Is Oregon still paying Pua?

When figuring out how many more weeks of PUA you have available from the CAA, you need to know how many weeks of PUA you had left on Dec. 12, 2020. On Dec. 12, High Extended Benefits ended in Oregon. Once HEB was turned off by the U.S. Dept. of Labor, legally we were no longer allowed to pay HEB benefits of any kind, including for PUA.

How to get back pay on my Nevada Pua refund?

There are several different ways this could happen:

- You have been diagnosed with or are experiencing symptoms of COVID-19 and are seeking a medical diagnosis;

- A member of your household has been diagnosed with COVID-19;

- You are providing care for a family member or a member of your household who has been diagnosed with COVID-19;

How to get Pua back pay Ohio?

The federal legislation provided the following benefits for employers through September 4, 2021:

- Extended full federal funding for Ohio’s SharedWork program.

- Authorized 75% credits to reimbursing employers for traditional unemployment benefit charges.

- Authorized full federal funding of the first week of traditional unemployment benefits, instead of 50%.

How to backdate Pua claim?

- You can refer to the PUA System Guide or the following helpful screenshot guides to guide you through the process:

- PUA Weekly Certification Filing Guide

- Part-time Job – PUA Weekly Certification Filing Guide – Use this guide if you have part-time earnings to report.

Do you have to pay back EDD unemployment?

If you do not repay your overpayment, the EDD will take the overpayment from your future unemployment, disability, or PFL benefits. This is called a benefit offset. For non-fraud overpayments, the EDD will offset 25 percent of your weekly benefit payments.

Do you have to pay back Pua in Michigan?

The Michigan Unemployment Insurance Agency (UIA) announced today that over 55,000 claimants will not have to pay back a total of approximately $431 million in overpayments of federal pandemic unemployment benefits that the agency previously determined to have been improperly awarded.

How does EDD find out about overpayments?

This notice includes the Letter ID and Claimant ID you need to make a payment. We will send the Benefit Overpayment Collection Notice 30 days after we send the Notice of Overpayment or Notice of Denial of Benefits and Overpayment, or when an appeal is denied.

What happens if you don't pay back unemployment Michigan?

If you don't repay an overpayment, the UIA may: Take your federal and/or Michigan income tax refund. Garnish your wages.

Why do I have to repay unemployment Michigan?

"No Michigander who did the right thing when applying for benefits should be required to pay anything back resulting from errors at the federal level," said Governor Gretchen Whitmer. The Michigan Unemployment Insurance Agency overpaid some claimants by mistake during the COVID-19 pandemic, the agency determined.

Do you have to pay back Pua California?

You may have to pay back the PUA benefits received if you do not qualify for a waiver. You may also be subject to penalties if you intentionally provided false information.

Can you go to jail for EDD overpayment?

What are the Penalties for EDD Fraud? A violation of Unemployment Insurance Code 2101 is a “wobbler” that can be charged as either a misdemeanor or felony crime. A misdemeanor conviction carries up to one year in the county jail and a $1,000 fine.

How much do you have to pay EDD back?

Your employer may withhold up to 25 percent of your wages to submit to the EDD to comply with the order. To avoid the wage withholdings, you repay the overpayment in full.

What is PUA in unemployment?

Recipients of Pandemic Unemployment Assistance — known as PUA — received a “fact-finding” letter this past March demanding proof of their unemployment claims. Now millions are at risk of losing this assistance as they scramble to prove they needed the money they have been surviving on for months.

What is PUA in the US?

It is a program to provide financial assistance to people who are both unable to work due to the pandemic and are also not eligible for unemployment insurance.

How many people have filed for PUA in Massachusetts?

They are not counted in the unemployment numbers, which only record those actively searching for work. More than 960,000 people have filed at least one claim for PUA in Massachusetts.

When is Hannah's PUA due?

The Continued Assistance Act that was signed into law by former President Donald Trump in December of last year requires that any individual receiving PUA benefits after December 27, 2020 , is required to provide documentation.

Is there a fact finding notice for unemployment in Massachusetts?

