But depending on your circumstances, your opportunities to enroll after the end of the annual open enrollment period may be limited. But you may find that you can still get coverage without having to wait for the next annual open enrollment period. Back to top Native Americans, those eligible for Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Can an employee make changes to their benefits outside of open enrollment?

The employee would have to wait to make the desired change during the next open enrollment period, however long that might be. Employees will often get upset when their HR representative denies their request to make changes to their benefits outside of an open enrollment period. Often, we hear “but it’s my money!”

Can I apply for health insurance after open enrollment?

Can you apply for health insurance after open enrollment? Most companies keep a checklist of who has submitted their documents and whose are still outstanding: calling, texting and emailing to get the paperwork completed. Try as you may, some employees still miss the deadline for open enrollment.

Can I extend my open enrollment period?

But there are some state-run exchanges that have extended enrollment windows. States that run their own exchanges have the option to extend open enrollment by adding a special enrollment period, available to all residents, before or after the regularly scheduled enrollment period.

Does open enrollment apply to small business retirement plans for employees?

Generally, open enrollment does not apply to small business retirement plans for employees. Employees can make changes to their small business retirement plans at any time during the year. When is open enrollment? Open enrollment lasts approximately a few weeks per year.

What happens if you don't make changes during open enrollment?

If they fail to make any changes to their benefits elections during open enrollment, every previous election will remain in place, but they will have to wait until the next open enrollment period to make changes to their plan(s).

What is the advantage of an open enrollment period to the insured?

It also helps protect people from the risk of not having health insurance when they incur expensive, unexpected medical care or have an existing chronic condition. During an open enrollment period, individuals cannot be turned down for ACA-compliant health insurance because of their health status.

What triggers a special enrollment period?

You qualify for a Special Enrollment Period if you've had certain life events, including losing health coverage, moving, getting married, having a baby, or adopting a child, or if your household income is below a certain amount.

What is the difference between annual enrollment and open enrollment?

Here's the bottom line on AE vs OE: Annual enrollment is for employees who get health insurance as part of their benefits. Open enrollment is for people who get insurance on the individual market. But everyone can make changes to their health insurance at any time of year, if they have a qualifying event.

Can I buy health insurance and use it immediately?

The initial waiting period completely varies from insurer to insurer, however the minimum waiting period is at least 30 days. The only exception in initial waiting period is accidental claims wherein the claims are approved if the insured meets with an accident and requires immediate hospitalisation.

What is true open enrollment?

A true open enrollment generally occurs once a year. Prior to implementation of the Affordable Care Act (ACA), open enrollment periods were not required under the Employee Retirement Income Security Act (ERISA) but may have been required by: Health insurance contracts. Collective bargaining agreements.

Is special enrollment period retroactive?

If you get married, you're eligible to get coverage effective the first of the following month, regardless of how late in the month you enroll. If you have a baby, adopt a child, or receive a court order for medical child support, the coverage can be backdated to the date of the birth, adoption, or court order.

Can a health insurance policy be backdated?

Backdating means coverage of your benefits is made retroactively effective by your insurance provider. Wouldn't it be great if we could all purchase retroactive coverage? As a general practice, it is illegal. A health insurance carrier will only backdate insurance coverage in some scenarios.

What is a waiting period for insurance?

A waiting period is the amount of time an insured must wait before some or all of their coverage comes into effect. The insured may not receive benefits for claims filed during the waiting period. Waiting periods may also be known as elimination periods and qualifying periods.

What can I do during OEP?

During MA OEP, you can make the following changes:Switch Medicare Advantage plans.Drop Medicare Advantage plan coverage and return to Original Medicare.Add a standalone Part D drug plan if you drop Medicare Advantage coverage.

How many changes can you make during OEP?

one changeChanges made during OEP will take effect on the first day of the following month. Beneficiaries can only make one change during OEP. Once a change has been made during OEP, it cannot be changed again until the next AEP.

What is open enrollment for health insurance?

An open enrollment period is a window of time that happens once a year — typically in the fall — when you can sign up for health insurance, adjust your current plan or cancel your plan. It's usually limited to a few weeks. If you miss it, you may have to wait until the next open enrollment period to make any changes.

Native Americans and People Eligible For Medicaid/CHIP Can Enroll Year-Round

Native Americans can enroll in exchange plans year-round.And people who qualify for Medicaid or CHIP can also enroll at any time. Income limits are...

A Qualifying Event at Any Time of The Year Will Allow You to Enroll in A Plan (with Some Limitations)

Applicants who experience a qualifying event gain access to a special enrollment period (SEP) to shop for plans in the exchange (or off-exchange, i...

