Here are some of the most common examples of de minimis fringe benefits:

- Holiday presents

- Cocktail parties

- Occasional snacks

- Birthday present

- Local phone calls

- Gift baskets/books

- Educational assistance

- Tickets for entertainment events

- Personal use of employer equipment

- Transport and food allowances for overtime working

- Holiday presents.

- Cocktail parties.

- Occasional snacks.

- Birthday present.

- Local phone calls.

- Gift baskets/books.

- Educational assistance.

- Tickets for entertainment events.

Are there any disadvantages to fringe benefits?

There are, however, some disadvantages to such structures; the owners can take advantage of fewer tax-favored and tax-free benefits than those that would be available as fringe benefits for employees of a "normal" C corporation.

What are de minimis benefits given to employees?

De minimis benefits are benefits of relatively small values provided by the employers to the employee on top of the basic compensation intended for the general welfare of the employees. Being of relatively small values, the same is not being considered as a taxable compensation. This concept has initially been introduced by Revenue Regulations No. 8-2000 sometime in year 2000 amending Revenue ...

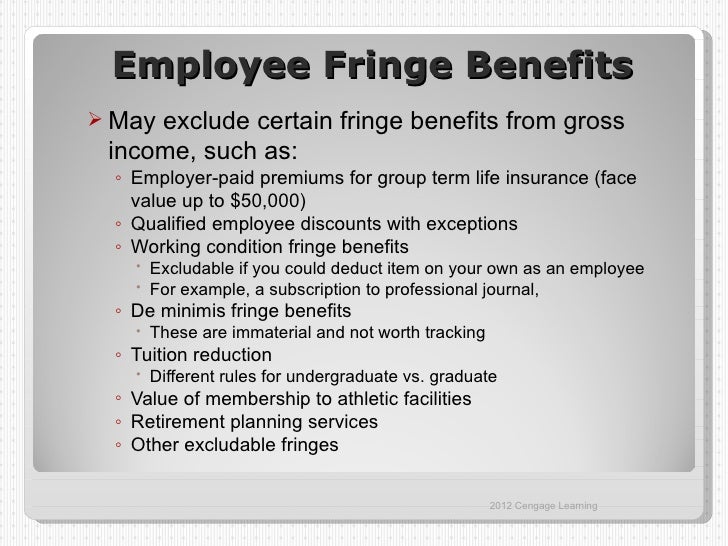

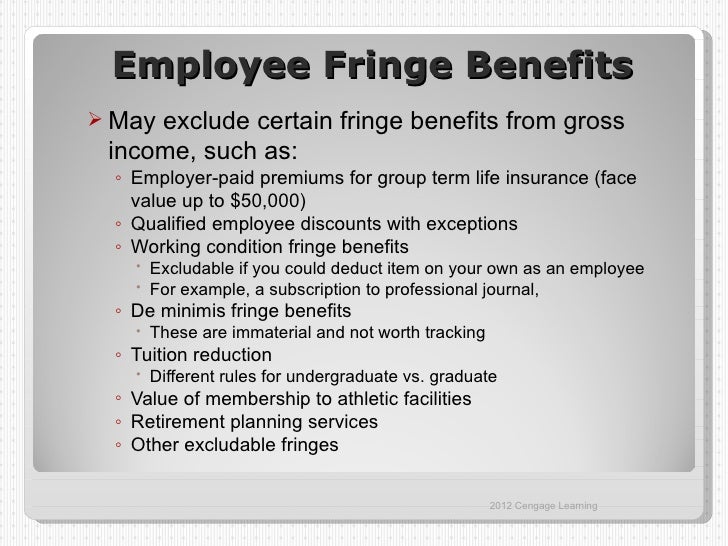

What is considered fringe benefit?

What Is a Fringe Benefit? A fringe benefit is a form of pay (including property, services, cash or cash equivalent) in addition to stated pay for the performance of services. Under Internal Revenue Code (IRC) Section 61, all income is taxable unless an exclusion applies. Some forms of additional compensation are

How do fringe benefits count as income?

Section 2 of Publication 15-B provides a list of excludable benefits, including:

- Accident and Health Benefits. These benefits include premiums the employer pays toward health insurance and long-term care insurance. ...

- Achievement Awards. ...

