Why is 401k called a defined contribution plan?

A defined contribution plan is sponsored by an employer, which offers the plan to its employees as a major part of their job benefits. It’s called a defined contribution plan because the account ...

Does a 401k really benefit an employer?

Yes. As mentioned earlier, 401k plans are tax-deductible for employers. Because 401k plans have several tax benefits, they are usually less expensive to offer than defined-benefit plans. The good news is that usually, every dollar a company contributes to a staff member’s 401k is a write-off.

Is a 401k considered a qualified retirement plan?

Yes, a 401k does meet the IRS rules to be considered a qualified retirement plan. Your employer is responsible for ensuring that the reporting and regulatory requirements are met to keep the plan in compliance.

Is a 401K a bad idea?

Your 401 (k) plan is protected by law. That’s why it can be foolish to use 401 (k) money to prevent foreclosure, pay off debt or start a business. In the case of future bankruptcy, your 401 (k) money is a protected asset. Don’t touch your 401 (k) money unless you retire. Should I withdraw my 401k if the market crashes?

Can I have both a 401k and a defined benefit plan?

Defined Benefit Contribution Limits What's more, the business owner can have both a Defined Benefit and a 401(k) Plan to save a large portion of their side business income.

Can you contribute to a defined benefit plan and an IRA?

Yes, you can contribute to a traditional and/or Roth IRA even if you participate in an employer-sponsored retirement plan (including a SEP or SIMPLE IRA plan).

How much should I have in my 401k if I have a pension?

In fact, most financial experts will suggest investing 15% of your income annually in a retirement account (including any employer contribution). With 401(k)s, or employer-sponsored retirement plans, you may find that your company offers a match if you contribute a certain amount.

Can you have a defined benefit and a defined contribution plan?

As the names imply, a defined-benefit plan—also commonly known as a traditional pension plan—provides a specified payment amount in retirement. A defined-contribution plan allows employees and employers (if they choose) to contribute and invest in funds over time to save for retirement.

Can I contribute to multiple defined contribution plans?

You can still contribute a total of $26,000 in pre-tax and designated Roth contributions to both plans. Your contributions can't exceed either: your individual limit plus the amount of age-50 catch-up contributions, or.

What if you have a pension and 401k?

You can have a pension and still contribute to a 401(k)—and an IRA—to take charge of your retirement. If you have a defined benefit pension plan at work, you have nothing to worry about, right? Maybe not. Now is a good time to start thinking about where your pension fits into your overall plan for retirement.

What is the average 401K balance for a 65 year old?

To help you maximize your retirement dollars, the 401k is an employer-sponsored plan that allows you to save for retirement in a tax-sheltered way....The Average 401k Balance by Age.AGEAVERAGE 401K BALANCEMEDIAN 401K BALANCE35-44$86,582$32,66445-54$161,079$56,72255-64$232,379$84,71465+$255,151$82,2972 more rows•Feb 25, 2022

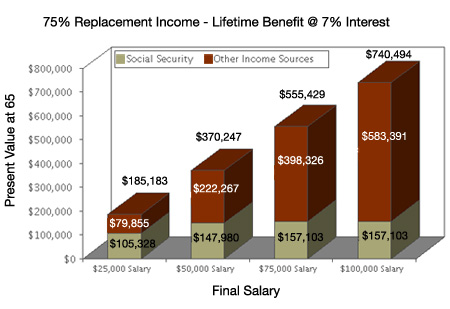

How much money do you need to retire with $100000 a year income?

Percentage Of Your Salary Some experts recommend that you save at least 70 – 80% of your preretirement income. This means if you earned $100,000 year before retiring, you should plan on spending $70,000 – $80,000 a year in retirement.

How Much Should 55 year old have in 401K?

Experts say to have at least seven times your salary saved at age 55. That means if you make $55,000 a year, you should have at least $385,000 saved for retirement.

What is one disadvantage to having a defined benefit plan?

The main disadvantage of a defined benefit plan is that the employer will often require a minimum amount of service. Although private employer pension plans are backed by the Pension Benefit Guaranty Corp up to a certain amount, government pension plans don't have the same, albeit sometimes shaky guarantees.

Is a 401k plan considered a defined contribution plan?

401(k) Plan is a defined contribution plan where an employee can make contributions from his or her paycheck either before or after-tax, depending on the options offered in the plan. The contributions go into a 401(k) account, with the employee often choosing the investments based on options provided under the plan.

Is a DB pension better than DC?

