Do non US citizens have SSN?

Social Security Numbers for Noncitizens Does a noncitizen need a Social Security number (SSN)? Unless you are a noncitizen who wants to work in the United States, you probably don’t need an SSN. Generally, only noncitizens authorized to work in the United States by the Department of Homeland Security (DHS) can get an SSN.

Can non citizens get SSI?

Under a few other circumstances, non-citizens may also sometimes qualify for SSI benefits. These include: American Indians that hold membership in a federally recognized tribe and who were born in Canada. Special immigrants from Afghanistan or Iraq who gave the U.S. government or military assistance while overseas.

Can undocumented immigrants get Social Security benefits?

To repeat: Illegal immigrants cannot legally receive Social Security benefits, and Congress isn’t about to vote on legislation that would change that. Of course, some immigrants who are here without legal permission do end up receiving Social Security and other benefits, through bureaucratic mistakes or through deliberate fraud.

Do resident aliens have SSN?

Upon admission to the United States based on your immigrant visa, you will be a U.S. permanent resident. Each permanent resident needs a Social Security Number (SSN). An SSN will help you to work in the United States, to conduct business with a bank or financial institution, to pay your taxes or to be listed as a dependent on a tax return, and for other purposes.

Can a non US citizen get Social Security benefits?

You don't have to be a U.S. citizen to qualify for Social Security benefits. Your benefits will be based on how much you earned and whether you've paid into the system for enough years.

Can a non resident alien receive Social Security benefits?

If you are a nonresident alien receiving retirement, disability or survivors benefits, SSA will withhold a 30 percent flat tax from 85 percent of those benefits unless you qualify for a tax treaty benefit. This results in a withholding of 25.5 percent of your monthly benefit amount.

Can a Green Card holder get Social Security benefits?

Can a Green Card Holder Apply for Social Security Benefits? Like anyone, you must have 40 qualifying credits, approximately 10 years, to earn Social Security benefits. Green card holders who pay into the system may qualify for their benefits, just like anyone else.

Do you have to be a US citizen to receive SSI benefits?

SSI benefits are available to all qualifying United States (U.S.) citizens; additionally, residents who are not citizens are sometimes eligible for benefits, including U.S. nationals, aliens, and other non-citizens.

How can a non citizen get a Social Security number?

Eligibility for a Social Security Number Temporary workers and those in non-immigrant visa status who are authorized to work in the United States by the Department of Homeland Security (DHS) can get a Social Security number (SSN).

Do immigrants get Social Security payments?

Under current Social Security rules, workers who have immigrated to the United States are likely to receive lower benefits than natives. Because Social Security requires 40 quarters of covered earnings before an individual is eligible to receive any benefits, many immigrants may not meet eligibility requirements.

Can a non citizen get Medicare?

Specifically, you will qualify for Medicare even if you are not a U.S. citizen if you qualify to receive or currently receive Social Security retirement benefits, Railroad Retirement Benefits (RRB), or Social Security Disability Insurance (SSDI). In any of these cases, you will qualify for premium-free Part A.

Who can get Social Security benefits in USA?

You can receive Social Security benefits based on your earnings record if you are age 62 or older, or disabled or blind and have enough work credits. Family members who qualify for benefits on your work record do not need work credits.

What is the maximum Social Security benefit?

The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2022, your maximum benefit would be $3,345. However, if you retire at age 62 in 2022, your maximum benefit would be $2,364. If you retire at age 70 in 2022, your maximum benefit would be $4,194.

Do immigrants qualify for SSI?

Their eligibility is subject to the proper certification in such status by the U.S. Department of Health and Human Services and possession of a valid "T" non-immigrant visa. Once the alien obtains proper certification and is in possession of a "T" non-immigrant visa, he or she becomes potentially eligible for SSI.

Can non-citizens get Social Security?

Other noncitizens who are fully insured for retirement, survivors or disability benefits, and who continue to meet U.S. lawful presence requirements. Noncitizens authorized to work in the United States who got a Social Security number after December 2003 can qualify for Social Security benefits. See Immigration for more information.

Can a non-citizen live in the US?

Yes, if they are lawfully in the United States and meet all eligibility requirements. Lawfully present noncitizens include, but are not limited to: Noncitizens lawfully admitted for permanent residence under the Immigration and Nationality Act (INA); Certain noncitizens admitted under other INA classifications that allow them to live ...

What is Social Security Disability?

In addition to benefits for retirees and their spouses, it provides survivor benefits for the spouses and children of deceased workers, Social Security Disability Insurance (SSDI) for disabled workers, and Supplemental Security Income (SSI) for older and disabled people with little to no income or financial assets.

How much tax is withheld from Social Security?

The withholding, which takes the form of a 30% tax on 85% of their monthly benefit, results in a reduction of 25.5%. However, some non-resident aliens are exempt from this withholding ...

How long does Social Security stop?

In some limited instances, Social Security will stop payments to non-U.S. citizens who have been outside the United States for six full calendar months, but resume them if the person returns to the U.S.

How many credits do you need to work for Social Security?

Eligibility requirements for these programs differ, but except for SSI, most require that the worker have earned at least 40 Social Security work credits. That equates to 10 years of covered work in the U.S.

Is Social Security complicated?

