How much should you rely on Social Security benefit estimates?

- Currently receiving benefits on your own Social Security record.

- Waiting for a decision about your application for benefits or Medicare.

- Age 62 or older and receiving benefits on another Social Security record.

- Eligible for a Pension Based on Work Not Covered By Social Security.

Should you trust your Social Security benefits estimate?

Unfortunately, your Social Security benefits estimate from the statements you can pull from the Social Security Administration is not the best source of information on what to expect in the future. The issue lies with the omissions that the Administration makes with their estimate methodology.

How to calculate your projected Social Security benefit?

- For every dollar of average indexed monthly earnings up to $926, you’ll get 90 cents per month in benefits.

- For every dollar of average indexed monthly earnings between $927 and $5,583 you’ll get $.32 cents per month in benefits.

- For every dollar of average indexed monthly earnings beyond $5,583 you’ll get $.15 cents per month in benefits.

How do you calculate social security benefit?

The following factors go into the formula:

- How long you work

- How much you make each year

- Inflation

- At what age you begin taking your benefits

How do you calculate what your Social Security will be?

Our simplified estimate is based on two main data points: your age and average earnings. Your retirement benefit is based on how much you've earned over your lifetime at jobs for which you paid Social Security taxes. Your monthly retirement benefit is based on your highest 35 years of salary history.

Are Social Security estimates in today's dollars?

Your Social Security Statement details what your estimated benefit will be at your full retirement age in today's dollars, not future dollars. That can be confusing to people who are trying to estimate how much income they will need in retirement. Your estimate is also a before-tax amount.

How much Social Security will I get if I make $60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much Social Security will I get if I make $120000 a year?

If you make $120,000, here's your calculated monthly benefit According to the Social Security benefit formula in the previous section, this would produce an initial monthly benefit of $2,920 at full retirement age.

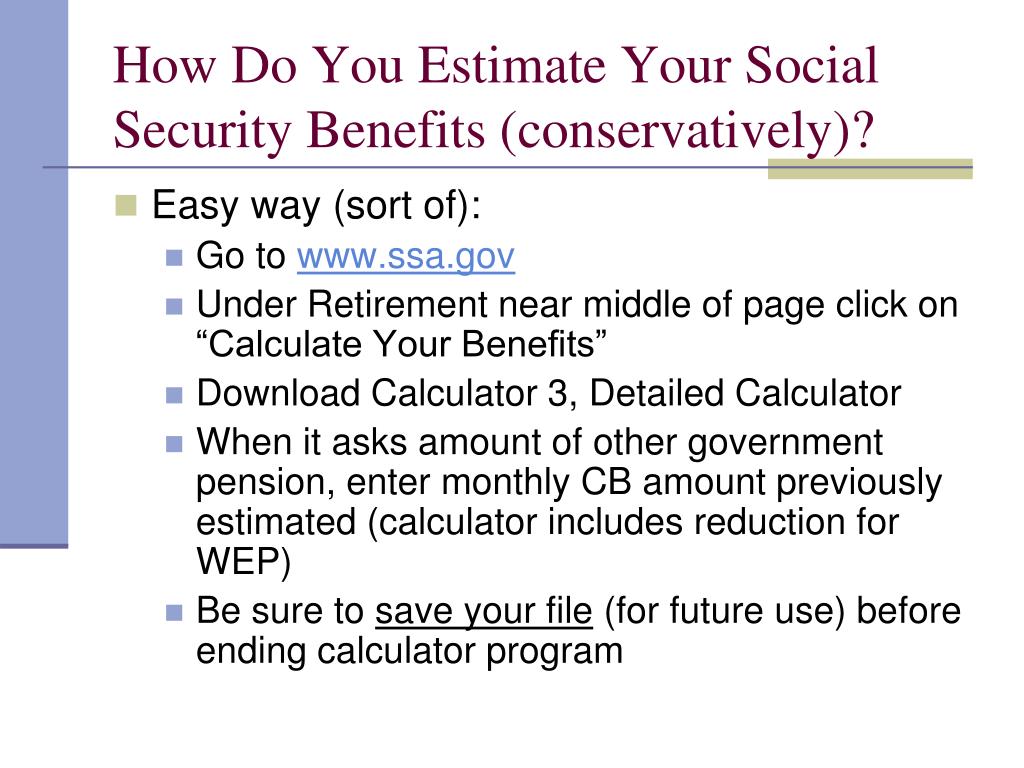

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

How many retirement estimates does Quick Calculator give?

If you do not give a retirement date and if you have not reached your normal (or full) retirement age, the Quick Calculator will give benefit estimates for three different retirement ages.

