How to determine if your employer is paying unemployment?

- Part-time workers

- Independent contractors, the self-employed, or gig workers

- Those that cannot work due to COVID-19 (included are those that need to take care of a sick family member, provide childcare due to daycare/school closures, or are under medically ...

- Small business owners

How unemployment benefits are charged to employers?

How Unemployment Benefits Are Charged To. Employers. When a worker becomes separated from his or her job and files for unemployment benefits, the worker’s past employer or employers will probably be charged for any benefits that may be paid. This fact sheet will explain some of the basic standards followed in charging unemployment benefits to ...

How much does an employer pay into unemployment?

In brief, the unemployment tax system works as follows:

- Employers pay into the system, based on a percentage of total employee wages.

- You don't deduct unemployment taxes from employee wages.

- Most employers pay both federal and state unemployment taxes.

- Employers must pay federal unemployment taxes and file an annual report.

Do all employers have to pay into unemployment?

Most employers pay both federal and state unemployment taxes. Employers must pay federal unemployment taxes and file an annual report. The tax paid goes into a fund that pays unemployment benefits to employees who have been laid off. Both the federal government and most state governments collect unemployment taxes.

Who pays for unemployment in California?

employersThe UI benefits are funded entirely by employers. In California, there are three methods of paying for UI: the tax-rated method, the reimbursable method, and the School Employees Fund method. Private sector employers are required to use this method and, therefore, most employers use it.

How much does an unemployment claim cost an employer in Texas?

The assessment is imposed on each employer paying contributions under the Texas Unemployment Compensation Act as a separate assessment of 0.10 percent of wages paid by an employer.

What can disqualify you from unemployment benefits in Texas?

You may be eligible for benefits if you were fired for reasons other than misconduct. Examples of misconduct that could make you ineligible include violation of company policy, violation of law, neglect or mismanagement of your position, or failure to perform your work adequately if you are capable of doing so.

Who pays for unemployment benefits in Texas?

EmployersEmployer taxes pay for unemployment benefits. Employers pay unemployment insurance taxes and reimbursements that support unemployment benefit payments. Employees do not pay unemployment taxes and employers cannot deduct unemployment taxes from employees' paychecks.

Which employer is responsible for unemployment benefits?

Employer responsibility for unemployment benefits: Taxes When you hire new employees, report them to your state. You must pay federal and state unemployment taxes for each employee you have. These taxes fund your state's unemployment insurance program. Federal Unemployment Tax Act (FUTA) tax is an employer-only tax.

What happens if employer does not respond to unemployment claim in Texas?

If an employer does not respond at all and the employee receives benefits, the employer receives a “Notice of Maximum Potential Chargeback.” Employers must then decide if they wish to challenge the decision to award unemployment benefits to the former employee.

How many hours can you work and still get unemployment in Texas?

If you work part time, you can earn up to 25 percent of your weekly benefit amount (WBA) before TWC reduces your benefit payment. For example, if your WBA is $160, you may earn $40 without a reduction. If you earn $50, we reduce your WBA for the week to $150.

Can I work part time and collect unemployment Texas?

Working Part Time If you work part time, you may be eligible to continue receiving unemployment benefits as long you meet all other requirements, including looking for full-time work.

What is the maximum unemployment benefit in Texas 2020?

Amount and Duration of Unemployment Benefits in Texas As explained above, the Texas Workforce Commission determines your weekly unemployment benefit amount by dividing your earnings for the highest paid quarter of the base period by 25, up to a maximum of $535 per week. Benefits are available for up to 26 weeks.

How is Texas unemployment funded?

The unemployment benefits program, funded through employer taxes, provides temporary income to workers who have lost their jobs through no fault of their own. TWC collects unemployment taxes from liable employers and pays unemployment benefits to qualified claimants.

What can disqualify you from unemployment benefits?

Unemployment Benefit DisqualificationsInsufficient earnings or length of employment. ... Self-employed, or a contract or freelance worker. ... Fired for justifiable cause. ... Quit without good cause. ... Providing false information. ... Illness or emergency. ... Abusive or unbearable working conditions. ... A safety concern.More items...•

Do you have to pay back unemployment in Texas?

State law requires that you repay your overpayment before we can pay further unemployment benefits. TWC cannot dismiss or forgive an overpayment, and there is no exception in the law for hardship cases.

How much does it cost to employ someone in Texas?

The Texas SUTA rate is 0.46-6.46 percent on the first $9,000 of an employee's wages. This rate is given to you by the state and can be influenced by how long you've been in business, the number of employees you have, the amount of unemployment benefits that have been charged to your account, as well as other factors.

What are Texas employer taxes?

What percentage is payroll tax in Texas? The minimum payroll tax rate in Texas is 0.31% and the maximum rate is 6.31%.

How much are payroll taxes in Texas?

You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. These taxes together are called FICA taxes. No matter which state you call home, you have to pay FICA taxes.

Are taxes taken out of unemployment checks in Texas?

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary; withholding taxes is not required. If you ask us to withhold taxes, we will withhold 10 percent of the gross amount of each payment before sending it to you.

