How to file taxes when on SSDI?

- Your Social Security number

- Medical records from your doctors, therapists, hospitals, clinics and caseworkers

- Laboratory and test results

- Names, addresses, phone and fax numbers of your doctors, clinics and hospitals

- Names of all medications you are taking

- Names of your employers and job duties for the last 15 years

How much can I get in SS disability benefit payments?

The monthly maximum federal SSI amounts for 2022 are $841 for an eligible individual. For an eligible individual with an eligible spouse, the amount is $1,261 a month. For an essential person, the amount is $421 a month. As a result of the COLA, SSI payments have increased by $34 on average to $621 a month. This equals $7,452 each year.

Will I get back pay from both SSI and SSDI?

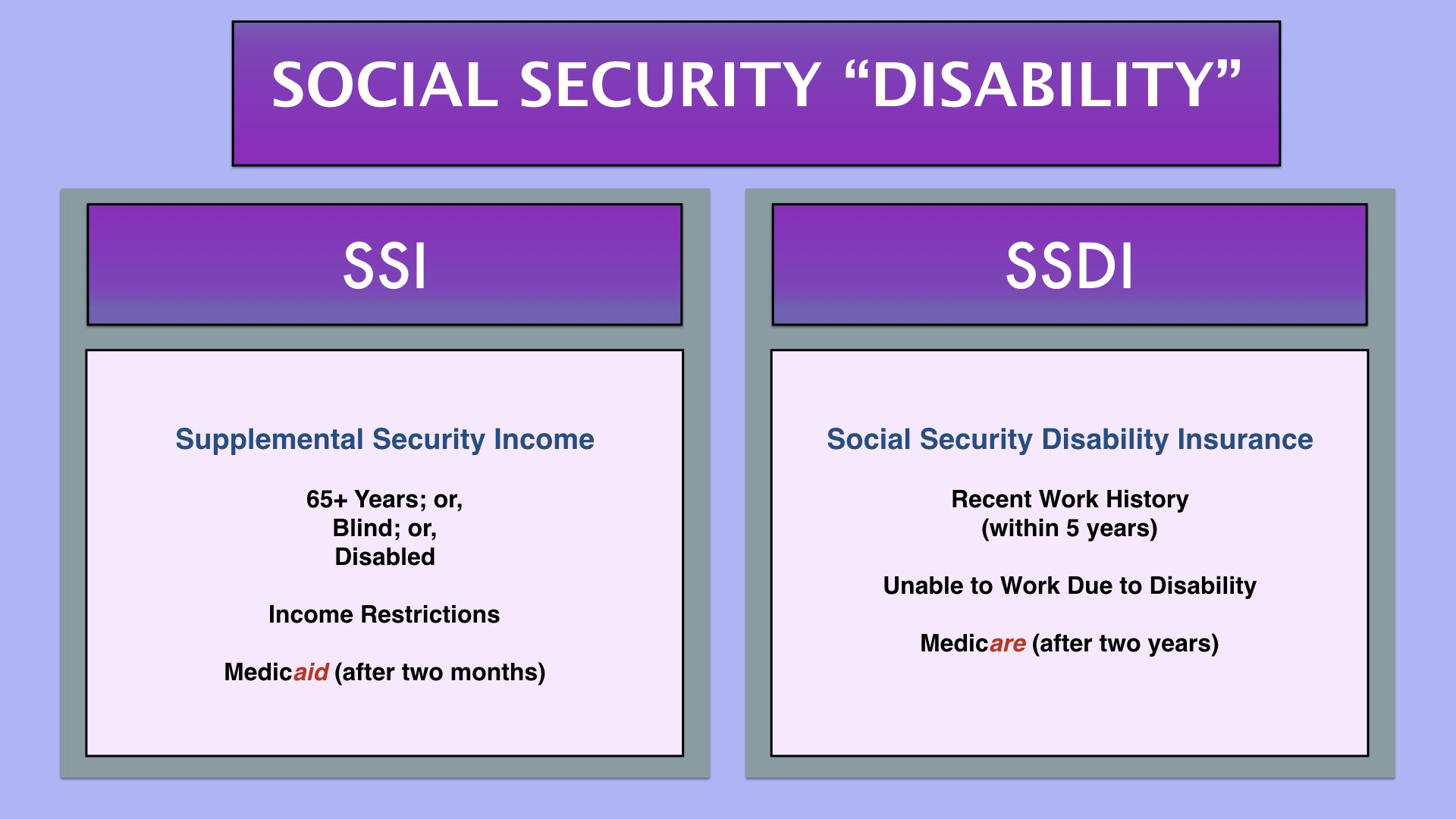

Those who are disabled can receive SSDI (benefits for those with enough work history) or SSI (benefits for those who have low income and assets). It's possible for individuals to receive both benefits, so you can receive both SSI and SSDI back pay.

