Can you get two Social Security benefits at once?

Not in the sense of getting both combined. When you are eligible for two Social Security benefits — such as a survivor benefit and a retirement payment — Social Security doesn’t add them together but rather pays you the higher of the two amounts. If that’s the retirement benefit, then the retirement benefit is all you’ll get.

Can I claim my second husband on my social security?

One at a Time. If your second spouse dies, you cannot receive benefits from two deceased husbands at the same time. Ask the Social Security Administration to compare the records from your previous husband with those of your second husband so that you can claim the record that provides the greatest benefit.

Can you collect both Social Security retirement and survivor benefits?

You cannot collect both full benefits. Can I collect Social Security on my spouse’s record? What are my options if I am eligible for both a Social Security retirement benefit and a survivor benefit?

Can I receive Social Security spousal benefits if I'm the only one?

Dan explains that you're only entitled to receive spousal benefits if your spouse files for Social Security under her own work history, and so if you're the only person to file, you can only claim your own benefits.

Can you receive two Social Security benefits at the same time?

You'll no longer be eligible to receive both benefits. You'll be notified which survivor benefit you'll receive. You can continue to work and still get Social Security retirement benefits.

Can I take my Social Security at 62 and then switch to spousal benefit?

Only if your spouse is not yet receiving retirement benefits. In this case, you can claim your own Social Security beginning at 62 and make the switch to spousal benefits when your husband or wife files.

How many Social Security benefits are allowed?

As you work and pay taxes, you earn Social Security “credits.” In 2022, you earn one credit for each $1,510 in earnings — up to a maximum of four credits per year. The amount of money needed to earn one credit usually goes up every year. Most people need 40 credits (10 years of work) to qualify for benefits.

Can you collect 1/2 of spouse's Social Security and then your full amount?

Your full spouse's benefit could be up to one-half the amount your spouse is entitled to receive at their full retirement age. If you choose to begin receiving spouse's benefits before you reach full retirement age, your benefit amount will be permanently reduced.

Is it better to take Social Security at 62 or wait?

You can start receiving your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

How much Social Security will I get if I make $60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

What's the average Social Security check at 62?

$2,364At age 62: $2,364. At age 65: $2,993. At age 66: $3,240. At age 70: $4,194.

What is SSDI benefits?

Social Security Disability Insurance (SSDI): SSDI pays benefits to people who have a qualifying disability that prevents them from working. This benefit isn’t needs-based, so it’s available to those with more income; however, it is based on work history. (Learn more about SSDI here.)

How long can you claim spousal benefits?

Spousal benefits: Married spouses and divorced spouses who were married more than 10 years can receive spousal benefits. If you are married, you can claim this benefit starting at age 62, as long as your spouse has claimed their own retirement benefits. However, if you have been divorced more than two years, you can claim spousal benefits whether ...

When can a spouse claim survivor benefits?

Like SSDI, it is based on work history. The spouse can claim survivor’s benefits at age 60, or at age 50 if disabled.

Can I get Social Security Disability if I am at full retirement age?

For example, if you are at or near full retirement age, you might qualify for your own retirement benefits as well as spousal or survivor’s benefits. if you have a disability, you might qualify for both Supplemental Security Income (SSI) and Social Security Disability (SSDI).

Can I receive both SSI and retirement?

For example, if you are eligible for both SSI and retirement benefits, you can receive both. However, the amount you receive through retirement benefits would reduce the amount you receive through SSI.

Is Social Security a part of your income?

After all, for many people Social Security is a large part of their income—or even their only source of income. Today, we’re talking about multiple Social Security benefits. You might be entitled to disability benefits, retirement benefits, spousal benefits, and/or survivor’s benefits. How do these benefits work?

Does Arnando still get SSI?

If that were the case, Arnando would no longer receive SSI benefits. That would be because his SSDI benefits would increase his income past SSI’s needs-based threshold. He would be making too much money to continue to qualify for SSI. The example of Arnando applies in other situations as well.