How does unemployment work?

How do unemployment benefits work? If an employee loses their job through no fault of their own (e.g., downsizing), they may be eligible for unemployment benefits. Employees may also apply for partial unemployment benefits if their employer reduces their work hours.

Why is my employee ineligible for unemployment?

Here are some reasons a worker is ineligible for unemployment benefits: You fired the employee for misconduct. The employee quit to take another job that fell through. There is false information on the employee’s claim form. The worker was an independent contractor, not your employee.

What is the federal unemployment tax rate?

Most employers receive a tax credit of up to 5.4%, meaning your FUTA tax rate would be 0.6%.

What to do when you receive unemployment notice?

When you receive an unemployment claim notice, you need to take action. The action you take depends on whether you want to contest the claim or not. Take a look at your responsibilities for accepting or contesting claims, as well as reasons why you might accept or contest claims. 1.

What is unemployment insurance?

Unemployment is a portion of the former employee’s compensation they receive while they look for new work. Unemployed individuals can apply to receive unemployment insurance benefits through their state unemployment office. If approved, states distribute benefits.

How long does it take to respond to unemployment?

If you contest a claim, respond to the state unemployment department. Failing to respond within the timeframe listed on the notice (generally 10 days ) could forfeit your ability to contest. Gather and provide your state with as much proof as possible to back your decision.

What are the requirements to get unemployment?

In most cases, unemployed individuals must meet a few state-specific requirements before receiving their benefits, such as: 1 Actively looking for work 2 Going through a waiting period

What is unemployment claim?

This claim is basically a notification to the state, the federal government, and the previous employer that they are seeking unemployment insurance benefits.

How long does it take to get unemployment benefits?

In most states, laid-off workers can receive 26 weeks of unemployment benefits and will receive a set percentage of their average annual pay. Programs to provide unemployment payments are managed at both the federal and state levels, and businesses fund these programs by paying state and federal taxes. In some states, employees also pay ...

What happens if you lose your unemployment claim?

Once the claim has been contested, both you and the claimant will receive a “Notice of Determination” that will show whether the unemployment claim has been accepted or not by the state. Even if the employee loses the determination, they may still be able to appeal the decision, so keep that in mind.

How much do you have to pay for a FUTA?

No matter what state you are located in, you’ll need to pay set FUTA taxes, which amount to 6% of the first $7,000 each employee earns per calendar year. This means the maximum you’ll pay per employee is $420. In some states, you’ll be eligible to receive a tax credit later where you’ll get some of these payments back.

Why did the worker leave?

Why the worker left, including whether they were laid off (lack of work), voluntarily quit, were fired or left because of a trade/strike dispute. Whether they refused employment. Is legally able to work in the U.S. Is receiving any form of compensation, such as a pension or severance pay.

Is letting employees go a normal job?

While letting employees go is a normal function of a business, it can sometimes be challenging to understand exactly how the process is supposed to work, what responsibilities employers have, what taxes are owed and more. Here are questions and answers to help employers better understand what happens when former (or furloughed) ...

Can you collect unemployment if you were laid off?

Generally speaking, unemployment is only available for employees who have been laid off through no fault of their own. If an employee was fired for misconduct or company policy violations, they are likely ineligible to collect benefits.

What is unemployment?

Unemployment insurance, also known as unemployment, is a social support precaution designed to help people who lose their jobs due to external circumstances. Unemployment allows eligible applicants to receive a portion of their former wages for a set period of time or until they secure employment again.

How does unemployment work?

Unemployment insurance works by collecting tax from employers each year and redistributing those funds to people who apply for unemployment benefits after losing their job. Individuals fill out forms at their state’s unemployment office and, pending approval, receive 13 to 26 weeks of supplemental pay.

Who pays for unemployment benefits?

Unemployment insurance is funded through a company’s payroll taxes. Each individual state has its own unemployment office that manages applications and payments, with the requirements to qualify for benefits varying from state to state.

What responsibilities do employers have when managing unemployment?

Your company has a few key responsibilities when it comes to setting up employment benefits:

What happens after an employee files an unemployment claim?

As an employer, you may eventually have to deal with unemployment claims from former employees. If one of your former employees files for unemployment, you will receive a notice explaining their claim and giving you a deadline to contest it.

Frequently asked questions about unemployment

Employers can disagree with an unemployment claim and submit evidence that it is not a valid claim, but they themselves do not have the authority to deny an unemployment claim. They have to fill out the proper paperwork and let the unemployment office choose to deny or approve the claim.

What is the federal unemployment tax rate?

The Federal Unemployment Tax Act (FUTA) tax is imposed at a flat rate on the first $7,000 paid to each employee. The current FUTA tax rate is 6%, but most states receive a 5.4% “credit” reducing that to 0.6%. There is no action an employer can take to affect this rate. Some of this federal money is used for loans to states ...

How to keep unemployment costs low?

This starts with smart and prudent hiring—hiring only workers who are needed and qualified. This helps prevent layoffs and situations where an employee is simply not a good fit.

Why do employers have to prevent UI?

