Who qualifies for Social Security spousal benefits?

You may also qualify for the spousal benefit If you’re divorced but the marriage lasted for at least 10 years and you’re not currently married. How Much Is the Social Security Spousal Benefit? If you’re eligible and can qualify, the spousal benefit can be as much as 50% of the higher-earning spouse’s full retirement age benefit.

Can my spouse collect Social Security before I retire?

No. You have to be receiving your Social Security retirement or disability benefit for your husband or wife to collect spousal benefits. When can a spouse claim spousal benefits? You can claim spousal benefits as early as age 62, but you won’t receive as much as if you wait until your own full retirement age.

How are Social Security spousal benefits calculated?

You can expect the following when applying for Social Security spousal benefits:

- You can receive up to 50% of your spouse’s Social Security benefit.

- You can apply for benefits if you have been married for at least one year.

- If you have been divorced for at least two years, you can apply if the marriage lasted 10 or more years.

- Starting benefits early may lead to a reduction in payments.

Can a spouse draw Social Security?

As a spouse, you can claim a Social Security benefit based on your own earnings record, or collect a spousal benefit in the amount of 50% of your spouse’s Social Security benefit, but not both. You are automatically entitled to receive whichever benefit provides you the higher monthly amount.

What are the rules for spousal benefits of Social Security?

Who is eligible for spousal Social Security benefits?You must have been married at least 10 years.You must have been divorced from the spouse for at least two consecutive years.You are unmarried.Your ex-spouse must be entitled to Social Security retirement or disability benefits.More items...•

Can I file for my Social Security at 66 and switch to spousal benefits later?

Generally, no. The SSA will usually give you the greater of your retirement or spousal benefit. However, if you were born on or before January 1, 1954, you may be eligible to start with your spousal benefit and switch to your retirement benefit later on.

Can my wife collect spousal Social Security benefits before I retire?

No. You have to be receiving your Social Security retirement or disability benefit for your husband or wife to collect spousal benefits.

When can a spouse claim spousal Social Security benefits?

least 62 years of ageTo qualify for spouse's benefits, you must be one of these: At least 62 years of age. Any age and caring for a child entitled to receive benefits on your spouse's record and who is younger than age 16 or disabled.

Can I collect ex spousal benefits and wait until I am 70 to collect my own Social Security?

You can only collect spousal benefits and wait until 70 to claim your retirement benefit if both of the following are true: You were born before Jan. 2, 1954. Your spouse is collecting his or her own Social Security retirement benefit.

At what age can I collect half of my husband's Social Security?

A spouse can choose to retire as early as age 62, but doing so may result in a benefit as little as 32.5 percent of the worker's primary insurance amount. A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months.

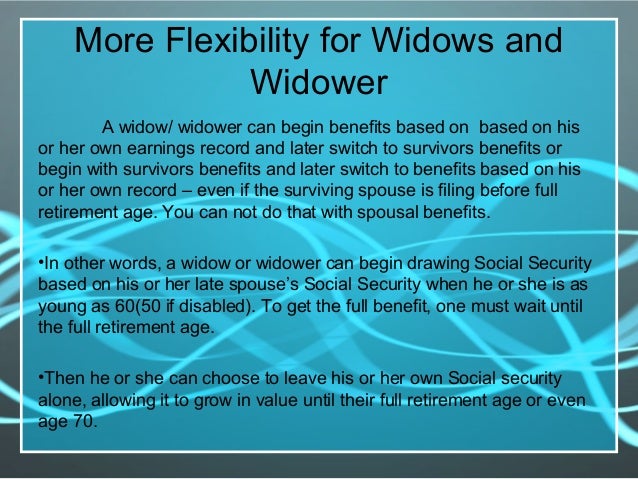

How do I switch from Social Security spousal benefits to my own benefits?

You will have to file an application to switch from survivor benefits on a late spouse's work record to retirement benefits on your own record. You should apply four months before you want your retirement benefit to start.

What is the best Social Security strategy for married couples?

3 Social Security Strategies for Married Couples Retiring EarlyHave the higher earner claim Social Security early. ... Have the lower earner claim Social Security early. ... Delay Social Security jointly and live on savings or other income sources.

Can I collect my husband's Social Security if he is still alive?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

Can you collect 1/2 of spouse's Social Security and then your full amount?

You're eligible for spousal benefits if you're married, divorced, or widowed, and your spouse is or was eligible for Social Security. Spouses and ex-spouses generally are eligible for up to half of the spouse's entitlement. Widows and widowers can receive up to 100%.

What percentage of Social Security benefits does a widow receive?

Widow or widower, full retirement age or older—100% of your benefit amount. Widow or widower, age 60 to full retirement age—71½ to 99% of your basic amount.

Do married couples get two Social Security checks?

Both partners in a marriage who worked enough to claim benefits, are able to receive two checks. Spousal benefits are a bit more complicated. This week the Social Security Administration (SSA) is expected to release the 2022 Cost-of-living-adjustment, or COLA as it is more commonly known.

How much can I receive as a spouse?

The maximum you can receive as a spouse or ex-spouse is 50 percent of your former spouse’s benefit at Full Retirement Age. So, if their benefit at Full Retirement Age would be $2,000 a month, you may be eligible to receive up to $1,000 a month if you wait until Full Retirement Age to file for spousal benefits.

How much do I get if I file for Social Security at 62?