New Open Enrollment Schedule May Have Caught People Off Guard

For 2018, HHS had originally planned to keep the same November 1 – January 31 schedule, but a market stabilization rule finalized in April 2017 sho...

Short-Term Insurance: The Closest Thing to “Real” Insurance If You Missed Open Enrollment

For people who didn’t enroll in coverage by the end of open enrollment and who aren’t expecting a qualifying event later in the year, the options f...

Short-Term Coverage Application: An Easy Process, but Pre-Existing Conditions Are Not Covered

The application process is very simple for short-term policies. Once you select a plan, the online application is much shorter than it is for stand...

Not A Qualifying Event: Losing Short-Term Coverage

Although loss of existing minimum essential coverage is a qualifying event that triggers a special open enrollment period for ACA-compliant plans,...

Can I Sign Up For Health Insurance after Open Enrollment?

Open Enrollment for 2020 plans is over, but you may still be able to enroll in two ways with a special enrollment period, which usually lasts 60 days from the date of a qualifying life event, or through Medicaid or the children’s Health Insurance Program.

Why Is There An Open Enrollment Period?

Well; there isn’t a clear definitive answer for why the government has certain systems in place; as there is no system without a flaw. However; the main idea behind an open enrollment period is to insure that people are paying towards their health insurance to be able to use it.

What Happens If I Miss Open Enrollment?

If you miss the open enrollment deadline, you could lose your coverage, and you would be unable to make changes. Moreover, you probably cannot sign up for health insurance until the next open enrollment period unless you experience a qualifying event.

Can I Still Get Health Insurance After Open Enrollment?

Outside of open enrollment, there are various ways that you can still secure a health insurance plan. You can still get public insurance or a subsidy if you qualify for special enrollment; otherwise, the private market is in fact open all year round.

How Do I Qualify for a Special Enrollment Period?

You can qualify for a special Enrollment Period, for example, losing health coverage, getting married or divorced, having a baby, or adopting a child, moving to a new area that provides different plans, or even when you become a U.S citizen.

Special Enrollment Qualifications

In order to qualify for public insurance or have the ability to apply for a subsidy outside of open enrollment; you must have experienced or be experiencing a life qualifying event. These events are listed below;

Private Insurance Options

Unlike the public market place, the private market is open for enrollment all year round and has no fixed open enrollment period. Private insurance qualify you based on health history, but also offer short terms plans for people who need the marketplace for a subsidy or to cover major medical conditions.

The Hire Date Opens the New Hire Enrollment Period

The employee’s hire date is the date the new hire enrollment period begins assuming the employee is working enough hours to qualify as a benefit eligible employee.

Most Common New Hire Enrollment Period Deadlines

The new hire enrollment window will vary from employer to employer but here are some of the most common new hire enrollment periods.

The Effective Date of Benefits for a New Hire is Subject to an Eligibility Waiting Period

Once an employee enrolls, their benefits are subject to an eligibility waiting period. Benefits go into effect at the end of the waiting period not when an employee enrolls in benefits.

Different Classes of Employees at the Same Employer Can Have Different New Hire Eligibility Waiting Periods

While all employees may have the same eligibility waiting period, different classes of employees can have different eligibility waiting periods.

Newly Eligibile Employees and Re-hires May Have Different Eligibility Waiting Periods

Employees who have a status change from a non benefit eligible status to a benefit eligible status like from part-time to full-time are called newly eligible employees. Newly eligibles employees may have the same or different waiting periods than the new hires do.

Different Benefits Could Have Different Effective Dates When Coverage Begins

The effective date of benefits can also be different for different benefits.

What Determines the Eligibility Waiting Period and the Effective Date of Benefits

Eligibility waiting periods are established by the employer in conjunction with the insurance companies involved. Employers work with the benefit brokers to establish what these policies are.

What is open enrollment?

Open enrollment is an annual period where individuals can enroll in, make changes to, or cancel their insurance plans. Open enrollment applies to employees who want to make changes to their employer-sponsored insurance as well as individuals who participate in the government’s Marketplace health plans. Typically, employees are not allowed ...

How long does open enrollment last?

Open enrollment lasts approximately a few weeks per year. For the most part, open enrollment takes place toward the end of the year, and the changes take place at the start of the following year. The 2019 open enrollment period for the Health Insurance Marketplace runs from November 1 until December 15. As an employer, you might use this same ...

How does insurance affect payroll?