However, employers must prevent UI benefit charges in order to keep their unemployment tax rate low. This is done by contesting and winning claims when employees should be judged ineligible for benefits, such as employees who quit (in most cases) or are fired for misconduct. Many employers use an outsourced UI claims management/cost control ...

How long does unemployment affect tax rates?

Each awarded unemployment claim can affect three years of UI tax rates. Employers often don’t realize the real cost of a claim since it’s spread out over a long period. The average claim can increase an employer’s state tax premium $4,000 to $7,000 over the course of three years.

How do state governments get money to pay claims?

State governments get the money to pay claims by debiting the employer’s UI account (in states that require an account balance) or by raising the employer’s UI taxes. A deduction in the account balance may also cause a rate increase, as the ratio between taxable payroll and the account balance changes. Each claim assessed to an employer’s account ...

Which states have unemployment taxes?

Only three states—Alaska, New Jersey and Pennsylvania —assess unemployment taxes on employees, and it’s a small portion of the overall cost. Unemployment is funded, and taxed, at both the federal and state level: The Federal Unemployment Tax Act (FUTA) tax is imposed at a flat rate on the first $7,000 paid to each employee.

Does each claim increase tax rate?

Each claim assessed to an employer’s account can result in a tax rate increase in future years. So the real story isn’t the cost of an individual claim (though it can be significant). It’s the higher tax rate that will have a long-term impact. The state formulas generally use a three-year moving period to assign a tax rate.

What is unemployment benefits?

Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed (working part-time) through no fault of their own. The benefits help unemployed workers who are looking for new jobs. Applicants must meet requirements concerning their past wages ...

What is the base period for unemployment?

Base Period. The base period is the first four of the last five completed calendar quarters before the effective date of the initial claim. The effective date is the Sunday of the week in which the person applies for unemployment benefits.

What is a pay instead of notice of layoff?

Wages Paid Instead of Notice of Layoff. Wages paid instead of notice of layoff are payments an employer makes to an employee who is separated without receiving prior notice. Texas law prohibits individuals from qualifying for unemployment benefits while receiving wages paid instead of notice of layoff.

What does TWC evaluate for unemployment?

TWC evaluates unemployment benefits claims based on the applicant's: An individual must meet all requirements in each of these three areas to qualify for unemployment benefits. Unemployment Benefits for job seekers and employees provides information for claimants on eligibility requirements.

Why is it important to respond to an employer notice?

It is important for you to respond promptly to our employer notices such as the Notice of Application for Unemployment Benefits or Request for Work Separation Information, to help ensure that benefit claims are paid correctly and employer charges are accurate.

What happens if you are fired but you are not laid off?

Fired. If you ended the individual's employment but he or she was not laid off as defined above, then the individual was fired. If you demanded their resignation, then we consider the individual fired. A person may be eligible for benefits if they were fired for reasons other than misconduct.

How long can you be disqualified from military benefits?

The person may be eligible for benefits but will be disqualified for 6 to 25 weeks, depending on the situation.

Online Services for Employers

Access your online unemployment insurance account to view and manage your employer information.

Unemployment Insurance Rate Information

View current unemployment insurance rates and calculate your contribution rate.

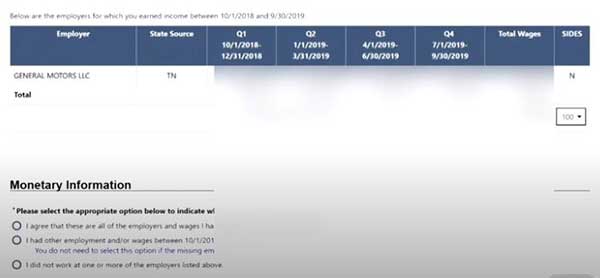

State Information Data Exchange (SIDES)

A web-based system that allows the Department of Labor and employers to communicate when a new claim is filed.

What are the benefits that employers are required to provide?

This article outlines what benefits employers are legally required to provide. Vacation, health insurance, long-term disability coverage, tuition reimbursement, and retirement savings plans are just a few of the many benefits employers may offer employees.

How much Social Security tax do employers have to pay?

Employers are required to withhold Social Security tax at 6.2 percent of gross compensation, up to the Social Security Wage Base ($127,400 for 2018).

How much Medicare tax do employers have to withhold?

Employers must also withhold Medicare tax at 1.45 percent of gross compensation, and an additional 0.9 percent of compensation in excess of a threshold amount based on the employee’s filing status if an employee’s compensation exceeds $200,000 (there is no wage base for Medicare).

What percentage of Social Security do employers have to match?

Employers must also match 6.2 percent for Social Security, up to the Wage Base and 1.45 percent for Medicare. Employers do not have to match the additional 0.9 percent. Unemployment insurance – Assists workers who lose their jobs.

Do Americans take Social Security?

Although many Americans today may take Social Security, Medicare, unemployment, and worker's compensation insurance for granted, these forms of assistance and compensation have been established for less than two generations. Prior wage earners only earned wages, nothing more. In that context, basic benefits are a big deal.