Can I file taxes with SSI benefits?

inancial hardships are becoming common occurrence during this pandemic, but as the economy starts to rise and more people return to their jobs, several changes to economic programs and social security benefits, have occurred and people want to know how much they can get from their monthly checks.

How much income is subject to tax on SSDI?

What is the tax rate for disability?

Do you pay taxes on Social Security Disability?

Do you have to pay taxes on SSDI?

Can SSDI payments bump up your income?

See more

About this website

Federal Taxation of Social Security Disability Benefits

Here's how it works. If you are married and you file jointly, and you and your spouse have more than $32,000 per year in income (including half of...

Taxation of Social Security Disability Backpay

Large lump-sum payments of back payments of SSDI (payments of benefits for the months you were disabled but not yet approved for benefits) can bump...

State Taxation of Social Security Disability Benefits

Most states do not tax Social Security disability benefits. The following states, however, do. Some of these states use the same income brackets as...

Are Social Security Disability Benefits Taxable?

Keep in mind. As with other types of income, you can make quarterly estimated tax payments to the IRS or elect to have federal taxes withheld from your Social Security payments to avoid a larger bill at tax time.; Twelve states — Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont and West Virginia — tax some or all disability ...

Don’t forget, Social Security benefits may be taxable

Tax Tip 2020-76, June 25, 2020. Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits.

Do I have to file taxes when receiving disability benefits?

There is a saying that the only two things in life that are certain are death and taxes. As United States citizens, we are well aware of the fact that we pay taxes on the income we receive. In fact, a part of those taxes is what makes it possible for disabled workers to obtain Social Security Disability benefits. The question is, do Social Security Disability beneficiaries have to file taxes ...

Is Social Security Disability Taxable? - TurboTax Tax Tips & Videos

TURBOTAX ONLINE GUARANTEES. TurboTax Free Edition: $0 Federal + $0 State + $0 To File offer is available for simple tax returns only with TurboTax Free Edition. A simple tax return is Form 1040 only (without any additional schedules). Situations covered: W-2 income

Do I have to pay tax on my Social Security Disability Benefits?

Social Security Disability Insurance (SSDI) is intended to help those who are unable to work due to a severe medical condition. While SSDI recipients can work (see our article Can I work while receiving Social Security Disability Insurance Benefits? ), it is assumed extensive employment is challenging and earnings are capped.

How do I know if my benefits may be taxable?

Social Security Disability Insurance (SSDI) is intended to help those who are unable to work due to a severe medical condition. While SSDI recipients can work (see our article Can I work while receiving Social Security Disability Insurance Benefits? ), it is assumed extensive employment is challenging and earnings are capped.

How does SSDI work?

How SSDI Works. When SSDI Benefits Are Taxed. State Taxes on SSDI. Social Security disability benefits may be taxable if you have other income that puts you over a certain threshold. However, the majority of recipients do not have to pay taxes on their benefits because most people who meet the strict criteria to qualify for ...

How much disability income can I avoid?

If you are single, the threshold amount is currently $25,000.

How many states will have tax benefits in 2020?

As of 2020, however, a total of 13 states tax benefits to some degree. Those states are Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. Most of these states set similar income criteria to the ones used by the IRS to determine how much, if any, ...

How long does a disabled person have to be disabled to work?

First, the SSA says, "Your condition must significantly limit your ability to do basic work such as lifting, standing, walking, sitting, and remembering—for at least 12 months.".

Why did Roosevelt include Social Security in the New Deal?

The purpose of the New Deal was to lift the country out of the Great Depression and restore its economy.

Is SSDI income taxed?

Key Takeaways. Many Americans rely on Social Security Disability Income (SSDI) benefits for financial support. If your total income, including SSDI benefits, is higher than IRS thresholds, the amount that is over the limit is subject to federal income tax.

How much do you have to pay taxes on your Social Security benefits?

You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000. If you file a joint return, you must pay taxes if you and your spouse have “combined income” of more than $32,000.

Do I have to pay taxes if I am married?

If you are married and file a separate return, you probably will have to pay taxes on your benefits. See Retirement Benefits: Income Taxes and Your Social Security Benefits for more information.

How much disability income is taxable?

The portion of your disability income that is subject to taxation depends on by how much your total income exceeds the federal threshold. If your total income is between $25,000 and $34,000, you can expect a maximum of 50% of your disability income to be considered taxable .

When is the deadline to file taxes for Social Security?

Find out more about disability and taxes from Social Security Disability Advocates USA. In light of the ongoing COVID-19 pandemic, the deadline to file your 2019 tax return has been extended to July 15, 2020.

