When do I get SSDI or SSI back pay?

When Disability Payments Begin

- Disability onset date. Social Security will use the date you filed a disability application as your " alleged onset date ."

- Wait period. A mandatory waiting period applies to all SSDI claims. ...

- Application date. You won't be able to collect retroactive benefits generally for more than 12 months—the 12 months before your application date.

Can I file taxes if I receive SSI?

SSI itself is not taxed, but if you earn additional income like self-employment, dividends, or interest, you will need to file a tax return. SSDI benefits are also not subject to federal tax. However, a few states do tax SSDI: More than 8 million Americans received Supplemental Security Income benefits in 2017.

Does your employer pay FICA taxes?

Your employer MUST withhold FICA taxes (Social Security and Medicare) from your employment income. You must pay self-employment tax on the net profit of your employment if you still owe these taxes after considering your total income for the year. You must pay these taxes on your total income.

Do you pay taxes on maternity leave disability payments?

Your method of payment is sometimes determined by you, and other times determined by a third party: your employer or government entity. Short-term disability for maternity leave is taxable when the employer pays the premium or the mother chooses a pre-tax deduction.

How much of your Social Security income is taxable?

Income Taxes And Your Social Security Benefit (En español) between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

How can I avoid paying taxes on Social Security?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

At what age is Social Security not taxable?

However once you are at full retirement age (between 65 and 67 years old, depending on your year of birth) your Social Security payments can no longer be withheld if, when combined with your other forms of income, they exceed the maximum threshold.

Are Social Security benefits taxable by the IRS?

