What is the difference between social security and SSI?

- Medicare will soon provide free at-home covid tests

- Billions distributed from the Provider Relief Fund

- Reasons why Congress won’t send another stimulus check

Why is SSDI better than SSI?

Neither?

- STEP ONE: CHECK MEDICAL CRITERIA. SSI and SSDI have the exact same medical criteria. ...

- STEP TWO: CHECK SSDI. You can qualify for SSDI if you worked and paid taxes, but it depends how much you worked and how recently you worked.

- STEP THREE: DON’T GIVE UP TOO EASILY. ...

- STEP FOUR: CHECK SSI. ...

- STEP FIVE: OTHER OPTIONS. ...

Is SSI the same as Social Security?

Social Security is commonly known for providing an ... Essentially, in those states, the SSI application and the Medicaid application are the same. The remaining states use their own eligibility requirements. In addition to these benefits, the SSA offers ...

What's the difference between SSA and SSI?

What Are the Differences Between SSI and SSA Benefits?

- SSI Eligibility. The fact that SSI does not consider work history distinguishes it from Social Security benefits. ...

- Social Security Eligibility. Social Security provides financial support for retirees, children and spouses of deceased workers and dependent parents of deceased workers.

- Benefit Payouts. ...

- Social Security Disability Insurance. ...

How does Social Security affect SSI benefits?

We reduce your Social Security benefits by the amount of SSI you would not have received if we had paid you Social Security benefits when they were due.

What pays more Social Security or SSI?

In general, SSDI pays more than SSI. Based on data from 2020: The average SSDI payment is $1,258 per month. The average SSI payment is $575 per month.

What are the 3 types of Social Security?

Social Security Benefits: Retirement, Disability, Dependents, and Survivors (OASDI)

What is the highest SSI payment?

The latest such increase, 5.9 percent, becomes effective January 2022. The monthly maximum Federal amounts for 2022 are $841 for an eligible individual, $1,261 for an eligible individual with an eligible spouse, and $421 for an essential person.

What is SSI for blind people?

Supplemental Security Income, or SSI, gives financial assistance to blind or disabled individuals, and those at least 65 years old with limited resources and earnings. If you qualify for both programs, you can receive monthly benefits under both.

What is Social Security Administration?

The Social Security Administration administers benefit programs for retirees, low-income individuals and the disabled. Social Security, funded by FICA taxes, provides retirement income to workers and their qualifying dependents and survivors. Supplemental Security Income, or SSI, gives financial assistance to blind or disabled individuals, ...

How many credits do you get on Social Security?

You earn up to four Social Security credits each year you pay FICA taxes. At retirement, you usually need 40 Social Security credits acquired over a decade of work to qualify for monthly benefits. Your child can get Social Security if she's unmarried and under 18 when your benefits begin, or if she is disabled. She can continue to get Social Security payments at age 18, if she became disabled before her 22nd birthday.

How long does a disabled child have to be on Social Security?

A child's disability from birth to age 18 need not be permanent, but it must be expected to last at least one year or be fatal. At age 18, disabled children must qualify for SSI under the adult definition. Adult disabilities must last at least 12 months, potentially result in death or make the individual unable to work. The SSA regards blindness as a unique disability. Children and adults are considered blind if their best eye has 20/200 vision or their field of vision is 20 degrees or less with corrective lenses.

How long does a disability last?

Adult disabilities must last at least 12 months, potentially result in death or make the individual unable to work. The SSA regards blindness as a unique disability. Children and adults are considered blind if their best eye has 20/200 vision or their field of vision is 20 degrees or less with corrective lenses.

Can a disabled child collect Social Security?

Children must be unmarried and disabled to collect both Social Security and SSI. If your child received Social Security payments due to a disability acquired before age 22, he may continue to get both benefits when he turns age 18, depending on his disability evaluation.

Is SSI based on income?

SSI Qualifications. Unlike Social Security, SSI is need-based. Income and the value of assets that you can turn into cash determine your need. Your wages, monetary gifts and money from worker's compensation or other sources constitute income.

How long can I get SSI?

You may receive SSI for a maximum of 7 years from the date DHS granted you qualified alien status in one of the following categories, and the status was granted within seven years of filing for SSI: Refugee admitted to the United States (U.S.) under section 207 of the Immigration and Nationality Act (INA);

What is considered income for SSI?

Income, for the purposes of SSI includes: money you earn from work; money you receive from other sources, such as Social Security benefits, workers compensation, unemployment benefits, the Department of Veterans Affairs, friends or relatives; and. free food or shelter.

Why does my SSI stop?

For example, your SSI will stop if you lose your status as a qualified alien because there is an active warrant for your deportation or removal from the U.S. If you are a qualified alien but you no longer meet one of the conditions that allow SSI eligibility for qualified aliens, then your SSI benefits will stop.

What is CAL disability?

