According to the rule, salaried professionals cannot get tax benefits on car loans. Only business owners and self-employed individuals can get those benefits and exemptions.” Cars for personal use are luxury products, whereas the cars used for businesses and commercial purposes can be considered a business expenditure.

Are tax benefits available for loans taken for a car purchase?

A variety of loans, such as Education Loan and Home Loan, come with associated tax benefits for individuals and business owners. But are such benefits also available for loans taken for a car purchase? If yes, then how can you claim it? Read this post to find out. People often take loans due to tax benefits.

Can I deduct car loan interest on my taxes?

If you have a car loan for the vehicle, you may also be able to deduct the interest when filing your federal tax returns. Only those who are self-employed or own their own business and use a vehicle for business purposes may claim a tax deduction for car loan interest.

What are the tax benefits of loans?

These range from education loans, home loans, car loans, and personal loans. Some loans do not have any tax benefits while some offer a tax exemption. Loans, be it of any type, are a great liability on any customer. Loans like home loans and auto loans have a considerable tenure too which makes repayment a really difficult and dreary regular task.

What are the tax benefits of car loan in India?

Tax benefits on Car Loans Car is considered a luxury product in India and, in fact, attracts the highest Goods and Services Tax (GST) rate of 28% currently. Thus, you are not eligible for any deductions on your Car Loan if you are buying for your personal use.

How to claim Car Loan tax benefit?

For claiming the benefit, at the time of filing tax returns include the loan interest paid in a year in the business expenses column.

When will car loan tax benefits be available?

Car Loan Tax Benefits and How to Claim It. January 22, 2020. A variety of loans, such as Education Loan and Home Loan, come with associated tax benefits for individuals and business owners.

How much can you depreciate a car in a year?

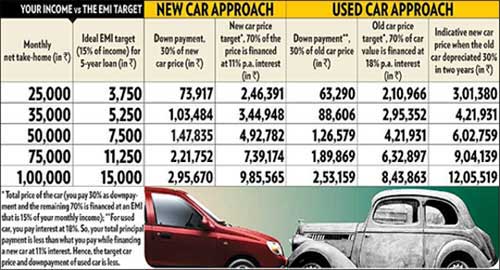

Another way to save taxes on your car purchase is to show it as a depreciating asset and show the depreciation as an expense. You can depreciate your car up to 15% in a year. This depreciation can be deducted whether you opt for a Car Loan or not.

How to know if you paid interest on a loan?

You can get in touch with your loan provider to get an interest certificate, so that you can know the exact interest you have paid in the year.

Why do people take loans?

People often take loans due to tax benefits.

Do banks offer pre-approved car loans?

For instance, banks now offer a pre-approved Car Loan to selected customers. Loans of up to 100% of the on-road price of the car, part-prepayment and full-prepayment facility, and zero processing fee are some of the other top benefits.

Can you deduct interest on a car loan?

However, if you are buying a car for commercial use, you can show the interest paid in a year as an expense and reduce your taxable income. The tax deduction is only available for the interest component of the loan and not for the principal amount.

When you can deduct car loan interest from your taxes

Only those who are self-employed or own their own business and use a vehicle for business purposes may claim a tax deduction for car loan interest. If you are an employee of someone else’s business, you are not eligible to claim this deduction.

Documentation to keep

When claiming deductions of any kind on your tax returns it’s best to keep detailed records and supporting documentation that can be used to verify all expenses should questions ever arise. Some of the records to maintain when claiming the auto loan interest deduction on your tax return include:

Bottom line

Deducting car loan interest on your tax returns can be a valuable write-off if you’re a small business owner or you’re self-employed. But before you claim this deduction be sure you qualify and work with a tax professional if you’re uncertain about how to calculate the exact amount you may be eligible to claim.

What happens if you can't pay your car loan?

However, using a HELOC to pay your loan means you risk losing your house instead of your car. This isn't a trade-off to be made lightly.

Can you write off car loan interest?

Mortgages and home equity loans fall into a tax-deductible category, so many borrowers consider this a feasible way to make their auto loan interest deductible. If your vehicle doesn't fit into one of the above categories on its own, you may be able to write off your car loan interest charges using a home equity line of credit (HELOC) to purchase your vehicle.

Can you deduct auto loan interest?

Auto Loans as Business Expenses. You can deduct the interest paid on an auto loan as a business expense using one of two methods: the expense method or the standard mile age deduction when you file your taxes.

Can you claim your car loan interest on your taxes?

Risks and Rewards to Auto Loan Interest Deductions. There are several instances when you can claim your vehicle on your taxes to help lower the amount of federal taxes you owe. While these deductions can be tempting, they don't come without risks.

Is CarsDirect loan approval guaranteed?

Loan approval is not guaranteed and is subject to credit application and approval of the lender. Individual loan terms may vary. Use of this website constitutes acceptance of CarsDirect.com's Terms of Use, Disclaimer, Privacy Policy, and Cookie Policy . Over 5 milion.

