Fifty percent of a taxpayer's benefits may be taxable if they are:

- Filing single, single, head of household or qualifying widow or widower with $25,000 to $34,000 income.

- Married filing separately and lived apart from their spouse for all of 2019 with $25,000 to $34,000 income.

- Married filing jointly with $32,000 to $44,000 income.

What are tax breaks are afforded to a qualifying widow?

- You have to have been eligible to file a joint return with your spouse for the year in which your spouse passed away. ...

- No more than two years can have passed between your spouse's death and the tax year for which you're filing a return.

- You must not have remarried before the end of the tax year for the return in question.

What are the social security rules for widows?

Understanding the Social Security Rules for Widows and Widowers

- Biden's Ideas for Social Security Survivor Benefits. Biden has proposed several reforms which, if enacted, would boost benefits for the surviving spouse, typically women.

- The Goal of Social Security Survivor Benefits. ...

- Social Security Claiming Advice for Married Couples. ...

- Resources for Claiming Social Security Benefits. ...

Do Social Security benefits pass to widow?

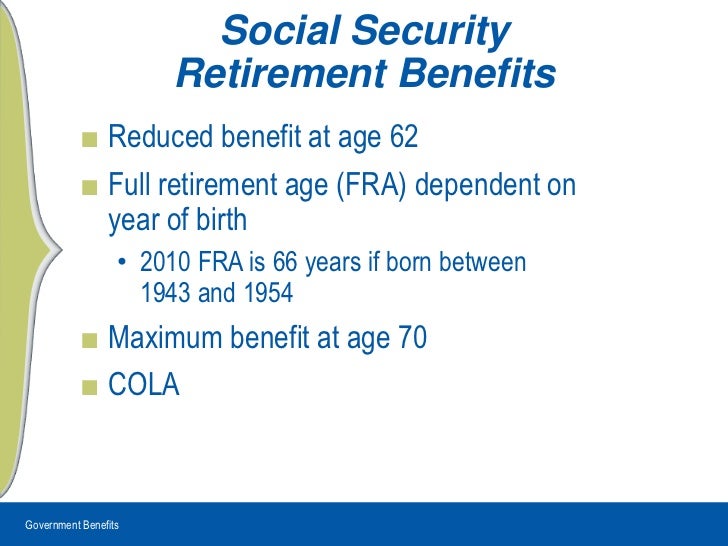

Social Security is gender neutral, therefore this information applies to both widows and widowers. You are entitled to 100% of your deceased spouse’s benefit at full retirement or you can take reduced benefits as early as age 60. If you are disabled, you can begin taking benefits at 50.

What percentage of Social Security does a widow receive?

- A widow or widower over 60.

- A widow or widower over 50 and disabled.

- Surviving divorced spouses, assuming the marriage lasted at least ten years.

- Widow or widower who is caring for a deceased child who is either under 16 or disabled.

Do Social Security survivor benefits count as taxable income?

Key Takeaways. Social Security survivor benefits paid to children are taxable for the child, although most children don't make enough to be taxed. If survivor benefits are the child's only taxable income, they are not taxable. If half the child's benefits plus other income is $25,000 or more, the benefits are taxable.

Does widow's pension count as income?

To find out if your benefits are taxable, add together your adjusted gross income for the year, any nontaxable benefits you earn and half of your Social Security benefits. If the total is at least $25,000, 50 percent of your benefits are taxable; at $34,000, 85 percent are subject to tax.

Do you have to file taxes on survivor benefits?

The IRS requires Social Security beneficiaries to report their survivors benefit income. The agency does not discriminate based on the type of benefit -- retirement, disability, survivors or spouse benefits are all considered taxable income.

Are death benefits to spouse taxable?

FERS Spousal Lump Sum Death Benefit Payment If the surviving spouse chooses the single payment option, then the following rules apply with respect to taxation: If a FERS survivor annuity is not paid, then at least part of the special death benefit is tax-free.

What is the difference between survivor benefits and widow benefits?

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

What is the widow's penalty?

Also known as Widow's Tax Penalty, taxes increase for most when they become widowed. Tax implications of filling taxes as single instead of married filing joint often leave the surviving spouse worse off financially. In addition to a loss of social security income, what income remains hits higher tax brackets.

Who claims death benefit on tax return?

A death benefit is income of either the estate or the beneficiary who receives it. Up to $10,000 of the total of all death benefits paid (other than CPP or QPP death benefits) is not taxable. If the beneficiary received the death benefit, see line 13000 in the Federal Income Tax and Benefit Guide.

What death benefits are taxable?

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received. See Topic 403 for more information about interest.

How long does a spouse get survivors benefits?

Widows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

Do widows pay tax on husband's pension?