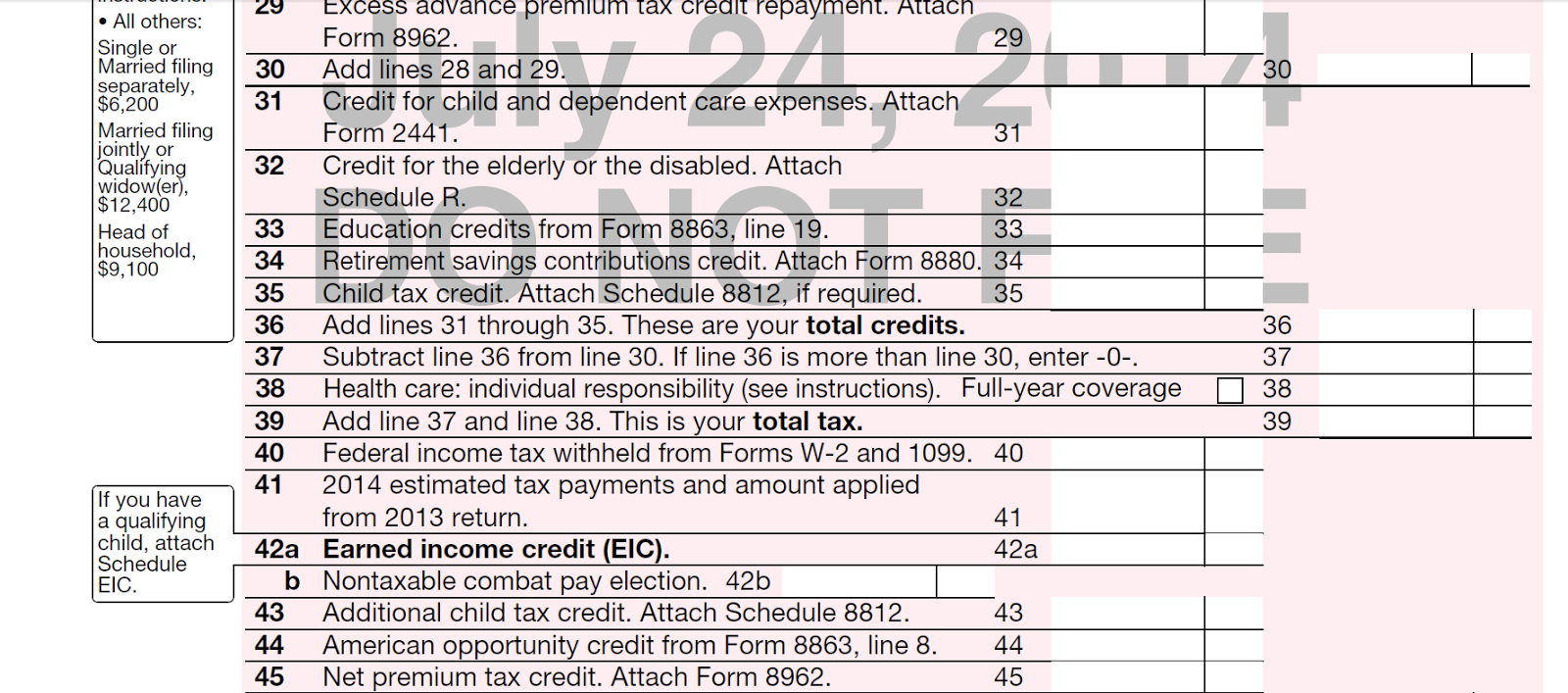

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) one-half of your benefits, plus (2) all of your other income, including tax-exempt interest, is greater than the base amount for your filing status.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

Do I need to report Social Security on my taxes?

Your Annual Social Security Benefit Statement You should report the amount of Social Security income you received to the IRS on your federal tax return. The Benefit Statement isn't available for people who only receive SSI payments because SSI payments aren't taxed.

Do you pay taxes on Social Security after 66?

Are Social Security benefits taxable regardless of age? Yes. The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level — specifically, what the Internal Revenue Service calls your “provisional income.”

What percentage of Social Security is taxable in 2020?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

Quick Rule: Is My Social Security Income Taxable?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security...

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never...

How to File Social Security Income on Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this par...

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay...

State Taxes on Social Security Benefits

Everything we’ve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes. As y...

Tips For Saving on Taxes in Retirement

1. What you pay in taxes during your retirement will depend on how retirement friendly your state is. So if you want to decrease tax bite, consider...

How much of your unemployment benefits are taxable?

more than $34,000, up to 85 percent of your benefits may be taxable. between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. more than $44,000, up to 85 percent of your benefits may be taxable.

How to get a replacement SSA-1099?

To get your replacement Form SSA-1099 or SSA-1042S, select the "Replacement Documents" tab to get the form.

Do you pay taxes on your benefits if you are married?

are married and file a separate tax return, you probably will pay taxes on your benefits.

How to find out if you will pay taxes on Social Security?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security benefits and add that amount to all your other income , including tax-exempt interest. This number is known as your combined income (combined income = adjusted gross income + nontaxable interest + half of your Social Security benefits).

How much of your Social Security income is taxable?

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income. If you file as an individual with a total income that’s less than $25,000, you won’t have to pay taxes on your social security benefits in 2020, ...

How much to withhold from Social Security?

The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit . After you fill out the form, mail it to your closest Social Security Administration (SSA) office or drop it off in person.

How to save on taxes in retirement?

You can also save on your taxes in retirement simply by having a plan. Help yourself get ready for retirement by working with a financial advisorto create a financial plan. It may seem daunting to wade through the options, but a matching tool like SmartAsset’scan help you find a person to work with to meet your needs. Just answer some questions about your financial situation and the tool will match you with up to three advisors in your area.

How much tax do you pay on your income if you live in one of the states?

So if you live in one of those four states then you will pay the state’s regular income tax rates on all of your taxable benefits (that is, up to 85% of your benefits). The other nine states also follow the federal rules but offer deductionsor exemptions based on your age or income.

How to file Social Security income on federal taxes?

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099.

How many states have Social Security taxes?

There are 13 states that collect taxes on at least some Social Security income. Four of those states (Minnesota, North Dakota, Vermont or West Virginia) follow the same taxation rules as the federal government.

How much of a person's income is taxable?

Fifty percent of a taxpayer's benefits may be taxable if they are: Filing single, single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Married filing separately and lived apart from their spouse for all of 2019 with $25,000 to $34,000 income.

When is the IRS filing 2020 taxes?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS. Social Security Income.

How much income do you need to be married to be eligible for a widow?