DB schemes have been the gold standard for pensions as they are much more secure and generally more generous than DC pensions and pay an income that increases in line with inflation. However, as people live longer DB pensions have become too expensive for companies and their numbers have dwindled.

Can I contribute to a defined benefit plan and SEP IRA?

Defined benefit plans can be combined with other retirement options such as a solo 401(k), or an SEP IRA, which increases the amount you can save for retirement each year.

Is an IRA considered a defined benefit plan?

Since individual retirement accounts (IRAs) often entail defined contributions into tax-advantaged accounts with no guaranteed benefits, they could also be considered a defined-contribution plan.

Can you roll a DCP into an IRA?

If you are interested in saving in a Roth IRA, you can move your DCP after-tax balance to a Roth IRA through a conversion rollover.

Can a defined benefit pension be rolled over into an IRA?

Because any funds in a defined benefit plan are pre-tax, you can elect to deposit or transfer the funds to a traditional IRA. If you then choose, you can convert the funds to a Roth IRA and pay the taxes immediately.

Why are defined contribution plans cheaper?

Defined contribution plans are cheaper for employers to maintain and fund. They also shift the burden of retirement planning—and the longevity risk—to the employee. 7 . For these reasons, traditional pensions are no longer part of the retirement equation for most workers. 3 .

Why are 401(k)s called IRAs?

These get their name because they are funded by employee contributions. The amount you receive at retirement depends on how much you contribute to the plan—and how well your investments perform. 5 6

What is a good retirement strategy?

A good retirement strategy is to contribute to a variety of retirement investments, including 401 (k)s and IRAs— even if you already have a pension. Now is a good time to start thinking about where your pension fits into your overall plan for retirement. It’s dangerous to rely on any pension—even a generous one—to cover all your retirement needs.

What are pension benefits based on?

Either way, your benefits are based on metrics, such as your age, earnings history, and years of service. Your employer funds the pension and takes on the investment risk. They also bear the longevity risk. That's the risk that plan participants will live longer—and collect more money—than the company expected.

When did most workers have defined benefit pensions?

Until the 1970s, most workers had defined-benefit pensions. 2 They were originally designed to encourage employees to stay with one company for the long haul. The employee was rewarded for loyalty, and the company benefited from having a stable, experienced workforce. 3 .

Can you control your employer's pension?

You Don’t Control Your Employer’s Pension Plan. A pension that looks good now can change—especially if it’s not part of a union contract or other mandate. Your employer has absolute control over a defined-benefit plan (subject, of course, to federal law and any contracts).

Is a defined benefit plan available to government employees?

Still, defined benefit plans are available to most government employees, whether they work at the federal, state, or municipal level. While it may be comforting to assume your retirement needs will be fully met by a government pension, that's not a good idea. 3

What is defined benefit plan?

A defined benefit is an employer plan that is sponsored by the self-employed business, and it only allows for employer contributions. When contributing to both a defined benefit plan and a solo 401k plan, the business owner will maximize the employer contributions to the DBP because it allows for larger dollar contributions than other plans such as ...

Can an employer contribute to a DBP?

Employee Contributions. Since the only type of contribution a defined benefit plan (DBP) can accept is employer contributions because it is not a defined contribution plan, the owner-only business will open a solo 401k plan for solely making annual employee contributions.

Can you apply 401(k) rules to a defined benefit plan?

Also, the 401k rules apply to the solo 401k plan and the define benefit rules apply to the defined benefit plan, so you cannot apply the rules of one plan to the other (e.g., the distribution rules that apply to the solo 401k plan cannot be applied to the defined benefit plan and vice versa).

What is defined benefit plan?

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans. However, defined benefit plans are often more complex ...

What is an excise tax plan?

Most administratively complex plan. An excise tax applies if the minimum contribution requirement is not satisfied. An excise tax applies if excess contributions are made to the plan.

What does 401(k) mean?

401 (k) Meaning. The 401 (k) retirement savings account got its name from the Revenue Act of 1978, where an addition to the Internal Revenue Services (IRS) code was added in section 401 (k). Consequently, 401 (k) does not stand for anything except for the section of IRS tax code it was created in.

What is a traditional 401(k)?

The traditional 401 (k), named after the relevant section of the IRS code, has been around since 1978. With this plan, any contributions you make to the 401 (k) account will reduce your income taxes for that year and will be taxed when they are withdrawn.

What are the alternatives to 401(k)?