If the deceased hadn't yet retired: Most schemes will pay out a lump sum that is typically two or four times their salary. If the person who died was under age 75, this lump sum is tax-free. This type of pension usually also pays a taxable 'survivor's pension' to the deceased's spouse, civil partner or dependent child.

Do you have to pay taxes on money received as a beneficiary?

Beneficiaries generally don't have to pay income tax on money or other property they inherit, with the common exception of money withdrawn from an inherited retirement account (IRA or 401(k) plan). The good news for people who inherit money or other property is that they usually don't have to pay income tax on it.

Do beneficiaries pay tax on inherited pension?

Pensions are usually free from inheritance tax, but any withdrawals your beneficiaries make will only normally be free from income tax if you die before age 75. If you die when age 75 or older, payments will be taxed as income at your beneficiaries' marginal rate (though they won't pay National Insurance).

What percentage of Social Security benefits are lost to a deceased parent?

If the family earnings are more than 150 percent to 180 percent of the deceased parent’s earnings, Social Security will reduce the benefits proportionally for everybody except the surviving parent until the total reaches the total maximum amount. 13 .

What happens if neither spouse claims benefits?

If neither spouse has claimed benefits, and the surviving spouse works, he or she will receive theirs or the deceased spouses —generally whichever is larger. If one was claiming benefits and one was not, the surviving spouse will need help figuring out how to maximize their benefits. 4 .

How much of a survivor's income is taxable?

6 . If the person has any additional income but it’s below $25,000, benefits won’t be taxed. 7 If they earn between $25,000 and $34,000, 50 percent of the survivor benefit is taxable.

How many children can you get from a deceased parent?

According to Social Security, 98 of every 100 children could get benefits. 9 If the deceased parent’s child is under the age of 18, or 19 if they’re attending elementary or secondary school full time, he or she qualifies for survivor benefits. 2

When do widows get full benefits?

Widow or Widower. If a spouse passes away, the surviving spouse may receive full benefits once they reach their full retirement age or reduced benefits as early as age 60. If the spouse is disabled, benefits begin as early as age 50. They can also get benefits at any age if they take care of a child who is younger than age 16 or disabled, ...

Is Social Security a survivor benefit?

You probably know that Social Security is a significant source of retirement income but you probably know little about Social Security survivor benefits. According to Social Security, the value of the survivor benefits you may qualify for upon the death of a spouse or parent is higher than the value of your individual life insurance, ...

Do children pay taxes on survivor benefits?

Survivor benefits to children are taxable under certain circumstances but in most cases, children will not pay taxes. If the survivor benefits are the only income the child earns, they won’t pay any taxes on the benefits. If the child earns income through a job or other means, some calculating has to take place.

How many widows receive Social Security?

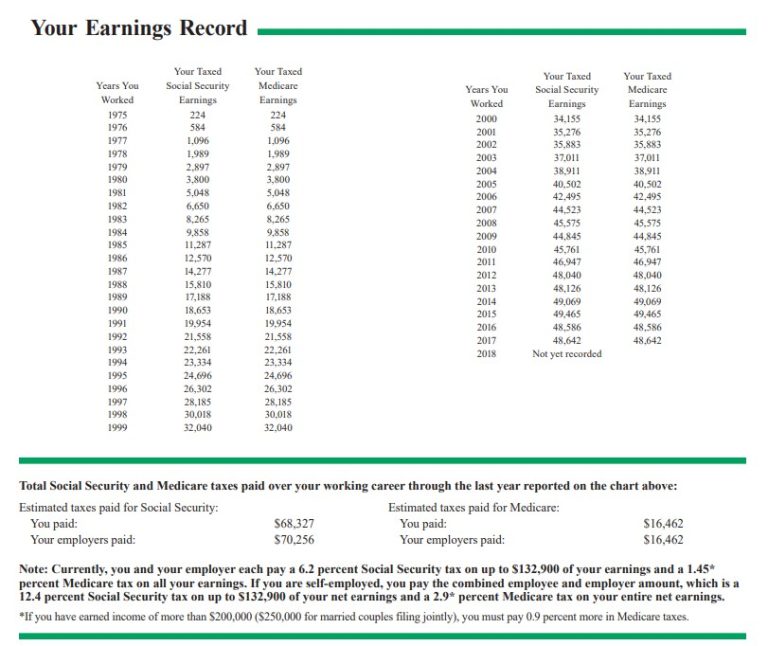

If you are using a tax software program, the amount is calculated for you. According to the Social Security Administration, approximately 5 million widows and widowers receive benefits based on their deceased spouse’s earnings record, and it also pays more benefits to children than any other federal program.

How much of your income is taxable?

Up to 85% of the benefits you receive may be taxable to you, depending on the amounts of other income you receive during the year. The IRS has a worksheet to complete to determine the taxable portion of your benefits and it is included in the IRS Form 1040 Instructions. If you are using a tax software program, the amount is calculated for you.