Filing single, head of household or qualifying widow or widower with more than $34,000 income. Married filing jointly with more than $44,000 income. Married filing separately and lived apart from their spouse for all of 2019 with more than $34,000 income.

Is Social Security taxable if you are single?

If they are single and that total comes to more than $25,000, then part of their Social Security benefits may be taxable.

Do you pay taxes on Social Security?

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income payments, which aren't taxable. The portion of benefits that are taxable depends on ...

What percentage of Social Security recipients owe income tax?

The Social Security Administration estimates that about 56 percent of Social Security recipients owe income taxes on their benefits. For purposes of determining how the Internal Revenue Service treats your Social Security payments, “income” means your adjusted gross income plus nontaxable interest income plus half of your Social Security benefits.

How many states tax Social Security?

All of the above concerns federal taxes; 13 states also tax Social Security to varying degrees. If you live in Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, North Dakota, Vermont, Utah or West Virginia, contact your state tax agency for details on how benefits are taxed.

Is unemployment taxable in Colorado?

Some follow the federal rules for determining if benefits are taxable, others have their own sets of deductions and exemptions based on age or income, and Colorado, Nebraska and West Virginia are phasing out taxation of benefits entirely for most or all residents. Contact your state tax agency for details on how benefits are taxed.

Is Social Security income taxable?

Supplemental Security Income (SSI) is never taxable. If you do have to pay taxes on your benefits, you have a choice as to how: You can file quarterly estimated tax returns with the IRS or ask Social Security to withhold federal taxes from your benefit payment. Updated June 30, 2021.

When Will I Have to Pay Taxes on My Benefits?

To determine if you will need to pay income tax on your benefits, you will need to assess the total tax-exempt income that you receive during the year as well as the total amount of benefits you receive.

How Much Will I Be Taxed on My Benefits if I Make More Than the Combined Income Limits?

If your combined income is more than the limits listed above, you will need to pay taxes on a portion of the social security benefits that you receive. How much you will be taxed is determined by how much over the income limits you fall.

How Can I Determine What My Exact Combined Income Is for the Year and How Much I Will Be Taxed?

If you receive benefits, assessing your combined income, as well as your tax rate, can be a bit overwhelming. It is a complicated process, and you will need to have a thorough understanding of what is considered taxable and tax-exempt income.

SocialSecurityDisability.com Can Help

Are you considering filing to receive Social Security Disability (SSD) benefits and are not sure where to start? If so, complete our free evaluation to be connected directly with a local disability attorney that can help you on your journey to receiving benefits.

How much of benefits are taxable?

The tax treatment is much the same as if the person was paying based on their own years of services. Up to 85% of the benefits received might be taxable but that depends on a lot of factors. Most notable is the income test. 6

What can you spend Social Security survivor benefits on?

The Social Security Administration requires that the money be spent first for the beneficiary's food, shelter, and medical needs. Any surplus must be saved in a federally insured, interest-bearing savings account or bond. You'll need to account for how you use the money by filling out a Representative Payee Report once a year.

How long does it take to get survivor benefits from Social Security?

Social Security generally takes about 30-60 days to start paying benefits after it approves your application. You can check the status of your application at the Social Security Administration's website.

What is survivor benefit?

Survivor benefits are based on the deceased person's income, along with the age of the beneficiary and their relationship to the deceased. Generally, benefits are calculated as follows:

What percentage of Social Security benefits are paid to a deceased parent?

If the family earnings are more than 150 percent to 180 percent of the deceased parent’s earnings, Social Security will reduce the benefits proportionally for everybody except the surviving parent until the total reaches the total maximum amount. 13

What happens if neither spouse claims benefits?

If neither spouse has claimed benefits, and the surviving spouse works, he or she will receive theirs or the deceased spouses —generally whichever is larger. If one was claiming benefits and one was not, the surviving spouse will need help figuring out how to maximize their benefits. 4 .

How much of a survivor's income is taxable?

6 . If the person has any additional income but it’s below $25,000, benefits won’t be taxed. 7 If they earn between $25,000 and $34,000, 50 percent of the survivor benefit is taxable.