When a Social Security beneficiary dies, his or her surviving spouse is eligible for survivor benefits. A surviving spouse can collect 100 percent of the late spouse’s benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age.

How do you calculate survivor Social Security benefits?

There are three basic steps:

- Adjust historical earnings for inflation.

- Get monthly average from the highest 35 years

- Apply monthly average to benefits formula

Who gets the 255.00 when someone dies?

Social Security provides the grand sum of $255.00, paid either to the funeral home or next of kin, when someone dies. Why $255? That was what a funeral cost in 1937 when Social Security first started. The benefit has never been raised over more than 70 years.

What is the maximum Social Security benefit for a widow?

You will need to meet one of the following criteria to collect Social Security survivor benefits:

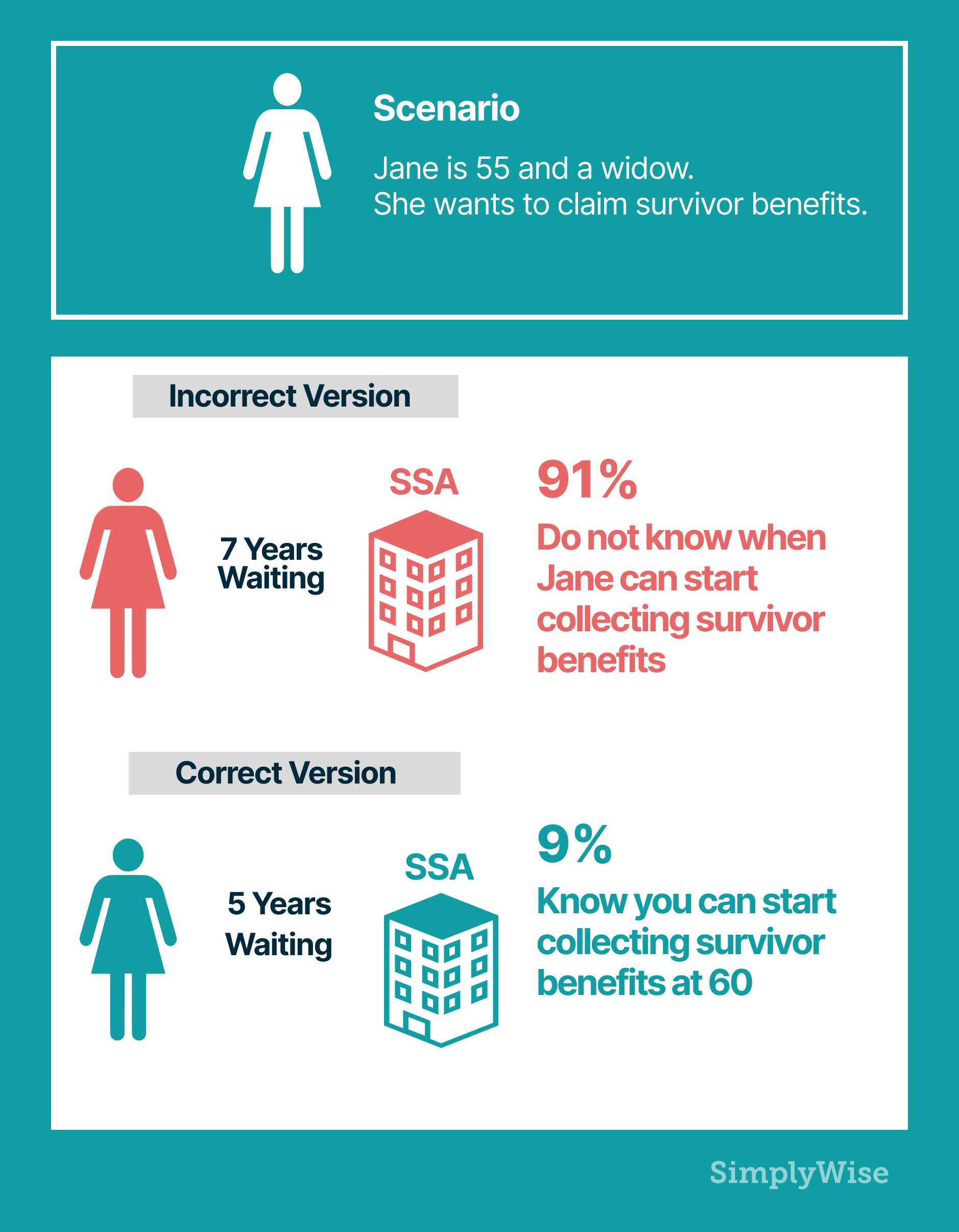

- A widow or widower who is at least 60 years old (50 years old if disabled)

- A widow or widower who is caring for the deceased’s child (under 16 years of age or receiving disability benefits)

- An unmarried child of the deceased who is either: 18 years of age or younger Disabled, with the disability occurring before the age of 22

Are widows benefits considered social security?

Social Security's Widow(er)’s Insurance Benefits are federally funded and administered by the U.S. Social Security Administration (SSA). These benefits are paid to the widow or widower of a deceased worker who had earned enough work credits. Determine your eligibility for this benefit

What are the qualifications to receive survivor benefits?

Who Qualifies for Social Security Survivor Benefits?A widow(er) age 60 or older (age 50 or older if they are disabled) who has not remarried.A widow(er) of any age who is caring for the deceased's child (or children) under age 16 or disabled.More items...

When a spouse dies does the survivor get their Social Security?

A surviving spouse can collect 100 percent of the late spouse's benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age.

Can you be denied survivor benefits?

If a person's application for Social Security Survivor Benefits is denied, the person can appeal the denial. A person has 60 days after they receive a notice of decision on their case from the SSA to ask for an appeal.

What is the difference between survivor benefits and widow benefits?

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