How old do you have to be to get Social Security?

Social Security benefits are available for unmarried children who are under 18 years old or up to age 19 if they are full-time students in elementary or secondary schools.

What is the retirement age if you were born in 1937?

If you were born in 1937 or earlier, it is age 65. If you were born in 1960 or later, your full retirement age is 67. The table shows the breakdown for those born in between those years. Year of birth. Age.

Is Social Security taxable to widows?

The Social Security benefits you receive as a widow or widower are known as Social Security survivors benefits and will be reported to you under your Social Security number, or SSN, rather than under your deceased spouse’s SSN. Up to 85% of the benefits you receive may be taxable to you, depending on the amounts of other income you receive ...

How long does a widow receive the same tax deduction?

In general, the qualifying widow (er) status allows a widow (er) to continue receiving the same tax rates as the married filing jointly status for two years following their spouse’s death if they remain single. The married filing jointly and qualifying widow (er) statuses also have the same standard deduction which is higher than other tax statuses.

How much income do you need to file taxes after a widow dies?

For the two years after a death has occurred, an individual filing under widow (er) status must have an income of: 9 . $24,400 if younger than 65.

What happens to the income of a deceased person after death?

2 . The income of a deceased person is subject to federal income tax in the year of their death. 3 Therefore, the married filing jointly status for the year of death requires income from both spouses.

What is a widow with dependent child?

The qualifying widow (er) with dependent child status offers several benefits for individuals with a child who have lost a spouse. The tax breaks offered to qualify widow (er)s include a lower tax rate, a higher standard deduction, and some potentially beneficial tax treatment in regard to some investments.

Can a deceased spouse claim a refund?

If the deceased spouse is owed a refund for individual income tax, the executor may claim it using IRS Form 1310, Statement of a Person Claiming Refund Due a Deceased Taxpayer. 4 . Special circumstances would apply if a widow (er) remarries in the year of their spouse’s death. Remarriage in the same year as a death would require the widow (er) ...

Can a widow file jointly after a death?

For the year the death occurred, the widow (er) must use either the married filing jointly status or the filing separately status. The qualifying widow (er) status cannot be used until the subsequent year. In the two years following the death, an individual can choose the status that results in the lowest tax payments. 2 .

Can a widow be a tax break?

Qualifying widow (er)s can also be eligible for special tax breaks on investments. This may apply to investments owned jointly with a deceased spouse. For one example, if a widow (er) and spouse owned rental property, it could qualify for a step-up in basis for tax purposes.

What happens when both spouses collect Social Security?

When both spouses are collecting Social Security and one passes, the surviving spouse generally receives whichever is greater: their own benefit, or their deceased spouse’s benefit. In our example, Steve was receiving $2,000 and Janet was receiving $1,000, for a combined monthly total of $3,000.

What happens to your spouse when you die?

Because of this, when a spouse dies, the surviving spouse may often face a drop in income and a hike in income taxes at the same time. Consider this hypothetical: Janet and her husband, Steve, are both 75 years old. Steve, who retired ten years ago, worked as an electrician, while Janet stayed home to raise their three children.

How much is the standard deduction for 2020?

We’ll assume they take the standard deduction, which is $27,400 for those over 65, married, and filing jointly. On December 15, 2020 Steve passes away. Janet is devastated. She lost her best friend and the love of her life.

What would happen if he passed in January?

If he had passed in January, it could have been beneficial to engage in a Roth IRA conversion or additional IRA withdrawals to take advantage of her last year being subject to the married filing jointly rules (e.g. higher standard deduction, higher income tax brackets, lower Social Security income, etc.).

How much of Janet's Social Security income is subject to taxes?

Before Steve passed, roughly 70% of their Social Security was subject to taxes. Now that Janet is filing as single, 85% of her Social Security income will be subject to taxes because of her level of income. So in our example, Janet’s actual income declines by $12,000 per year due to the reduction in Social Security benefits.

What is the tax bracket for Janet?

For a single person, the top of the 12% tax bracket in 2021 is $40,525. Therefore, as a single taxpayer, Janet will be subject to a higher tax bracket of 22%.

How much does Steve get after retirement?

After Steve retires, he begins to receive a monthly pension of $2,000 with a 100% survivorship benefit (meaning Janet will continue to get $2,000 per month when he passes). Steve also receives $2,000 per month in Social Security, while Janet collects a spousal benefit of $1,000 per month from Social Security.

How much is standard deduction for widows?

In addition, there are benefits beyond the tax brackets that qualifying widows and widowers get. For instance, standard deductions are $24,000 for qualifying widows and widowers, compared to $12,000 for singles and $18,000 for heads of household.

