How to get my 1099 from unemployment to file taxes?

- Name, full mailing address, and phone number.

- Driver’s license or state ID number.

- Social Security or Alien Registration number and drivers license number.

- Proof of income, which can include 1099 tax forms, 1099 pay stubs, Form 1040 tax returns and tax returns.

- Bank account number and routing number for direct deposit of benefits.

Does unemployment mail you a 1099?

In most cases, 1099-Gs for the previous year are mailed on or before January 31. For example, if you collected unemployment in 2018, the 1099-G should have been mailed by January 31, 2019. While on your state’s website, copy the contact information so you can contact the office directly if necessary.

When does unemployment send out 1099?

- Federal Pandemic Unemployment Compensation

- Pandemic Emergency Unemployment Compensation

- Pandemic Unemployment Assistance

Can 1099 employees file for unemployment?

Normally, self-employed and 1099 earners — such as sole independent contractors, freelancers, gig workers and sole proprietors — do not qualify for unemployment benefits. However, the federal government created new provisions that allow 1099 earners to tap into unemployment benefits during the ongoing COVID-19 pandemic.

Can you be 1099 and get benefits?

However, unlike an employee of a company, someone who gets a Form 1099 typically needs to purchase their own health insurance policy. While a 1099 worker usually doesn't qualify for employer-sponsored health coverage in California, they can still qualify for a private individual or family insurance policy.

Is a 1099 self employment?

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

Does 1099 income get reported to EDD?

Any business or government entity that is required to file a federal Nonemployee Compensation Form (1099-NEC) or a Miscellaneous Information Form (1099-MISC) for services received from an independent contractor is required to report specific independent contractor information to the Employment Development Department ( ...

Who qualifies for pandemic unemployment in California?

You must also have been unemployed, partially unemployed, or unable or unavailable to work due to at least one of the following reasons to be eligible for PUA: My place of employment was closed as a direct result of the COVID-19 public health emergency.

How much can you make on a 1099 before you have to claim it?

$600Normally income you received totaling over $600 for non-employee compensation (and/or at least $10 in royalties or broker payments) is reported on Form 1099-MISC. If you are self-employed, you are required to report your self-employment income if the amount you receive from all sources equals $400 or more.

How do I claim 1099 income?

Answer:Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship).Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more. ... You may need to make estimated tax payments.

How do I apply for EDD as an independent contractor?

Download a fill-in DE 542 (PDF) from the EDD website. Order through the Online Forms and Publications page. Print your data directly from your computer to the DE 542 by following the Print Specifications (PDF). Call the Taxpayer Assistance Center at 1-888-745-3886 to obtain a form.

How do I get EDD if self-employed?

If you are out of work or had your hours reduced, you may be eligible to receive unemployment benefits from California's Employment Development Department (EDD). First register or log in at Benefit Programs Online, then apply for unemployment benefits on UI Online℠.

What do I need to do as a 1099 employee?

How is an independent contractor paid?Obtain the independent contractor's Form W-9, Request for Taxpayer Identification Number and Certification. ... Provide compensation for work performed. ... Remit backup withholding payments to the IRS, if necessary. ... Complete Form 1099-NEC, Nonemployee Compensation.

Can self-employed get unemployment benefits in California?

If you are self-employed, you may have benefits available from EDD unemployment insurance programs that you or your employer may have paid into over the past 5 to 18 months. You may have contributions from a prior job, or you could have been misclassified as an independent contractor instead of an employee.

Is pandemic unemployment still available?

The COVID-19 Pandemic Unemployment Payment (PUP) was a social welfare payment for employees and self-employed people who lost all their employment due to the COVID-19 public health emergency. The PUP scheme is closed.

How long does Pua take to be approved?

It can take at least six weeks for us to process your PUA application. If your application is approved, we will send you your $205 (or more) per week in PUA benefits plus the extra $600 per week for all the past weeks you were eligible. You may get several checks at once.

Self-Employed Workers and Independent Contractors

Self-employed workers, sometimes also called independent contractors, are individuals who aren't hired by someone else as an employee. Instead, they may directly sell the fruits of their labor to consumers or they may work for one or more individuals or organizations via a contract.