When my husband dies do I get his Social Security and mine?

Social Security will not combine a late spouse's benefit and your own and pay you both. When you are eligible for two benefits, such as a survivor benefit and a retirement payment, Social Security doesn't add them together but rather pays you the higher of the two amounts.

How long does a widow receive survivor benefits?

for lifeWidows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

Who is not eligible for survivor benefits?

Widowed spouses and former spouses who remarry before age 60 (50 if they are disabled) cannot collect survivor benefits. Eligibility resumes if the later marriage ends. There is no effect on eligibility if you remarry at 60 or older (50 or older if disabled).

What documents do I need to apply for survivors benefits?

Get Started Applying for Survivor's BenefitsProof of death.Birth certificate.Proof of citizenship.Proof of disability.Certain SSA forms.W-2s and tax forms.Marriage certificate.Divorce decree.More items...

How long does it take to get approved for survivor benefits?

30 to 60 daysAbout 5 million widows and widowers currently qualify. It takes 30 to 60 days for survivors benefits payments to start after they are approved, according to the agency's website.

How do I claim my deceased husband's Social Security?

Form SSA-10 | Information You Need to Apply for Widow's, Widower's or Surviving Divorced Spouse's Benefits. You can apply for benefits by calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office.

Can I receive Social Security benefits and survivor benefits at the same time?

Social Security allows you to claim both a retirement and a survivor benefit at the same time, but the two won't be added together to produce a bigger payment; you will receive the higher of the two amounts. You would be, in effect, simply claiming the bigger benefit.

How to report a death to Social Security?

To report a death or apply for survivors benefits, use one of these methods: Call our toll-free number, 1-800-772-1213 (TTY 1-800-325-0778 ). Visit or call your local Social Security office. More Information. If You Are The Survivor. Survivors Benefits.

How old do you have to be to get unemployment benefits?

Unmarried children can receive benefits if they are: Younger than age 18 (or up to age 19 if they are attending elementary or secondary school full time). Any age and were disabled before age 22 and remain disabled.

What age can you take care of a child of a deceased person?