Changes to insurance plans can affect the way you run payroll. Insurance premiums are deductions you must withhold from an employee’s gross wages. When an employee adds, changes, or removes coverage, the amount you withhold from their wages changes.

What is a qualifying life event?

When an employee has a qualifying life event, they have a limited amount of time to add, remove, or cancel coverage. Examples of qualifying life events include when an employee gets married or divorced, has a baby, or loses coverage. Unless an employee has a qualifying life event, they cannot make changes to their insurance plans outside ...

Can employees switch health insurance plans?

Employees can switch plans during health insurance open enrollment. You may offer health plans with varying deductibles, copays, coverage, and premiums. Make sure employees know how much they need to contribute each pay period to the plans.

Do you need to distribute employee benefit enrollment forms?

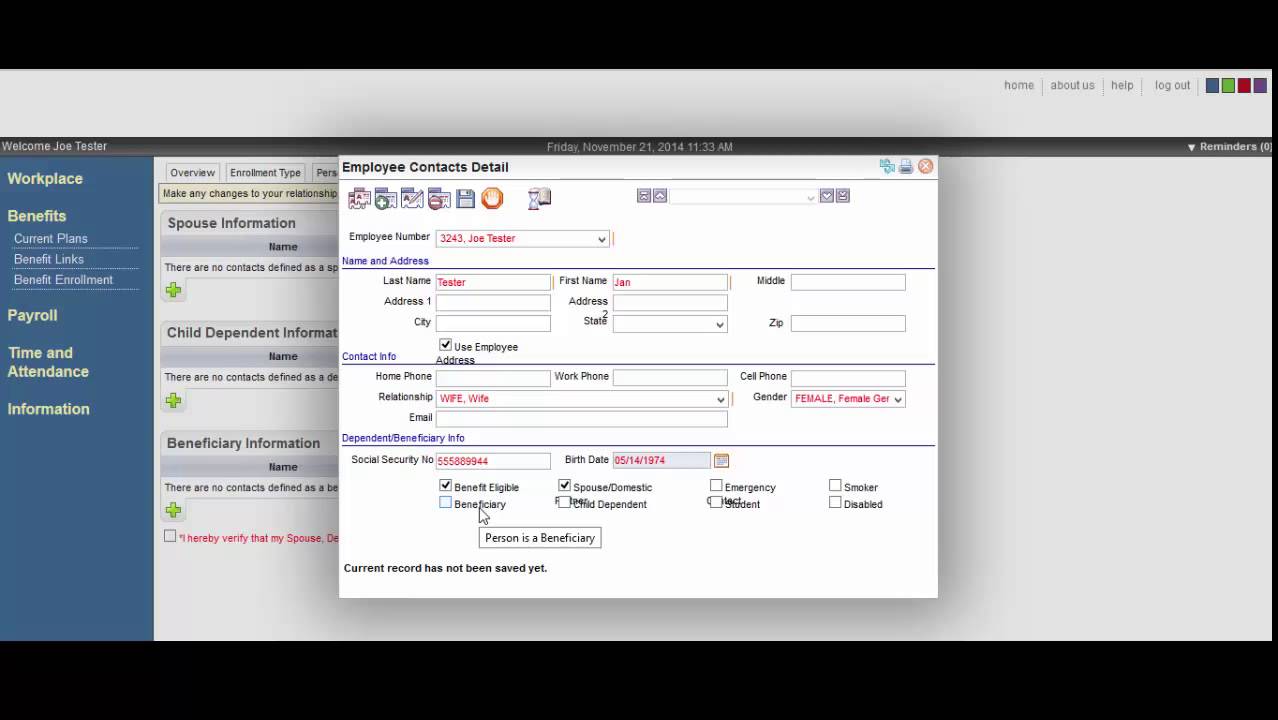

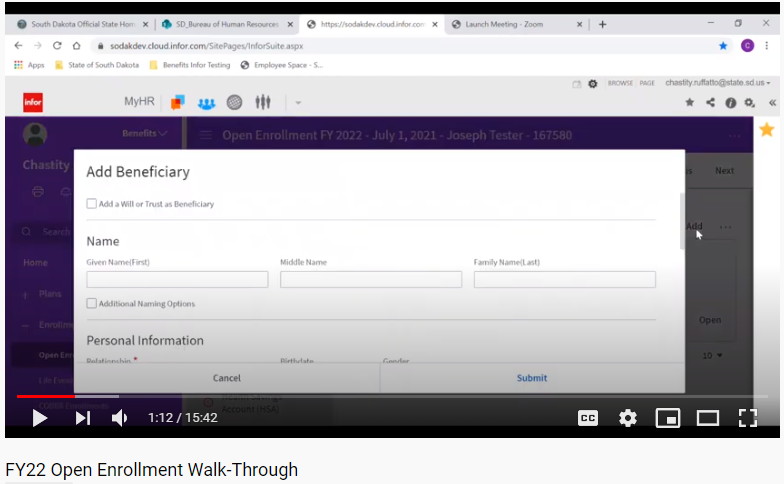

Make sure to distribute and collect benefit enrollment forms from employees during open enrollment. Not only do you need enrollment forms to make changes to their plans, but you also need these forms to store in your records. Managing employee benefit contributions doesn’t need to be overwhelming.