Unemployment Benefits

When an employee loses their job through no fault of their own, one of the first things they do is head to the unemployment office (either physically or online) and file for unemployment benefits (i.e., money that can help them cover living expenses while they look for a new job).

How the Coronavirus Pandemic Changed Unemployment Compensation

Due to the economic hardships faced by individuals and businesses alike during the pandemic, the U.S. Government passed the Coronavirus Air, Relief, and Economic Security (CARES) Act in March 2020. Among the relief offered by this act was the expansion of unemployment benefits, including the following:

How to Apply for Pandemic Unemployment Assistance

You can apply for PUA through your local unemployment office. In most cases, you can complete the process completely online for added convenience. You may need the following information when filling out the application:

Learn More About Self-Employment With Skynova

If you are self-employed and earning income reported on 1099 forms, Skynova has resources that can help. Skynova offers a variety of tools, including invoicing templates for small businesses and even accounting software to help you keep track of payments and expenses.

What is a 1099 form?

A 1099 is a form or set of forms that the Internal Revenue Service (IRS) uses to keep track of self-employment earnings. Take note that 1099 forms differ from W-2 forms based on the type of employment you are completing. Any time you have a source of income that is not from a full-time employer, you should receive a 1099 form to file ...

How much does unemployment pay?

Currently, the majority of states pay no more than $500 per week for unemployment, with a few exceptions that pay upwards of that amount. However, with the CARES Act, unemployment benefit recipients can expect an extra $300 weekly.

Is gig work good for unemployment?

Though unemployment can be beneficial in the immediate aftermath of job loss, gig work offers the income and schedule flexibility to fit your needs in the long-term. With Qwick, the shifts come right to you.

Is unemployment a safety net for independent contractors?

But working as an independent contractor isn’t all daisies; in fact, sometimes it can be a thorny rose. In times of hardship, unemployment benefits are a nice safety net. However, for contractors, this adds a new layer of complexity to their finances.

Do you have to report income to unemployment?

When collecting unemployment, you are required to report any source of income you receive . Whether you’re a self-employed entrepreneur or a gig worker, the earnings you make must be submitted to unemployment.

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

Delaware Income Tax 1099g Information

Posted: 1099-Gs were mailed during the week of January 25th. 1099-Gs are only issued to the individual to whom benefits were paid. If you have moved since filing for UI benefits, your 1099-G will NOT be forwarded by the United States Postal Service.

Des: Tax Information And 1099

Posted: What is the IRS Form 1099-G for unemployment benefits? By Jan. 31, 2021, all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. 1099-G forms are delivered by email or mail and are also available through a claimants DES online account.

Request For Income Verification

The EDD may request that you provide documents to prove your income for your Pandemic Unemployment Assistance claim.

Other Types Of 1099 Forms

You may also receive other 1099 forms to document various sources of income. For example, 1099-INTs record any interest you receive from interest-bearing bank accounts, certificates of deposit or bond investments. A 1099-DIV certifies any dividend income earned from your stock investments.

Misclassification As An Independent Contractor

Each state’s unemployment agency has its own rules for determining whether a worker is an employee or an independent contractor. In general, though, true independent contractors are people who are in business for themselves and have control over the way that they perform their work.

How To File A Claim

The fastest way to apply for benefits is through UI OnlineSM, just as you would for regular UI benefits. You can also apply for PUA by phone, mail, or fax.

How long can you collect unemployment if you have a contract job?

You’re entitled to 26 weeks of regular unemployment benefits during that time and may also be eligible for one or more tiers of extended unemployment. If your contract job ends and you still don’t have permanent work within that one-year time period, you can resume collecting benefits based on your original claim.

How long do you have to file unemployment if you are not working?

Once your file an unemployment claim, you generally have one year to collect your benefits.

What happens if you receive partial unemployment?

If you receive partial payment, you report that payment when you receive it, and report the balance when it’s paid. Your state’s unemployment commission will reduce your benefit payment for that week based on the amount you received in compensation for your 1099 work. The reduction may not be dollar for dollar.

Do you have to report unemployment?

If you’re collecting unemployment, you have to report any income you earn from work during this time. Whether you work for a single day or several months, and whether the work is from part-time or full-time work, as an employee or on a contract basis, you still must report this money. In the case of contract work, ...