Compassionate Allowances (CAL) are a way to quickly identify diseases and other medical conditions that, by definition, meet Social Security’s standards for disability benefits. These conditions primarily include certain cancers, adult brain disorders, and a number of rare disorders that affect children.

What age can you be considered disabled?

If you are age 18 or older we may consider you “disabled” if you have a medically determinable physical or mental impairment (including an emotional or learning problem) which:

When can I apply for SSI?

In most instances, you can apply for SSI benefits and Supplemental Nutrition Assistance Program (SNAP) benefits several months before you expect to be released from prison or jail. See the SSI spotlight on the Prerelease Procedure.

Can I get SSI if I am blind?

If you have a visual impairment, but are not blind according to our rules as defined above, you may still be eligible for SSI benefits on the basis of disability.

Who is eligible for SSI?

The SSI program provides monthly payments to adults and children who have low income and resources, and who are blind or disabled. The SSI program also provides monthly payments to people age 65 and older who have low income and resources.

What is the purpose of the Understanding SSI booklet?

The Understanding SSI booklet provides comprehensive general information about SSI eligibility requirements and processes. Written especially for SSI advocates, but also useful for the general public, it addresses a broad range of topics, from applying for benefits to reporting events that may change the payment of benefits. Please check out its "Table of Contents" for a list of these topics.

What is Supplemental Security Income?

Supplemental Security Income (SSI) is a Federal income supplement program funded by general tax revenues ( not Social Security taxes):

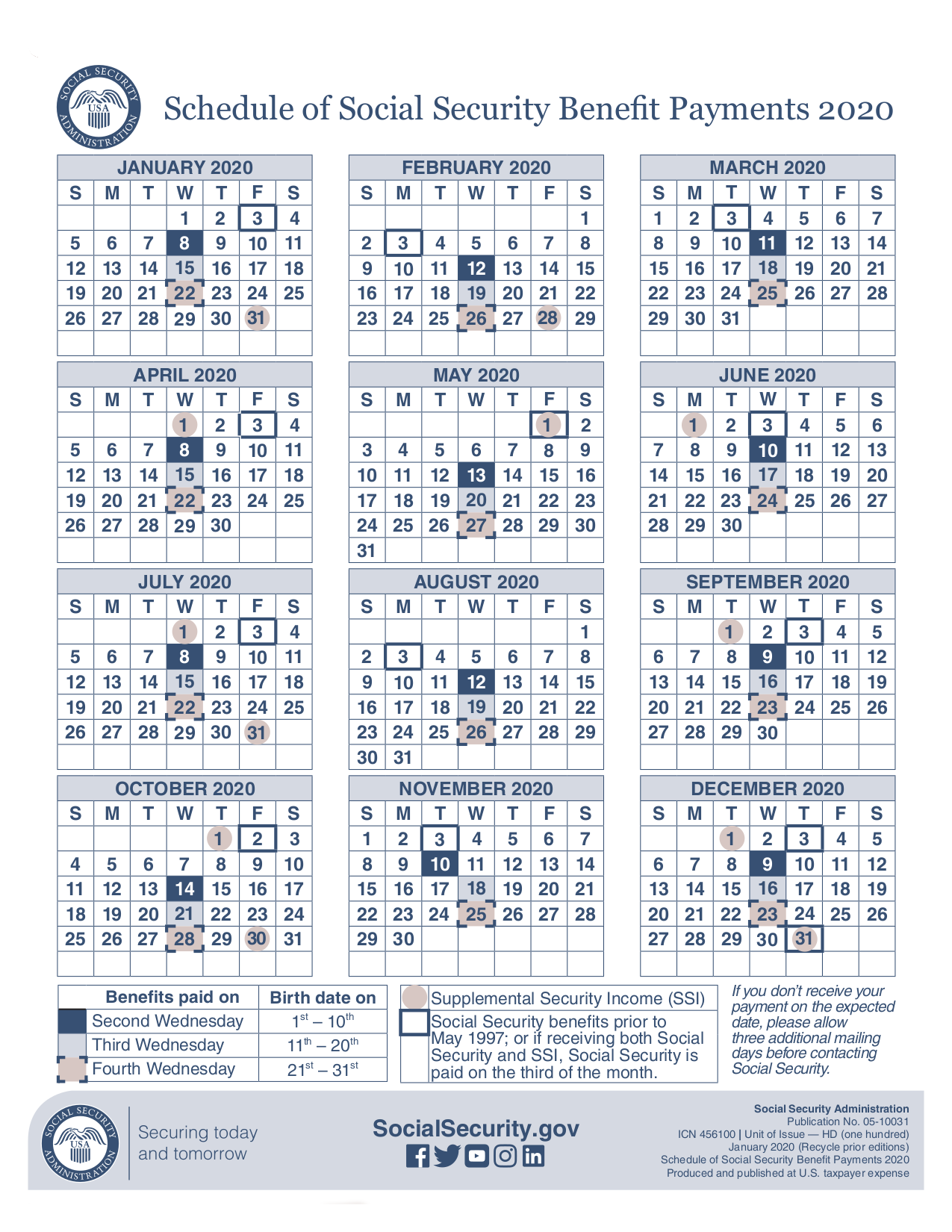

When will Social Security recipients receive notices?