What is the benefit estimate?

Benefit estimates depend on your date of birth and on your earnings history. For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough. Although the "Quick Calculator" makes an initial assumption ...

Why are retirement benefits unreliable?

Lack of a substantial earnings history will cause retirement benefit estimates to be unreliable.

How old do you have to be to use Quick Calculator?

You must be at least age 22 to use the form at right.

What does "0" mean in retirement?

If you entered 0, we assume you are now retired. Enter the last year in which you had covered earnings and the amount of such earnings.

How does Social Security affect retirement?

Social Security benefits in retirement are impacted by three main criteria: the year you were born, the age you plan on electing (begin taking) benefits and your annual income in your working years. First we take your annual income and we adjust it by the Average Wage Index (AWI), to get your indexed earnings.

How long do you have to be a Social Security employee to get full benefits?

Anyone who pays into Social Security for at least 40 calendar quarters (10 years) is eligible for retirement benefits based on their earnings record. You are eligible for your full benefits once you reach full retirement age, which is either 66 and 67, depending on when you were born.

What is the Social Security income test for 2021?

For 2021, the Retirement Earnings Test Exempt Amount is $18,960/year ($1,580/month). If you’re in this age group and claiming benefits, then every $2 you make above the Exempt Amount will reduce by $1 the Social Security benefits you'll receive. (Note that only income from work counts for the Earnings Test, so income from capital gains and pensions won’t count against you.)

What age do you have to be to claim Social Security?

If you claim Social Security benefits early and then continue working, you’ll be subject to what’s called the Retirement Earnings Test. If you’re between age 62 and your full retirement age, and you’re claiming benefits, you need to know about the Earnings Test Exempt Amount, a threshold that changes yearly.

How many states tax Social Security?

That covers federal income taxes. What about state income taxes? That depends. In 13 states, your Social Security benefits will be taxed as income, either in whole or in part; the remaining states do not tax Social Security income.

How long do I have to work to get Social Security?

To get your social security benefits we do a couple things. First we assume that you have or will work for 35 years before electing social security benefits (this is needed to calculate your benefits) We then take your income and we adjust it by the Average Wage Index (AWI), to account for the rise in the standard of living during your working ...

How much will Social Security be in 2052?

starting in 2052 at age 66: $48,771. The earliest you can begin receiving benefits is at age 62. Spouse's annual Social Security benefit. The earliest you can begin receiving benefits is at age 62. Social Security Benefits Accounting for Inflation: 1st year of benefits through age 95.

How does the Social Security calculator work?

The calculator provides an estimate of your Social Security benefits, based on your earnings history and age. Our tool also helps you see what percentage of daily expenses your payments can cover, and how you can increase your benefits by waiting to collect. It can also tell you how your retirement earnings will be affected if you keep working after you claim your Social Security benefit.

How is Social Security retirement calculated?

Our simplified estimate is based on two main data points: your age and average earnings. Your retirement benefit is based on how much you’ve earned over your lifetime at jobs for which you paid Social Security taxes. Your monthly retirement benefit is based on your highest 35 years of salary history. You can get your earnings history from the Social Security Administration (SSA).

How old do you have to be to get survivor benefits?

If you’re widowed, you may be entitled to survivor’s benefits. In most cases, you’re eligible if you’re at least 60 years old and were married at least nine months before your spouse died. The calculator does not calculate survivor benefits for widows or widowers. For this and other scenarios, consult the Social Security Administration website.

How much is Social Security tax?

Primarily through a payroll tax. The current tax rate for Social Security is 6.2 percent for the employer and 6.2 percent for the employee — 12.4 percent total. If you’re self-employed, you have to pay the entire amount. The government collects Social Security tax on wages up to $142,800 in 2021.

Can you claim survivor benefits if you are widowed?

Others should use the calculator as if they were single. If you’re widowed, you may be entitled to survivor’s benefits. In most cases, you’re eligible if you’re at least 60 years old and were married at least nine months before your spouse died. The calculator does not calculate survivor benefits for widows or widowers.

How to calculate Social Security if you are not 62?

Because of how the wage indexing formula works, if you are not yet age 62, your calculation to determine how much Social Security you will get is only an estimate. Until you know the average wages for the year you turn 60, there is no way to do an exact calculation. However, you could attribute an assumed inflation rate to average wages to estimate the average wages going forward, and use those to create an estimate.

How is Social Security decided?

Your Social Security benefit is decided based on your lifetime earnings and the age you retire and begin taking payments. Your lifetime earnings are converted to a monthly average based on the 35 years in which you earned the most, adjusted for inflation. Those earnings are converted to a monthly insurance payment based on your full retirement age.