At any age if they take care of a child of the deceased who is younger than age 16 or disabled.

How much is a death benefit for dependent parents?

Parents age 62 or older who received at least one-half support from the deceased can receive benefits. One-time lump sum death payment. A one-time payment of $255 can be made only to a spouse or child if they meet certain requirements.

Can you get Social Security if you die?

When you die, members of your family could be eligible for benefits based on your earnings. You and your children also may be able to get benefits if your deceased spouse or former spouse worked long enough under Social Security.

How do survivors benefit amounts work?

We base your survivors benefit amount on the earnings of the person who died. The more they paid into Social Security, the higher your benefits would be.

How long do you have to wait to receive Social Security if you die?

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death. For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 ( TTY 1-800-325-0778 ).

Who receives benefits?

Certain family members may be eligible to receive monthly benefits, including:

Are other family members eligible?

Under certain circumstances, the following family members may be eligible:

What percentage of a widow's benefit is a widow?

Widow or widower, full retirement age or older — 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99 percent of the deceased worker's basic amount. A child under age 18 (19 if still in elementary or secondary school) or disabled — 75 percent.

What happens if you die on reduced benefits?

If the person who died was receiving reduced benefits, we base your survivors benefit on that amount.

How much can a family member receive per month?

The limit varies, but it is generally equal to between 150 and 180 percent of the basic benefit rate.

What age can you collect a $1000 survivor benefit?

Generally, if the person who died was receiving reduced benefits, we base the survivors benefit on that amount. Year of Birth 1. Full (survivors) Retirement Age 2. At age 62 a $1000 survivors benefit would be reduced to 3. Months between age 60 and full retirement age.

What are the pros and cons of taking survivors benefits before retirement age?

Pros And Cons. There are disadvantages and advantages to taking survivors benefits before full retirement age. The advantage is that the survivor collects benefits for a longer period of time. The disadvantage is that the survivors benefit may be reduced.

How much is the 62 survivors benefit?

It includes examples of the age 62 survivors benefit based on an estimated monthly benefit of $1000 at full retirement age . If the worker started receiving retirement benefits before their full retirement age, we cannot pay the full retirement age benefit amount on their record. Generally, if the person who died was receiving reduced benefits, ...

When can a widow receive Social Security?

The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor. If the benefits start at an earlier age, they are reduced a fraction of a percent for each month ...

Can you use the retirement estimate to determine the amount of a spouse's retirement benefits?

You cannot use the Retirement Estimator to determine benefit amounts for a surviving spouse. However, if you know what the worker's yearly lifetime earnings were, you can use our Online Calculator to get a rough estimate of what the benefits would be for the surviving spouse at full retirement age.

Who Is Eligible For Spouse Survivor Benefits?

Many surviving spouses are eligible for monthly benefits from Social Security, based upon their age, disability, children at home, or some combination thereof. In general, spouse survivor benefits are available to:

How much Social Security can a 62 year old woman get?

From age 62 to 69, she could receive $1,200 per month as a survivor’s benefit. Once her own benefit has grown to the maximum, at age 70 and beyond, she can simply take that and receive $1,860 per month for the rest of her life. The Social Security Administration discusses this strategy at this link.

Why is knowing when you are full retirement important?

Why? Because if the survivor benefit is the highest benefit you’ll be entitled to, there is generally no benefit to delaying your filing beyond that age.

What happens if a deceased spouse files for Social Security?

If the Deceased DID File for Benefits. If the deceased spouse filed for benefit on or after their full retirement age, and the surviving spouse is at full retirement age, the benefit amount payable to the survivor will remain unchanged.

What is a surviving spouse?

A surviving spouse, who was residing with the deceased spouse, or. A surviving spouse, who was not residing with the deceased, but was receiving benefits based upon the work record of the deceased spouse, or who becomes eligible for benefits after the death of the spouse , or.

How long does it take to get a death benefit if you are not receiving it?