Can you deduct auto loan interest without a business license?

In most cases, you need to own a business to deduct auto loan interest. So, if you're a subcontractor, or work for yourself without a proper business license, you may not be able to legally claim the deductions at all. You could be audited.

What Is Auto Loan Interest?

Auto loan interest is what you pay when you borrow money from a lender to finance the purchase of a car, a truck, or some other type of vehicle. When you make your payment every month, a portion of the money goes toward paying the interest you owe and the rest goes toward the principal balance. Because auto loans are secured loans —the car is your collateral—the interest rates are typically lower than they are for unsecured loans. Still, over time (the average new car loan is about 70 months), paying interest can make buying your car much more expensive. So you can’t blame car owners for wondering if and how they could write off those monthly interest charges on their taxes, the way they can with a home mortgage or a qualified student loan.

Is There a Tax Benefit to Auto Loan Refinancing?

And though it might not be the primary reason to refinance, as a bonus there could be some tax benefits should you go that route. Let’s say your pickup is worth $8,000 and you owe just $4,000. If you refinanced for $6,500, you’d still owe less than what the truck is worth, and you’d have $2,500 left over after you paid off the old loan. You could put that money into your business or use it to tide you over between freelancing jobs. And as long as you’re using the truck for business, you can write off at least a portion of the interest on your taxes each year. Refinancing also may be a strategy worth exploring if you hope to lower your car payments by qualifying for a lower interest rate, by extending the length of the loan, or, if possible, doing both. Keep in mind, though, that if the length of the loan is extended, you could end up paying more in interest over the long haul—so you’ll want to find the best loan available. It can be helpful to use a comparison site like Lantern to review the refinancing rates and terms lenders are currently offering, then crunch the numbers before deciding to move to a new loan.

Can Auto Loan Interest Be Deducted If It Isn’t a Business Expense?

The IRS lists five types of interest that are deductible on an income tax return.

Is Auto Loan Interest Deductible?

Unfortunately, car loan interest isn’t deductible for all taxpayers. Should you use your car for work and you’re an employee, you can’t write off any of the interest you pay on your auto loan. But if you own your business or you’re self-employed, it’s a different story. You can, with some limits, deduct the interest you pay on debts that are directly connected to your business. And that may include the interest on an auto loan if the car is for work, or for work and personal use. Here’s how that breaks down depending on how you use the car.

When is tax benefit on education loan applicable?

Tax benefit on education loan is applicable only if the repayment of loan has already been started by loan borrower

How long can you get tax benefit on education loan?

Tax benefit on education loan can be availed for the full loan repayment period or for a maximum of 8 years, whichever is earlier

What is education loan?

Education Loans for higher and professional education are offered by various public and private sector banks. Public sector banks run various promotional schemes too on education loans so as to promote higher education on easy and convenient terms. Some of the most important characteristics of tax rebate on education loans are listed as under: ...

Can a loan be chosen by customers based on tax benefit?

So, loans cannot be chosen by customers based on the tax benefit that they offer.

Does personal finance offer tax rebates?

Other than this specific case, personal finance does not offer any form of tax rebate to customers.

Is a car a luxury item?

Cars come under the category of luxury items and as such no tax benefit is offered to customers who avail car or auto loan for purchase of vehicle.

Do home loans have tax rebates?

There are different tax rebates for different loans. These range from education loans, home loans, car loans, and personal loans. Some loans do not have any tax benefits while some offer a tax exemption.

What is deprication on car tax?

Deprication means wear and tear caused to asset because of it's use and it can be claimed as business expense, for car income tax allow deprication at rate of 15% p.a. which means you can show expense of 15% of value of car each year.

Can you claim deduction on car loan?

If you are a Business man or a professional and the car is being used for business purposes, you can claim deduction on account of interest on such loan

Is property tax paid on accrual basis or payment basis?

Property tax: the property tax paid at the end of the financial year and can be exempted on accrual basis and not on payment basis.

Can salaried people get a car loan?

However if you are a salaried person than sorry you can not get any benefit from CAR loan for income tax purpose.

Can you get indirect benefit and save tax?

However if you are business man than you can get indirect benefit and save tax.

Do you have to pay income tax on a car loan?

No, a person do not get any direct exemption under income tax for Car loan.

How much of a vehicle must be used for 179?

To qualify for Section 179, any vehicle, new or used, must be financed and used by the business before December 31 and must be used at least 50 percent of the time for business. It should be noted that you can only deduct the percentage of the cost equal to the percentage of business use.

What is the ad valorem tax?

What you will be deducting is the ad valorem tax, a tax whose amount is based on the value of a transaction or of property, which takes the place of sales tax on vehicle registration. Your deduction of state and local income, sales, and property taxes is limited to a total deduction of $10,000. When you purchase a new car, keep a record ...

Can you deduct mileage depreciation?