Are there other retirement savings plans other than a 401 (k) plan? Alternatives to 401 (k) plans include traditional IRAs, Roth IRAs, pension plans (if your employer offers one), and 403 (b) retirement plans for employees of non-profit organizations.

What does it mean when an employer offers an employee a pension?

If an employer offers an employee a pension, it means that they are promising to pay out a set amount of money to the employee at the time of their retirement. There is typically no option to grow this amount, but it also does not require any financial investment from the employee.

What is defined contribution plan?

401 (k)s, which are also called defined-contribution plans, take some of the financial pressure off of an employer, while also allowing employees to potentially earn a larger retirement package than they would have with a pension.

When did Roth 401(k)s start?

Roth 401 (k)s, named after former senator William Roth of Delaware, were introduced in 2006. Unlike a traditional 401 (k), all contributions are made with after-tax dollars and the funds in the Roth 401 (k) account accrue tax free. Typically, employees can take advantage of both plans at the same time, which is recommended ...

Can you rollover a 401(k) into a Roth 401(k)?

You can also roll your defined benefit plan into a Ro th 401 (k) if you choose, but you’ll have to pay taxes on the rollover amount at the time of distribution.

Why add 401(k) to defined benefit plan?

1) A salary deferral option can be added to maximize annual tax deductible contributions. 401 k salary deferral contributions are in addition to Defined Benefit Plan contributions.

What is the maximum 401(k) contribution for 2019?

The 2019 401k contribution limit is $19,000 and $25,000 if age 50 or older. Funding the 401k is completely discretionary. You can stop, decrease or increase your salary deferral contributions up to the salary deferral limit. Note: When paired with a defined benefit plan the profit sharing contribution is limited to 6% of compensation.

Can I set up a side business 401k?

Yes. You are eligible to establish a Defined Benefit Plan for a side business even if you participate in a 401k, 403b, 457 or Thrift Savings Plan through your primary employer.

Can I contribute to my 401(k) if I have a salary deferral?

Yes, you could make a salary deferral contribution, however contributions made to the employer’s 401k will impact the salary deferral limit for the 401k contribution for the Defined Benefit Plan. Example: Jennifer is age 50 and works as a W-2 employee for ABC accounting firm and contributes $10,000 to the 401k in 2020.

What is defined benefit plan?

A defined benefit plan is a qualified retirement plan in which annual contributions are made to fund a chosen level of retirement income at a predetermined future retirement date. Factors such as a client's age, income, length of time before retirement and rate of return of the investment portfolio impact the required annual contribution amount.

How much can I contribute to my retirement plan in 2020?

In 2020 the annual benefit payable at retirement can be as high as $230,000 per year. As a result, annual contributions into a defined benefit plan can be even larger ...

Can you terminate a retirement plan before retirement?

However, the actuary will run calculations and if there is a shortfall then additional contributions may be necessary before the plan is terminated. When the plan is terminated the lump sum value can be rolled over to an IRA.

Can you roll an IRA at 62?

At retirement, at reaching age 62, or upon plan termination, IRS rules generally allow you to roll the assets into an IRA. In an IRA assets continue to grow tax-deferred. Another option is to purchase an annuity and start receiving periodic distributions. Income taxes must be paid when distributions are received.

Can I add a 401(k) to a defined benefit plan?

Yes. You can potentially add a 401k and profit sharing plan to a defined benefit plan. Adding a 401k and profit sharing plan can increase annual contributions and tax deductions.

Is a 100% contribution tax deductible?

100% of the contributions are made by the employer. Contributions are generally 100% tax deductible (within IRS limits). Small business owners with employees must make contributions for eligible employees. Employees do not contribute to a defined benefit plan. When a defined benefit plan is setup eligibility requirements can be established such as ...

Is a contribution required for retirement?

Are annual contributions mandatory? Yes. A contribution is required each year to fund the predetermined retirement benefit amount at the specified future retirement date. The retirement benefit amount and retirement date are determined when the defined benefit plan is established.

rocknrolls2

I have an interesting question: can a defined benefit plan be merged into a 401 (k) plan? I learned early on that the conversion of a defined benefit plan into a 401 (k) plan would result in a termination of the defined benefit plan. However, I was not able to locate anything definitive which stands for this proposition in IRS guidance.

mbozek

how will this the conversion occur? Will the DB plan be terminated? Will the DB plan benefits be transferred to the 401k plan as an account balance? Lot of questions.

Tom Poje

ERISA Outline Book 6-Sec III Part D 3b1 (Readers Digest Condensed Version)