How much you receive, though, depends on when you file . If you file at age 62, you will receive a smaller percentage of your spouse’s benefit — roughly 30 percent versus 50 percent. Once you file for your benefits as a spouse, the amount you receive freezes at that amount for the rest of your life, which makes it worthwhile to see how long you can ...

Can I apply for spousal benefits if my spouse has retired?

The rules around spousal benefits can be complicated. Generally speaking, you can only apply for spousal benefits if your spouse has applied for their retirement benefits . If your spouse is eligible for retirement benefits, but has not yet filed for them, you can’t apply.

Can I get Social Security if my ex-husband made more money than I did?

In short, the answer is, yes.

Can I file for Social Security if I am an ex-spouse?

If, however, you are an ex-spouse, the rules are different. If you were married at least 10 years, and you and your former spouse are at least 62, and your former spouse is eligible for Social Security benefits, you may file for spousal benefits on their record even if they haven’t filed. Your filing as an ex-spouse will not impact the amount ...

Can my wife switch from spousal to retirement?

Just to clarify, though, your wife can't "switch" from drawing her own retirement benefits to drawing spousal benefits instead. What she would be applying for is a partial, or excess, spousal benefit to be paid in addition to her retirement benefit. Your wife will only qualify for an excess spousal benefit if 50% of your primary insurance amount ...

Can my wife get spousal benefits?

Your wife will only qualify for an excess spousal benefit if 50% of your primary insurance amount (PIA) is higher than her own PIA, and she can't qualify for spousal benefits at least until you start drawing your benefits. A person's PIA is equal to their Social Security retirement benefit rate if they start drawing their benefits ...

How old do you have to be to get spouse's Social Security?

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age.

What happens if your spouse's retirement benefits are higher than your own?

If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits equaling the higher spouse benefit. Here is an example: Mary Ann qualifies for a retirement benefit of $250 and a spouse’s benefit of $400.

When will my spouse receive my full retirement?

You will receive your full spouse’s benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse’s record who is younger than age 16 or disabled.

Social Security Spouse's Benefit Estimates

Plan for your future with a my Social Security account. With a my Social Security account, you can view the benefits you could receive based on your spouse’s earnings history, or the benefits your spouse could receive based on your earnings history.

Follow these steps to get started

Ask your spouse to create or open their my Social Security account, go to the ‘Plan for Retirement’ section, and note their retirement benefit estimate at their full retirement age or Primary Insurance Amount (PIA).

How many people receive Social Security benefits as a spouse?

A recent Social Security report found that 2.3 million individuals received at least part of their benefit as a spouse of an entitled worker. Some of these spouses had benefits of their own, but were eligible to receive higher benefit because the spousal benefit amount was greater than their own benefit. Others never worked outside the home ...

How much of my spouse's Social Security is my full retirement?

Remember, in that case, it’s between 32.5% and 50% of the higher-earning spouse’s full retirement age benefit, depending on your filing age. However, it can seem a little more complicated if you have Social Security benefits from your work history.

How much is spousal benefit?

Depending on how old you are when you file, the spousal benefit amount will range between 32.5% and 50% of the higher-earning spouse’s full retirement benefit. Check out the chart below to get an idea of how the benefit works and what your payment might be if you can take advantage ...

What is the 1 year requirement for Social Security?

The 1-year requirement is also waived if you were entitled (or potentially entitled!) to Social Security benefits on someone else’s work record in the month before you were married. An example of these benefits would be spousal benefits, survivor benefits or parent’s benefits.

What is Julie's reduction to her own benefit?

This means that Julie’s reduction to her own benefit would be based on her age when she filed for her benefit. However, her reduction to the spousal benefit would be based on her age when Joe filed for his benefit. So, if Julie filed when she was 62, her own benefit would be reduced.

How long do you have to be married to get spousal benefits?

The Two Exceptions to Know Around the 1 Year Marriage Requirement. Normally, you must be married for at least 12 continuous months to meet the spousal benefit duration-of-marriage requirement. However, there are two exceptions to this rule.

Can a spouse receive Social Security?

They have no benefit of their own, but thanks to the Social Security spousal benefit available under their spouse’s work record, they can still receive payments. This particular benefit doesn’t just provide retirement income, either. As an eligible spouse, you could also receive premium-free Medicare benefits.

How old do you have to be to claim spousal benefits?

To claim a spousal benefit based on an ex-spouse's earnings record, your ex-spouse has to be 62 and eligible for benefits, but there is no requirement that they must have already filed for benefits. 1 . To claim a spousal benefit based on your current spouse's earnings record, your current spouse must have filed for their own benefits already ...

What happens if my spouse has already filed for spousal support?

If your spouse has already filed, you will automatically receive the larger of your own or the spousal benefit. If your spouse has not filed yet but you have, when your spouse files, the deemed filing rules come into play.

What is deemed filing for Social Security?

Deemed Filing Rules. When you file for your Social Security retirement benefits you are deemed to be filing for both your own benefit and a spousal benefit, and you will be given the higher of the two. 3 .

Is Social Security confusing?

Social Security spousal benefits are confusing, and among the most common thing readers ask about. The most frequent cause for confusion comes from one small difference between benefits for a spouse versus an ex-spouse.

Can a spouse collect spousal benefits if their spouse is suspended?

Due to Social Security laws that were passed in November 2015 anyone who suspends benefits after April 30, 2016, will end up suspending all benefits based on their record — which means a spouse cannot collect spousal benefits during a time when their spouse has " suspended" benefits. 3 .