How do I file taxes if I am on disability?

- Click on Federal Taxes

- Click on Wages and Income

- Click on I'll choose what I work on

- Scroll down to Retirement Plans and Social Security

- On Social Security (SSA-1099, RRB-1099), click the start or update button

Do I have to claim disability on my taxes?

If you and your employer share the cost of a disability plan, you are only liable for taxes on the amount received due to payments made by your employer. So, if you pay the entire cost of a sickness or injury plan with after-tax money, you do not need to report any payments you receive under the plan as income.

Do federal employees on retirement disability pay income tax?

You must pay income tax on the payments, but not Social Security or Medicare tax. For more information on pensions and annuities, see IRS Publication 575, Pension and Annuity Income. Accrued Leave Payments. If you retire on disability, any lump-sum payment you receive for accrued annual leave is a wage payment. The payment is not a disability payment.

Is disability insurance income taxed as earned income?

The Social Security administration has outlined what does and doesn’t count as earned income for tax purposes. While the answer is NO, disability benefits are not considered earned income, it’s important to know the difference between earned and unearned income and know where your benefits fit in during tax season.

Do you have to file taxes on disability income?

But the good news is that you will never have to pay tax on all of your disability benefits. In fact, no matter how much you make, you will never have to pay taxes on more than 85 percent of your Social Security Disability income.

Is disability income taxable in 2021?

If you retired on disability, you must include in income any disability pension you receive under a plan that is paid for by your employer. You must report your taxable disability payments as wages on line 1 of Form 1040 or 1040-SR until you reach minimum retirement age.

Does disability count as gross income for taxes?

Disability benefits are excluded from being calculated as gross income. Instead, your benefits must be calculated into your combined income, which the IRS looks at to determine if you need to pay taxes on them.

How much of my Social Security disability is taxable?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

How do I prove my disability to the IRS?

Physician's statement. If you are under age 65, you must have your physician complete a statement certifying that you had a permanent and total disability on the date you retired. You can use the statement in the instructions for Schedule R Credit for the Elderly or the Disabled, page R-4.

What is the disability tax credit for 2021?

The federal DTC portion is 15% of the disability amount for that tax year. The “Base Amount” maximum for 2021 is $8,662, according to CRA's Indexation Chart....YearMaximum Disability AmountMaximum Supplement For Persons Under 182021$8,662$5,0532020$8,576$5,0032019$8,416$4,9092018$8,235$4,8049 more rows•Mar 7, 2022

How is disability income reported?

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) one-half of your benefits, plus (2) all of your other income, including tax-exempt interest, is greater than the base amount for your filing status.

What is a disability income exclusion?

—Generally, the most a person can exclude is $5,200. This exclusion goes down, dollar for dollar, by any amount over $15,000 on line 4(iii). That line shows your adjusted gross income before you take the deduction for a married couple when both work and the disability income exclusion.

Does SSI count as gross income?

Social Security benefits do not count as gross income. However, the IRS does count them in your combined income for the purpose of determining if you must pay taxes on your benefits.

Is Social Security benefits considered adjusted gross income?

How are Social Security benefits counted in Modified Adjusted Gross Income (MAGI)? Social Security benefits received by a tax filer and his or her spouse filing jointly are counted when determining a household's MAGI. For people who have other income, some Social Security benefits may be included in their AGI.

What line do you report Social Security benefits on?

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) ...

Do you have to add spouse's income to joint tax return?

If you're married and file a joint return, you and your spouse must combine your incomes and social security benefits when figuring the taxable portion of your benefits. Even if your spouse didn't receive any benefits, you must add your spouse's income to yours when figuring on a joint return if any of your benefits are taxable.

Is Social Security income taxable?

Social security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income (SSI) payments, which aren't taxable. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099, Social Security Benefit Statement, and you report that amount on line 6a of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. The taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and benefits for the taxable year. You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR.

Do I have to pay tax on my Social Security Disability Benefits?

Social Security Disability Insurance (SSDI) is intended to help those who are unable to work due to a severe medical condition. While SSDI recipients can work (see our article Can I work while receiving Social Security Disability Insurance Benefits? ), it is assumed extensive employment is challenging and earnings are capped.

How do I know if my benefits may be taxable?

Social Security Disability Insurance (SSDI) is intended to help those who are unable to work due to a severe medical condition. While SSDI recipients can work (see our article Can I work while receiving Social Security Disability Insurance Benefits? ), it is assumed extensive employment is challenging and earnings are capped.