From December 2020 through June 2022, we are sending notices to certain people who already receive Social Security benefits to let them know they may be eligible for Supplemental Security Income (SSI) benefits. If people who receive the notice have an E-mail address registered with us, they may also receive an E-mail.

What languages are SSI pamphlets available in?

Some of these publications are in different formats. Some are also available in both English and Spanish languages.

Once You've Applied

Once you've applied, we'll review your application to make sure you meet the basic requirements and contact you if we have any questions. We might request additional documents from you before we can process your application.

Appeal A Decision

You have a right to appeal any decision we make about whether you’re entitled to payments. You must request an appeal in writing within 60 days of receiving our decision.

You must inform us of certain changes

You must report the changes listed here, because they may affect your eligibility for SSI and your payment amount.

When Do You Need to Report?

Report all changes that may affect your SSI as soon as possible and no later than 10 days after the end of the month in which the change occurred.

Reporting your income

You can report your income to us in writing, by phone, online, or through our Smartphone app. Visit our SSI Wage Reporting page to learn more.

Manage your SSI information with a my Social Security account

Once you are receiving SSI, your my Social Security account provides personalized tools. You can use my Social Security to:

Who can receive SSI if they never worked?

It pays benefits to people who are disabled, blind or at least 65 years old and have low incomes and limited financial resources. It is unrelated to your employment history; you can receive SSI even if you never worked or paid Social Security taxes.

What is the difference between SSDI and SSI?

But SSDI provides payments to disabled people regardless of their financial situation. Qualification is tied to how long you were employed in work for which you paid Social Security taxes, and payment amounts are based on your average lifetime earnings.

What is used to determine SSI eligibility?

Along with SSDI benefits, income from work and other sources can be used to determine SSI eligibility and payments. The rules for what counts and what doesn't are complicated. You'll find information on Social Security's SSI website, which has a detailed page on the income rules.

When does SSDI start?

For another, there's a waiting period for SSDI: Benefits start in the sixth month after the date on which Social Security determines you become disabled . There's no such gap with Supplemental Security Income, so you could draw a full SSI benefit while waiting for SSDI to kick in. A concurrent claim can also help with health care.

Can I get SSDI if my Social Security payment is less than $814?

Social Security considers SSDI and other benefit payments to be countable but exempts $20 a month from that tally. Thus, if you get an SSDI benefit that exceeds $814, you don't qualify for SSI. If your SSDI payment is less than that, you may be able to get SSI, but it will be reduced by most of the amount of your SSDI.

Can I get Social Security Disability and Supplemental Security Income at the same time?

En español | Yes, you can receive Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) at the same time. Social Security uses the term “concurrent” when you qualify for both disability benefits it administers. However, drawing SSDI benefits can reduce your SSI payment, or make you ineligible for one.

Can I get SSDI if I have a low wage?

For one thing, if you qualify for a low SSDI benefit because you had a low-wage job or worked for only a short time before becoming disabled, SSI can be an additional income source until you're able to go back to work.

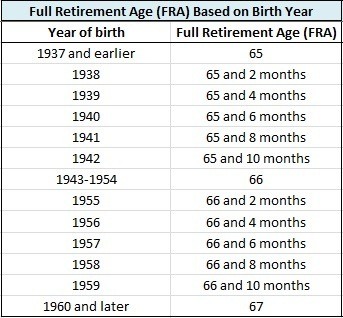

How old do you have to be to get Social Security?

Also known as Supplemental Security Income (SSI), you can receive Social Securityretirement benefits as long as you’re at least 62 years old and have at least 40 work credits.

When will Social Security be replaced with Social Security?

And if you haven’t yet reached early or full retirement age and you’re receiving SSDI, those benefits will be replaced with Social Security income once you reach age 62. But exceptions apply to those who take early retirement before being approved for SSDI benefits. Tips for Getting Retirement Ready.

Can you get both disability and early retirement?

The Exception to the Rule. You may be able to get both benefits if you opted for early retirement before you received disability benefits. These are also known an concurrent benefits. This exception would be applicable in a situation where an individual retired early due to serious medical conditions.

Can I collect Social Security and SSDI at the same time?

Wondering whether you can collect Social Securityand Social Security Disability Insurance(SSDI) at the same time? The short answer is probably not . The long answer, however, is maybe. Social Security and SSDI serve similar purposes, but the requirements vary for each. Social Security is for those who’ve reached early or full retirement age, while disability insurance typically serves younger individuals who cannot work due to serious medical conditions. However, an exception may apply. We take a closer look in this guide.