxable income you obtained from working your hourly or salaried job and revenue gained from self-employment. 1

How Does Earned Income Work?

Generally, earned income is any money your employer pays you for your labor, any sales generated from a business you own, or monetary profit from self-employment.

Types of Earned Income

Here are some common examples of earned income (although this list is does not cover every type of earned income):

What is the difference between unearned and earned income?

What’s the difference between earned and unearned income? Income can be divided into two categories, earned income and unearned income. Earned income is any income you receive in exchange for your time. For example, paycheck income, freelance income, side-gig income, etc. Unearned income, on the other hand, is not related to active work.

Why are taxes on earned income higher than unearned income?

Taxes on earned income is generally higher than unearned income because of taxes that are specific to it, payroll taxes. Payroll taxes consists of social security and medicare taxes also known as FICA. You and your employer each pay 6.2% in social security tax and 1.45% in Medicare tax on all earnings. For those who are self-employed, they must pay ...

How much is payroll tax?

Paycheck income will be taxed between 10% and 37% in federal taxes alone. Add payroll taxes, state taxes, and city taxes, and your earned income could be taxed closed to 50%. When corporations have a capped tax rate at 21% while a paycheck employee can have their earnings taxed upwards of 50% it reeks of unfairness.

What is unearned income?

The IRS defines unearned income as investment-type income such as taxable interest, ordinary dividends, and capital gain distributions.

What is the most common type of income?

Earned income or paycheck income is the most common type of income. Also known as active income, earned income is income that’s paid by an employer in exchange for your time or active work. Any compensation received from working, for example, salaries, tips, and bonuses are all earned income. It requires an active output of energy.

Why does Johnny Rose apply for unemployment?

When he goes to the unemployment office he learns that he doesn’t qualify because all of his income was earned while self-employed.

What are some examples of assets that produce investment income?

Stocks, bonds, real estate are examples of assets that produce investment income. Most investment income is earned passively. Passive income requires little to no effort in order to continue to produce a return or profit. Qualified dividends are paid by many U.S. stocks.