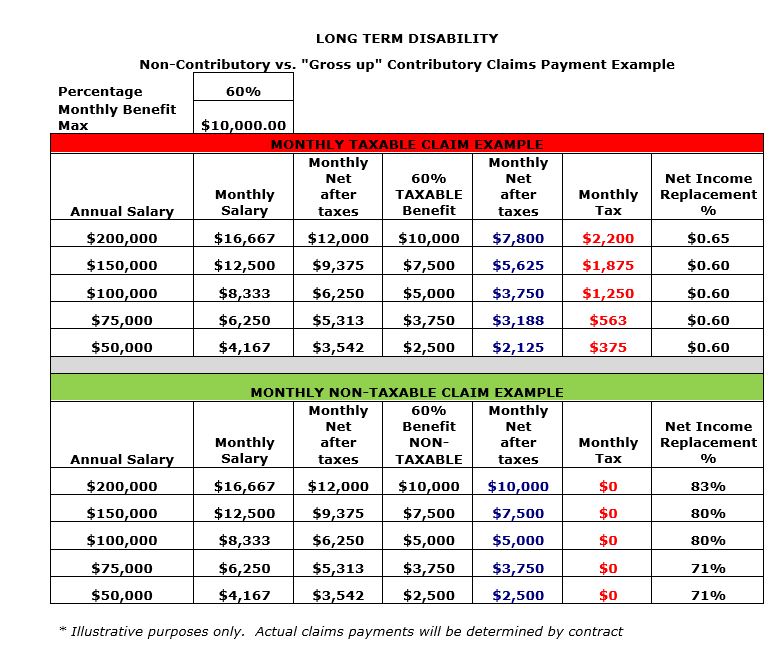

What happens if you don't pay disability insurance premiums?

Premiums keep your disability insurance policy in force and failing to pay the premiums could result in a loss of coverage. Although disability insurance benefits account for only 60% of your income, that amount comes close to matching your regular take-home pay.

What is disability insurance?

Disability insurance is protection against the financial burden of losing your income should you become disabled and can’t work. Coverage comes in the form of benefits paid to you monthly as if they were paychecks, and the amount should be about 60% of the income you were earning before you became disabled. You pay for disability insurance in the ...

What form do I use to pay estimated taxes?

You can also make estimated tax payments using Form 1040-ES , “Estimated Tax for Individuals,” which you’ll file directly to the IRS. If you start receiving taxable benefits, you need to include the amount of benefits you receive on your tax return as part of your salary or wages when you file.

When did the IRS update the tax tables?

In March 2018, the IRS released updated tax tables, which were mandated by the 2017 Tax Cuts and Jobs Act. The new rates are as follows, sorted by filing status:

Do you have to pay taxes on disability?

You do not have to pay taxes on disability benefits you receive if you purchased your policy with after-tax dollars. But those who receive their policy through their employer may have to. Taxable disability insurance benefits are classified as “sick pay,” so if you anticipate receiving benefits, you have to submit IRS Form W-4S, titled “Request for Federal Income Tax Withholding From Sick Pay” to the insurance company. You can also make estimated tax payments using Form 1040-ES, “Estimated Tax for Individuals,” which you’ll file directly to the IRS.

Can you deduct medical expenses on your taxes?

The IRS will let you deduct qualified out-of-pocket medical expenses if you’re eligible to itemize your deductions, so if your disability benefits cover medical care and you owe taxes on them, those medical expenses may negate the tax.

Can I get disability insurance through my employer?

Employer-sponsored disability coverage. Many people get disability insurance through their employer . These are either (or both) long-term and short-term policies that we usually recommend you take because they may be partially or wholly subsidized by your employer.

How much of your Social Security income is taxed?

If you and your spouse have a combined income of more than $44,000, then up to 85 percent of your Social Security Disability income may be taxed. The good news is that you will never have to pay taxes on more than 85 percent of your Social Security Disability earnings.

How much do you have to pay on Social Security?

The general rule of thumb to follow is that you will have to pay federal taxes on your Social Security Disability benefits if you file a federal tax return as an individual and your total income is more than $25,000. If you file a joint return, you will have to pay taxes if you and your spouse have a total combined income that exceeds $32,000.

Do you have to file taxes on Social Security Disability?

If Social Security Disability benefits are your only source of income and you are single, you do not necessarily have to file taxes. Doing so, however, may be in your best interests – such as the case with stimulus payments that you may not receive if you do not file taxes. The general rule of thumb to follow is that you will have ...

Does the SSA have to withhold taxes from Social Security?

The SSA is not obligated to withhold taxes from your Social Security Disability payments. If, however, you feel that you are going to owe taxes on your Social Security Disability benefits you can contact the SSA and ask them to withhold taxes for you if you prefer your tax situation be handled through tax withholding.

How are disability payments taxed?

How disability payments are taxed depends on the source of the disability income. The answer will change depending on whether the payments are from a disability insurance policy, employer-sponsored disability insurance policy, a worker’s compensation plan, or Social Security disability.

How much of my Social Security disability is taxable?

To figure your provisional income, use Publication 915, Worksheet A. If your provisional income is more than the base amount, up to 50% of your social security disability benefits will usually be taxable. However up to 85% of benefits will be taxable if your provisional income is more than the adjusted base amount.

What is disability insurance?

Disability insurance is a type of insurance that provides income in the event that an employee is unable to perform tasks at work due to an injury or disability. Disability insurance falls in two categories:

How long does a short term disability last?

Short-term disability: This type of insurance pays out a portion of your income for a short period of time – and can last from a few months to up to two years. Long-term disability: This type of insurance begins after a waiting period of several weeks or months – and can last from a few years to up to retirement age.