These “fact-finding” notices are not only arriving in the mailboxes of Massachusetts residents. According to the Department of Unemployment Assistance, this “fact-finding” is part of an effort to address “fraud nationwide.” The Department of Justice and mainstream media outlets have corroborated this narrative, publishing sensationalist articles about rare instances of PUA fraud, and reports from the FBI.

When do you have to pay back unemployment?

You may have to pay back unemployment benefits if you were overpaid, ineligible, or made fraudulent claims, but these circumstances vary from state to state. In terms of overpayment, if you’ve missed a deadline to validate your eligibility claims, you may be deemed ineligible for benefit status and could have to pay back benefits received since December 27, 2020. [1]

How long can you keep unemployment benefits in Illinois?

In that case, the state can keep up to 25% of any future unemployment benefits you may receive over a maximum of five years until the benefits are repaid. [21]

Can you waive unemployment overpayments?

According to the Department of Labor, “states may choose to waive recovery of overpayments under certain circumstances when an individual is not at fault.” Because unemployment insurance is a federal partnership administered by the states, each state has discretion. [12]

Can you get unemployment if you are overpaid?

[14] If you are still collecting unemployment and don’t ask for a waiver, the state may deduct what you owe from future unemployment checks. [5]

Does unemployment pay taxes?

Most employers pay both federal and state unemployment tax, and if you’re an employee, it’s not deducted from your wages in most states. [5] Only Alaska, [6] Pennsylvania, [7] and New Jersey [8] require employers to withhold state unemployment tax from employee wages.

Is there a downside to collecting unemployment?

If you’re worried that you won’t have enough money to cover your expenses, including things that can affect your credit like utility and credit card payments, collecting unemployment is probably a good idea. Unemployment insurance is one form of assistance you can use to protect your finances and credit in difficult times. By providing the funds to maintain consistent payment history, it helps you build your credit .

How many states have PUA?

10 states. But 10 states — Delaware, Kentucky, Mississippi, Missouri, New Mexico, New York, Oklahoma, Texas, Virginia and West Virginia — don’t have such laws for their standard programs, according to the U.S. Labor Department. Worker advocates are particularly concerned these states also won’t extend the protections to PUA recipients.

Did the Cares Act allow for overpayments?

However, it didn’t allow states to forgive money paid to workers by mistake — meaning states had to recoup these “overpayments” even if a worker wasn’t at fault or able to pay the money back.

Can you waive PUA overpayments?

Waiving PUA overpayments. The $900 billion federal relief package passed last month gives states the power to waive these overpayments, made through the Pandemic Unemployment Assistance program, in certain cases. But the law doesn’t require states to offer this safety valve — leading to concern that some may choose not to.

Can you waive overpayments on unemployment?

Most states do waive overpayments made through their traditional unemployment insurance programs. They generally forgive the debt in instances of financial hardship for the recipient or due to error on the part of an employer or unemployment agency, though the law varies by state.

Do states have latitude to interpret PUA?

Even states that do apply the new PUA protections have broad latitude to interpret when a person will or will not get relief, according to worker advocates. They may, for example, define “financial hardship” differently.

Did Texas send PUA benefits?

States, in their rush to get money to people quickly and implement new relief programs, accidentally sent PUA benefits to thousands of workers in the pandemic’s early days. Texas, for example, sent about 260,000 notices to PUA recipients between March 1 and Oct. 1 trying to claw back $214 million of funds, the state Workforce Commission said in ...

Will Kentucky waive overpayments?

Officials in the Kentucky governor’s office hope to be able to waive overpayments, Amy Cubbage, general counsel for Kentucky Gov. Andy Beshear, said during a Jan. 8 press briefing. The state legislature would need to amend state law to do so, she said.

What is PUA in unemployment?