- Adoption Assistance. ...

- Athletic Facilities. ...

- De Minimis Benefits. ...

- Dependent Care Assistance. ...

- Educational Assistance. ...

- Employee Discounts. ...

- Employee Stock Options. ...

- Employer-Provided Cellphones. ...

What qualifies as a de minimis fringe benefit?

In general, a de minimis benefit is one for which, considering its value and the frequency with which it is provided, is so small as to make accounting for it unreasonable or impractical.

What are examples of de minimis benefits?

What is a De Minimis Benefits Example?Meals, meal vouchers, or meal money provided to employees working overtime.Refreshments purchased for staff meetings or to boost team spirit in the office.Award luncheons or dinners for employees.Personal use of company-owned resources, such as printers and copiers.More items...

What are 4 examples of fringe benefits?

Some of the most common examples of fringe benefits are health insurance, workers' compensation, retirement plans, and family and medical leave. Less common fringe benefits might include paid vacation, meal subsidization, commuter benefits, and more.

What are examples of taxable fringe benefits?

Examples of taxable fringe benefits include:Bonuses.Vacation, athletic club membership, or health resort expenses.Value of the personal use of an employer-provided vehicle.Amounts paid to employees for moving expenses in excess of actual expenses.Business frequent-flyer miles converted to cash.More items...•

Why are some fringe de minimis benefits not taxable income?

De minimis benefits are not subject to income tax as well as to withholding tax on compensation income of both managerial and rank-and-file employees. When given to employees, no deduction for taxes will be made by the employer; thus, the employee profits from the whole amount of the benefit.

What is the de minimis rule?

DE MINIMIS RULE BASICS The de minimis rule states that if a discount is less than 0.25% of the face value for each full year from the date of purchase to maturity, then it is too small (that is, de minimis) to be considered a market discount for tax purposes.

What are the 7 fringe benefits?

These include health insurance, life insurance, tuition assistance, childcare reimbursement, cafeteria subsidies, below-market loans, employee discounts, employee stock options, and personal use of a company-owned vehicle.

What fringe benefits are not taxable?

Nontaxable fringe benefits can include adoption assistance, on-premises meals and athletic facilities, disability insurance, health insurance, and educational assistance.

Is a car allowance a fringe benefit?

Therefore, a car expense payment benefit paid on a cents per kilometre basis that is exempt from fringe benefits tax under the FBT Act is not subject to payroll tax.

What are some common examples of taxable and tax-free fringe benefits?

18 Common Examples Of Tax-Free Fringe BenefitsAccident insurance.Achievement awards.Disability insurance.Employee stock options.Educational assistance.Health Savings Accounts.Dependent care assistance.Lodging on the business premises.More items...•

Which employee benefits are tax-free?

Tax-Free Benefits In-house sports facilities. Certain childcare arrangements. Bicycles and cycling safety equipment provided for employees to get to and from work. Workplace parking for cars, bicycles and motorcycles.

Is a cell phone allowance a taxable fringe benefit?

If you provide your employees with a cell phone for business use, both their business and personal use of the cell phone is a non-taxable fringe benefit.

What is de minimis fringe benefit?

De minimis fringe benefit is a non-wage compensation method that has been used by several businesses for decades.

Why are de minimis benefits not taxed?

When tax season starts, these benefits are not taxed because they are not considered to have a high face value by the Internal Revenue Service (IRS). . The IRS has ruled in the past that amounts over $100 should not qualify for de minimis status.

What to do if you don't have a de minimis gift?

If you still don't feel comfortable assessing whether or not specific gifts are considered de minimis, you should seek professional help. Your accounting firm will answer your questions clearly and resolve your doubts. If you don't have an accounting firm you usually work with, you can contact the IRS directly for a quick answer.

What to do if you don't feel comfortable assessing whether or not specific gifts are considered de minimis?

If you still don't feel comfortable assessing whether or not specific gifts are considered de minimis, you should seek professional help. Your accounting firm will answer your questions clearly and resolve your doubts.

Is fringe benefit tax free?

These fringe benefits are considered tax-free fringe benefits. The two essential qualifying characteristics for a de minimis fringe benefit are: The fringe benefit cannot have a high face value. It must be a type of compensation that does not occur often.

Can small businesses compete for star employees?