Is disability income taxable?

Disability benefits may or may not be taxable. You will not pay income tax on benefits from a disability policy where you paid the premiums with after tax dollars. This includes: A employer sponsored policy you contributed to with after-tax dollars.

What is the tax rate for disability?

85%. Keep in mind that if your disability benefits are subject to taxation, they will be taxed at your marginal income tax rate. In other words, your tax rate would not be 50% or 85% of your benefits; your tax rate would probably be more like 15-25% of your benefits. Those with higher incomes (where 85% of your benefits would be taxed) ...

How much income is subject to tax on SSDI?

Here's how it works. If you are married and you file jointly, and you and your spouse have more than $32,000 per year in income (including half of your SSDI benefits), a portion of your SSDI benefits are subject to tax. If you are single, and you have more than $25,000 in income per year (including half of your SSDI benefits), a portion of your SSDI benefits will be subject to tax.

Do you pay taxes on Social Security Disability?

Social Security disability is subject to tax, but most recipients don't end up paying taxes on it. Social Security disability benefits (SSDI) can be subject to tax, but most disability recipients don't end up paying taxes on them because they don't have much other income.

Do you have to pay taxes on SSDI?

Most states do not tax Social Security disability benefits. The following states, however, do tax benefits in some situations. Some of these states use the same income brackets as the federal government (above) to tax SSDI benefits, but others have their own systems.

Can SSDI payments bump up your income?

Large lump-sum payments of back payments of SSDI (payments of benefits for the months you were disabled but not yet approved for benefits) can bump your income up for the year in which you receive them, which can cause you to pay a bigger chunk of your backpay in taxes than you should have to.

Which states don't tax short term disability?

Washington. Wyoming. New Jersey, California, and Rhode Island don’t tax short-term disability benefits, but the IRS imposes a few wrinkles. For example, the IRS requires that employers in New Jersey must treat short-term disability benefits as third-party sick pay.

How long does short term disability last?

Short-term disability coverage typically replaces some of your income for a few months up to as long as two years. 2 It usually pays anywhere from 40% to 70% of your salary. 3 Whether your short-term disability benefits are taxable, and what portion of them can be taxed, depends on whether and how you contribute to the premiums.

How much is taxed on $9,950?

The first $9,950 of your income would be taxed at 10%. Then you’d be taxed 12% on the portion of your income between $9,951 and $40,525—which includes most of your salary and the first $4,525 of your short-term disability benefits.

What is short term disability?

Short-term disability is insurance coverage. It shouldn’t be confused with the Social Security disability benefits provided by the federal government through the Social Security Administration (SSA). 1.

What happens if you are unable to work due to injury?

Read The Balance's editorial policies. Beverly Bird. Updated May 12, 2021. If you’re unable to work due to injury, illness , or even childbirth, short-term disability benefits can replace at least a portion of the income you would have earned during that time.

Can you get short term disability if you are unable to work?

Short-term disability benefits can replace a portion of your income while you're unable to work due to injury or illness. These benefits are often part of a compensation package offered by an employer, but you can also purchase your own policy.

What is a pre-tax disability payment?

Pre-tax, or before-tax, dollars is a payment made that has not yet been taxed. Post-tax, or after-tax, dollars is a payment that includes withheld tax dollars so you will not have to pay it later. If your long-term disability premiums are paid with pre-tax dollars, you will likely have to pay taxes on your long-term disability benefits. ...

Can you settle a long term disability claim in one payment?

A lump sum settlement might be offered through your long-term disability insurance company instead of intermittent payments. This means you would receive your entire long-term disability benefit in one payment. Before you settle on a lump sum claim, it is advised that you consult a disability lawyer. In cases where this happens, whether your lump ...

Is disability insurance tax deductible?

Disability insurance of any kind is generally not tax-deductible. If you pay with post-tax dollars, the premiums have already been taxed upfront, these payments cannot be claimed again. Any premiums paid with pre-tax dollars must be filed as income.

Can you deduct long term disability insurance premiums?

You cannot deduct long-term disability insurance premiums from your personal income taxes. Long-term disability insurance is often confused with medical insurance, which is tax-deductible. Long-term disability premiums are not considered a medical expense by the IRS. Disability insurance of any kind is generally not tax-deductible.

Is a group policy taxable?

A group policy is a policy that you get through your employer. If your employer pays the entire premium for your long-term disability insurance, then your long-term disability benefits are likely taxable. This means that while your employer pays the premiums for your long-term disability insurance, you will have to pay income taxes on ...

Is a lump sum settlement taxable?

In cases where this happens, whether your lump sum is taxable also depends on if you pay with pre- or post-tax dollars. If your lump sum settlement is taxable, it is possible that you will see your lump sum total reduced significantly by taxes. 17:16.

Is long term disability taxable?

In short, long-term disability benefits can be taxable or non-taxable. You should speak to an accountant or other tax professional to determine whether your benefits are taxable and to make sure your benefits are reported correctly. However, whether your long-term disability benefits are taxable can depend on a number of factors.