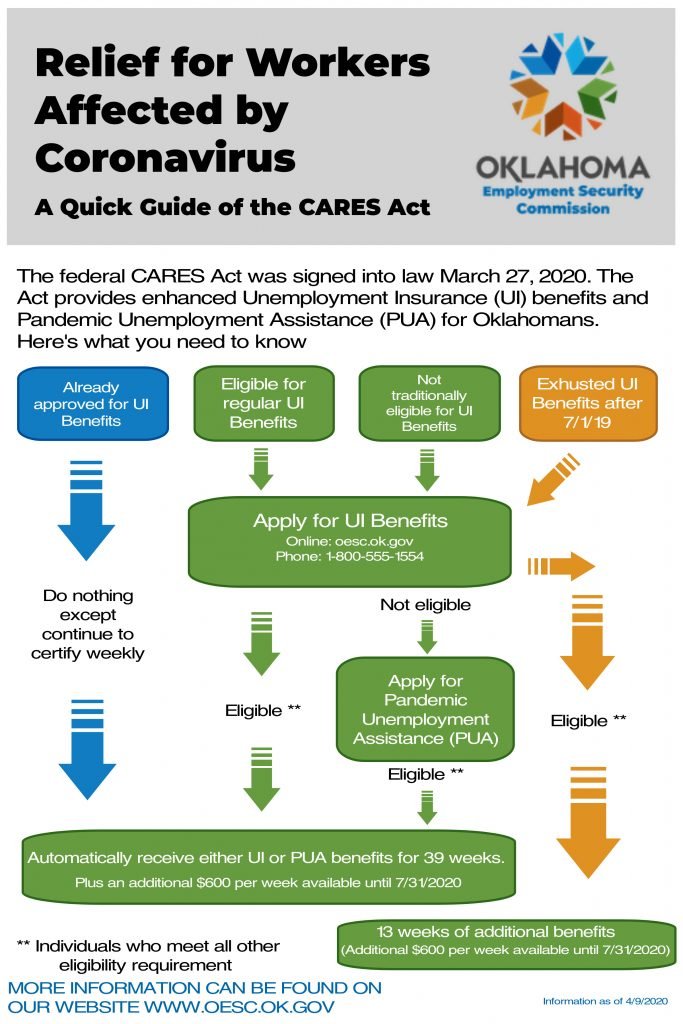

PUA was ena cted to help workers who don’t typically meet the requirements to get UI benefits. This program provided up to 79 weeks of unemployment benefits if you were unable to work because of the coronavirus pandemic. PEUC was available to people whose regular unemployment benefits expired or were about to expire. Claimants were enrolled in the program automatically after they reached their maximum claim weeks for the unemployment claim.

When will the Cares Act increase the UI benefits?

The CARES Act also extended the duration of UI benefits and increased the benefit payments by $600 per week through July 31, 2020. This enhanced weekly UI benefit payment went down to $300 after July 31, 2020.

What is the DUA program?

Some people may receive benefits under the federal program called Disaster Unemployment Assistance (DUA). This program provides unemployment benefits to individuals who have become unemployed due to a presidentially declared major disaster. DUA benefits are available to unemployed workers and self-employed people. To be eligible to receive DUA payments:

How do I get unemployment benefits?

To receive UI benefits, you’ll need to file an unemployment claim with the unemployment insurance division of your state’s department of labor. Each state has an unemployment program. Each state has its own rules about how much unemployment benefits a worker is eligible for, how long the benefits last, and whether the worker is eligible to apply for benefits.

What is unemployment insurance?

The unemployment insurance program is a state-run program with oversight from the U.S. Department of Labor. Employers fund the program by paying a federal unemployment tax. Employers also pay a state unemployment tax.

How to keep track of unemployment?

Take screenshots of online documentation. Keep receipts for the unemployment you receive. Make sure you know how much you are entitled to receive. If you are receiving more than you are supposed to receive, you will be required to return the overpayment. So, it is smart not to spend that money.

Where to send overpayment to unemployment?

It accepts checks or money orders. Typically, you’ll need to send the payment to your state’s Department of Labor, Unemployment Division at a P.O. box address.

Can you waive unemployment if you have been overpaid?

With traditional unemployment insurance benefits and with Federal Pandemic Unemployment Compensation, if someone has been overpaid, states have the discretion to waive repayment, as long as there was no fraud involved — particularly if repayment would cause financial hardship.

Can you waive PUA benefits?

Under current federal law, states do not have the authority to waive repayment of PUA benefits if a person was overpaid, according to Michele Evermore of the National Employment Law Project. “This is honestly the biggest reason that Congress needs to do something on COVID relief,” she said.