There's one important thing to keep in mind: to deduct vehicle depreciation, you'll have to forgo the standard mileage deduction. More on that later!

Do you deduct the cost of a business expense in the year you buy?

Naturally, business owners would much rather deduct the cost of the expense in the year they buy .

Can you deduct business use of car?

Note: You can only deduct the business-use percentage of the car's cost. So if you use your car for work 70% of the time, you can deduct 70% of the cost.

Can you write off sales tax on a new car?

You have to select one option because you can’t take both. The Schedule A form also has other write-offs for your tag registration (property tax).

Can you write off a car as a business expense?

You technically can't write off the entire purchase of a new vehicle. However, you can deduct some of the cost from your gross income.

When is the tax benefit for electric bike?

The loan for the purchase of electric vehicle must be sanctioned between April 1, 2019 and March 31, 2023. The loan must be taken from a financial institution.

What is the quantum of tax benefit?

The quantum of tax benefit will depend on the cost of your electric vehicle (quantum of your car loan) and your marginal income tax rate. As with any tax deduction, the absolute benefit is the highest to those in the highest tax brackets (for the same amount of interest paid). Let’s consider an example.

What Is the Tax Benefit under Section 80EEB?

Under Section 80EEB, you can get tax benefit of up to Rs 1.5 lacs for the interest paid towards the loan taken to purchase an electric vehicle. The benefit is available for purchase of both electric bikes and car. To get the tax benefit under Section 80EEB, you must satisfy the following conditions.

Is tax benefit useful?

Any tax benefit is useful . However, you must appreciate the following aspects that will affect the tax benefits you get.

Are There Any Special Loan Products for Electric Vehicle Loans?

I could not find any special loan products. There is no reason for such loan products either, except for marketing gimmicks. I read about SBI Green Car loan a few months back. Unfortunately, the banks manage a number of press releases, but do not provide much information on their websites. As per the press release, the interest rate was lower by up to 20 bps. However, with the introduction of tax benefits on such loans, this discount of a few basis points may vanish.

How much is the tax credit per vehicle?

LIMITATIONS: As we mentioned earlier, the IRS limits the total amount of credit per vehicle to $7,500. If you owe less than that to Uncle Sam, the difference disappears. For example, if your tax credit is $7,500 but you owe $6,000 when you file taxes, you don’t get a check for the difference — $1,500 — nor does it apply to your taxes for next year.

How much can you write off for a car purchase?

The federal maximum allows you to deduct up to $10,000 total in sales, income and property tax deductions ($5,000 total if married filing separately).

How much can you deduct on property taxes?

LIMITATIONS: The IRS only allows you to deduct up to $10,000 total in sales, income and property taxes ($5,000 total if married filing separately).

What is the sales tax rate in California?

For example, the California car sales tax is 7.25% ; of that, 1.25 percentage points go to local governments. Local governments can, however, charge more on top of that state rate. So, if your municipality charges an additional 0.50 percentage points, your California car sales tax would be 7.75%.

What form do you use to add up sales tax?

To do this, you would use the IRS’ Schedule A (Form 1040). Property taxes or other value-based fees would be entered on Schedule A’s “state and local personal property taxes” line.

Can you deduct sales tax on a used car?

Car sales tax. You may be able to deduct the car sales tax you paid when you bought a new or used vehicle from a dealer or private seller. The amount owed in car sales tax will be clear on the purchase order that’ll state your TT&L (tax, title and licensing) fees. Both states and local governments can charge sales tax.

Which method of depreciation is used for car taxes?

The first is the “actual expense method, ” which uses straight-line depreciation. The other two ways are more logarithmic, which could help small business owners by allowing for a larger car tax deduction earlier.

When You Can Deduct Car Loan Interest from Your Taxes

- Only those who are self-employed or own their own business and use a vehicle for business purposes may claim a tax deduction for car loan interest. If you are an employee of someone else’s business, you are not eligible to claim this deduction. In addition, interest paid on a loan that’s used to purchase a car solely for personal use is not deducti...

Documentation to Keep

- When claiming deductions of any kind on your tax returns it’s best to keep detailed records and supporting documentation that can be used to verify all expenses should questions ever arise. Some of the records to maintain when claiming the auto loan interestdeduction on your tax return include: 1. A log or record of all trips taken in the vehicle for business purposes including a log o…

If You’Re Unsure, Hire A Professional

- If you’re uncertain about whether you qualify for the car loan interest deduction, or you’re unsure about how to properly calculate the exact amount of the deduction to be claimed on your tax filing, it is best to consult a professional. A tax expert can help guide you through the process and determine whether the deduction makes sense for your unique circumstances. In cases when yo…

Bottom Line

- Deducting car loan interest on your tax returns can be a valuable write-off if you’re a small business owner or you’re self-employed. But before you claim this deduction be sure you qualify and work with a tax professional if you’re uncertain about how to calculate the exact amount you may be eligible to claim. Related Articles 1. How to use your tax return to pay for a car 2. Tax ad…