Who is eligible for VA pension benefits?

Veterans Pension is a tax-free monetary benefit payable to low-income wartime Veterans. Generally, a Veteran must have at least 90 days of active duty service, with at least one day during a wartime period to qualify for a VA Pension.

How much in taxes should I withhold from my pension?

Pensions and Annuity Withholding

- Withholding on Periodic Payments. Generally, periodic payments are pension or annuity payments made for more than 1 year that are not eligible rollover distributions.

- Nonperiodic Payments. ...

- Mandatory Withholding on Payments Delivered Outside the United States. ...

- Eligible Rollover Distributions. ...

- Depositing and Reporting Withheld Taxes. ...

Are VA survivor benefits taxable?

VA survivor benefits are not taxable. The VA offers a tax-free pension to low-income un-remarried surviving spouses and their children. To qualify, the deceased veteran must have wartime service. The family’s annual income must be below the limit set by Congress.

How to calculate income for veterans pensions?

The following types of income are all countable income for Pension purposes:

- earnings

- retirement or survivors' programs

- interest

- dividends

- unemployment compensation

- operation of a business, and

- life insurance proceeds received before December 10, 2004, because of the death of a Veteran

How do I know if my pension is taxable?

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money.

Can I get VA pension and Social Security?

Because of their similar nature, disabled veterans may be unsure whether they can collect Social Security and VA pension benefits simultaneously. Yes, you can. However, the amount you receive in VA pension benefits could be offset by SSD benefits.

How long does VA Pension last?

If VA assigns you a 100% rating, it has the option of also designating you permanently and totally disabled. If you receive this designation, your benefits are safe for the rest of your life.

Is VA Pension permanent?

Non-service connected disability pension is a needs-based program for veterans with war-time service who are permanently and totally disabled or over the age of 65. Non-Service Connected Pension is also known as VA pension or Widower's pension.

What are the benefits of being a veteran?

These include: Disability Compensation. Disability Pension. Education and Training Benefits (like the Post-9/11 GI Bill)

What is the number for financial coaching for veterans?

Free Financial Coaching for Veterans program (call 1-844-90-GOALS or click here for more information). Military OneSource Resources for Transitioning Service Members and Families which provides MilTax online software for free for qualified Veterans.

Can you get a tax credit if you are a veteran?

If Veterans benefits are your only source of income, then you may not qualify for other tax credit programs. “Unfortunately, Veterans’ benefits do not qualify as earned income for the Earned Income Tax Credit (EITC).

Does California have property tax for disabled veterans?

Property Tax. Some states, like California, have reduced or eliminated property tax for disabled Veterans. For example, according to Mike Jelinek of The Simple Dollar, with “California’s Disabled Veterans’ Exemption, as long as the property is the veteran’s primary place of residence; the full value of the residence does not exceed $150,000;

Is unemployment taxable to veterans?

Unemployment Compensation: Welsh says that “the military provides Veteran unemployment compensation under certain programs for ex-military personnel. Unemployment compensation received under these specialized programs is treated the same as any other unemployment benefits and is taxable to you as a recipient. ”.

Is a veteran pension taxable?

Veterans Pensions – What Is and Isn't Taxable at the Federal and State Levels. Posted in Uncategorized on February 27, 2018. When it comes to taxes, navigating regulations and terminology are difficult, but even more so for our nation’s veterans. That’s because there are many different types of veterans benefits and pensions, ...

Is military retirement taxable?

Military Retirement Pay: According to H&R Block’s Monica Welsh, “If you receive military retirement pay – based on age or length of service – this income is taxable and is included in your income as a pension.”

Supplemental Income for Wartime Veterans

VA helps Veterans and their families cope with financial challenges by providing supplemental income through the Veterans Pension benefit. Veterans Pension is a tax-free monetary benefit payable to low-income wartime Veterans.

Eligibility

Generally, a Veteran must have at least 90 days of active duty service, with at least one day during a wartime period to qualify for a VA Pension.

Additional Pension Allowances

Veterans or surviving spouses who are eligible for VA pension and are housebound or require the aid and attendance of another person may be eligible for an additional monetary payment.

How To Apply

You can apply for Veterans Pension online or download and complete VA Form 21P-527EZ, “Application for Pension”. You can mail your application to the Pension Management Center (PMC) that serves your state. You may also visit your local regional benefit office and turn in your application for processing.

What are VA benefits?

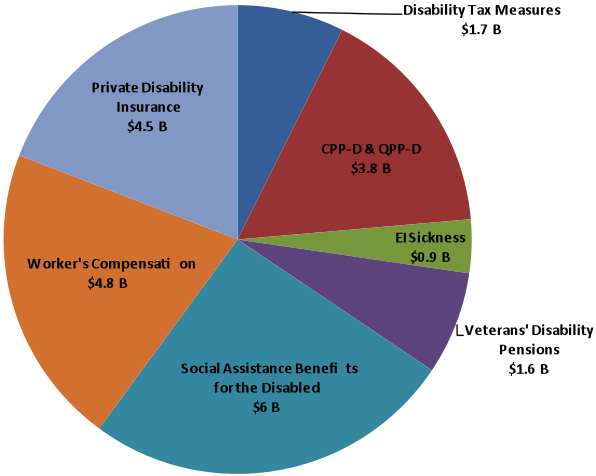

If you can exclude from income any VA benefits you receive – like benefits paid under any law, regulation, or administrative practice by the VA. Some examples of VA benefits include: 1 Education, training, and subsistence allowances. 2 Disability compensation and pension payments for disabilities paid either to veterans or their families. 3 Grants for homes designed for wheelchair living. 4 Grants for motor vehicles for veterans who lost their sight or the use of their limbs. 5 Veterans’ insurance proceeds and dividends paid either to veterans or their beneficiaries, including the proceeds of a veteran’s endowment policy paid before death. 6 Interest on insurance dividends left on deposit with the VA. 7 Benefits under a dependent-care assistance program. 8 The death gratuity paid to a survivor of a member of the Armed Forces who died after September 10, 2001. 9 Payments made under the compensated work therapy program. 10 Any bonus payment by a state or political subdivision because of service in a combat zone.