It allows small businesses to compete for star employees. Large businesses always held the upper hand when it came to recruiting employees. But, de minimis fringe benefit has changed the playing field. Small businesses can now compete for star employees easily by offering small benefits to their employees.

Is de minimis fringe tax deductible?

De minimis fringe benefits are also tax-deductible. It means that businesses can report the money spent on these fringe benefits as an expense. It can help businesses reduce their end-of-year tax bill.

What are fringe benefits?

IRS Publication 15-B defines a fringe benefit as a form of compensation in addition to a wage or salary for services performed. These services may be rendered by an employee, independent contractor, partner or director. Fringe benefit rules also apply to individuals who enter an agreement not to compete or not to perform services.

What are examples of fringe benefits?

Some fringe benefits are so widely available that many workers consider them a normal part of a compensation package. These include health insurance, family and medical leave, workers’ compensation and retirement savings plans. Smaller businesses may offer a combination of these and other attractive yet more economical provisions.

Which fringe benefits are taxable?

The IRS states that any fringe benefit is taxable unless specifically excluded under the law. Its full value is subject to federal income, Social Security, Medicare and federal unemployment taxes. The taxable portion can be reduced by any amount that the recipient contributes to the benefit or any amount that the law allows to be excluded.

What are the advantages of fringe benefits?

Benefits are some of the best tools for attracting and retaining high-quality talent. Perks are an important component of an employee’s compensation because they demonstrate a company’s tangible commitment to its workforce.

Fringe benefits FAQs

Employee training is a “ working condition ” fringe benefit, which encompasses services and property needed for an employee to do their job. Job-related education provided to workers qualifies as a business expense to the company.

What is fringe benefit?

A de minimis fringe benefit is one that is so low in value as to make it impractical to report on an employee’s income taxes. For example, a de minimis benefit might be the $10 coffee shop gift card given to an employee for handling a difficult client.

What does "de minimis" mean?

De Minimis. The term de minimis is a Latin expression that translates roughly to “pertaining to minimal things.”. In the U.S. legal system, the term is used to refer to certain facts or issues that are so minor as to be undeserving of the court’s attention. In addition, de minimis is relevant to certain bond and securities income, ...

What are some things that you can get for work?

Coffee, doughnuts or pastries, and occasional snacks. Occasional tickets for concerts, sports games, or other entertainment events. Occasional money for meals or transportation in connection with working overtime. Holiday gifts, and gifts for special circumstances, such as flowers, candy, fruit, books, etc.

Do you report fringe benefits on W-2?

Reporting De Minimis Fringe Benefits. If a fringe benefit meets the requirements to be considered de minimis, it does not need to be reported at all. If the benefit is taxable, however, it should be reported in the wages section of the employee’s Form W-2.

Is a de minimis award a cash equivalent?

The award is not disguised wages. The award is not cash, a cash equivalent, a vacation, theater or sports tickets, meals, lodging, or securities.

Is a cell phone considered a fringe benefit?

Cell phone provided by the employer, to be used primarily for business purposes. In determining whether a fringe benefit is de minimis, or if its value can be taxed , the IRS considers, not only the benefit’s value, but the frequency in which it is received.

Is de minimis compensation fringe benefit?

To be considered de minimis, a benefit cannot be a type of compensation in disguise as a fringe benefit. If a benefit that might be considered de minimis because of its infrequent nature is valued too high, it is taxable for its full value, not only the difference between the dollar limit for de minimis benefits and the item’s true value.

What is De Minimis?

De Minimis is a legal term that has been applied in many ways, including to copyright law, business law, and income tax law.

What is the De Minimis Rule?

The De Minimis Rule is established in the United States Internal Revenue Code under Section 132 (e) (1). This section of the tax code deals with the computation of taxable income, and in particular with items that may be specifically excluded from gross income.

What is a De Minimis Benefits Example?

De Minimis benefits include a variety of products or services that employers may provide to employees, and which employees are not required to claim as part of their gross income.

Which Benefits are Not Considered De Minimis Benefits?

The Internal Revenue Service has indicated specific types of benefits that should never be considered De Minimis fringe benefits. These include:

Keep Learning

Few compliance programs harness automation to its full potential. Learn how you can drive impact with every process by infusing technology where it matters most.