Collecting twice from Social Security sounds like it's too good to be true. Is it?

If you're married, Social Security offers benefits both under your own work history and under your spouse's work history. But can you claim both, essentially giving you a double Social Security benefit?

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

Who is entitled to two Social Security benefits?

Just about anyone who has worked and who is married or who has ever been married is potentially due two Social Security benefits: his or her own Social Security benefit and possibly a dependent benefit on a spouse's Social Security record.

What happens if you get a spousal check at 62?

At age 62, you are due about one third of his full age-66 benefit rate. In other words, you would get the difference between your benefit and one third of his added to your Social Security check. If there is no difference, meaning if your Social Security benefit exceeds one third of his, then you won't get any extra spousal benefits.

How long does it take to get Medicare for a widow?

So why bother with the disability claim? The answer is Medicare. With her original widow's claim, she would have to wait until age 65 to get Medicare coverage. But people getting Social Security disability benefits get Medicare two years after those benefits start.

How much is Mary on disability?

She filed for her own disability benefits and her claim was finally approved. She is due $1,200 per month from her own disability account. She will get a check for $1,200.

Can a widow take Social Security?

And as a widow, she has options other Social Security beneficiaries do not have. She can take reduced benefits on one record and later switch to full benefits on the other record.

Both partners in a marriage who worked enough to claim benefits, are able to receive two checks. Spousal benefits are a bit more complicated

This week the Social Security Administration (SSA) is expected to release the 2022 Cost-of-living-adjustment, or COLA as it is more commonly known. This upcoming news has raised many questions about Social Security benefits, including how married couples receive their checks.

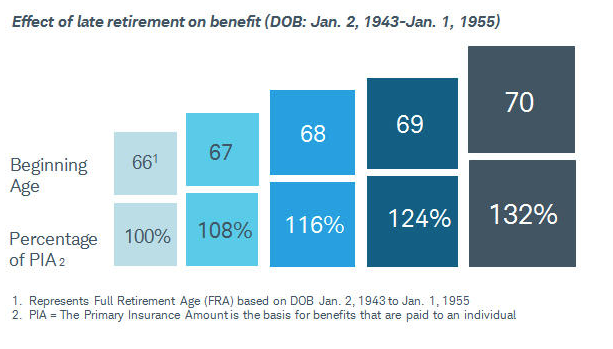

What is a Primary Insurance Amount?

The "primary insurance amount" (PIA) is the benefit (before rounding down to next lower whole dollar) a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement age. At this age, the benefit is neither reduced for early retirement nor increased for delayed retirement.

How long do you have to be married to collect widow benefits?

Generally, a couple must have been married for at least nine months before the worker died for the widow to collect benefits.

How much can a divorcee collect?

Divorcee's Benefits. A divorcee can collect an amount equal to 50 percent of her ex- husband’s benefits if the marriage lasted at least 10 years, she is 62 or older, is divorced for at least two years, and her own work record would produce lower benefits than her ex’s.

How much do widows get for surviving spouse?

A surviving spouse with a child younger than 16 receives 75 percent. A widow at any age can get benefits if she takes care of the deceased’s child, as long as that child is younger than 16 or disabled.

Can I collect Social Security from my deceased husband?

Can I Collect Social Security Benefits From Two Deceased Husbands? Social Security provides income for people who are retired as well as for their dependents. A surviving spouse, even one who has never worked, is entitled to receive benefits, depending on the age of the survivor at the time of the spouse’s death.

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

How old do you have to be to get spouse's Social Security?

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age.

What happens if your spouse's retirement benefits are higher than your own?

If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits equaling the higher spouse benefit. Here is an example: Mary Ann qualifies for a retirement benefit of $250 and a spouse’s benefit of $400.

When will my spouse receive my full retirement?

You will receive your full spouse’s benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse’s record who is younger than age 16 or disabled.