Can I use the same open enrollment period for my employer?

As an employer, you might use this same period for open enrollment at your business or use a different period. Your insurance provider may set the open enrollment time frame. Talk with your provider for more information about the open enrollment period you must use.

What is open enrollment?

Open enrollment is generally an annual event at most employers. During open enrollment, employees have a certain amount of time where they can add, change or waive benefits, including adding or removing dependents. Some employers have what is referred to as a passive enrollment, where employees can retain benefits they elect year ...

What is the IRS regulations regarding benefits enrollment?

To retain their tax-favored status, employers are required to make sure they follow IRS regulations. Failure to do so can cause the plan to lose its tax-favored status, costing employees more money.

How long does it take to notify an employer of a special enrollment?

Even special enrollment periods have rules. It is incumbent upon the employee to notify the employer within 30 days (60 for the birth of a child) of the event to quali fy for special enrollment rights . If an employee fails to notify the employer in a timely fashion, the request to add, cancel or change benefits due to the life status change event ...

How to choose a health insurance plan?

Here are some quick tips as well: 1 Decide what type of plan will meet your needs. An HMO may be less expensive but will restrict your ability to see certain doctors. A PPO can be more expensive but may give broader service provider options. 2 Review any changes the carrier may have made to your current plan. Many times, employees end up in the wrong plan due to complacency and not actively reviewing their options during open enrollment. They don’t realize that a service they get regularly is no longer covered or a drug they take is no longer on the formulary. Take some time to review the changes so you do not have buyer’s remorse after it’s too late. 3 Consider your spouse’s coverage too. Compare the plans offered by both companies to make sure you are choosing what will work best for your family.

What is a special enrollment period?

Certain events or “life status changes” trigger something called a “special enrollment period.”. An employee qualifies for a special enrollment period when a life event may require they make a different benefits election or they add or lose a family member on their coverage.

How long do you have to live with your benefits?

Having benefits is a great perk to any job but your family will typically have to live with the benefits you elect – good or bad – for a year at a minimum. Make sure that you carefully choose plans that provide the coverage you require and meet your financial needs.

Can an employer tell you what plan to choose?

An employer or HR services provider cannot tell you what plan to choose but you can refer to my previous post on choosing a medical plan. Here are some quick tips as well: Decide what type of plan will meet your needs. An HMO may be less expensive but will restrict your ability to see certain doctors.

What is open enrollment in healthcare?

For businesses that provide health care insurance for staff, open enrollment is a hectic time of year. Collecting all the documents needed to assure employees are enrolled properly is a complex process that requires a lot of organizational ability.

What happens if you miss the enrollment deadline?

Missing the deadline for open enrollment could result in no coverage or no change (s) in coverage.

What happens if you lose your other insurance?

Loss of Other Coverage. In some instances, employees lose other coverage which can trigger the special 30-day window to change coverage. If an employee divorces, for example, their spouse may remove them from another plan, giving access to yours. These losses can trigger special enrollment:

How long do you have to opt out of life changing insurance?

The special enrollment period is limited: employees who have a qualifying event will have 30 days from the date of the event to make any additions, deletions or changes in their coverage.

What happens if an employee fails to enroll in a health insurance plan?

If an employee fails to do so, the employer is not responsible for any losses they incur.

What are the life events that occur when someone becomes eligible or ineligible to join the plan?

Basic life events occur when someone becomes eligible or ineligible to join the plan. When a child is born, for example, they can be added to the plan. For marriage and divorce, additions or deletions can be made. The following events allow for the special 30-day window to change coverage: Birth of a child.

Can you change your insurance coverage outside of the open enrollment period?

Special circumstances. Some special cases also allow employees to make changes outside of the open enrollment period: Court orders: typically in the event of divorce or legal separation, a judge can require businesses to allow employees to make changes to coverage.

When is open enrollment period?