Why are de minimis benefits tax free?

De minimis benefits are considered tax-free because they are items or services offered by the employer that have so little value it would be difficult to account for.

What is fringe benefit?

Fringe benefits are additions included in an employee’s hiring package on top of the compensation. Examples of these can include a variety of insurances, employee discounts, stock options, tuition assistance, paid lunches, fitness reimbursements, or even pet-friendly work environments. According to the IRS, any fringe benefit you provide an ...

What are the benefits of employee discount?

Employee discount programs can go a long way and it is easier for companies to take on these low cost-per-employee fees to curate discounts that their work staff will be interested in. A complete list of other benefits excluded from income taxes includes: Access to athletic and health facilities.

What are the benefits of working condition?

There are other benefits you should take into consideration if your goal is to create a world-class, competitive workplace that fosters growth and loyalty and allows you to recruit the most talents and qualified team possible.

What is dependent care assistance?

Dependent care assistance. Taking care of your employee’s family helps you take care of your employee. Childcare and dependent assistance ranked second on benefits that employees could not live without. Employers are able to cover the first $5,000 of dependent care assistance.

What is a condition compatible with an employee's values?

Creating conditions compatible with an employees’ values for working and living can include altering the work environment, providing more recognition, or investing in training. Tackling the aspect of an employee’s offer is also a way to go about instilling company loyalty. While salary may be an obvious factor on the mind of employees, ...

Do in office perks come at a cost?

In-office perks come at no cost to employees but are shown to be desired by almost 80% of employees when looking at job benefits they want. Partnering with other companies and service providers to offer discounts to retailers, hotels, amusement parks, etc. is enticing to include in an hiring package.

What is fringe benefit?

De minimis fringe benefits include any property or service, provided by an employer for an employee, the value of which is so small in relation to the frequency with which it is provided, that accounting for it is unreasonable or administratively impracticable. The value of the benefit is determined by the frequency it’s provided to each employee, or, if this is not administratively practical, by the frequency provided by the employer to the workforce as a whole. IRC Section 132(e); Treas. Reg. Section 1.132-6(b)

What is the supplemental rate for fringe benefits?

The employer may elect to add taxable fringe benefits to employee regular wages and withhold on the total or may withhold on the benefit at the supplemental wage flat rate of 22% (for tax years beginning after 2017 and before 2026). Treas. Regs. 31.3402(g)-1 and 31.3501(a)-1T

How long did a railroad conductor stay in a hotel?

railroad conductor regularly rented a hotel room near a railroad station where he slept and ate during a 5-hour layover as part of an 18-hour workday. He could deduct his meals and lodging costs because his layover was long enough to obtain sleep or rest and he was required by his job to do so.

What is wage recharacterization?

Generally, wage recharacterization occurs when the employer structures compensation so that the employee receives the same or a substantially similar amount whether or not the employee has incurred deductible business expenses related to the employer’s business. If an employer reduces wages by a designated amount for expenses, but all employees receive the same amount as reimbursement, regardless of whether expenses are incurred or are expected to be incurred, this is wage recharacterization. If wage recharacterization is present, the accountable plan rules have not been met, even if the actual expenses are later substantiated. In this case, all amounts paid are taxable as wages. For more information, see Revenue Ruling 2012-25.

How to prevent financial hardship to employees traveling away from home on business?

To prevent a financial hardship to employees traveling away from home on business, employers often provide advance payments to cover the costs incurred while traveling. Travel advances may be excludable from employee wages if they are paid under an accountable plan. (Allowable travel expenses are discussed in Transportation Expenses) There must be a reasonable timing relationship between when the advance is given to the employee, when the travel occurs and when it is substantiated. The advance must also be reasonably calculated not to exceed the estimated expenses the employee will incur. Treas. Reg. Section 1.62-2(f)(1)

Why are items listed in IRC 280F considered listed property?

Items listed in IRC Section 280F are considered “listed property” because the property by its nature lends itself to personal use. Strict substantiation requirements apply to property in this category. Employees are required to account for business and personal use. IRC Sections 274(d), 280F(d)(4) and 132(d)

When to use per diem rate?

If the employee is traveling to more than one location in one day, use the per diem rate for the area where the employee stops for rest or sleep. Rev. Proc. 2011-47