How much can you make on social security before it is taxed?

Here's how to tell if your Social Security benefit is taxable:

- Individuals with a combined income between $25,000 and $34,000 are taxed on 50% of their Social Security benefit.

- If your combined income exceeds $34,000, 85% of your Social Security income could be taxable.

- Married couples face tax on 50% of their Social Security benefit if their combined income is between $32,000 and $44,000.

How to determine if your Social Security benefits are taxable?

- $25,000 – if taxpayers are single, head of household, qualifying widow or widower with a dependent child or married filing separately and lived apart from their spouse for all of ...

- $32,000 – if they are married filing jointly

- $0 – if they are married filing separately and lived with their spouse at any time during the year

Can the IRS tax my Social Security benefits?

Yes, some households have to pay federal income taxes on their Social Security benefits. This usually happens if you have other substantial earnings on top of your benefits - for example wages, self-employed earnings, interest, dividends or other taxable income. However, Supplemental Security Income (SSI) is never taxable.

How do you calculate taxable social security benefits?

- $25,000 if you’re filing single, head of household, or married filing separately (living apart all year)

- $32,000 if you’re married filing jointly

- $0 if you’re married filing separately and lived together with your spouse at any point in the year

News about Can You Be Taxed On Social Security Benefitsbing.com/news

Videos of Can you Be Taxed on Social Security benefitsbing.com/videos

How much of your Social Security income is taxable?

Income Taxes And Your Social Security Benefit (En español) between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

At what age is Social Security not taxable?

However once you are at full retirement age (between 65 and 67 years old, depending on your year of birth) your Social Security payments can no longer be withheld if, when combined with your other forms of income, they exceed the maximum threshold.

How can I avoid paying taxes on Social Security?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

Are Social Security benefits taxed after age 66?

1. Social Security benefits may be subject to income tax. If you're collecting Social Security benefits at or past full retirement age, your benefits may be subject to federal income tax. For workers with other sources of retirement income, up to 85% of their benefits may be taxable.

Is Social Security federally taxed after age 70?

Yes, Social Security is taxed federally after the age of 70. If you get a Social Security check, it will always be part of your taxable income, regardless of your age.

Is Social Security considered income?

The simplest answer is yes: Social Security income is generally taxable at the federal level, though whether or not you have to pay taxes on your Social Security benefits depends on your income level.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

Quick Rule: Is My Social Security Income Taxable?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security...

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never...

How to File Social Security Income on Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this par...

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay...

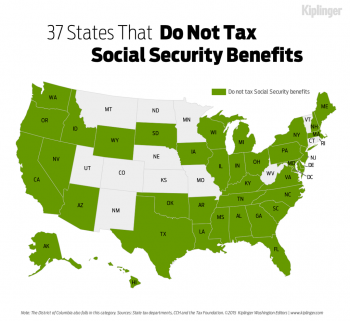

State Taxes on Social Security Benefits

Everything we’ve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes. As y...

Tips For Saving on Taxes in Retirement

1. What you pay in taxes during your retirement will depend on how retirement friendly your state is. So if you want to decrease tax bite, consider...