The open enrollment period typically occurs sometime in the fall , but employers have flexibility in terms of scheduling open enrollment and their plan year, so it doesn't have to correspond with the calendar year. Your company should notify you about your open enrollment period.

What is open enrollment insurance?

Open enrollment is also available for individuals or families who buy their own individual/family health insurance through the Affordable Care Act (ACA) exchanges or directly from health insurance companies (ie, off-exchange ). During an open enrollment period, eligible individuals can opt-in or out of plans, or make changes to ...

What happens if you lose your health insurance?

If you lose your job-based health insurance in the middle of the year, you're eligible to enroll in a plan through the exchange or directly through a health insurance company, despite the fact that open enrollment for the year has already ended. If nothing has happened to trigger a special enrollment period, you will most likely have to wait ...

What happens if you miss your job based open enrollment?

Missing Job-Based Open Enrollment. If you miss your company's open enrollment period for health insurance benefits, you may be out of luck. If you have not already signed up for health insurance, there's a good chance you won't be able to do so this year. But if you were already enrolled last year, your plan likely automatically renewed ...

How many employees are required to open enrollment in 2021?

Updated on February 08, 2021. Each year, employers with more than 50 employees that offer health benefits must offer an "open enrollment" period. Most small employers also offer an open enrollment period.

When is the 2021 Medicare enrollment window?

It runs from February 15, 2021 to May 15, 2021, and is open to anyone eligible to use HealthCare.gov—including people who are uninsured as well as people who already have coverage via HealthCare.gov and would prefer to pick a different plan. A qualifying event is not necessary in order to sign up during this window. 2 .

How long can you have short term health insurance?

Under rules that were finalized by the Trump administration in 2018, short-term health insurance plans can provide coverage for up to 364 days, although more than half of the states have regulations that limit short-term plans to three or six months, or prohibit them altogether. 5 .

What is open enrollment for benefits?

Open enrollment is often one of the most stressful and overwhelming times for employers and employees alike, as it is typically the only point during the year in which employees can make changes to their benefit elections, ...

What happens if an employee misses open enrollment?

If an employee does miss open enrollment, he or she may understandably be panicked and unhappy. In order to offset any decrease in morale, it is important that you provide opportunities for the employee to meet with HR or to attend informational meetings that discuss his or her options to obtain coverage for the next year. At this point, however, there is not much more that you can do for him or her unless he or she qualifies for an SEP.

What is G&A benefits?

As a leading provider of outsourced human resources services, G&A’s team of benefits specialists are experts in all things health care. These dedicated professionals can help you understand your obligations as an employer and simplify the open enrollment process. Call 1-866-634-6713 or contact us today to schedule a free consultation with one ...

What is the importance of asking employees to provide information?

Every employee has his or her own preferences when it comes to receiving important information. It can be beneficial to ask your employees if they like the way information is being provided to them, if they would prefer information to be distributed in different ways, or if they have any questions that have yet to be answered. ...

Can employers do anything if you missed the open enrollment deadline?

Legally, employers are not required to do anything for employees who have missed the open enrollment deadline. In fact, the terms of your benefits plans may prohibit you from making exceptions for employees who do not make benefits elections within a certain time period, such as before the new plan year begins.

Can you go it alone when it comes to employee benefits?

Selecting the right combination and level of benefits for your employees can be an overwhelming process, one that many employers aren't comfortable tackling on their own. Fortunately, they don't have to go it alone when it comes to employee benefits.

Do you have to sign an acknowledgement of benefits form?

By requiring employees to sign either an acknowledgement of benefits form for those who opt in to coverage, or a waiver of coverage form for those who opt out or miss the deadline to enroll in employer-based benefits packages, you will create a uniform policy.

When will FSAs roll over?

The Consolidated Appropriations Act that President Trump signed at the end of 2020 allows employers that sponsor health or dependent care flexible spending accounts (FSAs) to permit participants to roll over all unused amounts in these accounts from 2020 to 2021 and from 2021 to 2022.

Is the FSA amendment retroactive?

The amendment may be retroactive as along as it is adopted no later than the last day of the calendar year following the year in which the amendment is effective. See the SHRM Online article Appropriations Act Permits Midyear FSA Elections, Unlimited Carry-over Amounts Through 2021. updated May 12, 2020.

Can I drop my FSA coverage in 2020?

For both health FSAs and dependent care FSAs, used to fund for caregiving expenses with pretax dollars, employees will be able to enroll in the FSA, drop FSA coverage, and increase (within the annual limit) or decrease existing FSA payroll-deferred contributions during 2020. FSA Use-it-or-Lose-It Rules.