What is the tax rate for a person earning over $34,000?

For example, an individual whose total income is mid-range (between $25,000 and $34,000) would likely only pay between a 15% to 25% tax rate on benefits, while those earning above $34,000 could possibly pay a 35% tax rate on their benefits.

Do you pay taxes on SSDI?

The Social Security Administration (SSA) reports that only about one third of SSDI recipients ultimately pay taxes on their benefits each year. Virtually no beneficiaries who receive Supplemental Security Income will pay taxes on these benefits, as they are already designated for low-income individuals.

Is disability income considered unearned income?

Other types of income, including child support, alimony, retirement income, and disability benefits are all considered unearned income . In short, although disability benefits are income, the way the federal government taxes this income differs from traditional earned income.

Is disability income the same as income?

In this way, disability is income. But when it comes to the Internal Revenue Service (IRS), all income is not treated the same. For taxation purposes, the IRS distinguishes between two kinds of income: earned and unearned.

Do you have to pay taxes on disability?

You will only be required to pay federal taxes on your disability income if your total income exceeds the threshold limit set by the federal government. You can calculate your total income by adding half the amount of your disability benefits to any additional income.

Your SSDI Benefits May Be Subject to Federal Tax

SSDI benefits can be subject to federal tax if you have other income that places you above a certain threshold. That said, most recipients do not pay taxes on their benefits because they don’t have that additional income.

Are You Confused About Your SSDI Benefits?

Navigating the Social Security disability benefits process can be confusing and stressful. A lawyer with experience in handling these complicated disability matters can offer assistance as you navigate this process.

How many states tax Social Security disability?

As of 2020, 12 states imposed some form of taxation on Social Security disability benefits, though they each apply the tax differently. Nebraska and Utah, for example, follow federal government taxation rules.

How much income can you report on Social Security?

This means that if you’re married and file a joint return, you can report a combined income of up to $32,000 before you’d have to pay taxes on Social Security disability benefits. There are two different tax rates the IRS can apply, based on how much income you report and your filing status.

How long does a disability last?

Your disability must have lasted at least 12 months or be expected to last 12 months. Social Security disability benefits are different from Supplemental Security Income (SSI)and Social Security retirement benefits. SSI benefits are paid to people who are aged, blind or disabled and have little to no income. These benefits are designed ...

How much of my Social Security benefits do I get if I'm married?

Up to 50% of your benefits if your income is between $25,000 and $34,000. Up to 85% of your benefits if your income is more than $34,000. If you’re married and file a joint return, you’d pay taxes on: Up to 50% of your benefits if your combined income is between $32,000 and $44,000.

Is disability income taxable?

Whether you receive SSDI or SSI, your disability benefits are generally not taxable. Here's how to determine if you need to pay income tax on your benefits. Menu burger. Close thin.

Is Social Security taxable if you are working part time?

Social Security retirement benefits, on the other hand, can be taxable if you’re working part-time or full-time while receiving benefits. Is Social Security Disability Taxable? This is an important question to ask if you receive Social Security disability benefits and the short answer is, it depends.

Do you have to pay taxes on Social Security?

For most people, the answer is no. But there are some scenarios where you may have to pay taxes on Social Security disability benefits. It may also behoove you to consult with a trusted financial advisoras you navigate the complicated terrain of taxes on Social Security disability benefits.

How much income is subject to tax on SSDI?

Here's how it works. If you are married and you file jointly, and you and your spouse have more than $32,000 per year in income (including half of your SSDI benefits), a portion of your SSDI benefits are subject to tax. If you are single, and you have more than $25,000 in income per year (including half of your SSDI benefits), a portion of your SSDI benefits will be subject to tax.

What is the tax rate for disability?

85%. Keep in mind that if your disability benefits are subject to taxation, they will be taxed at your marginal income tax rate. In other words, your tax rate would not be 50% or 85% of your benefits; your tax rate would probably be more like 15-25% of your benefits. Those with higher incomes (where 85% of your benefits would be taxed) ...

Do you pay taxes on Social Security Disability?

Social Security disability is subject to tax, but most recipients don't end up paying taxes on it. Social Security disability benefits (SSDI) can be subject to tax, but most disability recipients don't end up paying taxes on them because they don't have much other income.

Do you have to pay taxes on SSDI?

Most states do not tax Social Security disability benefits. The following states, however, do tax benefits in some situations. Some of these states use the same income brackets as the federal government (above) to tax SSDI benefits, but others have their own systems.

Can SSDI payments bump up your income?

Large lump-sum payments of back payments of SSDI (payments of benefits for the months you were disabled but not yet approved for benefits) can bump your income up for the year in which you receive them, which can cause you to pay a bigger chunk of your backpay in taxes than you should have to.