Can you waive PUA if you are overpaid?

But that is not the case with Pandemic Unemployment Assistance. Under current federal law, states do not have the authority to waive repayment of PUA benefits if a person was overpaid, according to Michele Evermore of the National Employment Law Project.

Will Colorado waive unemployment overpayment?

Then, he doesn’t know. Kathy White is hoping that Colorado and other states will use their discretion to waive repayment in cases where there was no fraud, and that Congress will change the law so states can waive overpayment recoupment of Pandemic Unemployment Assistance.

How much time do I have to pay them back?

Each state and many cases are different – usually, you can negotiate a repayment schedule. The statute of limitation on unemployment overpayment varies from 20 years in New York to never in Texas.

What to do if you receive a payment when you go back to work?

If you receive a payment when you have gone back to work or received a different amount than expected – contact your agency immediately. Some individuals report receiving multiple payments on the same day or larger than typical deposits into their accounts. Put that money aside and contact your employment agency – it may take them a while, but they will eventually track down the error.

What happens if you commit unemployment fraud?

You committed fraud. Individuals found to have committed fraud are responsible for paying back the overpayment with interest and a penalty. Unemployment fraud usually occurs when an individual lies or misrepresents themselves on their application.

When will unemployment overpayments end?

With the rapid increase in applications for unemployment benefits and the addition of programs like PUA, overpayments are likely at a much higher level, some saying up to 25% – although hard numbers are unavailable at this time and likely won’t be until 2021 when the program period ends.

Do you have to repay your overpayment in Texas?

States like Texas require individuals to repay all of their overpayment before any future benefits are disbursed.

Can you appeal unemployment?

Yes – but you can appeal. Each state has an appeals section of its unemployment website, and each state’s appeal process is different. Some allow for hardship waivers, California and Florida, and some like Texas do not. States also differ on how they handle the overpayment of UI when the individual is still collecting.

Is there a higher risk of overpayment for unemployment?

The unemployment claims and payment systems and staff in most states are simply overwhelmed with the massive spike in unemployment following the COVID pandemic, which increases the likelihood of error and qualification checks when processing unemployment claims. The Pandemic Unemployment Assistance (PUA) program, which was put in place quickly, in particular is at a higher risk of overpayment because individuals making claims can self-certify and don’t have an employer verification step because this program generally covers freelancers, gig workers and contract workers who didn’t have a consistent employer or source of income. And given the rampant fraud already being reported for those filing false claims, it is likely a large number of already paid PUA claims will eventually be reviewed and may be found to have inaccurate or fraudulent information.

How long does it take for a state to issue a refund?

The U.S. Labor Department said Wednesday that, in these cases, states must issue refunds. It may take up to a year for some states to issue the refunds, the agency said.

When will unemployment be handed out in Hialeah?

Unemployment applications are seen as City of Hialeah employees hand them out to people in front of the John F. Kennedy Library on April 08, 2020 in Hialeah, Florida. Joe Raedle/Getty Images. Workers asked to repay unemployment benefits issued during the Covid pandemic may be getting a refund.

What is the $900 billion relief law?

Refunds and waivers. A $900 billion relief law passed in December let states opt to waive overpayments of benefits. Now, states who opt into that forgiveness must issue refunds to workers who’d repaid all or some of their benefits prior to getting a waiver, according to the U.S. Labor Department.

How long does it take to get the stimulus money?

However, it may take states up to a year to issue the money, according to a memo issued Wednesday by the U.S. Labor Department.

Can a state forgive overpayments?

States may forgive overpayments if a worker wasn’t at fault and recovering funds would cause financial hardship, for example.

Is Montana ending the 300 unemployment program?

Montana opts to end $300 unemployment boost. Other states may, too. Many had received money through a new federal program, Pandemic Unemployment Assistance, created by the CARES Act to expand aid to a large pool of people typically ineligible for state benefits.

Does the Cares Act allow states to forgive overpayments?

However, the CARES Act didn’t offer a safety valve for states to forgive overpayments. That essentially meant states had to try to collect the funds. Texas, for example, sent notices to about 260,000 PUA recipients between March 1 and Oct. 1 and tried to claw back $214 million.