What is a 1099 MISC?

An informational form, the 1099 MISC documents self-employment or business income. In some cases, filing this form with your tax return might prevent you from collecting unemployment benefits. The activity that necessitates the 1099, rather than the form itself, leads to the denial of benefits, however.

How long does unemployment last after a disaster?

The benefits typically last up to 26 weeks after the president declares a disaster.

What does it mean to be laid off?

This usually means people laid off or fired for reasons other than misconduct. To be eligible, you'll have to meet your state's requirements, which will likely include having proof that you worked within a specific base period.

What are the benefits of 1099?

There are a number of different benefits you can offer your 1099 workers. Health insurance, dental and vision coverage: Self-employed contractors and freelancers may have a more difficult time finding health coverage than that of a standard employee. Giving them the option to buy a plan or covering a plan for them could allow them ...

What are the resources that 1099 workers can bring to other jobs?

Educational resources: Training and certifications are valuable assets that 1099 workers can bring to other jobs. Therefore, offering educational resources including seminars, classes and programs to further their skill set can incentivize 1099 workers to want to work with you, since they can simultaneously develop their professional skills.

How are 1099 workers different from W-2 workers?

These 1099 workers are different from employees who receive a standard W-2 as there are more regulations on how much they can contribute to your company and what you as an employer can offer them.

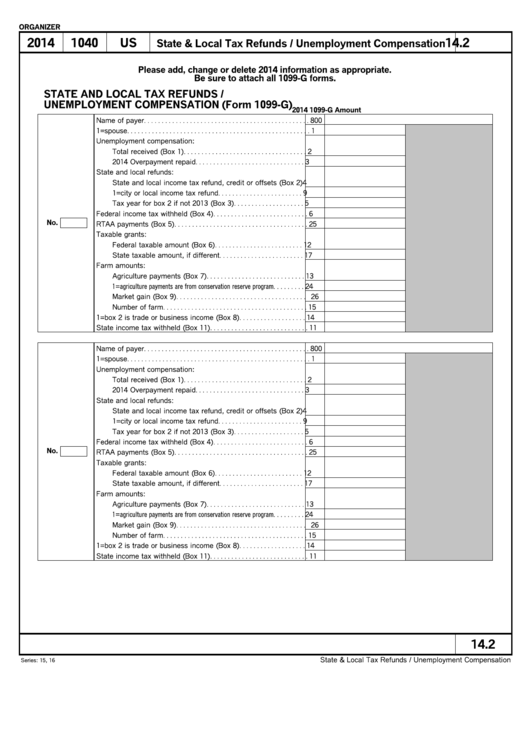

What is the 1099 G form?

The Statement for Recipients of Certain Government Payments (1099-G) tax forms are now available for New Yorkers who received unemployment benefits in calendar year 2020. This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2020, as well as any adjustments or tax withholding made to your benefits. Benefits paid to you are considered taxable income. You must include this form with your tax filing for the 2020 calendar year.

Is 1099-G a bill?

Q: Is the 1099-G a bill?#N#No, it is not a bill. It is a tax form showing how much you were paid in benefits from NYSDOL in a specific calendar year.

What is a 1099 employee?

When an employer enters a contract with a 1099 employee, the 1099 employee is typically responsible for their own hours, tools, taxes, and benefits. Unlike a standard employee (W2 employee), 1099 employees are not tied to a single employer and are required to follow different laws and regulations.

Do you need workers compensation for a 1099?

Answer: Like most laws, workers’ compensation laws vary from state to state. Whether a 1099 employee needs workers’ compensation is likely going to be dictated by individual state law. Check with your state’s workers’ compensation laws to see what, if any, coverage is needed for 1099 employees.

Is Uber a 1099 employee?

Currently, Uber and Lyft drivers are classified as 1099 employees, which was intentional in the foundation of both ridesharing companies to provide flexibility of work. However, the continued struggle with 1099 employment is the lack of benefits and workers’ compensation.

Is a 1099 employee an independent contractor?

Answer: A 1099 employee is also known as an “independent contractor.”. The 1099 employee is essentially self-employed through individual contracts with an employer (s). This allows them to set their own rates and hours, as well as puts taxes, benefits, and tools responsibilities on the 1099 employee rather than the employer.