Advising clients on Social Security issues is complicated enough. With the added complexity of a non-U.S. citizen as a client, the help you provide as a financial advisor must be even more specific. With financial advisors serving a growing number of non-citizen clients, here are some issues to be aware of.

Can non-citizens get Social Security?

For non-U.S. citizens to be eligible for Social Security benefits, they must be in the country legally and have a Social Security number. Non-cit izens who are immigrating to the U.S. can often apply for a Social Security number in their home country at the same time that they apply for an immigrant visa with the U.S. Department of State.

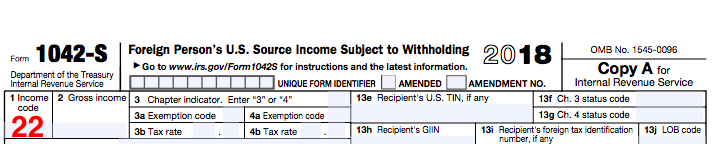

Do non-resident aliens pay Social Security taxes?

Resident aliens who work in the U.S. are subject to Social Security and Medicare taxes, just like U.S. citizens. Some non-resident aliens, however, are exempt. Those include, for example, employees of foreign governments who are in the U.S. on A-visas and certain teachers, students, and others, who are in the U.S. on other types of visas. The Internal Revenue Service lists all the exceptions and related rules on its webpage " Social Security/Medicare and Self-Employment Tax Liability of Foreign Students, Scholars, Teachers, Researchers, and Trainees ."

When did non-citizens get SSI?

A noncitizen (also called an "alien" for immigration purposes) may be eligible for Supplemental Security Income (SSI) if he or she meets the requirements of the laws for noncitizens that went into effect on August 22, 1996. In general, beginning August 22, 1996, most noncitizens must meet two requirements to be potentially eligible for SSI:

What form do I need to apply for SSI?

If you apply for SSI benefits, you must give us proof of your immigration status, such as a current DHS admission/departure Form I-94, Form I-551 or an order from an immigration judge showing withholding of removal or granting asylum.

Is Social Security a complex issue?

Social Security can be a complex topic. The good news is, once you get your account set up, you won’t have to worry about it for decades to come. By the time you do have to start thinking about Social Security again, it will be in the form of a continued monthly payout.

Is SSI based on work history?

Unlike Social Security, SSI requirements are not based on qualifying work history, but solely on age/disability and limited income/resources.

What determines a person's eligibility for Social Security?

person’s work history determines his or her eligibility for Social Security benefits, as well as SSI eligibility for some non-citizens. A person earns work credits based on the amount of money earned. The amount needed to earn a work credit goes up slightly each year as average earnings levels increase.

How long can I get SSI?

Some non-citizens can get SSI for up to seven years. If your SSI payments are limited to seven years because of your particular non-citizen status, we’ll send a letter to you telling you when your seven-year period ends. We’ll send another letter explaining your rights to appeal before we stop your payments.

How do I become a US citizen?

To learn more about how to become a United States citizen, call USCIS toll-free at 1-800-375-5283 (for the deaf or hard of hearing, call the TTY number, 1-800-767-1833). You also can contact your local USCIS office, or visit them online at www.uscis.gov.

What to do if your SSI stops?

If your SSI payments stop because you’re not an eligible non-citizen, you can apply again. Contact us right away if your immigration status changes, or if you become a U.S. citizen, and you think you qualify, or you have 40 credits of work. You’ll need to bring us your naturalization certificate or other documents that show your current immigration status.

Do I need to prove my military service to get SSI?

When you apply for SSI, you must prove your non-citizen status. Non-citizens who’ve served in the U.S. armed forces may also need to give us proof of military service. These are examples of things you may need to provide:

Do I need a social security number to work in the US?

If you’re a lawfully admitted non-citizen with permission to work in the United States, you may need a Social Security number. For more information, visit our website www.socialsecurity.gov and read our publication, Social Security Numbers for Non-Citizens (Publication No. 05-10096).

What countries qualify for Social Security?

You qualify for benefits based on your earnings and are a citizen of a broader set of countries including Mexico, Turkey, Costa Rica, and Jamaica. You are a citizen of countries such as China, India, Haiti, and South Africa, and earned at least 40 Social Security credits or lived in the U.S for a decade. 7. You are a resident of a country that has ...

How long does it take for SSA to stop paying you?

citizen or don't meet one of the conditions for receiving payment abroad, the SSA will stop making payments to you after you have been abroad for six months. The payments will resume when you have stayed in the U.S. for one full month.

Do you get Social Security if you work?

You are eligible for payment. This means that you qualify for Social Security benefits based on your earnings record. When you work and pay Social Security taxes, you earn “credits” toward Social Security benefits. The number of credits you need in order to receive retirement benefits depends on when you were born.

Can foreign governments tax Social Security?

Some foreign governments tax U.S. Social Security benefits, so it's a good idea to contact the country’s embassy or an international tax lawyer for tax advice. 13 Deductions and credits can sometimes soften or eliminate the impact of foreign tax payments.

Can Social Security send money to a country?

You are in a country where the Social Security Administration can send payments. To find out whether the SSA can send payments to the country where you plan to spend your retirement, use the Social Security Administration's Payment Abroad Screening Tool . You will be notified of your eligibility based on the country you specify as your new ...

/hand-holding-a-social-security-check-142900507-0a20f4ec7f4c406a8249d28437f2731a.jpg)