Most employers offer employee benefits packages, which can include basic health coverage and retirement planning. In addition to basic health coverage, employers offer a variety of other perks, depending on the nature of their companies.

Should employers provide health insurance to employees?

Employers might benefit from providing health insurance, for example, if it allowed them to recruit and retain high-quality workers. Perhaps employees who demand health benefits have other qualities that employers value; they might be forward-looking or less mobile (e.g., workers with children).

Why do companies offer health benefits to employees?

The idea is that any reputable company will care enough about their employees to offer competitive health benefits, which is why this benefit is listed on job descriptions along with 401K plans and PTO. To attract and keep the best employees, you’re going to need to provide them with what they need to live happy and healthy lives.

What do workers think about employment-based health insurance?

Surveys confirm that workers view employment-based health insurance as a very valuable benefit of work. Most workers report that the availability of health insurance is a key factor in their decision to take or keep a job.

Is health insurance worth the cost to employers?

A burgeoning “health and productivity management” literature argues that the value of health coverage far exceeds its direct cost to employers.

What is the most common type of employee benefit?

10 Most Commonly Offered Employee BenefitsHealth Insurance Benefits. This one is a no-brainer. ... Life Insurance. ... Dental Insurance. ... Retirement Accounts. ... Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs) ... Paid Vacation and Sick Time. ... Paid Holidays. ... Paid Medical Leave.More items...•

What types of benefits are commonly offered by employers?

Medical coverage. The most common employee benefit that employers offer is medical or health coverage. ... Dental insurance. ... Vision insurance. ... Life insurance policies. ... Prescription and pharmacy benefits. ... Specialist services. ... Mental health coverage. ... Retirement planning.More items...•

What triggered employer based health insurance as a benefit?

The Future of Employer Sponsored Healthcare Plans Employer-based healthcare came out of a market-driven response by employers after World War II. It grew out of a strong economy, low unemployment rates, and intense competition for talent.

What do most employers pay for health insurance?

Employers pay 83% of health insurance for single coverage In 2020, the standard company-provided health insurance policy totaled $7,470 a year for single coverage. On average, employers paid 83% of the premium, or $6,200 a year. Employees paid the remaining 17%, or $1,270 a year.

Do job offers include benefits?

It includes more than just salary — it's everything of value, monetary and otherwise, that an employer provides in exchange for the work you do. Think incentives, benefits and perks. What can be included in a job offer varies greatly depending on the employer and position, but here are the most common pieces: Salary.

What is considered an employee benefit?

Employee benefits are any benefits provided to employees in addition to their base salaries and wages. A complete employee benefits package may include health insurance, life insurance, paid time off (PTO), profit sharing, retirement benefits, and more.

Do employers pay for health insurance?

While there is no legislative requirement to do so, many employers offer supplemental private health insurance to their employees to help cover some of the expenses that are not covered under the public health care plan.

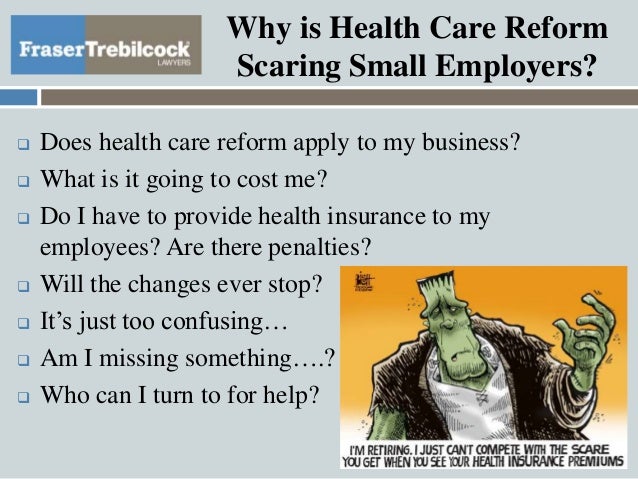

What are some disadvantages of employer-sponsored health insurance?

The disadvantages include an unfair tax treatment, lack of portability and job lock, little choice of health plans, and lack of universal coverage.

When did health insurance start as a fringe benefit associated with employment?

In the 1940s, the government indirectly incentivized employers to start offering health insurance to workers.

Is employer health insurance enough?

Most employers offer health insurance to their employees. However, this cover may not be sufficient in some cases. You may need an additional cover for certain aspects of your treatment such as co-pay clauses, room-rent limiting clauses, etc.

How does employee health insurance work?

Employee health insurance is a benefit extended by an individual's employer to their employees. It does not only cover the person working for the employer but also covers the rest of family members under the policy.

What are two common incentives offered by employers?

Compensation incentives may include items such as raises, bonuses, profit sharing, signing bonuses, and stock options.