How many years can you file taxes after your spouse dies?

No more than two years can have passed between your spouse's death and the tax year for which you're filing a return. You must not have remarried before the end of the tax year for the return in question.

How many years can you file a joint return with your spouse?

It's irrelevant whether you actually did file a joint return; you merely need to have been entitled to do so. No more than two years can have passed between your spouse's death and the tax year for which you're filing a return.

How much is the Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook. If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

Is a widower's tax bracket wider than a single filer?

Data source: IRS. As you can see, all of the brackets for a qualifying wid ow or widower are wider than the corresponding brackets for either single filers or heads of household. That can add up to thousands in tax savings, and the more you make, the more you'll save. In addition, there are benefits beyond the tax brackets ...

Is a widower tax break better than a single person?

The biggest benefit from the qualifying widow and widower tax break. The primary reason why filing as a qualifying widow or widower is better than filing as a regular single person or head of household is that the tax brackets that apply to qual ifying widows and widowers are the most generous available. More of your income will get taxed ...

How much is the EITC?

The Earned Income Tax Credit (EITC) gives refundable tax credits of up to $6,242 for low-income earners. Here’s what that means: the government could send you a check for more than $6,000 even if you don’t owe anything or haven’t paid a cent of taxes.

What are the standard deductions for 2015?

Because it dictates the size of your standard deduction – that is, it determines how much of your income is tax-free. Here are the standard deductions for 2015: 1 Single: $6,300 2 Married, filing jointly: $12,600 3 Married, filing separately: $6,300 4 Head of household: $9,250 5 Qualifying widow (er): $12,600

Is Social Security taxable if you have a job?

There’s a possibility some of their Social Security benefits will be taxable if they have a job. However, this is probably only likely if you have an older teen who is working near full-time hours. That’s because you can have a base income of up to $25,000 before any Social Security benefits are subject to tax.

Can you claim a non-child as a head of household?

So even if you are taking care of Mom and Dad, you can’t use Head of Household unless they are an exempted person listed on your income taxes.

Can I file jointly if my spouse died in 2015?

I don’t have any experience with filing separately, but if you file jointly, you do everything the same as you would any other year. You claim any income, deductions or credits your spouse may have earned while still alive.

Is 33 percent income taxed?

That means that even if you’re in the 33 percent tax bracket, all your income is not taxed at the 33 percent rate. Some of it may be taxed at a lower rate.

What happens if your spouse dies?

If your spouse has recently died, you need to handle lots of issues, including your taxes. A change in your marital status affects the way you file your taxes. The Internal Revenue Service (IRS) provides an option to help the transition process regarding your filing status and income tax rates—the qualifying widow (er) tax filing status. ...

What is the qualifying widow?

You are eligible for the qualifying widow (er) filing status if you: Qualified for married filing jointly with your deceased spouse for the year of his or her death. Did not get married again before the end of the tax year when your spouse passed away.

How long can a widow file a joint tax return?

A recently widowed person can: Keep filing a joint return for up to two years after the death of the spouse.

Why is filing status important?

Your filing status is important since it determines: The amount of taxes you need to pay. Standard deductions you can take. Special tax breaks you can claim. If your spouse has recently passed away, you should file your taxes using the filing status that provides you with the lowest tax bill.

How long after spouse's death can you file taxes?

The IRS requires you to report your deceased spouse’s income. Qualifying widow (er) You can use this filing status for up to two tax years after your spouse’s death unless you get married again. Single. You can file as single in the year after your spouse’s death unless your qualify for some of the above-listed options.

What is stepped up basis?

File for a stepped-up basis on the inherited property. The stepped-up basis is the cost basis of the property you inherit. It is the basis for determining taxes if the widow (er) decides to sell the property.

Does the federal estate tax apply to 2021?

The federal estate tax doesn’t apply to assets below $11.7 million for deaths in 2021. As the estate and gift tax exemption figures may change, you need to check the specifics if such a situation arises. All assets a surviving spouse inherits are legally exempt from federal taxation. The widow (er) exemption and additional taxation ...

How to determine taxability of benefits?

The taxability of benefits must be determined using the income of the person entitled to receive the benefits. If you and your child both receive benefits, you should calculate the taxability of your benefits separately from the taxability of your child's benefits. The amount of income tax that your child must pay on that part ...

How to find out if a child is taxable?

To find out whether any of the child's benefits may be taxable, compare the base amount for the child’s filing status with the total of: All of the child's other income, including tax-exempt interest. If the child is single, the base amount for the child's filing status is $25,000.

Is a child's Social Security payment taxable?

If the total of (1) one half of the child's social security benefits and (2) all the child's other income is greater than the base amount that applies to the child's filing status, part of the child's social security benefits may be taxable.