What are some examples of VA benefits?

Some examples of VA benefits include: Education, training, and subsistence allowances. Disability compensation and pension payments for disabilities paid ...

When did you receive disability payments for combat related injury?

You were a member of a listed government service or its reserve component, or were under a binding written commitment to become a member, on September 24, 1975; You receive the disability payments for a combat-related injury. This is a personal injury or sickness that; Results directly from armed conflict,

Is military retirement taxable?

If you receive military retirement pay – which is based on age or length of service – it is taxable and is included in your income as pension. If there is a reduction in your retirement pay to provide a survivor annuity under the Survivor Benefit Plan (SBP), that amount should not be included in your income.

Do veterans qualify for EITC?

Therefore, if the only income you receive would be classified as veterans benefits, you would not have any earned income to qualify you for the EITC.

Can you exclude disability payments from your income?

If you receive disability retirement pay as a pension, annuity or similar allowance for personal injury or sickness, you may be able to exclude the payments from your income. You can exclude the disability payments from your taxable income if any of the following conditions apply:

What are VA disability benefits?

Disability benefits received from the VA should not be included in your gross income. Some of the payments which are considered disability benefits include: 1 Disability compensation and pension payments for disabilities paid either to Veterans or their families, 2 Grants for homes designed for wheelchair living, 3 Grants for motor vehicles for Veterans who lost their sight or the use of their limbs, or 4 Benefits under a dependent-care assistance program.

What is the VA homeless program?

VA 's specialized programs for homeless Veterans serve hundreds of thousands of homeless and at-risk Veterans each year. Independently and in collaboration with federal and community partners, VA programs provide Veterans with housing solutions, employment opportunities, health care, justice- and reentry-related services and more. Learn more about these programs at VA Programs for At-Risk Veterans and Their Families.

What is tax credit for working families?

The Tax Credits for Working Families organization produced a video sharing how tax credits are a vital resource for many who have served our country.

What is SPEC in tax?

The Stakeholder Partnerships, Education and Communication (SPEC) office within the Wage & Investment Division has built a network of national and local partners. Organizations include corporate, faith-based, nonprofit, educational, financial and government. With so many tax benefits available today, taxes can serve as the starting point for many people's dream of stronger financial security.

Do veterans get tax credits?

Many Veterans are eligible for various tax credits including the Earned Income Tax Credit, a refundable federal income tax credit for low- to moderate-income workers and their families. Roughly two million Veterans and military households receive the EITC, the refundable component of the Child Tax Credit or both, according to Center on Budget and Policy Priorities. The credits provide a tax break for eligible service members, allowing them to keep more of what they've earned and build a financial cushion for unexpected emergencies. The Tax Credits for Working Families organization produced a video sharing how tax credits are a vital resource for many who have served our country.

Is a combat injury severance taxed?

The Combat-Injured Veterans Tax Fairness Act of 2016, went into effect in 2017. Under this federal law, Veterans who suffer combat-related injuries and are separated from the military are not to be taxed on the one-time lump sum disability severance payment they receive from the Department of Defense.

Does Vita offer free tax returns?

VITA generally offers free tax return preparation to those who qualify. TCE is mainly for people age 60 or older. The program focuses on tax issues unique to seniors. AARP participates in the TCE program through AARP Tax-Aide. VITA and TCE provide free electronic filing.

Supplemental Income For Wartime Veterans

- VA helps Veterans and their families cope with financial challenges by providing supplemental income through the Veterans Pension benefit. Veterans Pension is a tax-free monetary benefit payable to low-income wartime Veterans.

Eligibility

- Generally, a Veteran must have at least 90 days of active duty service, with at least one day during a wartime period to qualify for a VA Pension. If you entered active duty after September 7, 1980, generally you must have served at least 24 months or the full period for which you were called or ordered to active duty (with some exceptions), with at least one day during a wartime period. In …

Additional Pension Allowances

- Veterans or surviving spouses who are eligible for VA pension and are housebound or require the aid and attendance of another person may be eligible for an additional monetary payment.

How to Apply

- You can apply for Veterans Pension online or download and complete VA Form 21P-527EZ, “Application for Pension”. You can mail your application to the Pension Management Center (PMC) that serves your state. You may also visit your local regional benefit office and turn in your application for processing. You can locate your local regional benefit office using the VA Facilit…

Military Retirement Pay

Military Retirement Disability Pay

Veterans Affairs (VA) Benefits

Unemployment Compensation

EITC

- Unfortunately, veterans’ benefits do not qualify as earned income for the Earned Income Tax Credit(EITC). Therefore, if the only income you receive would be classified as veterans benefits, you would not have any earned income to qualify you for the EITC. We hope we answered common questions, like “Are veterans benefits taxable?” For more questions...