Even though $255 isn’t a lot, who wants to pass on money that’s rightfully theirs? If the eligible spouse or child is not receiving benefits at the time of death, they must apply for benefits within two years in order to receive the death payment.

What age can a spouse care for a deceased child?

Surviving spouses, of any age, caring for the deceased’s child aged 16 or younger or disabled.

How Does Social Security Help You When Your Loved One Dies

When someone dies, you should notify the Social Security Administration as soon as you can.

What Are Death Benefits

The Death Benefit is a one-time lump-sum payment for the spouse of the deceased.

What Documents Do I Need To Provide For The Death Benefit Lump Sum Payment

To apply for the lump sum Death Benefit you will need to provide the following:

When Will I Receive Death Benefits Payments

Once you have provided all the necessary documents, answer all Social Securities questions, and they have reviewed your case you should receive the death benefit lump sum payment within 30-60 days.

Who Can Receive Survivors Benefits

Widows and widowers, divorced spouses, children, stepchildren, and other family members could be eligible for Survivors Benefits. In some cases, the individual must prove they are related to the deceased or prove they are caring for the deceased’s child.

How Do I Apply For Childs Benefits

You can apply for Child’s Benefits by calling Social Securities national toll-free number at 1-800-772-1213 or (TTY 1-800-325-0778). You could also visit your local Social Security office. Find your nearest office here.

What Documents Do I Need To Submit For Survivors Benefits

Generally, to apply for Survivors Benefits you will need to submit the following documentation:

What percentage of survivor benefits do you get when you retire?

If you claim survivor benefits between age 60 and your full retirement age, you will receive between 71.5 percent and 99 percent of the deceased’s benefit. The percentage gets higher the older you are when you claim.

How long do you have to be married to receive survivor benefits?

In most cases, a widow or widower qualifies for survivor benefits if he or she is at least 60 and had been married to the deceased for at least nine months at the time of death. But there are a few exceptions to those requirements: 1 If the late beneficiary’s death was accidental or occurred in the line of U.S. military duty, there’s no length-of-marriage requirement. 2 You can apply for survivor benefits as early as age 50 if you are disabled and the disability occurred within seven years of your spouse’s death. 3 If you are caring for children from the marriage who are under 16 or disabled, you can apply at any age.

What happens to Social Security when a spouse dies?

En español | When a Social Security beneficiary dies, his or her surviving spouse is eligible for survivor benefits. A surviving spouse can collect 100 percent of the late spouse’s benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age. (Full retirement age for survivor benefits differs from that for retirement and spousal benefits; it is currently 66 but will gradually increasing to 67 over the next several years.)

What percentage of late spouse's disability is survivor?

If you claim in your 50s as a disabled spouse, the survivor benefit is 71.5 percent of your late spouse's benefit.

Can a survivor get Social Security if they are still working?

If you are below full retirement age and still working, your survivor benefit could be affected by Social Security's earnings limit. It does not matter whether a surviving spouse worked long enough to qualify for Social Security on his or her own.

Do you get a survivor benefit if you are on Social Security?

You will not receive a survivor benefit in addition to your own retirement benefit; Social Security will pay the higher of the two amounts.

Can you get survivor benefits if you remarry?

If the remarriage took place before you turned 60 (50 if you are disabled), you cannot draw survivor benefits. You regain eligibility if that marriage ends. And there is no effect on eligibility for survivor benefits if you remarry at or past 60 (50 if disabled).

How old do you have to be to get spouse's Social Security?

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age.

How old do you have to be to apply for retirement?

If you are at least 62 years of age and you wish to apply for retirement or spouse’s benefits, you can use our online retirement application to apply for one or both benefits.

What happens if your spouse's retirement benefits are higher than your own?

If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits equaling the higher spouse benefit. Here is an example: Mary Ann qualifies for a retirement benefit of $250 and a spouse’s benefit of $400.

When will my spouse receive my full retirement?

You will receive your full spouse’s benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse’s record who is younger than age 16 or disabled.