How to calculate indexing year?

Your wages are indexed to the average wages for the year you turn 60. 4 For each year, you take the average wages of your indexing year (which is the year you turn 60) divided by average wages for the years you are indexing, and multiply your included earnings by this number. 5

What is the formula for Social Security benefits?

The Social Security benefits formula is designed to replace a higher proportion of income for low-income earners than for high-income earners. To do this, the formula has what are called “bend points." These bend points are adjusted for inflation each year.

What is wage indexing?

Social Security uses a process called wage indexing to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3 .

How to find average indexed monthly earnings?

Total the highest 35 years of indexed earnings, and divide this total by 420, which is the number of months in a 35-year work history, to find the Average Indexed Monthly Earnings.

When is PIA calculated?

Your PIA is calculated at age 62. If you wait beyond age 62, cost-of-living adjustments (COLAs) will be applied to your PIA for each year afterward. 16 17

How much do retirees rely on Social Security?

Most retirees rely on Social Security. One in four gets 90% of their retirement income from the program. About half rely on it for 50% of their income. 1. Although Social Security is only one part of a secure retirement plan, it's helpful to get a rough idea of how much you can expect. If you're eligible for Social Security, ...

What is the monthly benefit of Social Security?

If you're eligible for Social Security, your monthly benefit is based on two factors: How much money you earned during your working career. The age you choose to start getting payments. Let's look at how each of these affects your future Social Security income.

How much will FICA be in 2021?

The same threshold applies to both your earnings and your benefits. This amount is $142,800 in 2021. 5.

How many credits do you need to qualify for spousal benefits?

2. You may be entitled to a spousal benefit because of your partner's work history. If your spouse, ex-spouse, or deceased spouse has earned 40 credits, you may qualify.

Is FRA a full benefit?

The monthly amount you are eligible to receive at your FRA is considered your full benefit, but it is not your minimum or maximum benefit .

What is the maximum amount of retirement benefits for spouse?

The maximum benefit for the spouse is 50 percent of the benefit the worker would receive at full retirement age. The percent reduction for the spouse should be applied after the automatic 50 percent reduction. Percentages are approximate due to rounding.

What happens if you delay taking your full retirement?

If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase. If you start receiving benefits early, your benefits are reduced a small percent for each month before your full retirement age.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

How to change your earnings?

The easiest way to change your past earnings is to change the growth factor until the past earnings look fairly close to your actual earnings, and then select option 1 to make adjustments to earnings for a few specific years.

Do people's wages increase as they retire?

On the other hand, as people approach retirement, their wages often grow slower than the increase in the average wage for all workers.

Can you enter relative growth factor for past earnings?

Note that if you select option 2, you must check the second option box in addition to entering a growth factor in the box provided . If you choose to see your benefit estimates in future dollars, you may enter a growth factor for your future earnings.

Can you use the Quick Calculator for non-covered employment?

If you had several years in non-covered employment , then we recommend that you not use the Quick Calculator because the Quick Calculator will estimate all of your past earnings as covered earnings and overestimate your benefit. Please use one of our other calculators.

How does the SSA calculate Social Security benefits?

To calculate your Social Security benefit, the SSA will take your historical earnings and adjust them for inflation. This inflation adjustment goes through age 59; once you hit 60, your benefit amount is at face value at that point and into the future.

How much does Social Security pay at 67?

To figure this out we can use the Social Security Online Calculator (I love this calculator, by the way). If we plug in Jeremy’s earnings and use the “today’s dollars” option, it gives him a benefit at age 67 of $2,452 per month. If you simply change that to “future (inflated) dollars” it changes the benefit at age 67 to $5,464 per month — that’s a $3,012 per month jump in benefits!

What happens if you don't have earnings in the past two years?

If you don’t have earnings recorded for the past two years they’ll assume that the future earnings will be $0.

Why are Social Security benefits worse for younger people?

This means that these problems are worse for people who are younger because they have more years of future earnings, and the calculation’s assumptions of o% growth, ahead of them.

What does it mean to not assume your wages will increase?

The combination of not assuming your wages will increase or the use of the bend point formula means that you could be planning your retirement income strategy with faulty numbers. Not including these number on the benefits estimates raises a few questions.

Does Social Security assume earnings will increase over time?

The double whammy of the underestimation issue is that not only does the Social Security Administration assume your earnings will not increase over time, but they also assume the Social Security formula will stay the same .

Is not paying attention to earnings a serious oversight?

Since the system is progressive and rewards a higher benefit for a higher earnings history, not paying attention to these additional earnings is a serious oversight.